What are the pros and cons of a VA loan?

Contents

| Pro | Con |

|---|---|

| No participation | VA funding fee |

| No PMI | The VA funding fee increases after the first use |

| Higher allowed DTI | The loan could exceed the market value |

| Credit flexibility | For primary housing only |

Why shouldn’t you get a VA loan? Yikes! Lower interest rates on VA loans are deceptive. … Both will end up costing you much more interest over the life of the loan than their 15-year-old counterparts. In addition, you are more likely to get a lower interest rate on a 15-year conventional loan with a fixed interest rate than on a 15-year VA loan.

What are the disadvantages of using a VA loan?

5 Potential disadvantages of VA loans

- You may have less capital in your home. …

- VA loans cannot be used to buy holiday homes or invest in real estate. …

- Seller resistance to VA funding. …

- The financing fee is higher for subsequent use. …

- Not all lenders offer – or do not understand – VA loans.

Why do Realtors hate VA loans?

In some cases, home sellers will not accept purchase offers that are backed by VA-guaranteed mortgages for fear of low valuation. … Because VA estimates can increase their repair costs, home sellers sometimes refuse to accept purchase offers backed by mortgage agencies.

What is the downside of a VA loan?

Disadvantages of a VA Loan Although you will not pay mortgage insurance with a VA loan, you will pay a closing financing fee (although this fee may be financed in your loan). If you take your first VA loan and do not pay your participation fee, the financing fee is 2.3 percent of what you borrowed.

