In fact, about 73% of all FHA loans successfully close within 90 days, according to Ellie Mae’s Origination Insight Report of May 2019. For comparison, about 75% of all conventional loans successfully close within 90 days. That’s only a 2% difference.

Is it better to go conventional or FHA?

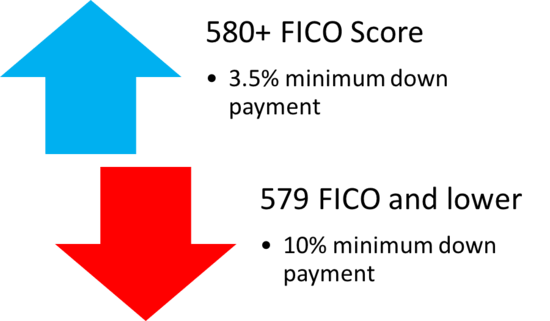

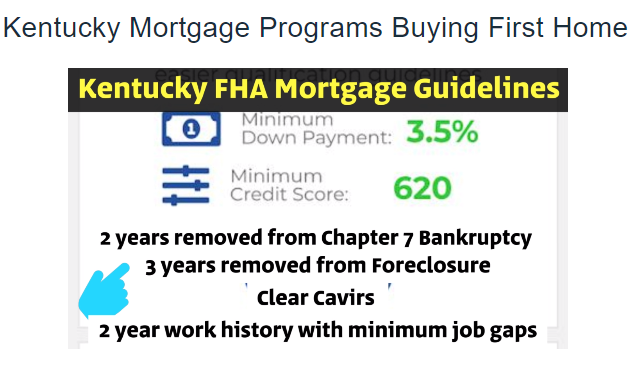

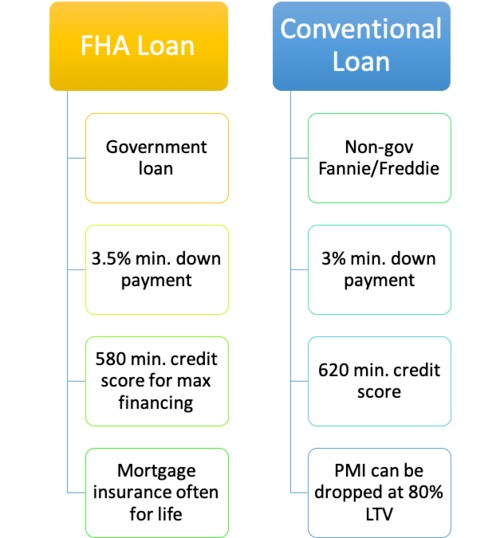

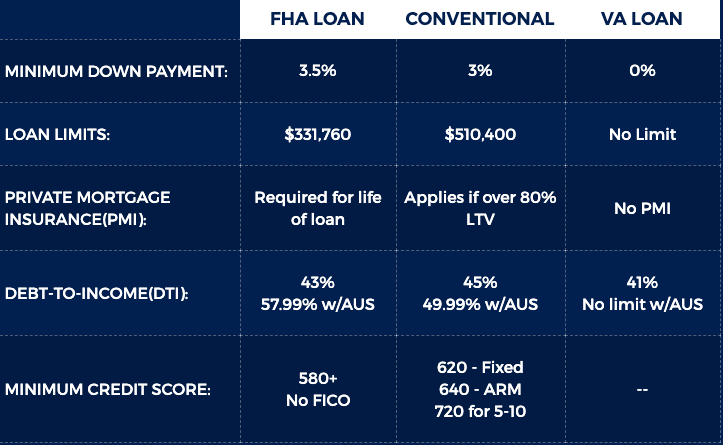

FHA could be better than conventional if you have a credit score below 680, or higher levels of debt (up to 50% DTI). Conventional loans become more attractive the higher your credit score, as you can get a lower interest rate and a monthly payment.

Why would you choose FHA than conventional? Conventional Loans. FHA loans allow for lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow for slightly lower down payments. … FHA loans are insured by the Federal Housing Administration, and conventional mortgages are not insured by a federal agency.

What is the downside of a FHA loan?

A major disadvantage of FHA loans is the high cost of FHA mortgage insurance, which must be paid over the life of the loan if you make the minimum 3.5% down payment. FHA district loan limits also limit your purchasing power, as they are set at 35% below compliant conventional loan limits in most counties in the United States.

Why you should not get an FHA loan?

There are several reasons to avoid an FHA loan, including higher costs before and in each payment. Not being willing to accept a mortgage: A small down payment could be a red flag. … Pre-insurance: When you lower less than 20%, you have to pay for mortgage insurance. FHA loans come with two types of insurance.

