How do you calculate if PMI can be removed?

Pay Your Mortgage One way to eliminate the PMI is to take the purchase price of the home and multiply it by 80%. Then pay your mortgage to that amount. So if you pay $250,000 for a house, 80% of that value is $200,000. Once you’ve paid off a loan of up to $200,000, you can write off PMI.

What does your LTV need to clear PMI? Under the Homeowner Protection Act, your lender must automatically cancel the PMI on the date your LTV is at 78% based on the original payment schedule. If you make an extra payment and your LTV reaches 78% earlier than scheduled, you will need to contact the lender to have the PMI removed early.

How do you calculate when PMI can be removed?

To estimate the amount your mortgage balance must reach to qualify for PMI cancellation, multiply your original home purchase price by 0.80. Who is affected: Homeowners can use this method once they reach 20 percent equity.

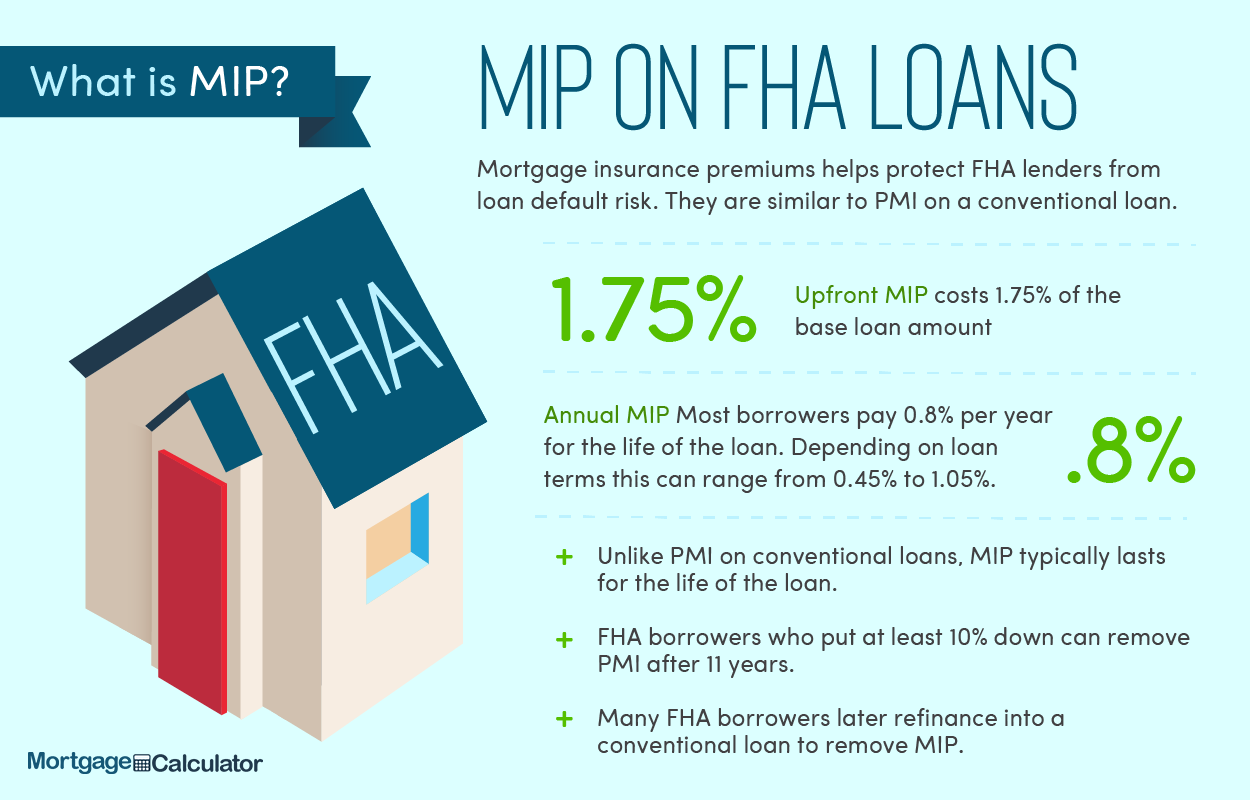

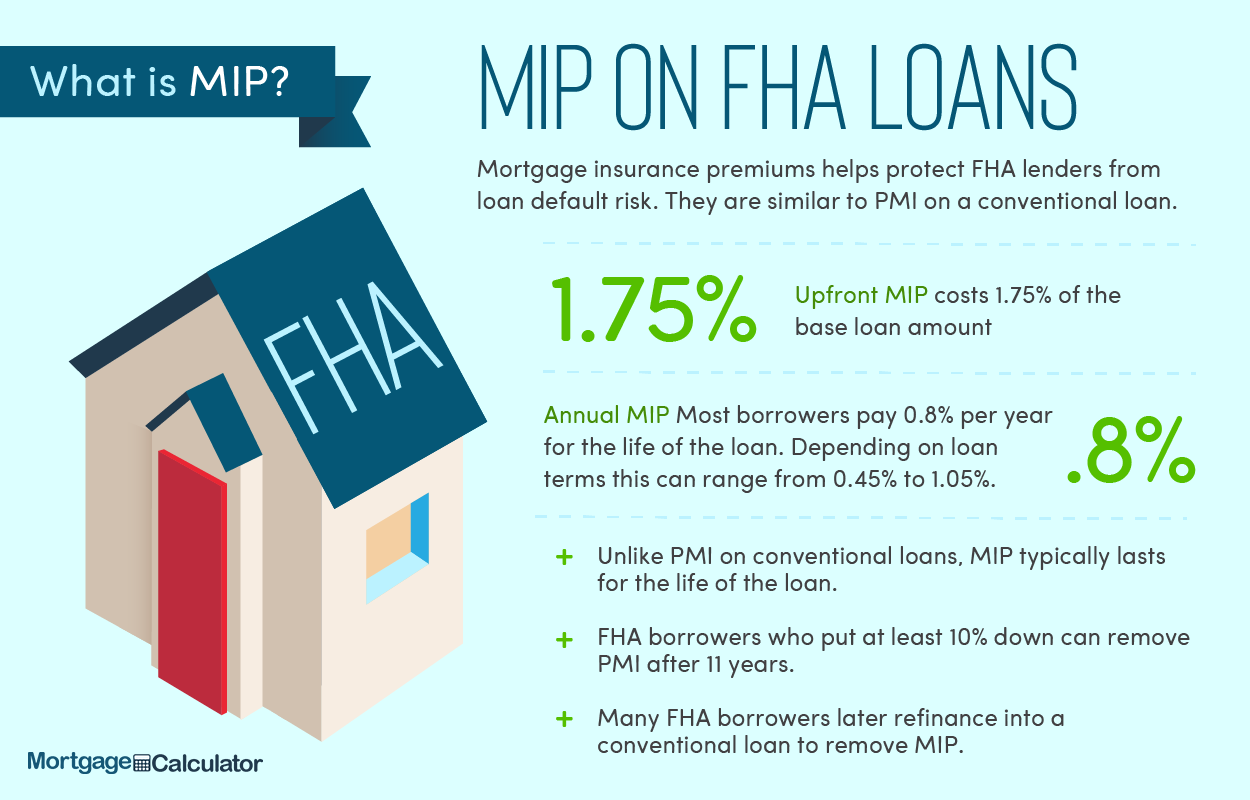

Do FHA loans have PMI forever?

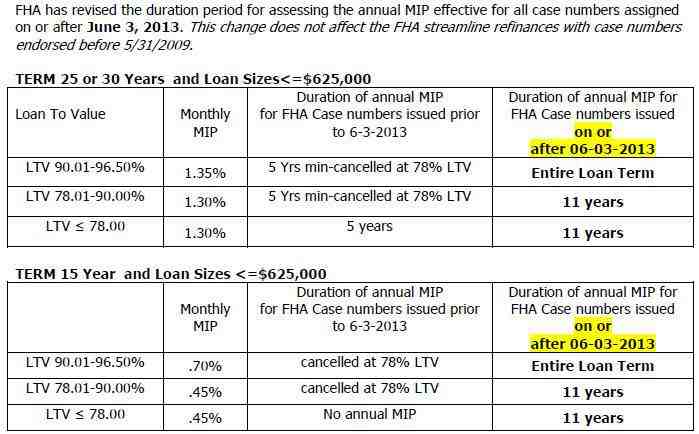

Mortgage insurance (PMI) was removed from conventional mortgages after loans reached a 78 percent loan-to-value ratio. But removing FHA mortgage insurance is a different story. Depending on your down payment, and when you first took out the loan, the FHA MIP usually lasts 11 years or the term of the loan.