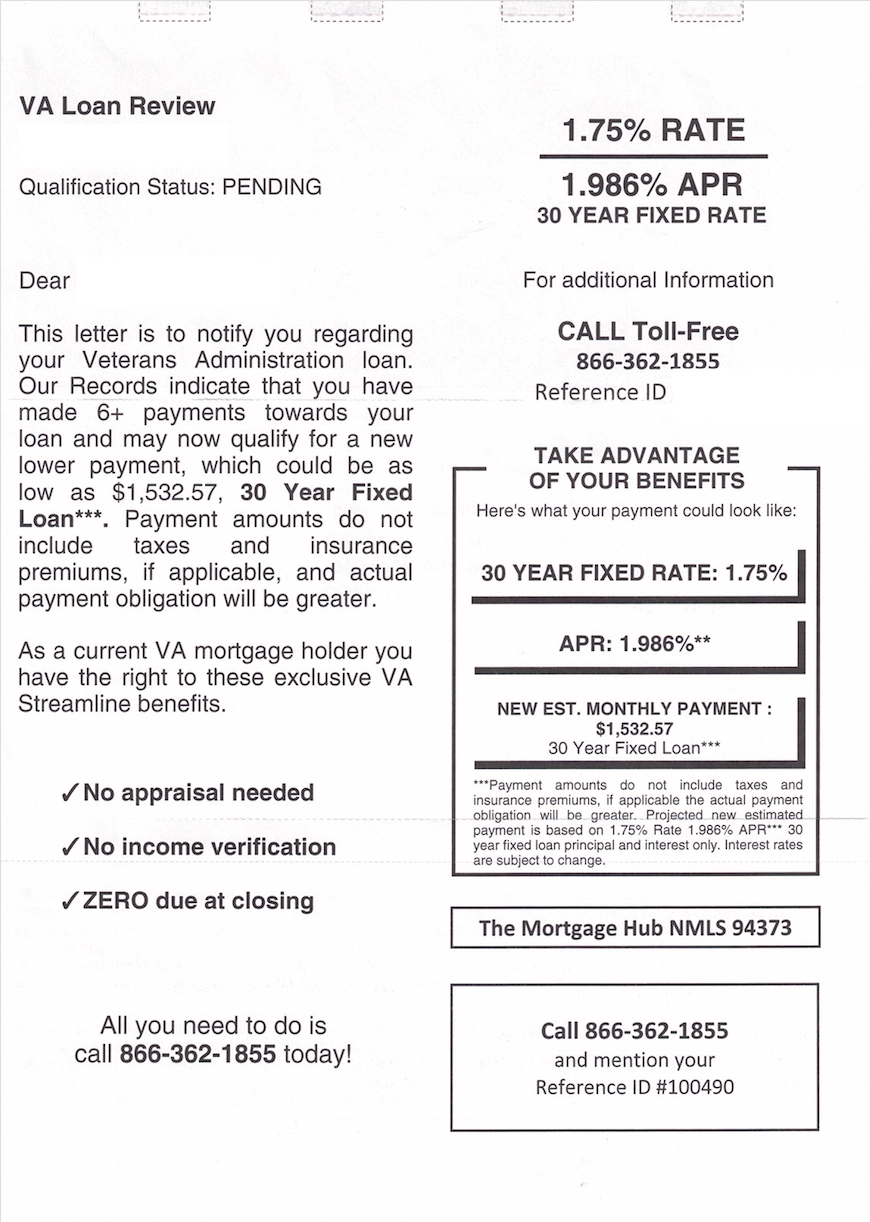

How can I avoid closing costs with a VA loan?

Now, you know there are costs to closing a VA loan, but what if you don’t want to or can’t bring those costs to a close? The most common way to overcome bringing these funds to close is for the seller to pay the costs of closing and the VA sales concession. Remember, the seller is NOT required to pay the buyer’s closing costs.

Can a VA buyer pay their own closing costs?

Closing costs are always part of the mortgage equation. But one of the great advantages of VA loans is that they limit what veterans and military members can pay in closing costs. VA customers are prohibited from paying certain costs and fees in some cases. … A flat rate fee of 1 percent charged by the lender.

Why do sellers hate VA loans?

VA mortgages also come with minimal property requirements that can eventually force home sellers to make many repairs. Because VA estimates can increase their repair costs, home sellers sometimes refuse to accept mortgage-backed agency offers.

Is VA loan worse than conventional?

VA loans typically have lower interest rates than conventional mortgages, allow for higher debt-to-income ratios and lower credit scores, and do not require private mortgage insurance. … He says lenders often offer veteran products other than VA loans that are better for the bank rather than the borrower.

Do sellers prefer VA loans?

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer who uses a VA loan when selling your home can be just as difficult as a buyer who uses a conventional mortgage. There are many myths and misconceptions about VA credit, but you as a seller should have nothing to worry about.

Is it better to go VA or Conventional?

VA loans usually have easier credit qualifications compared to conventional loans. … Typically, VA loans tend to have lower interest rates – and if rates fall, refinancing with an interest rate reduction loan (IRRRL) can be easier than with a conventional loan.

Can my dad use his VA loan to buy me a house?

The joint VA loan program allows veterans and / or active military personnel to use a joint borrower who is not a spouse or other veteran. Most lenders will not allow such loans and will block veterans from buying a house with a sister, brother, mother, father, son, daughter, or someone unrelated.

Can I take Dad’s VA loan? Veterans with VA mortgages can have their VA home loan taken out by someone else, which is also called a VA loan assumption. If your plans, goals or needs have changed and you need to get out of a VA loan, one option is to sell your home, but the alternative is a mortgage that can be taken out, the buyer takes the loan.

Can you use your VA loan for someone else?

VA loans are transferable If approved, the other person assumes financial responsibility for the mortgage. … As long as the person taking out the loan meets the lender’s financial requirements for the VA loan, he will be approved and will be able to take out the loan.

Can I give my VA home loan to a family member?

We get a lot of questions about that – can a family member use a housing loan benefit for veteran assistance? The short answer is non-siblings and dependent children cannot take advantage of VA loans. … The VA Loan Policy does not allow children or siblings of veterans or members currently serving in the military to take advantage of VA Loan benefits.

Can I use my VA loan with my girlfriend?

When couples are looking for a shared home, they often put both names on credit. Applying for a VA loan with your spouse as a co-borrower, regardless of their veteran status, is no different from other loans. Veterans. Except for the spouse, no civilian can borrow for a VA loan.

Can you use your parents VA loan to buy a house?

Also, $ 0 is less than a USDA loan The main caveat is that you have to live in what the USDA considers rural. The rural area label is actually quite large and includes many suburban areas. You can learn more about USDA loans and contact a USDA lender here.

Can I use my parents VA loan?

Brothers, sisters, parents, dependent children and other relatives are not allowed to use the benefits of the VA loan. … Borrowers are allowed under the rules of the VA Loan Program to apply for a “joint loan” with a non-veteran borrower.

