Can two veterans combine their VA loans?

Contents

It is considered a joint loan if both the military borrower and the other borrower are responsible for the mortgage and own the home together. The VA loan allowance can be used by military personnel, veterans and eligible spouses in active service.

Can my father use his VA loan to buy me a house? The joint VA loan program allows veterans and / or active members to use a joint borrower who is not a spouse or other veteran. Most lenders do not allow such loans and prevent veterans from buying a home with a sister, brother, mother, father, son, daughter, or anyone unrelated.

Can my girlfriend be on my VA loan?

Can a veteran join a non-veteran (e.g., girlfriend, boyfriend, loved one) who is not his or her spouse to obtain a VA loan? Yes, but the guarantee is only based on the veteran loan portion. … Both incomes can be used to obtain a loan.

Who can be on title on a VA loan?

The only parties allowed to be on top of a VA home loan are either: (a) a veteran / servicer; (b) the veteran / member of the service and the spouse of that person; (c) two veterans / members of service; or (d) if permitted, a veteran / non-veteran and a non-veteran who requires a contribution …

Do you have to be married to be on a VA loan?

Both applicants for a VA home loan do not have to be eligible for the VA to receive the full benefits of the program – as long as they are married. … Both spouses can apply for a mortgage and their income can be used to qualify. Double income raises the purchase price at which the pair can be approved.

Can there be a co borrower on a VA loan?

Applying for a VA loan with your spouse as a co-borrower, regardless of your veteran status, is no different for other loans. veterans. No civilian, except the spouse, may co-borrow to obtain a VA loan. What’s more, the veteran you choose to co-borrow is going to live on the property with you.

Can both spouses use VA loan?

Both applicants for a VA home loan do not have to be eligible for the VA to receive the full benefits of the program – as long as they are married. … Both spouses can apply for a mortgage and their income can be used to qualify. Double income raises the purchase price at which the pair can be approved.

Can a non military spouse cosign a VA loan?

Everyone can sign or take out a VA loan, depending on the lender’s policy, but the VA may not guarantee the entire loan. Although VA guidelines may allow non-spouses and non-spouses to sign a mortgage, they do not fully guarantee the loan.

Can 2 veterans buy a house together?

Two VA-eligible borrowers can also buy a home together. Under this scenario, borrowers can exercise one right, both (called a dual right), or divide the rights as they see fit. In all three cases, no deposit would be required.

Can you combine a VA loan with first time home buyer?

Because this program is a deferred junior loan, you do not have to repay it until you have sold or refinanced the property. In many cases, you can combine MyHome Assistance with CalHFA loan programs, including FHA, USDA, VA, and regular loans.

How many names can be on a VA loan?

The only parties allowed to be on top of a VA home loan are either: (a) a veteran / servicer; (b) the veteran / member of the service and the spouse of that person; (c) two veterans / members of service; or (d) if permitted, a veteran / non-veteran and a non-veteran who requires a contribution …

Who pays closing costs on a VA loan?

Who pays the closing costs of a VA loan? When using a VA loan, the buyer, seller and lender pay different parts of the closing costs. The seller cannot pay more than 4% of the total home loan as closing costs. However, their share of the closing costs includes commissions from the buyer’s and seller’s real estate agents.

.

What is the VA jumbo loan limit?

A VA loan is usually considered a large loan if the loan amount exceeds the county-based VA loan limit. The VA loan limit in most counties in 2021 will be $ 548,250, but in high-cost areas it will reach $ 822,375.

What is the VA loan limit in 2020? The 2020 limit is $ 510,400 in a typical U.S. county and higher in high-end housing markets such as San Francisco. If you are subject to VA loan limits, the lender will require a down payment if the purchase price exceeds the loan limit.

What is the jumbo loan limit for 2021?

By 2021, the federal housing finance agency had raised the maximum eligible loan limit for single-family homes from $ 510,400 (in 2020) to $ 548,250. In high-cost areas, compliance with the mortgage limits is 150% of that limit, or $ 822,375 by 2021.

Will jumbo loan limits increase in 2021?

