What would disqualify you from getting an FHA loan?

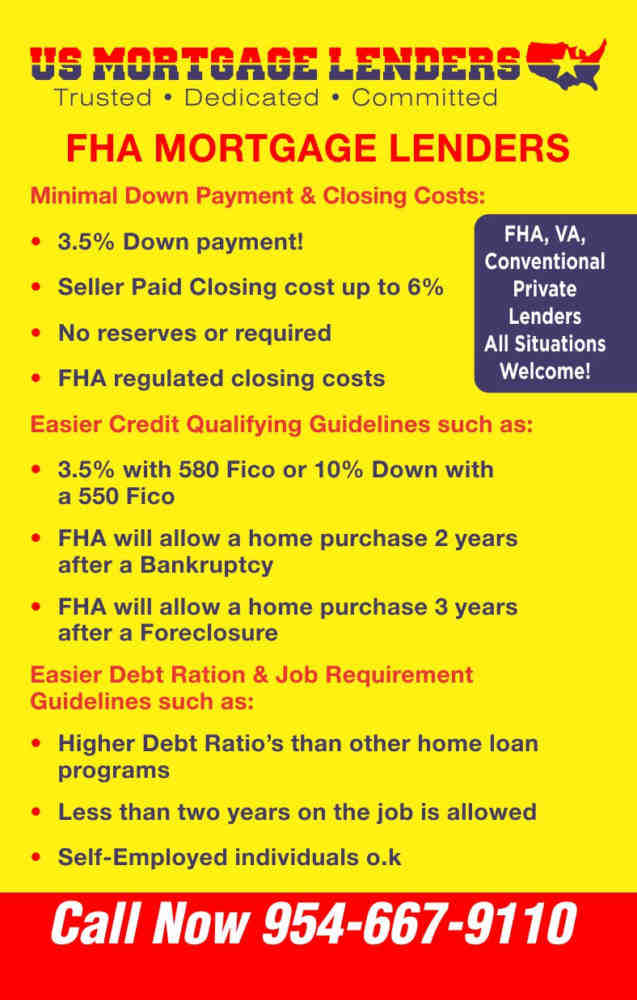

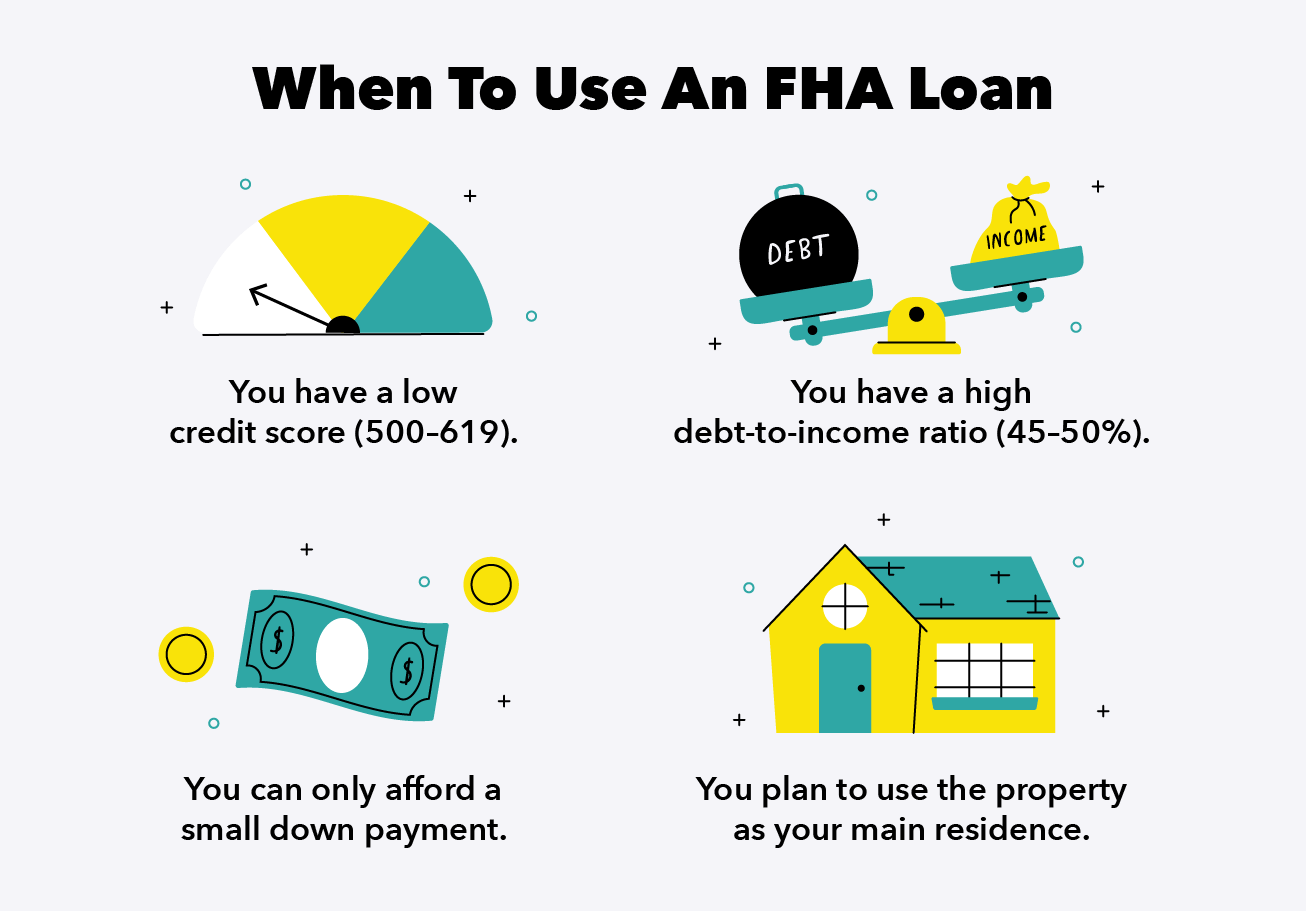

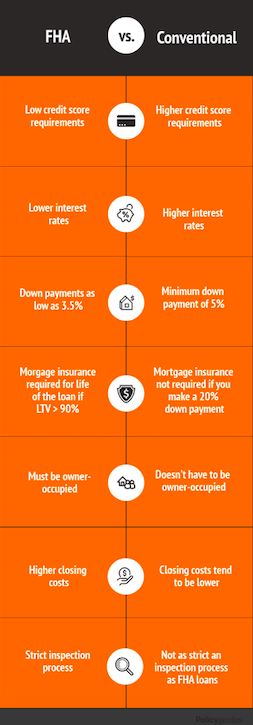

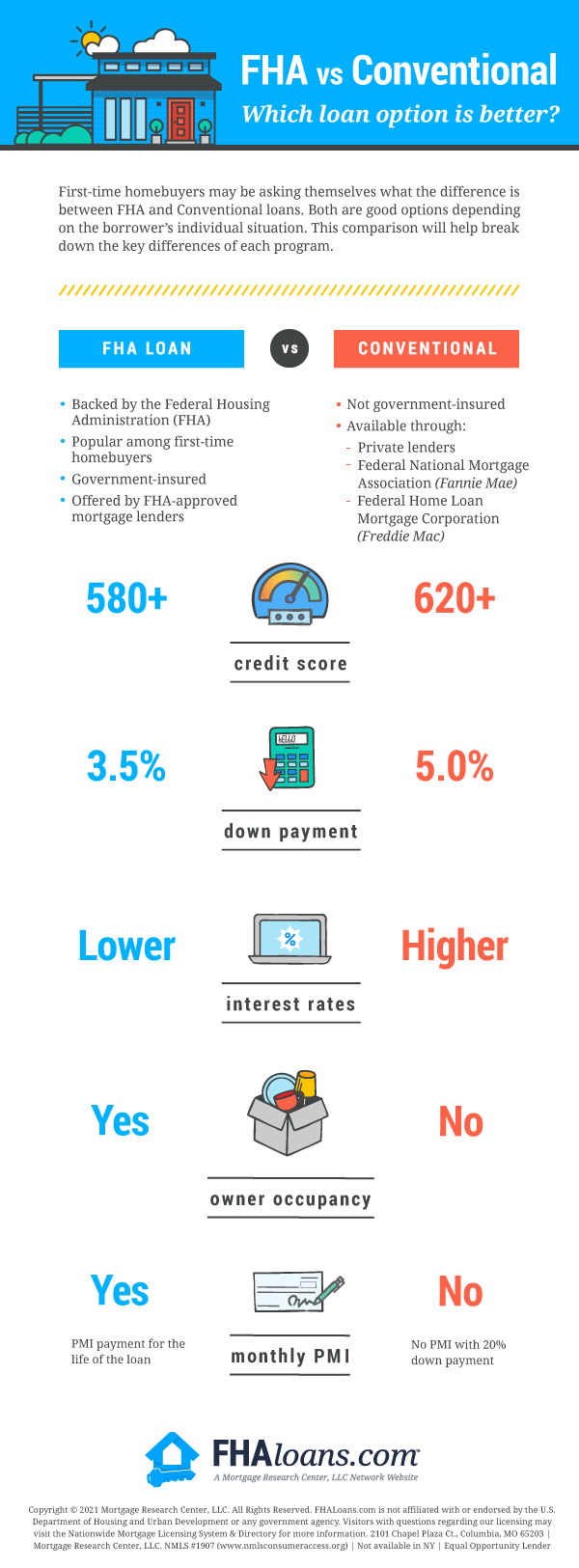

Reasons for FHA Rejection There are three