How much is the VA funding fee for first time use?

Contents

Fees for a VA First Purchase Loan are 2.3% with a zero down payment, 1.65% with a 5% to 9.9% down payment, and 1.4% with a zero down payment. initial 10% or more. The financing fees for a VA cash-out refinance loan are the same as for a purchase loan.

Does VA waive the finance fee? The VA Financing Fee Waiver provides a special waiver for eligible military service members, veterans, or surviving spouses that removes the financing fee from your closing costs. … You are the surviving spouse of a veteran who died while on duty or as a result of a service-connected illness or disability.

Is the VA funding fee a one-time fee?

The VA financing fee is a one-time payment that the Veteran, service member, or survivor pays on a VA-backed direct mortgage loan. This fee helps lower the cost of the loan for US taxpayers, as the VA home loan program does not require down payments or monthly mortgage insurance.

Is a VA loan a one-time deal?

VA loans are not a one-time benefit; you can use them multiple times as long as you meet the eligibility requirements. You can even have multiple VA loans at the same time.

How much is a VA funding fee 2021?

VA Financing Fees in 2021 Most veterans will pay a 2.3 percent financing fee when purchasing a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit – a no-down payment home loan.

What is a typical VA funding fee?

The VA financing fee is a one-time fee of 2.3% of the total amount borrowed with a VA home loan. The finance fee increases to 3.6% for borrowers who have previously used the VA loan program, but can be lowered by putting at least 5% at closing.

How much is a VA funding fee 2021?

VA Financing Fees in 2021 Most veterans will pay a 2.3 percent financing fee when purchasing a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit – a no-down payment home loan.

How much is a VA funding fee 2020?

As of January 1, 2020, the VA financing fee rate is 2.30% for first-time VA loan borrowers with no down payment. The finance fee increases to 3.60% for those who borrow a second VA loan. The financing fee rate only applies to the amount financed in the VA loan, so no fee is applied to the borrower’s down payment.

How much is a VA funding fee 2021?

VA Financing Fees in 2021 Most veterans will pay a 2.3 percent financing fee when purchasing a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit – a no-down payment home loan.

How is VA funding fee calculated?

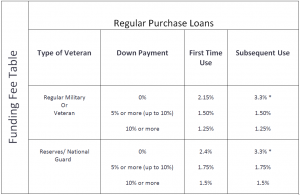

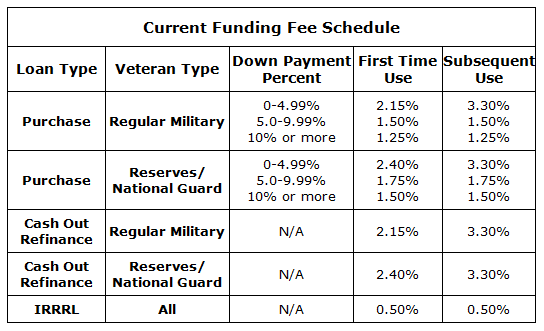

The VA financing fee is expressed as a percentage of the loan amount. For regular military borrowers with no down payment, the financing fee is 2.15%. The rate increases to 3.3% for borrowers with previous VA loans. For those with a 5% to 9% down payment, the finance fee is 1.5%.

Is the VA funding fee tax deductible 2021?

The good news is that the VA loan financing fee is fully tax deductible. Since it is a form of mortgage insurance, you can take the total amount you pay as a deduction from your annual income taxes.

Can the VA funding fee be paid by seller?

The seller may agree to pay your VA Financing Fee as a concession rather than adding it to your loan amount. They can also cover prepaid taxes and insurance; debts to be paid at closing; and liens or judgments against the borrower.

What fees must the seller pay on a VA loan? It is generally between $ 300 and $ 900. It is a non-allowable cost. Some lenders forgo it on VA loans, but many will charge the seller. The other fee is from the title company and will be called an escrow, settlement, or closing fee.

What does the seller pay for on a VA loan?

With VA loans, sellers can pay some or all of the buyer’s costs. VA loans allow sellers to contribute up to 4.0 percent of the home’s sale price. In this example, it would be $ 8,000, but closing costs of $ 200,000 will generally not be that high.

What does seller pay at closing for VA loan?

The seller cannot pay more than 4% of the total mortgage loan in closing costs. … As a buyer, you will have to pay the VA financing fee, loan origination fee, loan discount points, VA appraisal fee, title insurance, and more.

Is a VA loan good for the seller?

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer using a VA loan when selling their home can be as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but you, as a seller, should have nothing to worry about.

Who pays the VA funding fee?