Home price increase 8.2% (last 12 months). This is the fifth year in a row that the corresponding loan limits did not increase from 2006 to 2016. From 1 January 2021, the new limit for one-piece dwellings will be $ 548,250, which is $ 37,850 higher (or 7.4% of the $ 510,400 limit in 2020).

Do jumbo loans require 20%?

As a general rule, you can expect to make at least a 10% down payment on your major loan. Some lenders may require a minimum deposit of 25% or even 30%. While a 20% down payment is a good benchmark, it is always best to talk to your lender about all the options.

What is the VA jumbo rate today?

| VA loan type | Interest | APR |

|---|---|---|

| 30-year VA payout | 2.990% | 3.274% |

| 15-year VA payout | 2,750% | 3.216% |

| 30-year-old fixed VA Jumbo | 2.875% | 3.158% |

| 30-year-old streamline (IRRRL) Jumbo | 3,250% | 3.417% |

What is jumbo loan amount in Virginia?

A mortgage is a home loan that exceeds the limit set by Fannie Mae and Freddie Mac. In Virginia, the limit is $ 510,400 for most counties and cities. And in other counties and cities, it can reach $ 765,600.

What is VA jumbo?

What is a VA Jumbo Loan? A VA jumbola loan is usually any loan that exceeds the corresponding loan limits set for ordinary loans. It is important to note that there are no technical restrictions on the size of many VA loans. However, lenders also assess the risks and usually limit higher-risk loans.

What is the VA loan limit for 2021?

The standard VA loan limit in most U.S. counties will be $ 548,250 in 2021, an increase from $ 510,400 in 2020. In the more expensive housing markets in the continental United States, VA loan limits will reach $ 822,375 by 2021, compared to $ 765.60.

What will loan limits be in 2021?

The starting credit limit for 2021 is $ 548,250, compared to $ 510,400 in 2020. The limit is higher in areas where the average cost of a house exceeds that number, so borrowers in high-cost areas can get the corresponding loans up to $ 822,375. at the border of your county.

What is the VA maximum loan amount for 100 financing?

The current VA loan limit is set at $ 548,250, but may be higher in high-cost areas determined by the VA.

What is the VA jumbo rate today?

| VA loan type | Interest | APR |

|---|---|---|

| 30-year VA payout | 2.990% | 3.274% |

| 15-year VA payout | 2,750% | 3.216% |

| 30-year-old fixed VA Jumbo | 2.875% | 3.158% |

| 30-year-old streamline (IRRRL) Jumbo | 3,250% | 3.417% |

What is the Virginia Major Loan in 2021? What is a VA Jumbo Loan? A VA loan is usually considered a large loan if the loan amount exceeds the county-based VA loan limit. The VA loan limit in most counties in 2021 will be $ 548,250, but in high-cost areas it will reach $ 822,375.

What is jumbo loan amount in Virginia?

A mortgage is a home loan that exceeds the limit set by Fannie Mae and Freddie Mac. In Virginia, the limit is $ 510,400 for most counties and cities. And in other counties and cities, it can reach $ 765,600.

What is the jumbo loan limit for 2021?

By 2021, the federal housing finance agency had raised the maximum eligible loan limit for single-family homes from $ 510,400 (in 2020) to $ 548,250. In high-cost areas, compliance with the mortgage limits is 150% of that limit, or $ 822,375 by 2021.

What are the conforming loan limits for 2021?

The starting credit limit for 2021 is $ 548,250, compared to $ 510,400 in 2020. The limit is higher in areas where the average cost of a house exceeds that number, so borrowers in high-cost areas can get the corresponding loans up to $ 822,375. at the border of your county.

Are VA jumbo loan rates higher?

The only difference is that the interest rate on large loans is slightly higher than a VA loan of less than $ 548,250. There may also be a higher credit score requirement. A credit score of 620 is required for non-jumbo. A credit score of 640 is required for VA jumbo.

Do jumbo loans have higher rates?

Taking out a mortgage does not immediately mean a higher interest rate. In fact, jumbo mortgage rates are often competitive and may be lower than the corresponding mortgage rates.

Why are VA loan rates higher?

VA says higher fees are necessary because loans do not require down payments or private mortgage insurance, although as with other loans, the fees can be included in the monthly mortgage payment. … There is also a VA home inspection, known as minimum real estate requirements or MPR.