What is the catch with an FHA loan?

Mortgage insurance protects the lender if you are unable to pay your mortgage on the way. If your down payment is less than 20%, you generally have to pay this insurance, no matter what loan you receive.

Why is it so hard to buy a house with an FHA loan?

You can’t buy any house with an FHA loan Well, the FHA has a few more rings to skip than conventional loans. To be approved for the loan, the home must pass an inspection conducted by the U.S. Department of Housing and Urban Development.

Are FHA closing costs more than conventional?

Closing costs for FHA loans are about the same as they are for conventional loans, with a few exceptions. The FHA home assessment is a little more complicated than the standard assessment, and it often costs about $ 50 more. FHA requires a prepaid mortgage insurance (MIP) of 1.75 percent of your loan amount.

How much is closing cost on a house FHA?

The closing costs on your FHA loan will be similar to those of a conventional mortgage loan. These costs will usually be around 2% to 6% of the cost of your property. Your costs will be linked to things like your loan amount, where the property is located and lender costs.

Is it better to go conventional or FHA?

FHA loans allow for lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow for slightly lower down payments. … FHA loans are insured by the Federal Housing Administration, and conventional mortgages are not insured by a federal agency.

Do you end up paying more with FHA loan?

A longer term will lower your monthly payment, but you will pay much more interest during that long time. A 15-year fixed-rate FHA mortgage will lower the total interest rate, but your monthly payment will be higher.

What does FHA mean for seller?

But as you enter the sale, you’ll need to determine if you’re interested in receiving all sorts of offers, including those backed by FHA loans. For those unfamiliar with the term – FHA means Federal Housing Administration.

What are the disadvantages of an FHA loan for the seller? Another possible downside for sellers is that FHA loans have stricter criteria than conventional mortgages. The appraisal should look at the home more closely, and the sale may be blocked by things like carved paint, broken windows, or malfunctioning appliances.

Is an FHA loan bad for the seller?

Unfortunately, some home sellers see the FHA loan as a riskier loan than a conventional loan because of its requirements. The softer financial requirements of the loan can create a negative perception of the borrower. And, on the other hand, the strict appraisal requirements of the loan can make the seller nervous.

How does a FHA loan affect the seller?

FHA loans attract buyers who may not have the cash savings for the closing costs out of pocket. FHA loans let the seller take even 6 percent of the value of the home to pay the buyer’s closing costs, making it easier for the buyer to pay off the house.

Do sellers discriminate against FHA loans?

There is no law that can force a seller to accept FHA funding, although sellers artificially restrict their buyer by doing so. Buyers, however, can help their business by agreeing on a “how is” assessment, for example. They might also consider asking for less in vendor contributions to help with closing costs.

Why do sellers hate FHA loans?

There are two main reasons why sellers may not want to accept offers from buyers with FHA loans. … The other major reason that sellers don’t like FHA loans is that the guidelines require appraisers to look for certain defects that could cause housing concerns or health, safety or security risks.

What does FHA loan require of seller?

In the FHA appraisal process, the seller must complete repairs that are “necessary to maintain the safety, security and soundness of the Property, maintain the continued marketability of the property, and protect the health and safety of the residents” for the loan to close.

Are FHA loans difficult for sellers?

FHA loans require that the home be appraised by an appraiser who meets high qualifications. The property condition is one of the biggest reasons why an FHA mortgage could be a problem for a home seller. These appraisers seek to ensure that the house is in good condition, safe and habitable.

How do FHA loans work for the seller?

FHA loans attract buyers who may not have the cash savings for the closing costs out of pocket. FHA loans let the seller take even 6 percent of the value of the home to pay the buyer’s closing costs, making it easier for the buyer to pay off the house.

What are seller required fees for FHA loans?

FHA loans allow sellers to cover closing costs up to six percent of your purchase price. This can mean lending fees, property taxes, homeowners insurance, fee payments and title insurance. Of course, this kind of help from vendors is not really free.

Why do sellers not want FHA?

There are two main reasons why sellers may not want to accept offers from buyers with FHA loans. … The other major reason that sellers don’t like FHA loans is that the guidelines require appraisers to look for certain defects that could cause housing concerns or health, safety or security risks.

Do sellers discriminate against FHA loans?

There is no law that can force a seller to accept FHA funding, although sellers artificially restrict their buyer by doing so. Buyers, however, can help their business by agreeing on a “how is” assessment, for example. They might also consider asking for less in vendor contributions to help with closing costs.