popular reasons for being turned down for an FHA loan – bad credit, a high debt-to-income ratio, and generally enough money to cover the lower payment and closing costs.

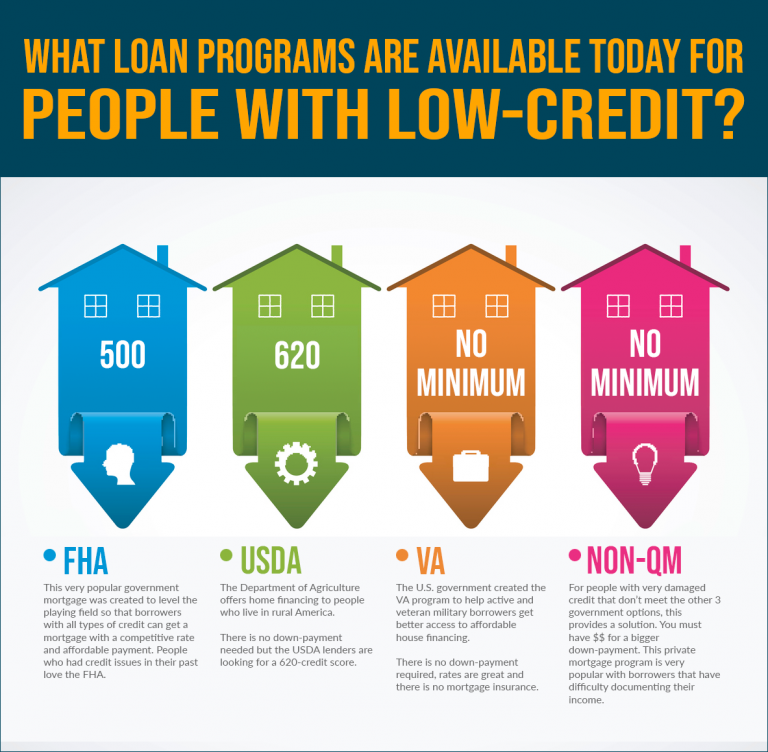

Who is not eligible for an FHA loan? Lenders with FICO ratings between 500 and 579 would be required to put down 10% for their FHA mortgage. Those with FICO scores below 500 are not eligible for FHA funding. In addition, borrowers will need a 12 month record of timely payments for all financial responsibilities.