Can family members of veterans get a VA loan?

Veterans, service members and surviving spouses of deceased veterans are entitled to VA housing loans. Borrowers must also meet the following requirements: Qualify for the VA Loan Eligibility Certificate. Fulfillment of income and credit qualifications with the VA and the individual lender.

Can a family member use my VA loan?

We get a lot of questions about that – can a family member use a housing loan benefit for veteran assistance? The short answer is non-siblings and dependent children cannot take advantage of VA loans. … Essentially, the VA loan benefit is intended for the veteran and the spouse, where applicable, who wish to purchase a home.

Can I use my VA loan to buy my mom a house?

I was wondering if my mom could use my VA home loan to buy and build a new house on her land? ”The short answer is no. … The resident and the spouse must be legally married to use the benefit together, otherwise the borrower must apply for the loan himself (in order to get a full VA loan guarantee).

Who can take over a VA loan?

In some cases, a VA loan can be assumed, ie the buyer can take a VA loan regardless of whether it is civilian or military. At one time, all homes purchased with the help of VA loans were considered presumed, but since then the rules have changed.

What is the new VA funding fee for 2020?

As of January 1, 2020, the VA financing fee rate is 2.30% for first-time borrowers taking out a VA loan without participation. The financing fee is increased to 3.60% for those who borrow another VA loan. The financing fee rate applies only to the amount financed in the VA loan, so the fee does not apply to the borrower’s payments.

When did the VA funding change? SD: The Vietnam Navy Blue Water Veterans Act 2019 has led to an increase in the VA funding fee from 2.15% to 2.30% for first-time borrowers and 2.40% to 3.60% for those taking out loans. have previously used a VA home loan. Those changes took effect on January 1, 2020, and are expected to remain so until 2022.

Is there a VA funding fee for 20% down?

Fees for the first VA purchase loan are 2.3% with zero participation, 1.65% with participation from 5% to 9.9% and 1.4% with participation of 10% or more. Fees for financing a VA refinancing loan with disbursement are the same as for a purchase loan.

How much do you have to put down to avoid VA funding fee?

The financing fee rate applies only to the amount financed in the VA loan, so the fee does not apply to the borrower’s payments. Borrowers can reduce their financing fee rate by lowering at least 5% on a VA housing loan, and about one-third of all borrowers are exempt from paying the financing fee in full.

Do you pay the VA funding fee at closing?

The VA financing fee is due at the time of closing and is included as one of the closing costs that the borrower must pay. Your lender sends the VA fee paid on your behalf. The financing fee can be a significant and expensive closing cost for borrowers.

How much is the VA funding fee 2021?

VA Funding Fees in 2021. Most veterans will pay a 2.3 percent funding fee when buying a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: a no-participation mortgage.

Is the VA funding fee tax deductible 2021?

The good news is that the VA loan financing fee is fully tax deductible. Since this is a form of mortgage insurance, you can take the entire amount you pay as a deduction from your annual income tax.

How is VA funding fee calculated?

The VA financing fee is expressed as a percentage of the loan amount. For regular military borrowers without participation, the financing fee is 2.15%. The fee is increased to 3.3% for borrowers with previous VA loans. For those with a share of 5% to 9%, the funding fee is 1.5%.

What is the current VA loan funding fee?

How much is the VA funding fee? The VA financing fee is a one-time fee of 2.3% of the total amount borrowed from the VA housing loan. The financing fee is increased to 3.6% for borrowers who have previously used the VA loan program, but can be reduced by a reduction of at least 5% at closing.

What is the average closing cost on a VA loan?

How much does it cost to close a VA loan? The exact amount you will pay within the cost of closing a VA loan will vary depending on the home you choose and the details of your loan. However, you should expect to find closing costs between 3% â € “up to 5% of the total loan value.

How do I get my VA funding fee waived?

Under the VA, you may be exempt from paying the VA funding fee if:

- You receive a VA disability allowance in connection with military service.

- You are entitled to receive disability benefits in connection with the service, but instead receive a pension or work allowance.

