What will go wrong in a VA appraisal? In general, any visible health or safety concern will be a problem on a VA evaluation report. You will not be able to close a home until these issues are resolved. In some cases, sellers are willing to cover the cost of essential repairs instead of losing the sale.

Is it harder to buy a house with a VA loan?

Should you be worried? The short answer is no. “It is true that VA loans were once more difficult to close, but that’s ancient history. Today, you are likely to have roughly the same problems with a homebuyer who has this type of mortgage as Any other, and VA’s flexible guidelines may be the only reason your buyer can buy your home.

Why are VA loans bad for sellers? VA loans come with red tape, appraisal delays, and fees borne by sellers rather than buyers – all reasons offers are rejected, agents say. Also, realtors and veterans say, some sellers turn down offers due to misconceptions about the VA program.

Why would a home seller not accept a VA loan?

Before guaranteeing mortgages, VA wants to make sure that the homes that eligible veterans buy are safe and worth their asking price. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

Why would a house not be VA approved?

Insufficient heating. Homes that do not have adequate heating systems will never pass the VA assessment. For a home to be approved, there must be an efficient and acceptable heat source that can provide residents with comfortable living conditions.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory way; the seller must comply with the laws of the Fair Housing Act.

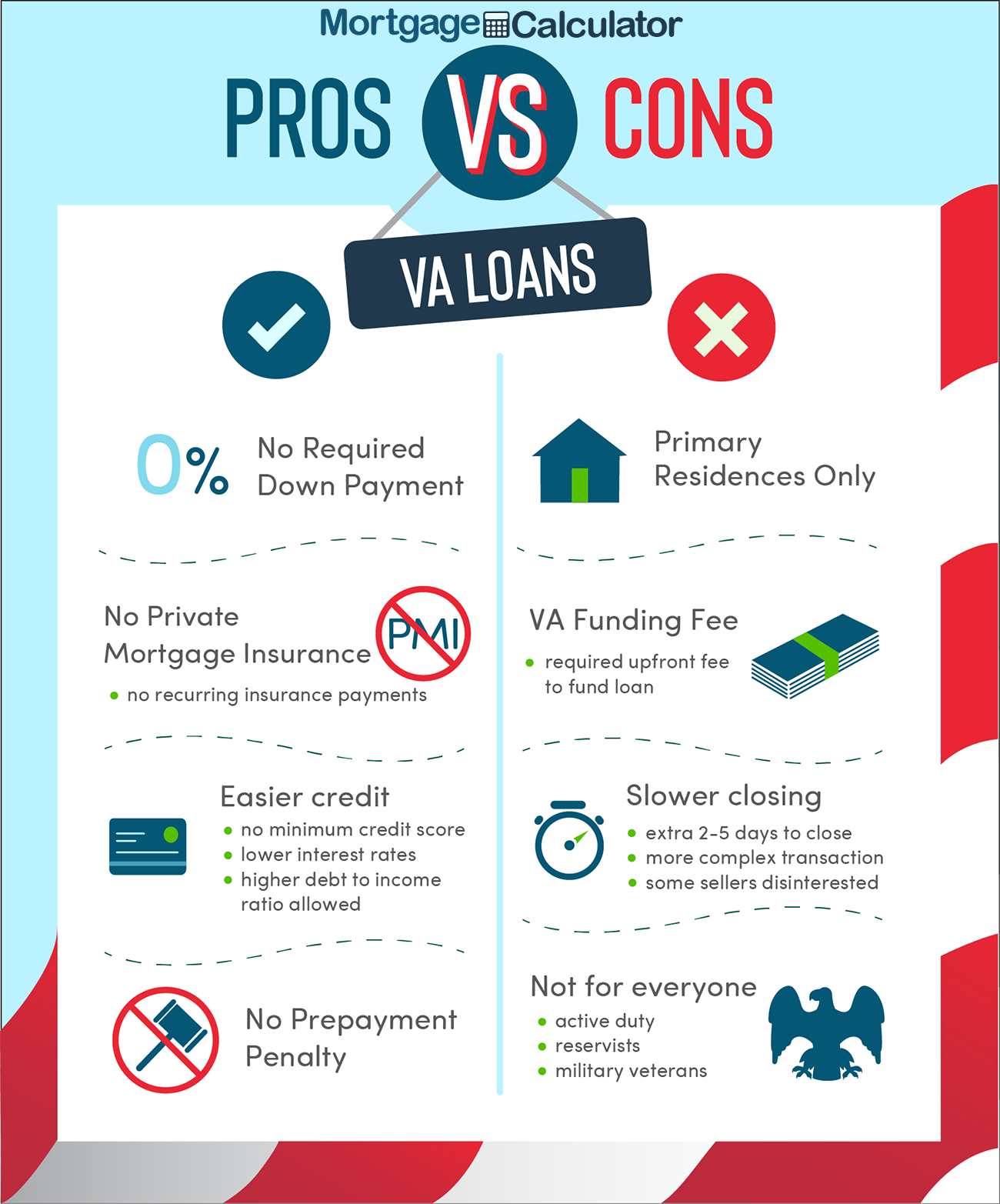

What are the disadvantages of a VA loan?

5 possible downsides to a VA loan

- You may have less equity in your home. …

- VA loans cannot be used to buy vacation homes or investment properties. …

- Seller resistance to VA financing. …

- The financing fee is higher for later use. …

- Not all lenders offer, or understand, VA loans.

What are the pros and cons of a VA loan for a seller?

| Pro | Swindle |

|---|---|

| Without PMI | VA financing fee increases after first use |