How do you figure out when PMI will end?

Your mortgage provider is required to cancel your PMI for free when your mortgage balance reaches 78% of the value of the home, or the mortgage reaches the midpoint of the loan term, such as the 15th year of a 30-year mortgage.

Why did my PMI go up?

The bigger your loan, the more PMI you have to pay. PMI costs are also affected by your loan-to-value (LTV) ratio. … The lower your LTV, the higher the risk to lenders, which is why PMI fees often increase as your LTV declines. Finally, your credit score can also affect PMI costs.

Can I cancel PMI after 1 year?

You have the right to ask your service provider to cancel the PMI when you have reached the date when your principal balance on your mortgage is scheduled to fall to 80 percent of the original value of your home. This date should be provided to you in writing on the PMI disclosure form when you receive your mortgage.

Did you never get your PMI money back? The PMI paid by the lender is non-refundable. The benefit of lender-paying PMI, even though the interest rate is higher, is that your monthly payments can still be lower than making monthly PMI payments. That way, you can qualify to borrow more.

Can you get a refund on PMI?

When the PMI is cancelled, the lender has 45 days to return the applicable premium. That said, do you get your PMI back when you sell your home? It’s a reasonable question given that new borrowers are ready for mortgage insurance moving forward. Unfortunately for you, the seller, the premium you paid will not be refunded.

Can I claim my PMI?

Yes, through the 2020 tax year, private mortgage insurance premiums (PMI) are deductible as part of the mortgage interest deduction.

How do I get PMI back?

Refunds on upfront mortgage insurance premium payments (MIP) can be requested through HUD’s Single Family Insurance Operations Division (SFIOD). In FHA Connection, go to the Upfront Premium Collection menu and select Request a Refund in the Pay Upfront Premium section.

Can I get mortgage insurance refund?

On FHA loans, the lender must cancel your mortgage insurance when you have 22 percent equity in your home. You may get a refund on your FHA mortgage insurance payment up front if you don’t default on your loan. Likewise, you may get a partial refund of your personal mortgage insurance policy after coverage ends.

Can you get PMI removed early?

Even if you pay PMI, the coverage protects the lender, not you, against the risk that you will stop making your mortgage payments. … You may be able to clear the PMI early by asking the mortgage lender, in writing, to clear the PMI once your mortgage balance reaches 80% of the home’s value at the time you bought it.

Can PMI be removed early?

You can request to cancel PMI early if you have made additional payments that reduce the principal balance of your mortgage to 80 percent of the original value of your home. … You must have a good and current payment history in your payments.

Is PMI removal worth?

It’s worth refinancing to remove PMI’s mortgage insurance if your savings will outweigh the closing costs of your refinancing. The current low interest rate climate offers the opportunity to get out of loans with higher interest rates while also eliminating mortgage insurance.

Can you cancel PMI before 2 years?

Many loans have “seasoning requirements” that require you to wait at least two years before you can refinance to get rid of PMI. So if your loan is less than two years, you can request a PMI cancellation refund, but you are not guaranteed approval.

How do I get rid of my PMI?

To clear PMI, or personal mortgage insurance, you must have at least 20% equity in the home. You can ask the lender to cancel the PMI when you have paid the mortgage balance of up to 80% of the initial appraisal value of the home. When the balance drops to 78%, the mortgage provider is obliged to write off the PMI.

Can you finally get rid of PMI? Some types of loans do not allow you to make advance payments for the purpose of writing off mortgage insurance. You must pay PMI for the duration of your loan if you have an LPMI. The only way to cancel PMI is to refinance the interest rate or type of your mortgage loan.

Is it worth it to get rid of PMI?

It’s worth refinancing to remove PMI’s mortgage insurance if your savings will outweigh the closing costs of your refinancing. The current low interest rate climate offers the opportunity to get out of loans with higher interest rates while also eliminating mortgage insurance.

Should I pay extra on my mortgage to get rid of PMI?

Paying off the mortgage early can be wise for some people. … Eliminating your PMI will reduce your monthly payments, giving you an immediate return on your investment. Homeowners can then apply the extra savings back to the principal of the mortgage loan, ultimately paying off their mortgage faster.

Can you get rid of PMI after 2 years?

Many loans have “seasoning requirements” that require you to wait at least two years before you can refinance to get rid of PMI. So if your loan is less than two years, you can request a PMI cancellation refund, but you are not guaranteed approval.