What do FHA underwriters look for approval?

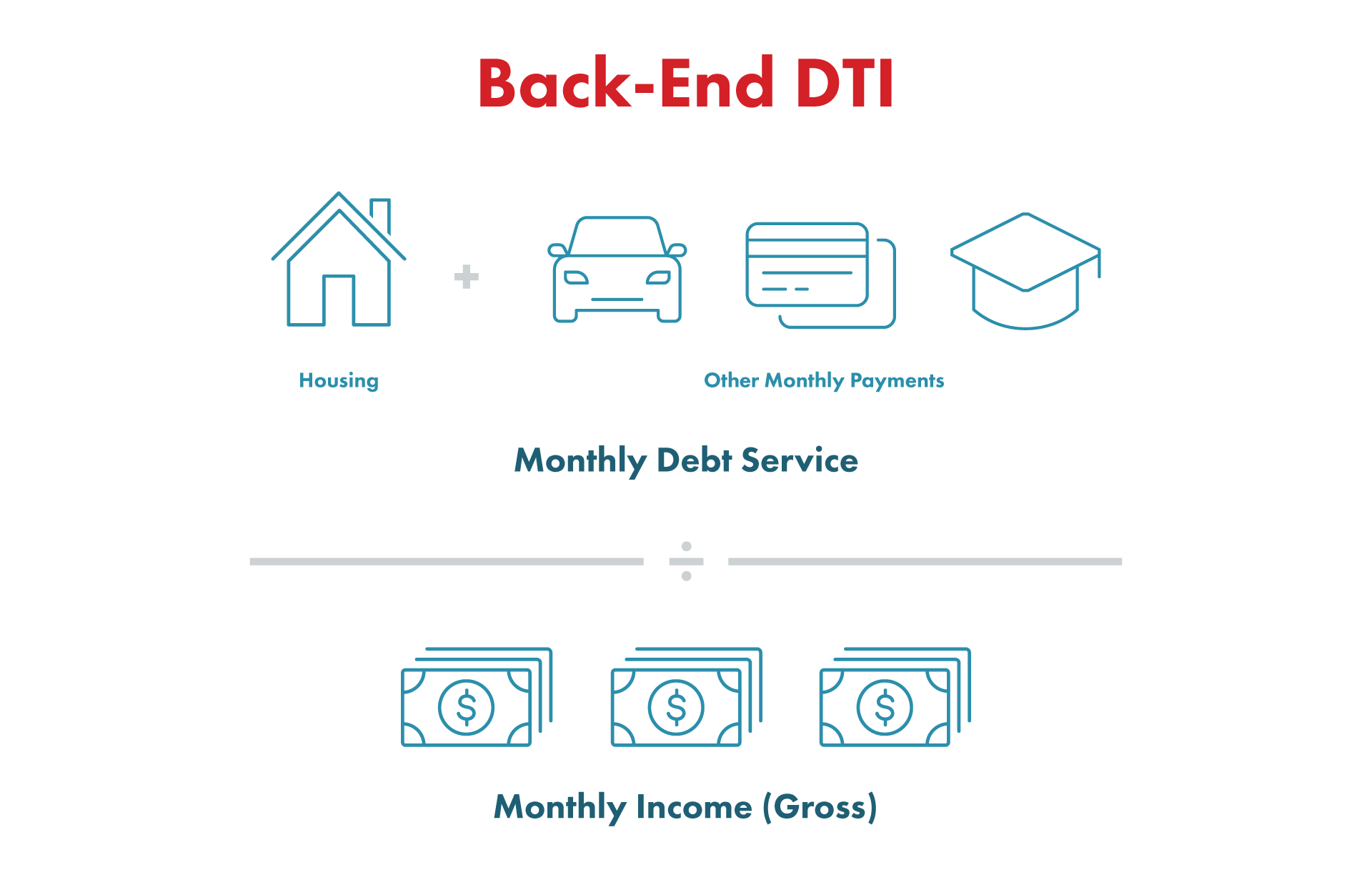

Some of the things the FHA underwriter will look for during this process are: Lender’s credit ratings and (possibly) credit reports. Debt-to-income ratio, or DTI. Bank statements showing current assets, verified.

Can I buy a house if I make 45000 a year?

It is definitely possible to buy a house at $ 50K a year. For many lenders, low-payment loans and down payment assistance programs make homeownership more accessible than ever.

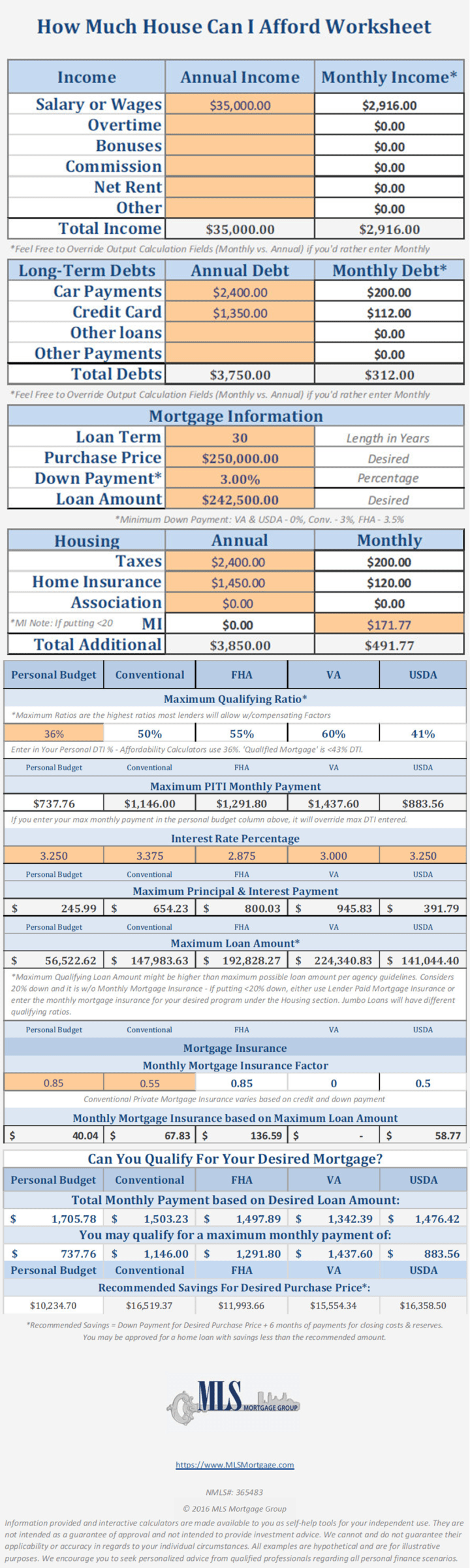

How much house can I afford if I make 43000? Multiply $ 100,000 by 43% to get $ 43,000 in annual income. Divide $ 43,000 by 12 months to convert the 43% annual limit to a $ 3,583 monthly upper limit. All your monthly bills including your prospective mortgage cannot exceed $ 3,583 a month.

Can I afford a house on 40k a year?

Take a home buyer who makes $ 40,000 a year. The maximum for monthly mortgage-related payments at 28% of gross income is $ 933. ($ 40,000 times 0.28 equals $ 11,200, and $ 11,200 divided by 12 months equals $ 933.33.)