| Highest allowed DTI | The loan could exceed the market value |

| Credit flexibility | Only for main residences |

| Better than average interest rates | Sellers and agents may not be familiar |

Why you shouldn’t use a VA loan?

Since you have to factor in the cost of the VA financing fee, you could ultimately end up with a loan that exceeds the market value of your home. Manufactured homes may require a minimum down payment and may not be eligible for a 30-year period. You cannot use a VA loan for rental properties.

How long does it take to buy a house with a VA loan?

How long does it take to close a VA loan? Most VA loans close in 40 to 50 days, which is standard for the mortgage industry, regardless of the type of financing.

Is it hard to buy a house with a VA loan?

Should you be worried? The short answer is no”. It’s true that VA loans were once more difficult to close, but that’s ancient history. Today, you are likely to have roughly the same problems with a buyer who has this type of mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

How long does it take for underwriters to approve a VA loan?

The subscription process usually takes at least a few weeks. If your loan has to be subscribed manually, it will generally take a little longer due to the additional work required. According to the latest data from ICE Mortgage Technology, a VA loan takes approximately 61 days to close.

How long do you have to live in a VA loan House?

Veterans and active duty personnel who obtain a VA loan must certify that they intend to personally occupy the property as their primary residence. Basically, home buyers have 60 days, which the VA considers a “reasonable time”, to occupy the home after the loan closes.

Do I have to live in the house on a VA loan? VA Occupancy Rules Basically, anyone who gets the loan must live in the house, ruling out renting the property, using the building exclusively for work purposes, or allowing ineligible friends or family to live there. In addition, the occupation must be completed within a “reasonable time”, which in most cases means 60 days.

How can I get out of my VA home loan?

