Well, you know there are closing costs on VA loans, but what if you can’t or can’t close those costs? The most common way to close these funds is by paying seller-paid closing costs and VA sales concessions. Remember, the seller is NOT required to pay the buyer’s closing costs.

What does the VA loan do?

Contents

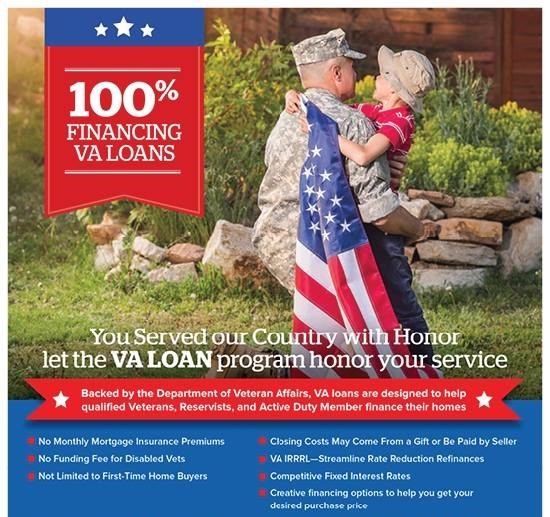

A VA loan is a mortgage loan granted by the U.S. Department of Veterans Affairs is guaranteed. This enables VA lenders to lend money to borrowers with lower credit scores without down payments or other risk factors.

What are the disadvantages of a VA loan? 5 Potential Cons of a VA Loan

- You may have less equity in your home. …

- VA loans cannot be used to purchase vacation homes or investment properties. …

- Seller’s Resistance to VA Financing. …

- If you use it later, the financing fee is higher. …

- Not all lenders offer – or understand – VA loans.

What are the pros and cons of a VA loan?

| professional | Con |

|---|---|

| No deposit | VA funding fee |

| No PMI | VA funding fee increases after first use |

| Higher permitted DTI | Credit could exceed market value |

| Credit flexibility | For primary residences only |

Is VA loan worse than conventional?

The VA loans typically have lower interest rates than traditional mortgages, allow for higher debt-to-income ratios and lower credit ratings, and do not require private mortgage insurance. … He says lenders often offer veteran products other than VA loans that are better for the bank, not the borrower.

Why you shouldn’t get a VA loan?

Ouch! The lower interest rates on VA loans are deceiving. … Both will cost you much more interest over the life of the loan than their 15-year counterparts. Also, you are more likely to get a lower interest rate on a 15 year traditional fixed rate loan than you would on a 15 year VA loan.

What is a VA loan designed to do?

The basic intent of the VA Home Loan Program is to provide home financing to eligible veterans and to help veterans purchase real estate without a down payment. … The loan can be granted by qualified lenders.

What is the purpose of the VA loan program?

The main purpose of the VA home loan program is to help veterans finance the purchase of homes on favorable loan terms and at an interest rate that is usually lower than the rate charged on other types of mortgage loan.

Why are VA loans bad?

The lower interest rates on VA loans are deceiving. Both will cost you much more in interest over the life of the loan than their 15-year counterparts. Also, you are more likely to get a lower interest rate on a 15 year traditional fixed rate loan than you would on a 15 year VA loan.

How much income do I need for a VA loan?

Are There Any Income Restrictions On VA Loans? No, the VA does not limit income for qualified VA borrowers. Other state-guaranteed mortgage programs may set a maximum amount of income to qualify for certain loan programs, but the VA does not have such a requirement.

Is It Hard To Qualify For A VA Loan? If you are eligible, it can be relatively easy to qualify for VA loans as there is no down payment required, no minimum creditworthiness, and no maximum borrowing amount relative to income.

Can I get a VA loan with no income?

So, no, getting a VA loan is not impossible if you are unemployed, you just need to be able to prove that you have a source of income other than a paycheck.

Can I qualify for a VA loan without a job?

You don’t have to have a job at all to qualify for a VA mortgage. … When applying for a VA loan, you can ask your lender to consider Social Security income, disability income, alimony, child support, retirement benefits, and retirement income.

How much do I need to make to qualify for a VA loan?

If your gross monthly income is $ 7,000, the debt ratio is 2,639 divided by 7,000 for a ratio of. 38 or 38. Since the rate is below the maximum rate of 41, the borrower will qualify for the loan based on the debt ratios.

