Why do Realtors hate VA loans?

Contents

Before guaranteeing mortgages, VA wants to ensure that homes purchased by eligible veterans are safe and secure and worth their sale price. … Because VA estimates can increase their repair costs, home sellers sometimes refuse to accept purchase offers backed by agency mortgages.

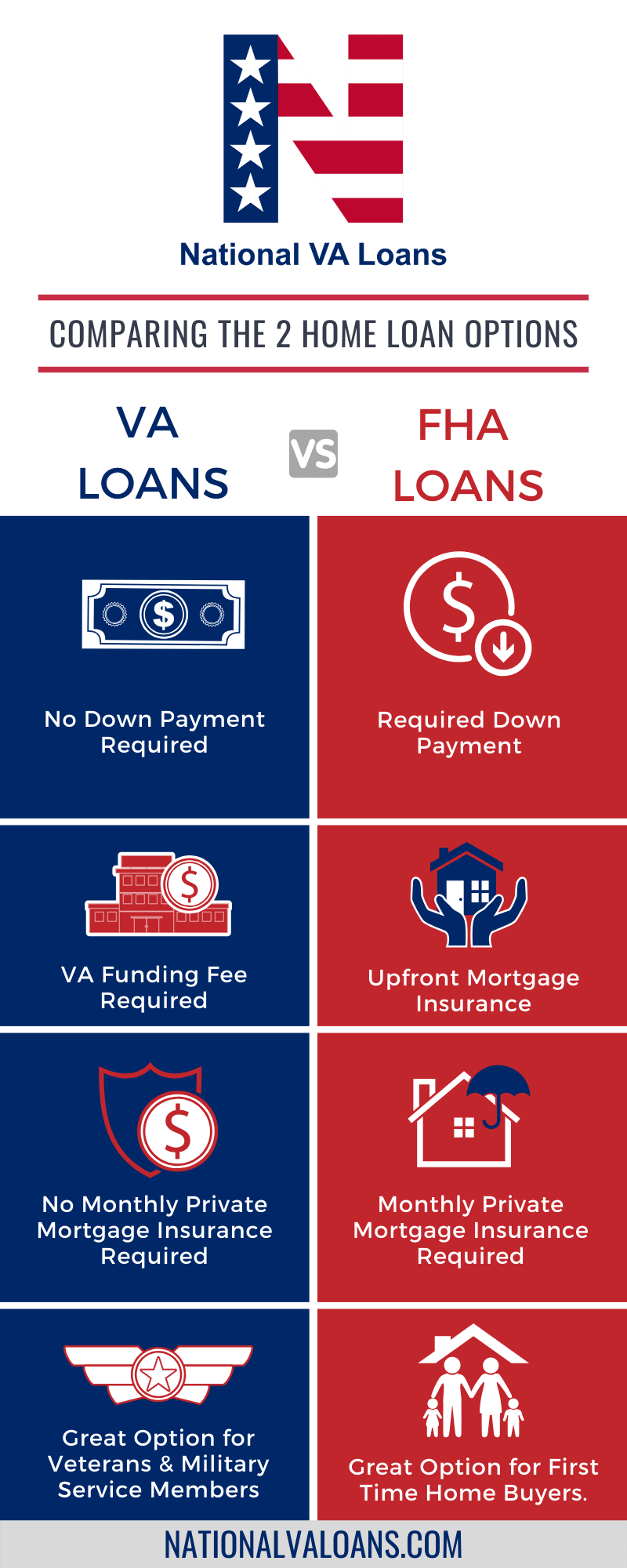

Are VA Loans Better than FHA?

If you are eligible, a VA loan is often a better choice between an FHA loan and a VA loan. This is because VA loans allow borrowers to enter the home with zero reduction and no mortgage collateral. However, FHA loans can also be a great option, especially for borrowers with poor credit or low income.