Is FHA bad for seller?

The short answer: It is true that some sellers are wary of accepting offers from home buyers using FHA loans. … In some cases, there could be legitimate reasons why a salesperson would not want to work with an FHA borrower. But more often than not, these worries are unfounded and unnecessary.

Why you should not get an FHA loan?

There are several reasons to avoid an FHA loan, including higher costs before and in each payment. Not being willing to accept a mortgage: A small down payment could be a red flag. … Pre-insurance: When you lower less than 20%, you have to pay for mortgage insurance. FHA loans come with two types of insurance.

Can you buy an as is home with an FHA loan?

While HUD does not make its own loans, the Federal Housing Administration (FHA) does. “Either way properties may not qualify for government-insured loans like FHA or VA,” Brook warns. “To qualify for this type of loan, real estate may not have defects such as roofing problems, spray paint or other major deficiencies.”

CAN YOU NEGOTIATE AS IS HOME? When a real estate agent is listed as a home to sell “as is,” that doesn’t change the buyer’s legal rights. The listing agent must still have the seller reveal known problems, and the buyer can still negotiate an offer with the final sale, subject to a property inspection.

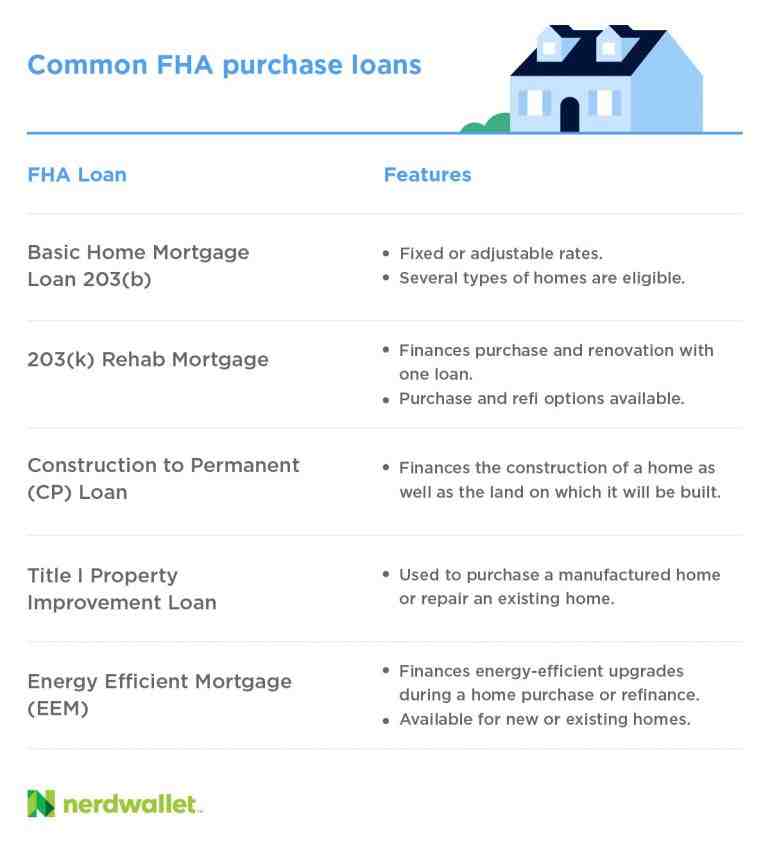

Can you get a FHA loan on a home that needs repairs?

Limited and standard 203 (k) loans have different rules on how much you can borrow for renovations and what you can do with the money. Improvements that the FHA deems, such as luxuries, such as a swimming pool or outdoor kitchen, are generally not eligible.

Can you use an FHA loan to fix up a house?

Absolutely. A program known as HUD 203 (k) lets qualified buyers purchase repairs with secured FHA loans, and even has built-in protection for the borrower if the repair and renovation process will cost more than expected. IS AN FHA “FIXER UPPER” LOAN DIFFERENT FROM A STANDARD FHA MORTGAGE?

Can I get a home loan for a house that needs repairs?

Obtain a construction loan If a property (including vacant land) requires extensive building or renovation work, a special construction loan can be used to pay it off. Unlike a traditional mortgage, you do not receive all the money as a down payment at the beginning of a construction loan.

Does FHA require repairs before closing?

The Federal Housing Administration (FHA) mortgage program is a great way to buy a home. The most common FHA product is the 203 (b) loan, which requires that some household items be repaired by the seller before closing. A seller may refuse to make repairs, which may lead to the termination of the FHA contract.