Do you need income for VA loan?

The VA prefers a debt-to-income ratio (DTI) of no more than 41%. However, borrowers with higher DTI rates may be approved if they have sufficient “residual income,” another factor lenders consider when considering mortgage applications.

What disqualifies for VA loan?

You have served 181 days of active service in peacetime OR. You have served in the National Guard or Reserve, OR, for 6 years. You are the spouse of a soldier who has died on duty or as a result of incapacity for work.

Is a VA loan based on income?

The debt to income ratio determines whether you can qualify for VA loans. The acceptable debt to income ratio for a VA loan is 41%. In general, the debt to income ratio refers to the percentage of your gross monthly income that is used on debt. In fact, it is the ratio of your monthly debt obligations to gross monthly income.

How long do you have to live in a VA loan House?

Veterans and active staff receiving a VA loan must certify that they intend to have the property personally as their primary residence. Essentially, homebuyers have 60 days in what the VA considers “reasonable time” to move into the home after the loan is closed.

Can I sell my home and get another VA loan? The good news is, yes, you can get another VA home loan if you are an Eligible Service Member, Veteran, or other qualified borrower. … buy a house with a VA loan, sell it, and then buy another house with a new VA loan. Refinancing From One VA Loan To Another.

How can I get out of my VA home loan?

The easiest way to accomplish this may be to apply for a VA Interest Rate Reduction Refinance Loan (VA IRRRL) which usually gives the borrower an advantage in the form of a lower interest rate, lower payments, or the ability to switch out a variable rate mortgage into a VA fixed rate loan.

How long do I have to stay in my VA loan home?

Essentially, homebuyers have 60 days in what the VA considers “reasonable time” to move into the home after the loan is closed. But some buyers may find that two months is not enough – especially those who are on active duty or preparing to leave the service.

Can you give away your VA loan?

VA loans are among the few loans that another person can take. However, you cannot just transfer a VA loan to someone else. You will need to go through a process with the lender in order for someone else to take over the loan.

Do I have to live in the house with a VA loan?

Occupancy rules of the VA In principle, everyone who receives the loan must live in the apartment, exclude letting, use the building exclusively for work purposes or allow friends or family members who are not entitled to live to live. In addition, occupancy must be achieved within a “reasonable time”, which in most cases means 60 days.

Can my dad use his VA loan to buy me a house?

The VA Joint Loan Program allows veterans and / or active service members to use a joint borrower who is not a spouse or other veteran. Most lenders do not allow these type of loans and prevent veterans from buying a home with a sister, brother, mother, father, son, daughter, or someone who is unrelated.

Can you rent out a home with a VA mortgage?

Renting out your home with a VA loan is an option. … VA loans are generally not used to purchase investment properties due to the owner-occupied property. But once you’ve lived in the house, it’s okay to vacate the house and rent it out.

Who pays closing costs on a VA loan?

Who pays the closing costs of a VA loan? When using a VA loan, the buyer, seller, and lender each pay different portions of the closing costs. The seller is not allowed to pay more than 4% of the total home loan in closing costs. However, your share of the closing costs includes the commissions for buyers and sellers of real estate agents.

Why don’t sellers like VA loans? Many sellers – and their real estate agents – do not like VA loans because they believe these mortgages make it harder or more expensive for the seller to close.

What fees do sellers pay on a VA loan?

In California and nationwide, these “seller concessions” are typically capped at 4% of the loan amount. The VA website states, “We require that a seller cannot pay more than 4% of the total home loan in the seller’s concessions.

Why VA loans are bad for sellers?

VA loans come with red tape, valuation delays, and fees borne by sellers instead of buyers – all reasons why offers are turned down, agents say. Additionally, real estate agents and veterans say that some sellers are turning down offers due to misunderstandings about the VA program.

Do sellers have to pay VA closing costs?

One of the great advantages of VA loans is that sellers can pay for all of your loan-related closing costs. Again, you don’t have to pay any of them, so this will always be a negotiation product between buyer and seller.

Who pays the VA closing fee?

One of the great advantages of VA loans is that sellers can pay for all of your loan-related closing costs. Again, you don’t have to pay any of them, so this will always be a negotiation product between buyer and seller.

