Why are VA loans bad?

Contents

Lower interest rates on VA loans are deceptive. Both will end up costing you much more interest over the life of the loan than their 15-year counterparts. In addition, you are more likely to get a lower interest rate on a 15-year conventional fixed rate loan than on a 15-year VA loan.

What are the disadvantages of a VA loan? 5 Potential Disadvantages of a VA Loan

- You may have less capital in your home. …

- VA loans cannot be used to buy vacation homes or invest in real estate. …

- Seller resistance to VA funding. …

- The funding fee is higher for subsequent use. …

- Not all lenders offer – or do not understand – VA loans.

Is a VA loan a good idea?

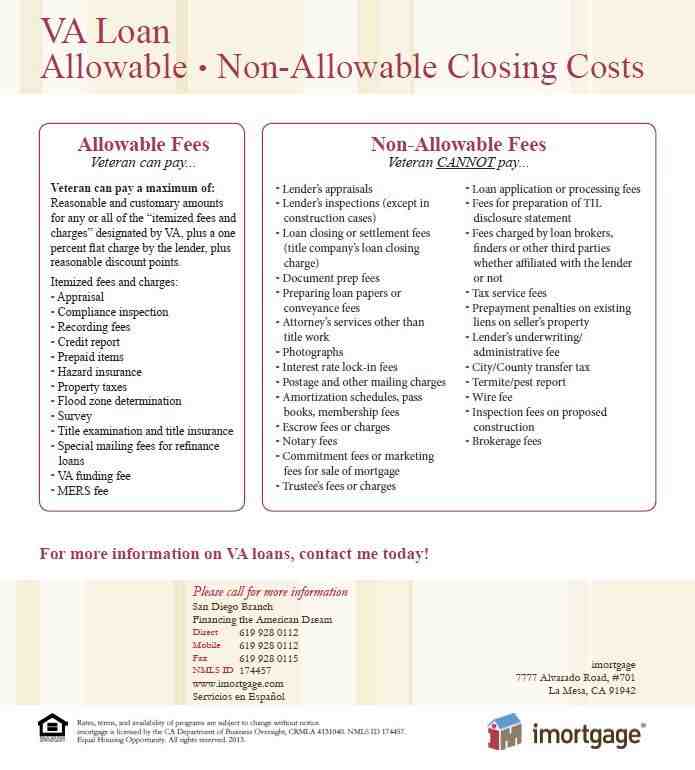

VA loans are perfect for those who qualify to want a loan with no down payment and less closing costs. However, if you have a 20 percent down payment, you should consider the second option, avoiding the financing fee charged for all VA loans.

Is VA loan worse than conventional?

VA loans typically have lower interest rates than conventional mortgages, allow for higher debt-to-income ratios and lower credit scores, and do not require private mortgage insurance. … He says lenders often offer veteran products other than VA loans that are better for the bank rather than the borrower.

Can you get a VA loan if you are not military?

Contrary to popular belief, VA loans are available not only to veterans, but also to other classes of military personnel. The list of eligible VA borrowers includes: active service members. Members of the National Guard.

Can a non-veteran be on a VA loan? There are lenders (including Veterans United) who will give a “joint loan” for a veteran and a non-spouse co-debtor who is not a veteran. … With joint VA loans, a non-veteran co-borrower will often have to pay an advance to cover his or her share of the loan.

Do you have to be military to get a VA home loan?

You may be eligible for a VA loan if you meet one or more of the following conditions: You have served 90 consecutive days of active service during the war, OR. You have served 181 days of active peacetime service, OR. You have 6 years of service in the National Guard or Reserve, OR.

Can you get a VA loan without being in the military?

The short answer is, you cannot get a VA loan as a non-veteran. You must serve or have previously served in the U.S. Army and qualify for VA service. You can also be eligible as a surviving spouse of a veteran with a few special conditions.

What is required for a VA loan?

24 months continuously, or. The full period (at least 181 days) for which you have been called or ordered into active service, or. At least 181 days if you are fired because of difficulties, a reduction in strength, or because of the convenience of the government, or. Less than 181 days if you are discharged due to a service-related disability.

Can I get a VA loan without my DD214?

DD214 is not required for your VA loan There is only one type of VA loan for which DD214 is absolutely not required at all. In fact, a Certificate of Eligibility is not required either. This loan is a loan to refinance a reduced interest rate or & quot; IRRRL & quot ;.

Why would an underwriter deny a VA loan?

Don’t take no for an answer In the vast majority of cases, inexperienced loan officers or strict overlaps are the reason for refusing a VA loan. If your lender is not approved to manually take out VA home loans, you may be told that you are not approved without further explanation or options.

Is insurance the last step? No, insurance is not the last step in the mortgage process. You still have to attend the closing to sign a pile of paperwork, and then the loan has to be financed. … The insurer may request additional information, such as bank documents or letters of explanation (LOE).

What does a VA underwriter look for?