Is it worth getting a VA home loan? VA loans tend to have lower interest rates than conventional mortgages, allow for a higher debt-to-income ratio and lower credit ratings, and do not require private mortgage insurance. … He says lenders often offer veteran products other than VA loans that are better for the bank than for the borrower.

What’s the difference between FHA and VA loans?

In short, FHA mortgages are mortgages secured at the federal level designed to help eligible borrowers buy a home with less money and lower credit. VA mortgages are government-secured mortgages for active or veteran military personnel and their spouses.

What are the advantages and disadvantages of a VA loan?

| Pro | Kon |

|---|---|

| No prepayment | VA Financing Fee |

| No PMI | The VA funding fee is increased after the first use |

| Higher allowed DTI | The loan could exceed the market value |

| Credit flexibility | For basic accommodation only |

Is FHA or VA more strict?

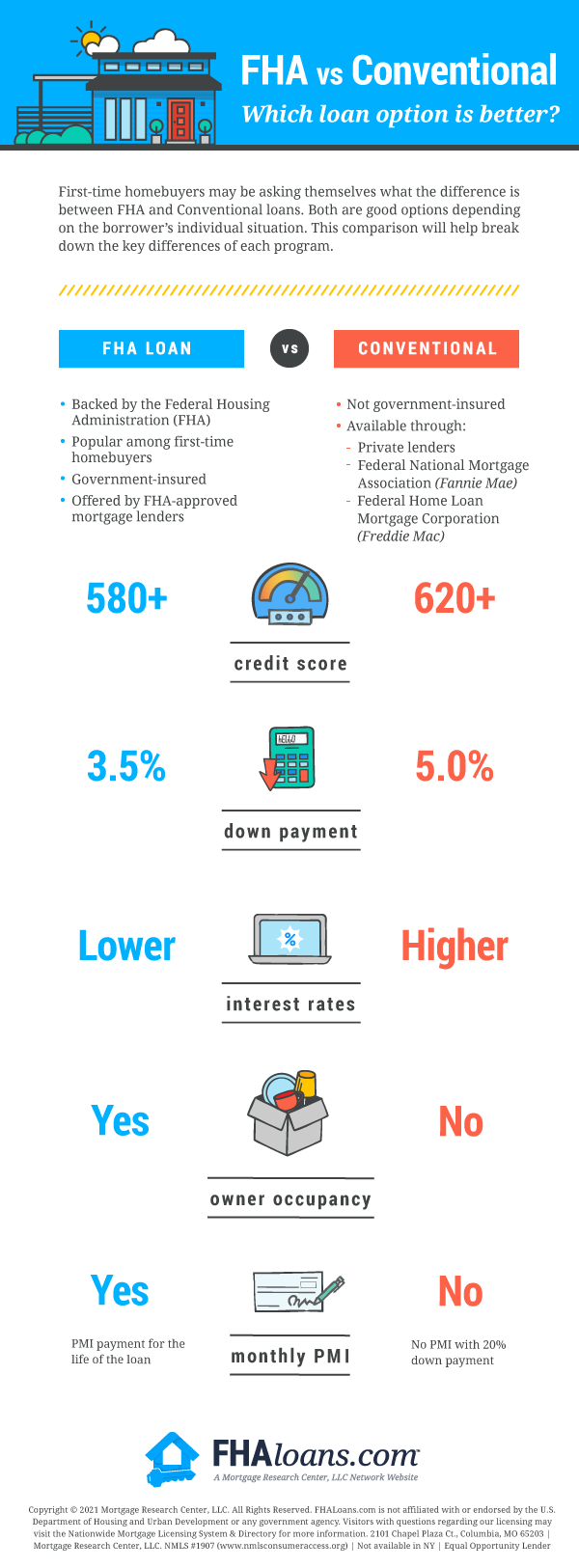

Loan VA. … Although both have less stringent requirements for borrowers compared to conventional loans, there are some differences between FHA and VA loans. Some people may qualify for an FHA loan but not, for example, a VA loan. Another important difference between a VA loan and an FHA loan is the size of the down payment.

Why do sellers hate VA loans?

