What is needed to qualify for a VA loan?

Contents

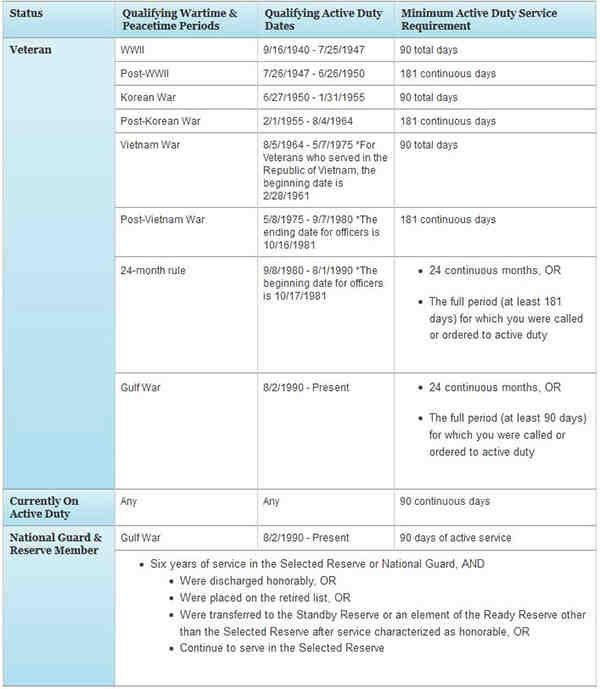

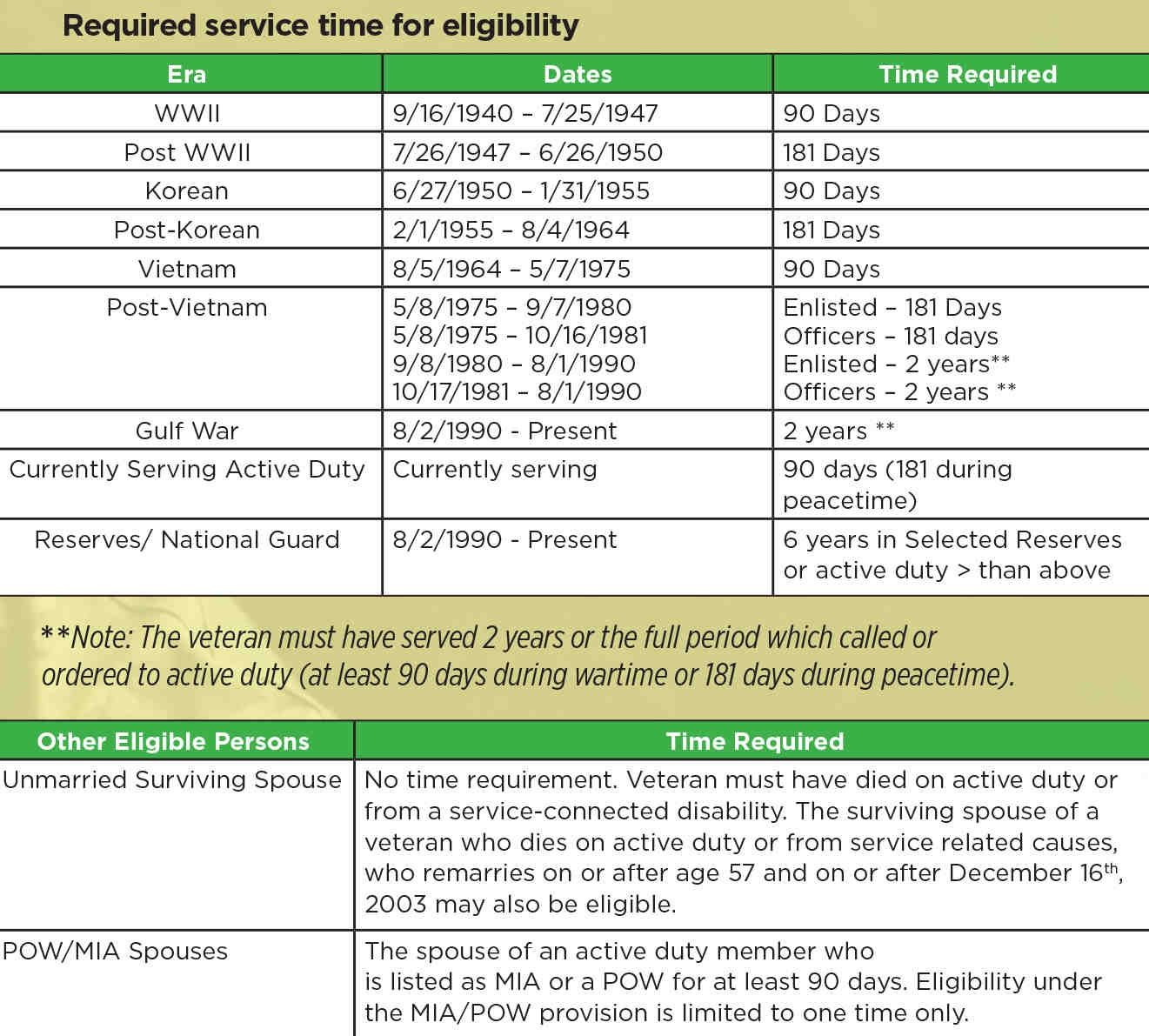

You can be eligible for a VA loan by meeting one or more of these requirements:

- You have served 90 consecutive days of active service during the war, OR.

- You have served 181 days of active service during peacetime, OR.

- You have 6 years of service in the National Guard or Reserves, OR.

What are the income requirements for a VA loan? Are There Income Limits for VA Loans? No, the VA does not limit income to eligible VA loan borrowers. Other government -guaranteed mortgage programs can set a maximum amount of income to qualify for a special loan program but the VA does not have such requirements.

How hard is it to get a VA loan?

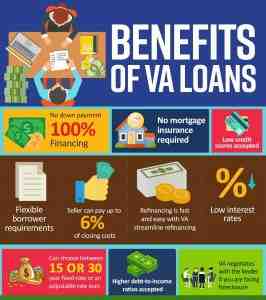

If you qualify, a VA loan is easy enough to qualify for, because there are no payments required, no minimum credit score, and no maximum limit on how much you can borrow relative to income.

Why is it so hard to get a VA loan?

Borrowers must show that they have the income to pay the mortgage. They don’t have to have a huge debt burden. Although there is no minimum credit score requirement, borrowers can be difficult to be approved by a lender if they do not have at least a 620 FICO Score.

What disqualifies you from a VA loan?

Dishonorable Discharge Veteran status requires that service members be discharged or released from the military under circumstances other than dishonorable. Veterans who have indecent freedom will not be eligible to participate in the VA Loan Guarantee program.

Is there a minimum credit score for a VA loan?

Personal Lender Requirements In general, lenders require a minimum credit score of 580 to 620 to qualify for a VA loan.

Can you get a VA home loan with a 500 credit score?

Most mortgage companies state you must have at least a 620-660 credit score and a higher income to qualify for a VA loan. … You can receive a VA loan with a credit score of 500.

Does the VA require a minimum credit score?