They will look at things like your income, debts, employment history, credit report and more, trying to distinguish whether you are a safe investment or risky. At the end of this step, the insurer will either approve your loan, reject it, or issue you a conditional approval – which we will address later.

What will cause VA loan to get disapproved?

If your VA loan application is denied, it may be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income has been too low. If so, look for ways to increase your income if at all possible.

How long does it take for underwriters to approve a VA loan?

Once the loan officer has completed the loan file, income documents and credit report, the application will be submitted to the VA insurer for processing. Insurers may need as much as 14 days to make a decision on taking out a loan for individuals with a solid credit background.

Can you manually underwrite a VA loan?

Manual insurance can make the loan process a little more involved for military borrowers. But it is also a kind of safety net. Veterans who have been affected by difficult financial or credit events can still secure a VA home loan.

Can my loan be denied underwriting?

Even if you have been previously approved, your insurance may still be denied. … Your loan is never fully approved until the insurer confirms that you are able to repay the loan. Insurers can deny your loan application for several reasons, from minor to major.

Can you be denied a VA loan?

How often do insurers refuse VA loans? About 15% of VA loan applications are denied, so if yours is not approved, you are not alone. If you are rejected during the automated download phase, you may be able to seek approval through a manual download.

Is it difficult to get approval for a VA loan? If you qualify, VA loans are fairly easy to qualify, as no down payment is required, there are no minimum credit points, and there is no maximum limit on how much you can borrow relative to income.

Can VA home loan be denied?

Although, when it comes to credit issues, the VA is pretty mild. Unlike traditional loans, credit history will take into account the borrower’s rental history. In the case of VA loans, the automatic insurance may reject the application, but the manual insurance may accept it.

What would cause an underwriter to deny a VA loan?

An automated insurance system can refuse a loan for several reasons. It is possible that something was entered incorrectly. This may be because something is incorrectly reported in your credit account. … In any case, VA loans offer a lot of flexibility and opportunities.

Why would a VA home loan be denied?

The most common reason why VA home loan applications are rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial information is accurate. Before you submit your application, take the time to review each statement and numbers you enter.

Why would a VA home loan be denied?

The most common reason why VA home loan applications are rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial information is accurate. Before you submit your application, take the time to review each statement and numbers you enter.

What will cause VA loan to get disapproved?

If your VA loan application is denied, it may be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income has been too low. If so, look for ways to increase your income if at all possible.

How often do VA home loans get denied?

Overall, about 15 percent of applications were rejected, but some could re-apply.

What disqualifies you from a VA loan?

Dishonorable Discharge Veteran status requires service members to be discharged or discharged from the military under conditions that are not dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA Loan Guaranty program.

Do VA loans get denied?

About 15% of VA loan applications are denied, so if yours is not approved, you are not alone. If you are rejected during the automated download phase, you may be able to seek approval through a manual download.

What disqualifies you for a VA loan?

You have served 181 days of active peacetime service, OR. You have 6 years of service in the National Guard or Reserve, OR. You are the spouse of a member of the service who has died in the line of duty or as a result of a disability in the service.

Can a VA loan close in 30 days?

You can close in 30 days. It is possible to close a VA loan in just 30 days. This makes buying a home with a VA loan just as quick as a traditional mortgage. The key to closing fast is to have everything you need to speed things up.

Does it take longer to close VA home loans? Although it takes longer to close an average VA loan than other loan programs, they do not need to close forever – in reality, according to the June 2021 ICE Origin Report, it took an average of 55 days for a VA loan to close. This includes everything from applying for a mortgage to getting the keys to the house.

Can you close a VA loan in 2 weeks?

You are at the point when you want to get approved for a VA loan or you may be in the process and wondering “How fast can a VA loan be closed?” The simple answer is, you can close a VA loan in less than 2 weeks.

Can a VA loan close in 20 days?

Most VA loans close within 40 to 50 days, which is the standard for the mortgage industry regardless of the type of financing. In fact, delve a little into the numbers and you won’t find much difference between VA and conventional loans.

Can VA loans close in 30 days?

“The truth is,” Charles said, “you can close a VA loan in 30 days or less, just like any other type of loan. Although a VA appraiser inspects a house to make sure it meets VA standards, they usually look for safety hazards and things of that nature.

How quickly can a VA loan closing?

How long does it take to close a VA loan? Most VA loans close within 40 to 50 days, which is the standard for the mortgage industry regardless of the type of financing.

Are VA loans harder to close?

Should you be worried? The short answer is no. It’s true that VA loans used to be harder to close – but that’s a long history. Today, you will probably have about the same problems with a buyer who has this type of mortgage as any other. And flexible VA guidelines may be the only reason why your customer can buy your home.

Are VA loan appraisals tougher?

The Veterans Affairs Department supports the home, so they want to make sure the condition of the home is good before approving any type of mortgage. This makes it difficult to pass most VA appraisals and can slow down the home buying process.

Why do sellers not like VA loans?

Why do sellers not like VA loans? Many sellers – and their real estate agents – don’t like VA loans because they believe these mortgages make it harder to close or make it more expensive for the seller.