Many sellers – and their real estate agents – do not like VA loans because they believe that these mortgages make it harder to close or more expensive for the seller. … VA loans have changed a lot in recent years and are now generally not harder or more expensive for sellers than any other loans.

Why VA loans are bad for sellers?

VA loans are associated with bureaucracy, valuation delays, and costs borne by sellers instead of buyers – all reasons why bids are turned down, agents say. In addition, real estate agents and veterans say, some vendors are turning down offers because of misconceptions about the VA program.

Are VA loans difficult for sellers?

The short answer is no. It’s true that VA loans used to be harder to close – but that’s ancient history. Today, you are likely to have about the same problems with a buyer who has such a mortgage as any other. And flexible VA guidelines may be the only reason your customer can buy your home.

Why you shouldn’t get a VA loan?

Because you have to consider the cost of the VA financing commission, you may end up getting a loan that exceeds the market value of your house. Manufactured housing may require a minimum advance and may not be eligible for a 30-year period. You cannot use a VA loan to rent a property.

What is the downside of a VA loan?

Disadvantages of a VA Loan Although you will not pay for your mortgage with a VA loan, you will pay a financing fee at the time of closing (although this fee can be financed in your loan). If you take out your first VA loan and don’t pay the down payment, the financing fee is equal to 2.3 percent of what you borrowed.

Why do sellers dislike VA loans?

Many sellers – and their real estate agents – do not like VA loans because they believe that these mortgages make it harder to close or more expensive for the seller.

Why do sellers hate VA loans?

Many sellers – and their real estate agents – dislike VA loans because they believe these mortgages make it harder to close or irritate the seller. … VA loans have changed a lot in recent years and are now generally not harder or more expensive for sellers than any other loans.

Why are VA loans bad for sellers? VA loans are associated with bureaucracy, valuation delays, and costs borne by sellers instead of buyers – all reasons why bids are turned down, agents say. In addition, real estate agents and veterans say, some vendors are turning down offers because of misconceptions about the VA program.

Are VA loans difficult for sellers?

The short answer is no. It’s true that VA loans used to be harder to close – but that’s ancient history. Today, you are likely to have about the same problems with a buyer who has such a mortgage as any other. And flexible VA guidelines may be the only reason your customer can buy your home.

What should a seller know about VA loans?

And for resellers, the most important thing is to understand VA loans, how good a mortgage product is for qualified borrowers. This high-quality nature means that if he is dealing with a veteran buyer, he is likely to use a VA loan.

Do sellers prefer VA or conventional loan?

Some agents advise home sellers to take the usual offers for loans or cash, even if they are lower than VA offers, because these options are perceived as less of a problem than VA loans. … “Choosing a normal offer over a VA offer is not considered discrimination.”

Can sellers discriminate against a VA loan?

No VA-approved lender may discriminate against a buyer. … No seller can refuse to offer a property on a discriminatory basis – the seller must comply with the laws on fair housing.

Can a home seller discriminate against a VA loan?

And the idea that retailers have to pay the final cost for VA buyers is simply not true. In short, there is no reason for a seller to reject your offer to buy just because you are using a VA loan.

Do sellers prefer VA or conventional loan?

A big challenge for old home buyers is that sellers prefer conventional loans over VA loans. “In today’s market with more offers that vendors can review, vendors may prefer to choose contracts with conventional financing rather than VA financing.