VA residual income guidelines ensure Veteran borrowers can afford the loan and determine how much Veteran money should be left after all debts and living expenses are considered. There is no minimum credit score requirement. Instead, the VA requires the lender to review the entire loan profile.

How does VA loan calculate income?

You determine your DTI by dividing your total monthly debt by your total gross income. Total monthly debt (rent + car payments + credit card payments + student loan payments) / Gross monthly income = Debt-to-income ratio ($ 1,200 total debt / $ 4,500 gross income = 0.26 or 26 percent).

Does income affect VA loans? What Factors Affect VA Loan Ability? To calculate how much land you can afford with a VA loan, VA tenants will evaluate your debt-to-income ratio (DTI). The DTI ratio represents the relationship between your gross monthly income and major monthly debt. … There is no strict limit on the DTI ratio for VA loans.

Can tax free income be grossed up on a VA loan?

VA borrowers must have a minimum amount of discretionary income remaining each month after paying major expenses. … VA lenders cannot gross up non-tax income when calculating your residual income figure.

Are VA benefits grossed up?

VA loans. Recently, the VA clarified its stance on gross income. Currently, the VA loan program allows gross up to 25%.

What military pay can be grossed up?

If the housing allowance is $ 1,200 per month, that is the amount received by the service member – no tax deduction. In this case, a VA mortgage lender is allowed to “rough up” this nontaxable income.

How much income do you need to qualify for a VA loan?

If gross monthly income is $ 7,000 the debt ratio is 2,639 divided by 7,000 for the ratio. 38, or 38. Because the ratio is below the maximum ratio of 41, the borrower qualifies for a loan based on the debt ratio.

Is a VA loan based on income?

The debt-to-income ratio determines if you can qualify for a VA loan. The debt-to-income ratio accepted for VA loans is 41%. In general, the debt-to-income ratio refers to the percentage of your gross monthly income that goes into debt. In fact, it’s the ratio of your monthly debt obligations to gross monthly income.