Who pays VA funding fee?

Borrowers must pay the one-time VA sponsorship fee on a VA purchase or loan refinancing. Borrowers pay the fee directly to the Department of Veteran Affairs. The government will use the money raised to continue to fund home purchases for active service members, retired veterans, and surviving spouses.

Does the VA pay for closing costs?

Do California Home Buyers Have to Pay Graduation Costs on VA Loans? The answers are yes. In most cases, borrowers using the VA mortgage program to buy a home in California will have to pay the closing costs.

Is it easier to get a VA loan?

On average, VA loans are easier to approve than traditional loans, but more difficult to obtain today than they were in the past.

Are VA Loans Difficult? Should you be concerned? The short answer is, “No.” It’s true that VA loans used to be harder to close – but that’s old history. Today you likely have about the same problems with a buyer who has this type of mortgage as anyone else. And VA’s flexible policies may be the only reason your buyer can buy your home.

Why is it so hard to get a VA loan?

Borrowers must provide evidence that they have the income to make the mortgage payments. You shouldn’t have a lot of debt. While there are no minimum creditworthiness requirements, borrowers could struggle to get approved by a lender if they don’t have a FICO score of at least 620.

Can you be denied for a VA loan?

How Often Do Underwriters Refuse VA Loans? Approximately 15% of VA loan applications are rejected. So if your application is not approved, you are not alone. If you get rejected during the automated underwriting phase, you may be able to seek approval through manual underwriting.

What can disqualify you from a VA loan?

Veteran status requires service members to be discharged or discharged from the military on conditions other than dishonorable. A veteran with a dishonorable discharge is not eligible to participate in the VA Loan Guarantee Program.

Can you be denied a VA loan?

How Often Do Underwriters Refuse VA Loans? Approximately 15% of VA loan applications are rejected. So if your application is not approved, you are not alone. If you get rejected during the automated underwriting phase, you may be able to seek approval through manual underwriting.

Why would a VA home loan be denied?

The most common reason VA home loan applications are denied is because of mistakes in the application itself. Lenders cannot grant loans unless they are certain that your personal and financial information is correct. Before submitting your application, take the time to review every statement you have made and the numbers you entered.

How often do VA home loans get denied?

Overall, around 15 percent of applications are rejected, but some may be able to reapply.

Why do Realtors hate VA loans?

In some cases, home sellers will not accept offers to buy backed by VA guaranteed mortgages for fear of a low appraisal. … Because VA appraisals can add to their repair costs, home sellers sometimes refuse to accept offers to buy that are covered by the agency’s mortgage.

Are VA Loans Difficult For Sellers? Accepting an offer from a buyer with a VA loan to sell your home can be just as difficult as a buyer with a traditional mortgage. There are many myths and misconceptions about the VA loan but you, the seller, should not be concerned.

Should sellers stay away from VA loans?

Using a VA loan means you will end up saving money both on the purchase and during the life of the loan. However, it does mean that the person selling the house to you will have to spend more to sell the house to you. If you are concerned that the seller will refuse your offer because you are using a VA loan, don’t.

Why are VA loans bad?

The lower interest rates on VA loans are deceiving. Both will cost you much more in interest over the life of the loan than their 15-year counterparts. Also, you are more likely to get a lower interest rate on a 15 year traditional fixed rate loan than you would on a 15 year VA loan.

What are the pros and cons of a VA loan for a seller?

| professional | Con |

|---|---|

| No PMI | VA funding fee increases after first use |

| Higher permitted DTI | Credit could exceed market value |

| Credit flexibility | For primary residences only |

| Above average interest rates | Sellers and agents may not be familiar |

Can sellers discriminate against a VA loan?

No VA approved lender is allowed to discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory manner – the seller must comply with the laws of the Fair Housing Act.

Are VA loans a hassle for the seller?

The short answer is, “No.” It’s true that VA loans used to be harder to close – but that’s old history. Today you likely have about the same problems with a buyer who has this type of mortgage as anyone else. And VA’s flexible policies may be the only reason your buyer can buy your home.

Why do sellers refuse VA loans?

Some home sellers do not accept VA bids because they (mistakenly) believe that they will have to pay all of the buyer’s closing costs. The VA limits the closure costs veterans can pay, which is a huge benefit for those who have served our country.