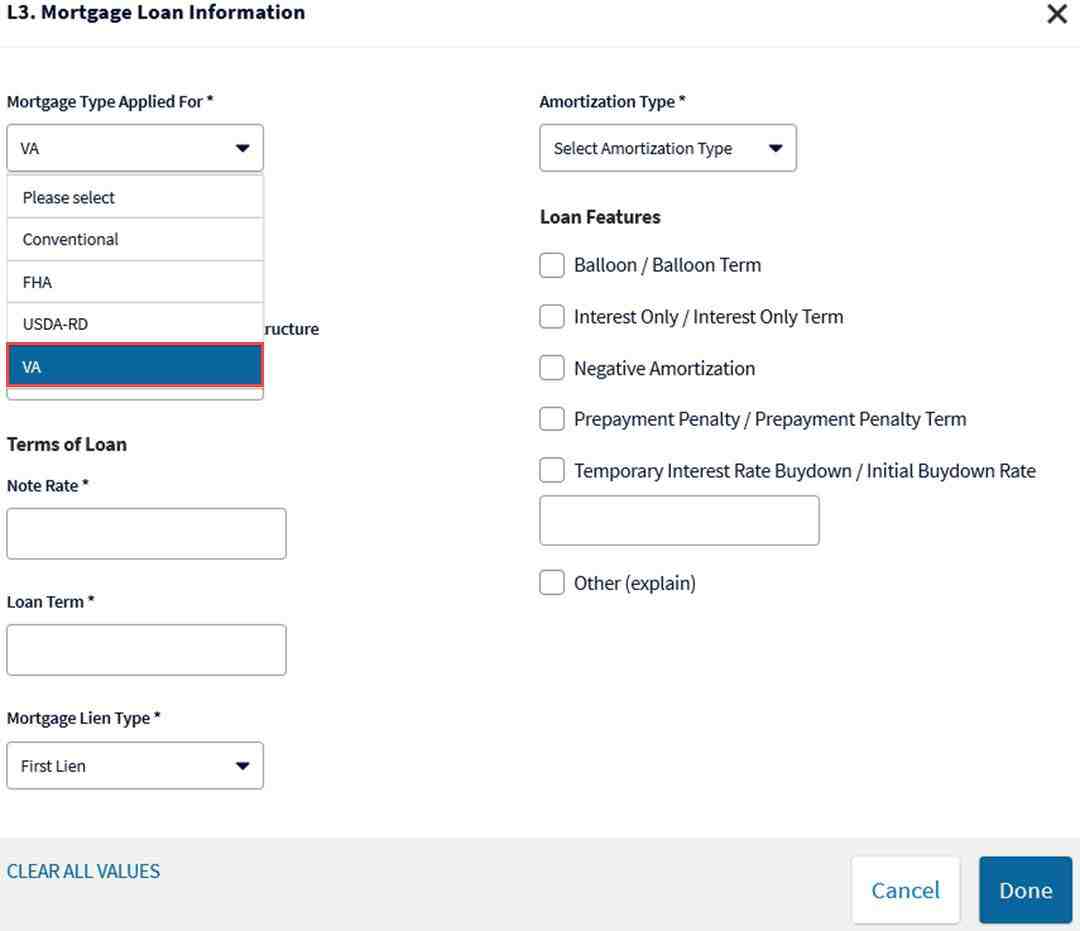

What kind of loan is a VA loan?

The VA loan is a mortgage offered through the U.S. Department of Veterans Affairs program. VA loans are available to active and veteran staff and their surviving spouses and are supported by the federal government but issued by private lenders.

What kind of loan is a VA loan? A VA loan is a type of government loan supported by the Department of Veterans Affairs (VA). The VA offers special guarantees to private lenders dealing with VA loans. As a result of these guarantees, lenders will issue loans to applicants without prepayment or less stringent requirements than other loans.

Is a VA loan an FHA loan?

Both mortgages are backed by the federal government and are popular among early home buyers. VA loans are open only to those who have served or are serving in the military and to some surviving spouses. FHA loans are open to everyone. In addition, the specific characteristics and requirements of both loans also differ.

Are VA and FHA loan limits the same?

Usual loan – $ 510,400. FHA loan – $ 331,760. VA loan – no loan limit.

Can you go from VA to FHA loan?

Under HUD 4000.1, eligible military borrowers can refinance in an FHA mortgage, even if they have military duties that prevent them from using the home as their permanent residence. HUD 4000.1 instructs the lender: … Like VA loans, FHA mortgages require occupancy, but as we read above, military service is an exception.