Borrowers must pay the one-time VA financing fee with a VA loan purchase or refinance. Borrowers pay the fee directly to the Department of Veterans Affairs. The government uses the money raised to continue financing the purchase of homes for active duty military members, retired veterans, and surviving spouses.

What fees does the seller have to pay on a VA loan?

In California, and throughout the country, these “seller’s grants” are generally limited to 4% of the loan amount. As it says on the VA website: “We require that a seller cannot pay more than 4% of the total home loan in the seller’s concessions.

Who is exempt from paying VA funding fee?

The VA funding fee is a one-time payment to the federal government to help keep the program running for future generations. Veterans receiving disability benefits, military spouses, and Purple Heart recipients are exempt from paying the VA funding fee.

Can seller pay VA closing costs?

One of the great benefits of VA loans is that sellers can pay all of the closing costs related to the loan. Again, they are not required to pay for any of them, so it will always be a product of negotiation between the buyer and the seller.

Why VA loans are bad for sellers?

VA loans come with red tape, appraisal delays, and fees borne by sellers rather than buyers – all reasons offers are rejected, agents say. Also, realtors and veterans say, some sellers turn down offers due to misconceptions about the VA program.

What closing costs can seller pay for buyer?

Depending on the buyer’s loan-to-value (LTV) ratio and down payment, a seller can contribute between 3% and 9% of the sale price toward closing costs. FHA and USDA loans allow the seller to contribute up to 6% of the sales price toward closing costs, prepaid expenses, discount points, etc.

Why do Realtors hate VA loans?

In some cases, home sellers will not accept VA-guaranteed mortgage-backed purchase offers for fear of a low appraised value. … Because VA appraisals can add to your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

Why Sellers Dislike VA Loans Many sellers, and their real estate agents, dislike VA loans because they believe that these mortgages make closing difficult or more expensive for the seller.

Should sellers stay away from VA loans?

Using a VA loan means that you will end up saving money both on the purchase and over the life of the loan. However, it does mean that the person selling the house to you will have to spend more to sell it. If you are concerned that the seller will reject your offer because they are using a VA loan, don’t be.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory way; the seller must comply with the laws of the Fair Housing Act.

Why is VA loan bad for seller?

VA loans come with red tape, appraisal delays, and fees borne by sellers rather than buyers – all reasons offers are rejected, agents say. Also, realtors and veterans say, some sellers turn down offers due to misconceptions about the VA program.

Are VA loans difficult for sellers?

The short answer is no”. It’s true that VA loans were once more difficult to close, but that’s ancient history. Today, you are likely to have roughly the same problems with a buyer who has this type of mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

What are the pros and cons of a VA loan for a seller?

| Pro | Swindle |

|---|---|

| Without PMI | VA financing fee increases after first use |

| Highest allowed DTI | The loan could exceed the market value |

| Credit flexibility | Only for main residences |

| Better than average interest rates | Sellers and agents may not be familiar |

What should a seller know about a VA loan?

And, for sellers, the most important thing to understand about VA loans is how good the mortgage products are for qualified borrowers. This high-quality nature means that if you are a veteran buyer, you are likely to use the VA loan.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory way; the seller must comply with the laws of the Fair Housing Act.

Can a seller refuse to accept a VA loan?

VA home loans also come with minimum property requirements that can end up forcing home sellers to do a lot of repairs. Because VA appraisals can add to your repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

Why do sellers refuse VA loans?

Some home sellers will not accept VA offers because they (wrongly) believe that they will have to pay all of the buyer’s closing costs. The VA limits the closing costs Veterans can pay, which is a great benefit to those who have served our country.

What fees can a veteran not pay?

Here is a list of the VA fees that a borrower cannot pay outside of the 1% origination fee:

- Application costs.

- Lender-ordered home appraisals.

- Lender-ordered home inspections.

- Document preparation fees.

- Legal costs.

- Mortgage Rate Lock Fees.

- Shipping costs.

- Escrow fees.

.

When did the VA funding fee change?

SD: The Blue Water Navy Vietnam Veterans Act of 2019 caused the VA financing fee to increase from 2.15% to 2.30% for first time borrowers and from 2.40% to 3.60% for those who had previously used a VA home loan. Those changes went into effect on January 1, 2020 and are expected to last through 2022.

What is the new VA financing rate for 2020? As of January 1, 2020, the VA financing fee rate is 2.30% for first-time VA loan borrowers with no down payment. The finance fee increases to 3.60% for those who borrow a second VA loan. The financing fee rate only applies to the amount financed in the VA loan, so no fee is applied to the borrower’s down payment.