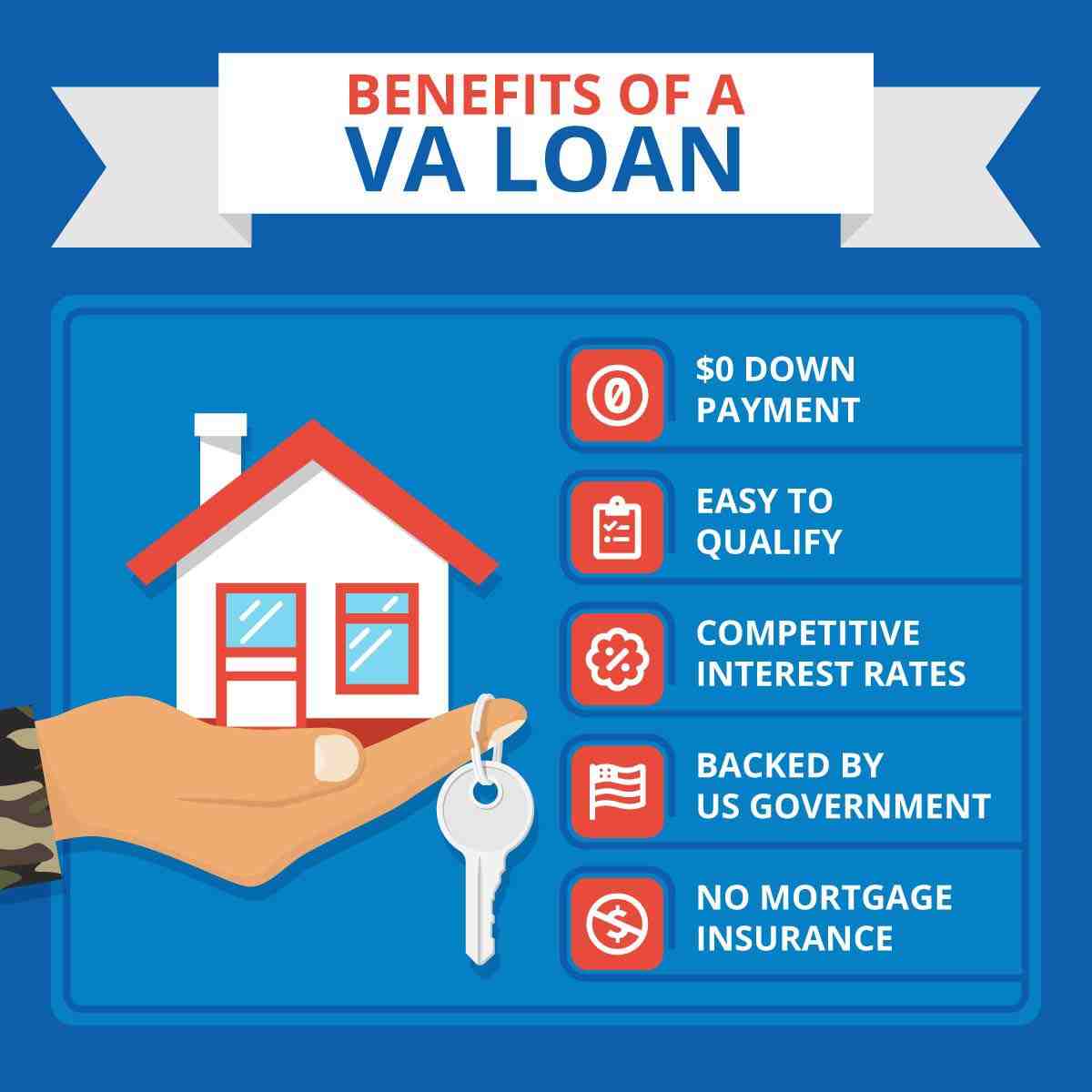

Is a VA mortgage good?

VA loans offer better terms and interest rates than most other home loans. 100% financing – usually no participation is required for a VA loan, as long as the purchase price of the house does not exceed the estimated value of the house. … There is no penalty for early loan repayment.

What are the disadvantages of VA loans? 5 Potential disadvantages of VA loans

- You may have less capital in your home. …

- VA loans cannot be used to buy holiday homes or invest in real estate. …

- Seller resistance to VA funding. …

- The financing fee is higher for subsequent use. …

- Not all lenders offer – or do not understand – VA loans.

Why do sellers not like VA loans?