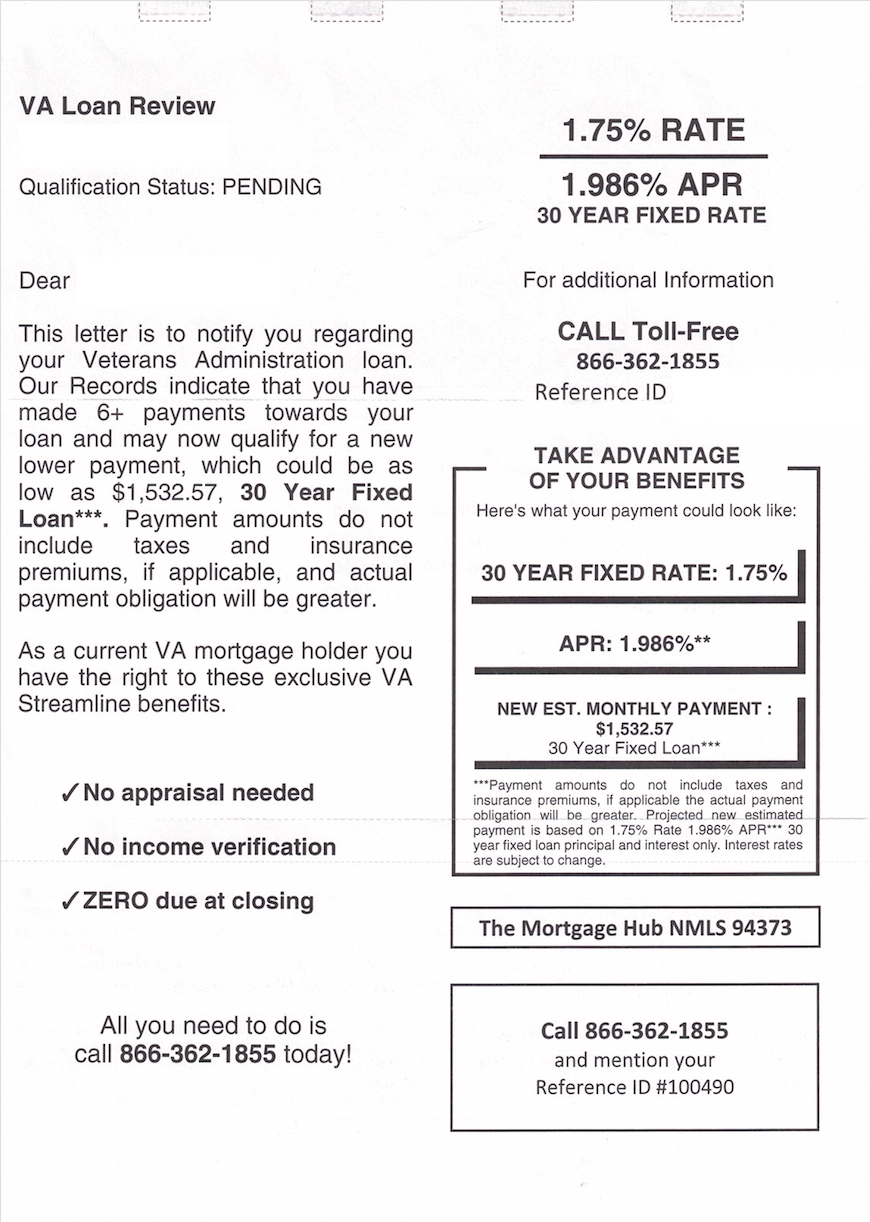

The simplest way to accomplish this may be to apply for a VA Interest Rate Reduction Refinance Loan (VA IRRRL) which should generally result in some form of benefit to the borrower in the form of a lower interest rate, payments lower rates or the ability to switch from an adjustable rate mortgage to a fixed rate VA loan.

Can you give away your VA loan?

VA loans are among the few loans that someone else can take on. However, you cannot simply transfer a VA loan to someone else. You must go through a process with the lender for someone else to take over the loan.

Can I back out of a VA home loan?

If a major problem arises in your home inspection, such as cracks in the foundation, the buyer can cancel the contract. In this case, the security deposit will be returned to the buyer.

Can I sell my home and get another VA loan?