Did the VA funding fee increase?

The finance fee increases to 3.6% for borrowers who have previously used the VA loan program, but can be lowered by putting at least 5% at closing. The Department of Veterans Affairs requires the VA financing fee and it is applied to every VA refinance purchase and loan.

How much is a VA funding fee 2021?

VA Financing Fees in 2021 Most veterans will pay a 2.3 percent financing fee when purchasing a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit – a no-down payment home loan.

Why does the VA funding fee increase?

After-use financing fees will increase from 3.3% to 3.6%. You may be wondering, “why is this change necessary?” Big question. The increase is intended to help fund health care costs for veterans who suffer the effects of exposure to Agent Orange as a result of their service.

Did VA loan limits change in 2020?

The changes include: There is no maximum loan limit for VA mortgages as of January 1, 2020. An increase in the VA Loan Financing Fee for all non-exempt borrowers. Purple Heart recipients are now exempt from paying the VA loan financing fee in the same way as those who receive or are entitled to receive VA compensation.

Are there VA loan limits in 2020?

The 2020 limit is $ 510,400 in a typical US county and higher in expensive real estate markets like San Francisco County. If you are subject to VA loan limits, the lender will require a down payment if the purchase price is above the loan limit.

What is the maximum VA loan entitlement?

VA loans are available up to $ 548,250 in most areas, but can exceed $ 800,000 for single-family homes in high-cost counties. Loan limits do not apply to all borrowers. Your VA loan limit, or how much you can borrow without making a down payment, is based directly on your entitlement.

What is the funding fee for a VA loan?

The VA financing fee is a one-time fee paid to the Department of Veterans Affairs that supports the VA home loan program. Veterans who deposit less than 5% on their home purchase will pay 2.3% of the total loan amount when they first purchase a home and 3.6% on subsequent loans.

Do VA loans require a funding fee?

The VA financing fee is a one-time fee of 2.3% of the total amount borrowed with a VA home loan. … The Department of Veterans Affairs requires the VA financing fee and it applies to every VA refinance purchase and loan. The finance fee helps cover any losses and keeps the program running for future veteran homebuyers.

What is the VA funding fee for 2021?

VA Financing Fees in 2021 Most veterans will pay a 2.3 percent financing fee when purchasing a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit – a no-down payment home loan.

Can I use VA loan twice?

VA loans are not a one-time benefit; you can use them multiple times as long as you meet the eligibility requirements. You can even have multiple VA loans at the same time.

How many times can you reuse a VA loan? A VA loan is not a one-time deal. “There is no limitation on the number of times you can use a VA loan,” says Summer Kim-Davis, founder and CEO of IKON Mortgage, a Dallas-based mortgage broker. If you qualify, you can use VA loans for your entire life, no matter how many major homes you buy.

Can I use VA loan again?

How many times can I use a VA loan? VA loans are not a one-time benefit; you can use them multiple times as long as you meet the eligibility requirements. You can even have multiple VA loans at the same time.

Can you buy two houses with a VA loan?

Bottom Line: Yes, you can buy two houses with a VA loan As such, it is allowed to buy a house with a VA loan in order to convert it to a second home or an investment property, but you can convert the property after you have lived there. You can also earn rental income by living in one unit and renting the others.

How many times can u use a VA loan?

Bottom line: There are no limits on using VA loans, but understand your rights. The most important conclusion is that as long as you are eligible and can qualify with a lender, there is no limit to the number of times you can get a VA loan in your lifetime.

Can you use your VA loan twice at the same time?

The VA allows Veterans to have two VA loans at the same time in some situations, and eligible Veterans can qualify for a VA loan even if they have defaulted on one in previous years.

Can I use a VA loan if I already have one?

Yes: VA loan benefits can be used over and over again, as long as you qualify for reuse.

How do I use my VA home loan multiple times?

As long as you are still eligible for a VA loan and can qualify with a lender, there is no limit to the number of these mortgages you can purchase in your lifetime.

How do I use my VA home loan multiple times?

As long as you are still eligible for a VA loan and can qualify with a lender, there is no limit to the number of these mortgages you can take out in your lifetime.

When can you use your VA loan again?

As long as you sell the house and pay off the loan in full, you can regain all your rights and be available for another purchase. Having all your rights means being able to borrow as much as a lender is willing to lend without the need for a down payment.

How many times can you use your VA home loan benefit?

Bottom line: There are no limits on using VA loans, but understand your rights. The most important conclusion is that as long as you are eligible and can qualify with a lender, there is no limit to the number of times you can get a VA loan in your lifetime.