Many sellers – and their real estate agents – do not like VA loans because they believe that these mortgages make it harder to close or more expensive for the seller.

Can sellers discriminate against a VA loan?

No lender approved by the VA may discriminate against the buyer. … No seller can refuse to offer a property on a discriminatory basis – the seller is required to comply with the law on fair housing.

Do sellers dislike VA loans?

VA loans come with bureaucracy, delays in appraisals and fees borne by sellers instead of buyers – all the reasons why bids are turned down, agents say. In addition, real estate agents and veterans say, some sellers turn down offers because of misconceptions about the VA program.

Is it hard to buy a house with a VA loan?

Should I be worried? The short answer is no. It is true that VA loans used to be harder to close – but that is a long history. Today, you will probably have about the same problems with a buyer who has this type of mortgage as any other. And flexible VA guidelines may be the only reason why your customer can buy your home.

How long does it take to buy a house with a VA loan?

How long does it take to close a VA loan? Most VA loans close within 40 to 50 days, which is the standard for the mortgage industry regardless of the type of financing.

Is it a good time to buy a house with a VA loan?

Although 2020 was a difficult year for many people, financially speaking, American veterans agree that 2021 is a good time to buy a house. According to the Veterans United Home Loans report for 2021, the Veteran Homebuyer Report, 1 in 3 veterans plans to buy this year, while 58% plan to buy in the next five years.

What is a better loan VA or FHA?

If you qualify, a VA loan can often be a better choice between an FHA loan and a VA loan. This is because VA loans allow borrowers to enter a home with zero fall and no mortgage insurance. However, FHA loans can also be a great option, especially for borrowers with bad credit or low income.

What is the difference between VA loan and FHA loan?

In short, FHA mortgages are federal-level mortgages designed to help qualified borrowers buy a home with less money and lower credit. VA mortgages are mortgages secured by the state for active or veterans of military service and their spouses.

Is FHA or VA more strict?

VA credit. … Although both have less stringent requirements for borrowers compared to conventional loans, there are some differences between FHA and VA loans. Some people may qualify for an FHA loan, but not a VA loan, for example. Another significant difference between a VA loan and an FHA loan is the size of the advance.

How often do VA loans get denied?

Overall, about 15 percent of applications were rejected, but some may be able to re-apply.

Why would a VA home loan be denied? The most common reason why VA home loan applications are rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial information is accurate. Before you apply, take the time to review each statement you make and the numbers you enter.

Can a VA loan be rejected?

When lenders refuse a loan, they do so reluctantly. VA lenders make money by approving loans, not denying them so they will do everything they can to get your approval. When they can’t, they will send a so-called spam notification. … You must first find out specifically why your loan was denied.

Can you be denied a VA loan?

How often do insurers refuse VA loans? Approximately 15% of VA loan applications are denied, so if yours is not approved, you are not alone. If you were rejected during the automated download phase, you may be able to seek approval through a manual download.

What will cause VA loan to get disapproved?

If your VA loan application is denied, it may be because your income is too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income was too low. If so, look for ways to increase your income if at all possible.

How often do VA loans fall through?

For all purchases, according to Ellie Mae, 74.3 percent of VA loans were closed, compared to 74.1 percent of all mortgages. Conventional (NGOs fared slightly better than the VA, with a closing rate of 75.2 percent. In short, VA mortgages will close at a high rate and are less likely to close than the average loan.

Is it hard to pass a VA loan inspection?

Guidelines for VA assessment can be strict and can eliminate fixers from conflict. Many guidelines can be frustrating for military buyers considering older homes in need of renovation. If the house does not meet the MPRs, the buyer will have to decide how he wants to proceed.

What will fail a VA loan inspection?

What will the VA assessment fail? In general, any visible health or safety concerns will be a problem in the VA assessment report. You will not be able to close the house until these problems are resolved. In some cases, sellers are willing to cover the cost of major repairs instead of losing sales.

What will cause VA loan to get disapproved?

If your VA loan application is denied, it may be because your income is too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income was too low. If so, look for ways to increase your income if at all possible.

What disqualifies you from a VA loan?

Dishonorable Discharge Veteran status requires service members to be discharged or discharged from the military under conditions other than dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA credit guarantee program.