Can I get a VA loan with no income?

So, no, it is not impossible to get a VA loan if you are unemployed, you just need to be able to prove that you have a source of income other than the loan.

What type of income calculation is used for VA loans?

The VA issues the standards used by lenders when setting these and involves calculating the debt-to-income ratio. This ratio is a number that represents the total monthly liabilities associated with gross monthly income and amounts to 41.

What credit score is needed for a VA loan 2021?

The VA itself does not have a minimum credit score requirement. Conversely, it requires lenders to view the loan profile in general. However, mortgage lenders can set their own underwriting requirements, and many lenders want to see a credit score of 620 or higher.

What credit score do you need to buy the earth in 2021? What are the FHA Credit Score Requirements in 2021? The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. At least 580 is required to make a minimum payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

What credit score is needed to qualify for a VA loan?

In general, lenders require a minimum credit score of 580 to 620 to qualify for a VA loan. Fortunately, though, there are alternatives. If the borrower has sufficient residual income, some lenders will even approve a VA loan with a credit score of as little as 500.

Can I get a VA home loan with a 550 credit score?

The short answer is yes, it is possible to get a VA loan with bad credit. For VA loans, borrowers often need a FICO score of at least 620, but the VA does not require a minimum credit score requirement and some lenders may be willing to fall below that cutoff.

Can you get a VA home loan with a 500 credit score?

Most mortgage companies state you must have at least a 620-660 credit score and a higher income to qualify for a VA loan. … You can receive a VA loan with a credit score of 500.

How much can you borrow with a VA loan 2021?

About the VA Loan Limit The standard VA loan limit is $ 548,250 for most U.S. counties in 2021, an increase from $ 510,400 in 2020. $ 765,600 in 2020.

What is the VA funding fee for 2021?

VA fund costs in 2021 Most veterans will pay a 2.3 percent fund cost when purchasing land. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: an unsecured mortgage loan.

Can I get a 1 million dollar VA loan?

Lingo Loan Limit: There Is Actually No Maximum Amount on a VA Loan. The VA loan limit is more as a guide than a restriction on the amount of money you can borrow. … There is no maximum loan amount on a VA loan. That’s more of a question of how much you can borrow without paying.

What will cause VA loan to get disapproved?

If your VA loan application is rejected, it can be because your income level is too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income is too low. If so, look for ways to increase income if possible.

What is canceling you from a VA loan? Dishonorable Discharge Veteran status requires that service members be discharged or released from the military under circumstances other than dishonorable. Veterans who have indecent freedom will not be eligible to participate in the VA Loan Guarantee program.

Can a VA loan be rejected?

When lenders refused a loan, they would be reluctant. VA lenders make money by approving loans, not rejecting them so they do what they can to get your approval. When they can’t, they will send a so -called Adverse Action notice. … You first need to find out specifically, exactly why your loan was declined.

How often do VA loans get denied?

Overall, about 15 percent of applications are rejected, but some can apply again.

How often do VA loans fall through?

For all purchases, according to Ellie Mae, 74.3 percent of VA loans were closed, compared to 74.1 percent of all mortgages. Conventional (non-government) is slightly better than VA, with a closing rate of 75.2 percent. In short, VA mortgages will close at a high rate and are less likely than the average loan to fail to close.

Why would a VA home loan be denied?

The most common reason why a VA land loan application is rejected is because of an error in the application itself. Lenders cannot issue a loan unless they believe that your personal and financial details are correct. Before you submit your application, it’s time to review every statement you make and the number you enter.

What would cause an underwriter to deny a VA loan?

Application errors Application errors are a major cause of VA loan denial. That’s why before you submit your document, you should double check to make sure it is accurate. Underwriters are perfectionists when it comes to accuracy and wisdom to eliminate any errors.

Do underwriters like VA loans?

Your Financial History Importance Standard applications for VA land loans are easily processed by underwriters. However, if you have filed for bankruptcy in the past or have a relatively new credit score, underwriters will need to do a bit more research into your situation.

Can a VA loan be denied in underwriting?

How Often Do Underwriters Reject VA Loans? About 15% of VA loan applications are rejected, so if you are not approved, you are not alone. If you are rejected during the automated underwriting phase, you can seek approval through manual underwriting.

Can a VA loan be rejected?

When lenders refused a loan, they would be reluctant. VA lenders make money by approving loans, not rejecting them so they do what they can to get your approval. When they can’t, they will send a so -called Adverse Action notice. … You first need to find out specifically, exactly why your loan was declined.