The good news is, yes, you can get another VA home loan if you are a military service member, veteran, or other eligible qualified borrower. … Buy a home with a VA loan, sell it, and then buy another home with a new VA loan. Refinancing from one VA loan to another.

Can you have 2 VA loans at once?

VA loans can only be used for primary residences and come with occupancy requirements to ensure that this is how the loan will be used. That said, it is possible to have two VA loans at the same time for two different primary residences.

How long after buying a house with a VA loan can you sell it?

Generally, home buyers have 60 days from closing to occupy a home purchased with a VA loan. However, VA allows home buyers in certain situations to go beyond the 60-day mark, potentially extending up to a year.

What are the rules for a VA loan?

From a high level, to get a VA loan, you must:

- Be an eligible veteran or military spouse entitled to available VA loans.

- Use VA loans for an eligible purpose (home ownership).

- Occupy or intend to occupy the home within a reasonable amount of time (typically within 60 days of closing).

- Be an acceptable credit risk.

What are the terms of a VA loan?

VA will guarantee up to 50 percent of a home loan up to $ 45,000. For loans between $ 45,000 and $ 144,000, the minimum collateral amount is $ 22,500, with a maximum collateral of up to 40 percent of the loan up to $ 36,000, subject to the amount of entitlements available to a veteran.

What can disqualify you from a VA loan?

Veteran status requires service members to be discharged or released from the military under conditions other than dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA Loan Guaranty program.

What credit score is needed for a VA loan?

While the VA itself does not establish a required minimum credit score for a VA loan, most mortgage lenders will want to see a credit score above 620 FICO. Some lenders may go down, but borrowers often incur additional scrutiny and lender requirements.

Can You Get A VA Home Loan With A Credit Score Of 500? Most mortgage companies claim that you must have at least a 620-660 credit score and high income to qualify for a VA loan. … You can get a VA loan with a credit score of 500.

What is the minimum credit score for a VA loan?

Generally speaking, lenders will require minimum credit scores of 580 to 620 to qualify for a VA loan.

What is the lowest credit score for VA loan?

Despite this VA flexibility, many individual lenders impose a minimum credit score requirement on VA loans. Generally speaking, lenders will require minimum credit scores of 580 to 620 to qualify for a VA loan.

Does the VA require a minimum credit score?

VA residual income guidelines ensure veteran borrowers can repay the loan and determine how much money a veteran should have left after all debt and living expenses are considered. There is no minimum credit score requirement. Instead, VA requires a lender to review the entire loan profile.

Is it hard to get approved for a VA home loan?

If you are eligible, VA loans are fairly easy to obtain, as there is no down payment required, there are no minimum credit scores, and there is no maximum limit on how much you can borrow relative to income.

How often do VA home loans get denied?

In general, about 15 percent of applications are rejected, but some may be able to reapply.

Can you be denied a VA home loan?

How Often Do Underwriters Deny VA Loans? About 15% of VA loan applications are rejected, so if yours is not approved, you are not alone. If you are denied during the automatic subscription stage, you may be able to seek approval through manual subscription.

Can you get a VA loan with a credit score of 580?

VA Mortgage: 580-620 Minimum Credit Score Technically, there is no minimum credit score requirement for a VA loan. However, most lenders impose a minimum score of at least 580. And many start at 620. Like FHA loans, VA loans do not have risk-based pricing adjustments.

What lenders approve a 580 credit score?

580 mortgage lenders with credit scores

- 1.) New American funding.

- 2.) Finance of America.

- 3.) Guaranteed Rate.

- 4.) Supreme Loan.

- 5.) Caliber Home Loans.

- 6.) Bank of the United States.

- 7.) Flagstar Bank.

- 8.) American Financial Network.

What kind of home loan can I get with a 580 credit score?

An FHA loan requires a minimum down payment of 3.5% for credit scores of 580 or higher. If you can make a 10% down payment, your credit score may be in the range of 500 to 579. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans.

What are the disadvantages of using a VA loan?

