Should I accept a buyer with a VA loan?

Contents

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer who uses a VA loan when selling their home can be as difficult as a buyer who uses a conventional mortgage. There are many myths and misconceptions about the VA loan, but you, as the seller, should have nothing to worry about.

Why don’t sellers accept VA loans? In some cases, home sellers do not accept VA mortgage-backed purchase offers for fear of the low appraised value. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Is a VA loan bad for the seller?

Using a VA loan means that you will end up saving money on the purchase and over the life of the loan. However, this means that the person who sells you the house will have to spend more to sell it. If you’re worried about the seller denying your offer because you’re using a VA loan, don’t worry.

Why do sellers hate VA loans?

VA mortgage loans also come with minimal property requirements that can end up forcing homeowners to make a lot of repairs. Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

What are the pros and cons of a VA loan for a seller?

| Pro | Swindler |

|---|---|

| No PMI | VA funding rate increases after first use |

| highest DTI allowed | Loan may exceed market value |

| credit flexibility | For main residences only |

| Better than average interest rates | Sellers and agents may not be familiar |

What are the pros and cons of a VA loan for a seller?

| Pro | Swindler |

|---|---|

| No PMI | VA funding rate increases after first use |

| highest DTI allowed | Loan may exceed market value |

| credit flexibility | For main residences only |

| Better than average interest rates | Sellers and agents may not be familiar |

Do home sellers hate VA loans?

VA mortgage loans also come with minimal property requirements that can end up forcing homeowners to make a lot of repairs. Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

What fees does the seller pay on a VA loan?

In California, and across the country, these “seller leases” are generally limited to 4% of the loan amount. As it states on the VA website: “We require that a seller cannot pay more than 4% of the total home loan on the seller’s concessions.

How much does a VA loan cost the seller?

Who Pays Closing Costs on a VA Loan? When using a VA loan, the buyer, seller and lender pay different parts of the closing costs. The seller cannot pay more than 4% of the total home loan in closing expenses. But their share of closing costs includes commissions for buyers and sellers.

Why VA loans are bad for sellers?

VA loans come with bureaucracy, appraisal delays and fees charged by sellers rather than buyers — all reasons why offers are being rejected, agents say. Also, say real estate agents and veterans, some sellers reject offers because of misconceptions about the VA program.

What fees do sellers pay on a VA loan?

In California, and across the country, these “seller leases” are generally limited to 4% of the loan amount. As it states on the VA website: “We require that a seller cannot pay more than 4% of the total home loan on the seller’s concessions.

Can you be denied for a VA loan?

How often do underwriters deny VA loans? About 15% of VA loan applications are denied, so if yours isn’t approved, you’re not alone. If you are denied during the automated underwriting stage, you can get approval through manual underwriting.