What is VA jumbo?

What is a VA Jumbo Loan? A VA jumbola loan is usually any loan that exceeds the corresponding loan limits set for ordinary loans. It is important to note that there are no technical restrictions on the size of many VA loans. However, lenders also assess the risks and usually limit higher-risk loans.

What is the difference between a VA loan and a VA jumbo loan?

The application and qualification process is the same. The only difference is that the interest rate on large loans is slightly higher than a VA loan of less than $ 548,250. There may also be a higher credit score requirement. A credit score of 620 is required for non-jumbo.

Can you borrow more than asking price on a house with a VA loan?

Financing More Than the Value of Your Home Here’s the advantage of VA loans: Your lender also allows you to finance a financing fee. Therefore, technically, you can take a loan up to the value of the home and the financing fee. … Additional monthly financing costs will be added to your monthly payments.

Do you have more than a VA loan? There can be more than one VA loan at a time. To do this, you must use your remaining right to get a second loan – this is also called a secondary right.

Can you take out a VA home loan for more than the purchase price?

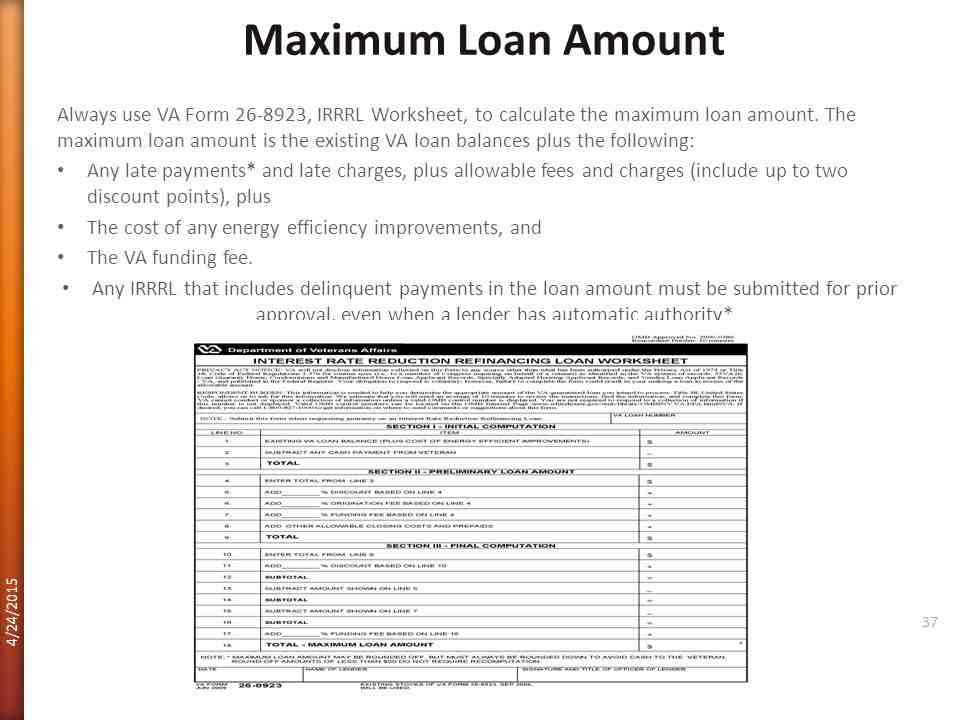

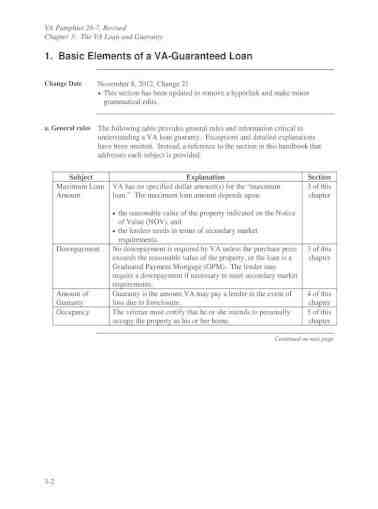

There is no maximum VA loan, except that the loan may not exceed the estimated value or purchase price, plus the VA financing fee and, if necessary, energy efficient improvements, whichever is lower.