5 possible downsides to a VA loan

- You may have less equity in your home. …

- VA loans cannot be used to buy vacation homes or investment properties. …

- Seller resistance to VA financing. …

- The financing fee is higher for later use. …

- Not all lenders offer, or understand, VA loans.

Why Real Estate Agents Hate VA Loans In some cases, home sellers will not accept VA-guaranteed mortgage-backed purchase offers for fear of a low appraised value. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

What is the downside of a VA loan?

Disadvantages of a VA loan While you won’t pay for mortgage insurance with a VA loan, you will pay a financing fee at closing (although this fee can be financed with your loan). If you are applying for your first VA loan and you do not make a down payment, the financing fee is 2.3 percent of what you are borrowing.

Why you shouldn’t use a VA loan?

Since you have to factor in the cost of the VA financing fee, you could ultimately end up with a loan that exceeds the market value of your home. Manufactured homes may require a minimum down payment and may not be eligible for a 30-year period. You cannot use a VA loan for rental properties.

Why sellers do not like VA loans?

Before guaranteeing mortgages, VA wants to make sure that the homes that eligible veterans buy are safe and worth their asking price. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

What are the pros and cons of a VA loan for a seller?

| Pro | Swindle |

|---|---|

| Without PMI | VA financing fee increases after first use |

| Highest allowed DTI | The loan could exceed the market value |

| Credit flexibility | Only for main residences |

| Better than average interest rates | Sellers and agents may not be familiar |

Do home sellers hate VA loans?

VA home loans also come with minimum property requirements that can end up forcing home sellers to do a lot of repairs. Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

Should a seller accept a VA loan offer?

And the idea that sellers have to pay the closing costs of VA buyers is simply false. In short, there is no reason why a seller should reject your offer to purchase simply because they are using a VA loan.

Why you shouldn’t use the VA loan?

Since you have to factor in the cost of the VA financing fee, you could ultimately end up with a loan that exceeds the market value of your home. Manufactured homes may require a minimum down payment and may not be eligible for a 30-year period. You cannot use a VA loan for rental properties.

What is bad about a VA loan?

With every VA home loan, there are certain fees. While you can negotiate the lender’s share, there is no need to negotiate the financing fee charged by the VA. This fee can range from about 1.25% to more than 3%, depending on how much you are putting down as an advance, etc.

How much are VA fees?

How much is the VA financing fee? The VA financing fee is a one-time fee of 2.3% of the total amount borrowed with a VA home loan. The finance fee increases to 3.6% for borrowers who have previously used the VA loan program, but can be lowered by putting at least 5% at closing.

What is the VA financing rate for 2021? VA Financing Fees in 2021 Most veterans will pay a 2.3 percent financing fee when purchasing a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit – a no-down payment home loan.

How much is a VA funding fee 2020?

As of January 1, 2020, the VA financing fee rate is 2.30% for first-time VA loan borrowers with no down payment. The finance fee increases to 3.60% for those who borrow a second VA loan. The financing fee rate only applies to the amount financed in the VA loan, so no fee is applied to the borrower’s down payment.

Is the VA funding fee worth it?

“Any type of down payment on a government home loan is effectively a de facto down payment,” says Bowden. … But even though the VA Financing Fee can make buying or refinancing a home a bit more expensive, the benefits of VA loans can often outweigh the upfront costs, making it worth it. a VA home loan is worth considering.

What is a typical VA funding fee?

The VA financing fee is a one-time fee of 2.3% of the total amount borrowed with a VA home loan. The finance fee increases to 3.6% for borrowers who have previously used the VA loan program, but can be lowered by putting at least 5% at closing.

Who pays VA funding fee?

Borrowers must pay the one-time VA financing fee with a VA loan purchase or refinance. Borrowers pay the fee directly to the Department of Veterans Affairs. The government uses the money raised to continue financing the purchase of homes for active duty military members, retired veterans, and surviving spouses.