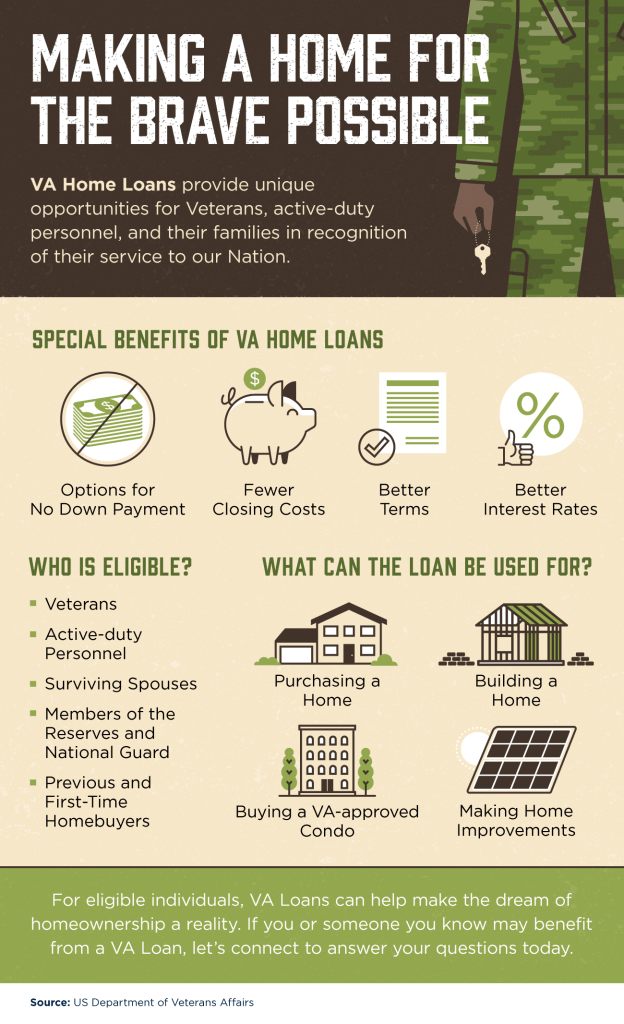

Is it difficult to get approved for a VA loan? If you are eligible, VA loans are reasonably easy to qualify as there is no down payment required, no minimum credit score and no maximum limit on how much you can borrow against income.

Can a VA loan be rejected?

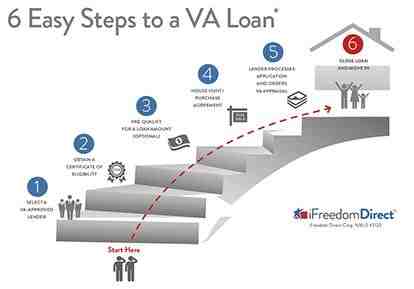

When lenders refuse a loan, they do so reluctantly. VA lenders make money by approving loans, not denying them, so they will do their best to get their approval. When they cannot, they will send what is called an adverse action notice. … You must first find out specifically, exactly why your loan was denied.

What will cause VA loan to get disapproved?

If your VA loan application was denied, it could be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell if your income was too low. If so, look for ways to increase your income if possible.

Why would a VA home loan be denied?

The most common reason VA home loan applications are denied is because of errors in the application itself. Lenders cannot grant loans unless they are sure your personal and financial details are correct. Before submitting your application, please take the time to review each statement made and numbers entered.

Why would a VA home loan be denied?

The most common reason VA home loan applications are denied is because of errors in the application itself. Lenders cannot grant loans unless they are sure your personal and financial details are correct. Before submitting your application, please take the time to review each statement made and numbers entered.

Why would a house not be VA approved?

Insufficient Heating Homes that do not have adequate heating systems will never pass the VA assessment. In order for a home to be approved, there must be an efficient and acceptable heat source that can provide residents with a comfortable living condition.

What would cause an underwriter to deny a VA loan?

Application Errors Application errors are the main cause of VA loan rejections. That’s why before submitting your documents, you need to double-check them to make sure they’re correct. Underwriters are perfectionists when it comes to accuracy and it is advisable to eliminate all mistakes.

What disqualifies you from a VA loan?

Dishonorable Dismissal Veteran status requires that military personnel be discharged (or discharged) from military service under conditions other than dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA Loan Guaranty program.

What will cause VA loan to get disapproved?

If your VA loan application was denied, it could be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell if your income was too low. If so, look for ways to increase your income if possible.

What will fail a VA appraisal?

What will fail in a VA assessment? In general, any visible health or safety concerns will pose an issue on a VA assessment report. You will not be able to close a house until these issues are resolved. In some cases, sellers are willing to cover the cost of essential repairs rather than losing the sale.

Who pays closing costs on VA loan?

Who Pays Closing Costs on a VA Loan? When using a VA loan, the buyer, seller and lender pay different parts of the closing costs. The seller cannot pay more than 4% of the total home loan in closing expenses. But their share of closing costs includes commissions for buyers and sellers.

What seller is responsible for a VA loan? Sellers Must Pay Certain Fees The loan program prohibits buyers from paying certain fees at closing. Typically, this will include the loan underwriting fee and the closing fee. These fees do not go away. Instead, they become the seller’s responsibility.