Can you get a VA loan for more than the appraised value?

The VA loan program has an “escape clause” that allows the borrower to waive the home loan without penalty in cases where the appraised value is lower than the asking price. The VA and the lender cannot force the borrower to figure out a cash difference to complete the transaction.

Can you borrow more than home purchase price?

The loan amount may exceed the purchase price because the FHA uses the post-improvement value of the home to determine the loan amount. Generally, you can borrow up to 110 percent of the current value of a home on one of these loans.

Can you go over asking price with VA loan?

A VA loan cannot be issued more than the appraisal value, so a low appraisal can confuse buyers. … Let the seller know that the appraisal value was below the sale price. Ask the seller to lower the sale price to equal the appraisal value.

Can you get a VA loan for more than the appraised value?

A VA loan cannot be issued more than the appraisal value, so a low appraisal can confuse buyers. … Ask the seller to lower the selling price to the appraisal value. This is the most common solution to an increasingly common problem, especially in the current housing market.

Can you go over VA loan limit?

One of the most common misconceptions is that VA loan limits represent the absolute maximum amount of money you can borrow using this long-valued home loan rebate. The fact is that a VA loan does not actually have a maximum loan amount, which means that you can borrow above the VA loan limit.

Can you get a VA loan for more than the appraised value?

The VA loan program has an “escape clause” that allows the borrower to waive the home loan without penalty in cases where the appraised value is lower than the asking price. The VA and the lender cannot force the borrower to figure out a cash difference to complete the transaction.

What is the maximum purchase price for a VA loan?

About VA Loan Limits The standard VA loan limit in most U.S. counties will be $ 548,250 in 2021, up from $ 510,400 in 2020. In the more expensive housing markets in the continental United States, VA loan limits will reach $ 822,375 by 2021. $ 765,600 in 2020.

Can you offer over asking price with a VA loan?

Sellers and their realtors know that you are a qualified buyer. Other VA lending strategies include offering a asking price, not asking the seller to cover closing costs, and putting serious funds under it.

What is the maximum VA loan with no down payment?

Eligible veterans, employees, and survivors who are fully eligible will no longer have a loan limit of more than $ 144,000. This means that you do not have to pay a down payment, and we guarantee to your lender that if you leave a loan over $ 144,000, we will pay them up to 25% of the loan amount.

Can you get a VA loan without money? Yes. Although about 90 percent of borrowers use VA loans without a down payment, a 5 percent discount is an advantage. If the VA borrower lowers by at least 5 percent, the VA financing fee will decrease. For a first-time VA borrower, the financing fee is usually 2.3 percent, without any reduction in money.

What is the VA loan limit for 2021?

The standard VA loan limit in most U.S. counties will be $ 548,250 in 2021, an increase from $ 510,400 in 2020. In the more expensive housing markets in the continental United States, VA loan limits will reach $ 822,375 by 2021, compared to $ 765.60.

What will loan limits be in 2021?

The starting credit limit for 2021 is $ 548,250, compared to $ 510,400 in 2020. The limit is higher in areas where the average cost of a house exceeds that number, so borrowers in high-cost areas can get the corresponding loans up to $ 822,375. at the border of your county.

Can I get a VA loan for $1000000?

Loan limits are defined as the maximum VA loan that is possible without a down payment. However, currently credit limits apply only to those who have a partial loan right. If you are fully eligible, the maximum VA guarantee is simply 25% of your loan amount – even if your loan is $ 1,000,000 or more.

What is the maximum VA for 100% financing?

The current VA loan limit is set at $ 548,250, but may be higher in high-cost areas determined by the VA.

What is the maximum VA loan entitlement?

VA loans are available in most regions up to $ 548,250, but can exceed $ 800,000 for single-family homes in expensive counties. Loan limits do not apply to all borrowers. Your VA loan limit â € ”or how much you can borrow without making a down payment â €“ depends directly on your borrowing rights.

Can you get a 100% VA loan?

VA loans are an exception. Instead of a down payment, VA can finance up to 100 percent of the purchase price of the home you want to buy. And you never have to pay for mortgage insurance.