What fees does the seller have to pay on a VA loan?

In California, and throughout the country, these “seller’s grants” are generally limited to 4% of the loan amount. As it says on the VA website: “We require that a seller cannot pay more than 4% of the total home loan in the seller’s concessions.

Can lender pay VA funding fee?

Mortgage lenders have no control over who should pay the VA financing fee or the specific amount. Your Certificate of Eligibility (COE) generally indicates whether you must pay the VA financing fee. Those who are required to pay the VA financing fee must do so at closing.

How can I avoid the VA funding fee?

| 2021 VA Financing Fee Table | ||

|---|---|---|

| Advance percentage | First use of VA loan | Repeat use of the VA loan |

| 0% to 5% | 2.30% | 3.60% |

| 5% or more | 1.65% | 1.65% |

How do you avoid funding fees?

VA Financing Fee Waiver You are exempt from the financing fee in 2021 if: You are entitled to or receive compensation for a service-connected disability. A surviving spouse of a veteran who died while on duty or from a service-connected disability. An active duty service member who has received a Purple Heart.

How do you get exempt from VA funding fee?

Veterans injured in service are exempt from paying the VA financing fee if they receive disability compensation or have a disability rating of 10% or more. Surviving spouses of Veterans who died in the line of duty also qualify for an exemption from the financing fee.

Is a VA loan bad for the seller?

Using a VA loan means that you will end up saving money both on the purchase and over the life of the loan. However, it does mean that the person selling the house to you will have to spend more to sell it. If you are concerned that the seller will reject your offer because they are using a VA loan, don’t be.

What should a seller know about a VA loan? And, for sellers, the most important thing to understand about VA loans is how good the mortgage products are for qualified borrowers. This high-quality nature means that if you are a veteran buyer, you are likely to use the VA loan.

Why do sellers hate VA loans?

Before guaranteeing mortgages, VA wants to make sure that the homes that eligible veterans buy are safe and worth their asking price. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

Why would a home seller not accept a VA loan?

Some home sellers will not accept VA offers because they (wrongly) believe that they will have to pay all of the buyer’s closing costs. The VA limits the closing costs Veterans can pay, which is a great benefit to those who have served our country.

Are VA loans a hassle for the seller?

The short answer is no”. It’s true that VA loans were once more difficult to close, but that’s ancient history. Today, you are likely to have roughly the same problems with a buyer who has this type of mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

What are the pros and cons of a VA loan for a seller?

| Pro | Swindle |

|---|---|

| Without PMI | VA financing fee increases after first use |

| Highest allowed DTI | The loan could exceed the market value |

| Credit flexibility | Only for main residences |

| Better than average interest rates | Sellers and agents may not be familiar |

Should a seller accept a VA loan offer?

And the idea that sellers have to pay the closing costs of VA buyers is simply false. In short, there is no reason why a seller should reject your offer to purchase simply because they are using a VA loan.

Do home sellers hate VA loans?

VA home loans also come with minimum property requirements that can end up forcing home sellers to do a lot of repairs. Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

What fees does the seller pay on a VA loan?

In California, and throughout the country, these “seller’s grants” are generally limited to 4% of the loan amount. As it says on the VA website: “We require that a seller cannot pay more than 4% of the total home loan in the seller’s concessions.

What does the seller pay for on a VA loan?

With VA loans, sellers can pay some or all of the buyer’s costs. VA loans allow sellers to contribute up to 4.0 percent of the home’s sale price. In this example, it would be $ 8,000, but closing costs of $ 200,000 will generally not be that high.

Do sellers pay closing costs on VA loan?

Who Pays the Closing Costs on a VA Loan? When using a VA loan, the buyer, seller, and lender pay different parts of the closing costs. The seller cannot pay more than 4% of the total mortgage loan in closing costs. But your share of the closing costs includes commissions for real estate agents buyers and sellers.