How much are closing costs in VA for buyer?

In California, VA loan closing costs tend to average between 3% and 5% of the amount being borrowed. For example, on a loan amount of $500,000, the borrower’s total closing costs can fall between $15,000 (3%) and $25,000 (5%). But they can fall outside of that range in some cases.

Who pays for closing costs in Virginia?

Buyers have closing costs, as do sellers. In addition to the initial loan payment, they usually pay another 2-3% of the sale price. Because of this, it is not uncommon for the buyer to ask you to give them a credit on the settlement to help cover closing costs.

How much are closing costs for buyer in Virginia?

As a general rule of thumb, when shopping in Virginia, you can expect the sum of your closing costs, escrow account, and miscellaneous fees and inspections to not exceed 2% of the sales price plus $2,000. For example, on a $300,000 property, you want to budget $8,000 plus your down payment.

How can I avoid closing costs with a VA loan?

Now, you know there are closing costs on VA loans, but what if you don’t want to or can’t bring those costs into closing? The most common way to beat closing these funds is through closing costs paid by the seller and VA sales grants. Remember that the seller is NOT obligated to pay the buyer’s closing costs.

Can a VA buyer pay their own closing costs?

Closing costs are always part of the mortgage equation. But one of the great benefits of VA loans is that they limit what veterans and military personnel can pay in closing costs. VA buyers are prevented from paying certain costs and fees in some cases. … A flat rate of 1 percent charged by the lender.

Does VA loan waive closing costs?

The VA loan allows you to include some of the closing costs in the total loan amount. … The other fees that create your closing costs cannot be incorporated into the loan. But you can receive concessions from the seller or lender to reduce the initial cash cost.

What fees must the seller pay on a VA loan?

It is normally between $300 and $900. It is a non-allowed cost. Some lenders waive VA loans, but many will charge the seller. The other fee is for the security company and will be called the guarantee, settlement or closing fee.

Why VA loans are bad for sellers?

VA loans come with bureaucracy, appraisal delays and fees charged by sellers rather than buyers — all reasons why offers are being rejected, agents say. Also, say real estate agents and veterans, some sellers reject offers because of misconceptions about the VA program.

What fees are sellers required to pay on a VA loan?

In California, and across the country, these “seller leases” are generally limited to 4% of the loan amount. As it states on the VA website: “We require that a seller cannot pay more than 4% of the total home loan on the seller’s concessions.

Why do sellers prefer conventional over VA?

Some brokers advise homeowners to accept conventional loan or cash offers, even if they are lower than VA offers, because these options are considered less cumbersome than VA loans. … “Choosing a conventional offer over a VA offer is not considered discrimination.”

Is a VA loan bad for the seller? Using a VA loan means that you will end up saving money on the purchase and over the life of the loan. However, this means that the person who sells you the house will have to spend more to sell it. If you’re worried about the seller denying your offer because you’re using a VA loan, don’t worry.

Why do sellers hate VA loans?

Before securing mortgages, the VA wants to ensure that the homes that qualified veterans buy are safe and worth the sale price. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

What is bad about a VA loan?