How much do I need to make to buy 200k house?

How much income is needed for a 200k mortgage? A $ 200k mortgage with a 4.5% interest rate over 30 years and a $ 10k underpayment will require an annual income of $ 54,729 to qualify for the loan. You can account for even more variations in these parameters with our Mortgage Required Income Calculator.

How much do you need to make to afford a 100k house?

When trying to decide how much mortgage you can afford, a general guide is to multiply your income by at least 2.5 or 3 to get an idea of the maximum house price you can afford. If you earn about $ 100,000, the maximum price you could afford would be about $ 300,000.

How much should I put down on a 150k house?

Assuming a $ 150,000 purchase price, this means you will need a minimum down payment of $ 5,250.

What is the income limit for FHA loan?

FHA loan income requirements There is no minimum or maximum wage that will qualify you for or prevent you from getting a FHA-insured mortgage. However, you must: Have at least two established credit accounts. For example, credit card and car loan.

What would prevent you from getting an FHA loan? Reasons for FHA Rejection There are three popular reasons for being turned down for an FHA loan – bad credit, a high debt-to-income ratio, and generally insufficient funds to cover the down payment and closing costs.

What income does FHA look at?

Your gross monthly income is $ 4,166. That means, your monthly mortgage payment would need to be about $ 1,458. You will also need to account for any other debt you have. To get an FHA loan, your mortgage payment plus other monthly debt payments cannot exceed 50 percent of your income.

What counts as income for FHA?

The FHA home loan rules require the lender to consider how long you’ve been earning the income whether it’s commissions, self-employed earnings, tips and other forms of payment. … These can all be counted as income for loan approval purposes if the income meets FHA loan requirements.

Does FHA look at gross or net income?

The lender takes into account your gross income – the amount you make before taxes or deductions – when calculating your DTI ratios. … The Department of Housing and Urban Development, which sets FHA guidelines, defines gross income as the annual amount earned by the lenders who will be responsible for the loan.

Is FHA loan based on income?

FHA loan requirements The exact amount depends on a variety of factors, such as: Your debt-to-income ratio (DTI). DTI ratio is the amount of your monthly debt payments divided by your gross monthly income. … This should be no more than 43% of your gross monthly income.

Can you make too much money to qualify for an FHA loan?

Like many HUD programs, FHA loans were originally intended for borrowers with low to moderate incomes. But there are no specific income requirements associated with this program, either minimum or maximum. As far as the official rules and requirements go, you can’t make too much money to qualify for an FHA loan.

How is FHA loan amount determined?

FHA loan requirements The exact amount depends on a variety of factors, such as: Your debt-to-income ratio (DTI). DTI ratio is the amount of your monthly debt payments divided by your gross monthly income. Lenders look at two types of DTI ratios, end-to-end ratios.

What are FHA income requirements?

Everyone who is financially eligible based on the FHA minimum loan and lender standards is welcome to apply for an FHA mortgage loan, refinancing loan, reverse mortgage, etc. As the FHA loan rulebook, HUD 4000.1, does not specify any minimum income requirement for an FHA mortgage, there will be no upper income limit or ceiling.

Can you make too much money to qualify for an FHA loan?

Like many HUD programs, FHA loans were originally intended for borrowers with low to moderate incomes. But there are no specific income requirements associated with this program, either minimum or maximum. As far as the official rules and requirements go, you can’t make too much money to qualify for an FHA loan.

Can Rich people get an FHA loan?

Although FHA can be used by people first and repurchase alike, it is most used by first time buyers. What is interesting about FHA is that while it is aimed at first time buyers and low to moderate income individuals and families, there are no income restrictions.

Is there a salary limit for FHA loan?

FHA loan income requirements There is no minimum or maximum wage that will qualify you for or prevent you from getting a FHA-insured mortgage. However, you must: Have at least two established credit accounts.