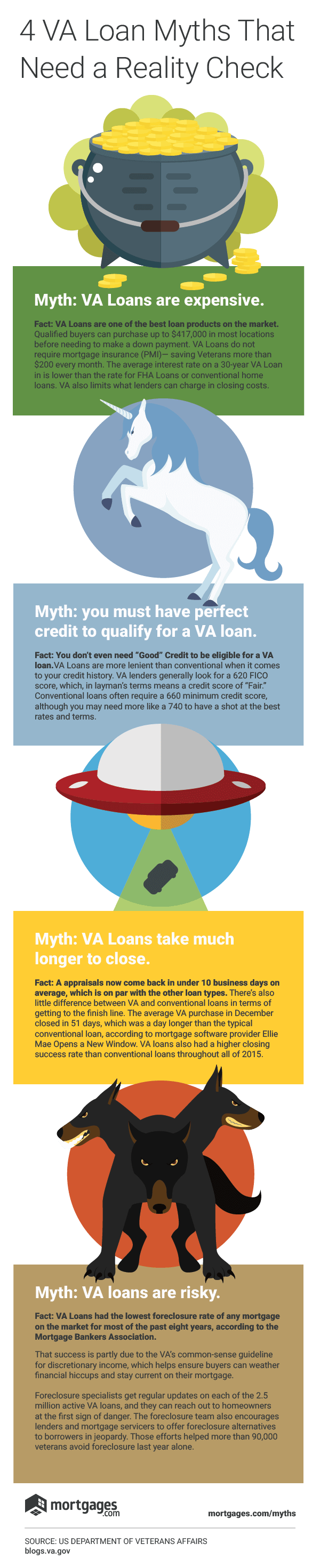

Bureaucracy and lack of awareness prevented more soldiers from using VA loans. … VA loans typically have lower interest rates than conventional mortgages, allow for higher debt/income rates and lower credit scores, and do not require private mortgage insurance.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory way – seller is obligated to comply with Fair Housing Act laws.

Why would a seller prefer a conventional loan?

Time to close. In general, conventional loans simply tend to close faster. Less paperwork and fewer stipulations allow these mortgages to be processed faster, and many sellers find this an attractive bonus.

What are the advantages of conventional loans?

Conventional loans may require less paperwork and can be obtained faster than government-backed loans. Mortgage lenders can approve conventional loans without the typical delays incurred with FHA or government-backed loans.

Why would a seller not accept a conventional loan?

Reasons Sellers Don’t Like FHA Loans With a conventional loan, if the appraised value is less than the agreed price, the buyer has the opportunity to negotiate the price or make a difference. This means that the seller can still sell at or near the agreed price.

Can you get denied a VA loan?

If your VA loan application was denied, it could be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell if your income was too low. If so, look for ways to increase your income if possible.

Can a VA loan be rejected? When lenders refuse a loan, they do so reluctantly. VA lenders make money by approving loans, not denying them, so they will do their best to get their approval. When they cannot, they will send what is called an adverse action notice. … You must first find out specifically, exactly why your loan was denied.

Why would a VA home loan be denied?

The most common reason VA home loan applications are denied is because of errors in the application itself. Lenders cannot grant loans unless they are sure your personal and financial details are correct. Before submitting your application, please take the time to review each statement made and numbers entered.

Why would a house not be VA approved?

Insufficient Heating Homes that do not have adequate heating systems will never pass the VA assessment. In order for a home to be approved, there must be an efficient and acceptable heat source that can provide residents with a comfortable living condition.

What would cause an underwriter to deny a VA loan?

Application Errors Application errors are the main cause of VA loan rejections. That’s why before submitting your documents, you need to double-check them to make sure they’re correct. Underwriters are perfectionists when it comes to accuracy and it is advisable to eliminate all mistakes.

Why is a VA loan so hard to get?

Borrowers must show that they have the income to make mortgage payments. They shouldn’t have a huge debt. While there is no minimum credit score requirement, borrowers can have difficulty getting approval from a lender if they don’t have at least 620 FICO Score.

How often are VA loans denied? Overall, about 15 percent of applications are denied, but some may be able to re-apply.

What would disqualify you from getting a VA loan?

You need to prove to the lender that you can afford the loan payments each month. If your VA loan application was denied, it could be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell if your income was too low.

What disqualifies you from a VA loan?

Dishonorable discharge veteran status requires that military personnel be discharged from or released from military service under conditions that are not dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA Loan Guaranty program.

Why would a VA home loan be denied?

The most common reason why VA home loan applications are denied is because of errors in the application itself. Lenders cannot grant loans unless they are sure your personal and financial details are correct. Before submitting your application, please take the time to review each statement made and numbers entered.