Is a VA loan a conventional loan?

| Loans VA | Conventional loans |

|---|---|

| Residence: Can only be used for primary housing | Residence: Can be used for primary, secondary, investment property and even holiday homes |

Is VA considered a conventional loan?

The VA loan is secured by the U.S. Department of Veterans Affairs, while the usual loan is offered through a private lender and has no government guarantee. While VA loans have more relaxed financial standards than regular loans, they also have stricter real estate standards.

Is VA loan conventional or FHA?

VA Loan: Unlike regular and FHA loans, VA loans do not require a down payment. They also do not require mortgage insurance, but have a one-time financing fee of 1.25% to 3.3% of the loan amount.

Is a VA loan a Fannie Mae loan?

The VA loan limits are the same as the Fannie Mae and Freddie Mac loan limits. Each veteran is entitled to a guarantee of a minimum of $ 36,000 and a maximum of 25 percent of the county loan limit.

Is a VA loan considered a regular loan?

Who is the lender for a VA loan?

Veterans United offers VA loans only 0% lower. For loans, VA NBKC offers advances of up to 0%. For loans, VA Quicken Loans offers prepayments of up to 0%.

Who is the #1 VA Lender?

Mortgage Freedom is ranked as the # 1 VA lender.

How do I find my VA lender?

5 Tips for Finding the Best VA Mortgage Lenders

- Get to know your financial numbers. Your credit score, monthly spending, and debt-to-income ratio affect your rate and chances of approval.

- Buy more than one lender. …

- Understand fees. …

- See APR. …

- Find the right lender for your situation.

Is a VA loan backed by Fannie Mae?

Fannie Mae will purchase or securitize fixed-rate VA-guaranteed loans that are subject to interest rate redemption as long as the borrower qualifies at the bond rate. The amount of the VA guarantee in dollars must be at least 25% of the original principal amount of the mortgage loan.

Are VA loans backed by the government?

Loans VA. VA loans are the most restrictive of government-supported loans in terms of affordability. To qualify for one, you must be an active member, veteran, eligible veteran spouse, or U.S. citizen who served in the armed forces of a government that was an ally of the U.S. during World War II.

Are VA loans Fannie Mae or Freddie Mac?

Unlike Fannie Mae and Freddie Maca, VA does not buy and charter loans. Instead, VA loans are delivered to the secondary market, most commonly through Ginnie Mae’s mortgage-backed securities.

What type of mortgage is a VA loan?

The VA loan is a $ 0 mortgage option issued by private lenders and partially covered or guaranteed by the Department of Veterans Affairs (VA). Eligible borrowers can use a VA loan to purchase real estate as their primary residence or to refinance an existing mortgage.

Is a VA loan a qualified mortgage?

The VA issues a definition of “qualified mortgage” for VA guaranteed or secured loans. … In general, all VA loans are QM safe haven loans, regardless of whether the loan is a high-cost mortgage or exceeds the limit of the DTI CFPB ratio, subject to certain exceptions relating to VA IRRRL.

How do you tell if a mortgage is federally backed?

You can use Freddie Mac or Fannie Mae search tools to find out if your loan is repaid at the federal level. You can also call your credit service technician and ask (he is required by law to tell you this). If you have questions about whether you can get a state-backed loan, talk to Integrity First Lending today.

How do I know who my mortgage is secured with? You can find out who owns your mortgage online, call or send a written request to your service technician and ask who owns your mortgage. The repairer is obliged to provide you, as far as he knows, with the name, address and telephone number of the owner of your loan. It’s not always easy to tell who owns your mortgage.

What mortgage loans are not federally backed?

Ordinary loans are not supported by the federal government and come in two packages: compliant and non-compliant. Compatible loans – as the name suggests, a compliant loan is “compliant” with a set of standards introduced by the Federal Housing Finance Agency (FHFA).

What type of mortgages are not federally backed?

Conventional loans: Conventional loans are mortgages issued by private lenders. They are not guaranteed by the federal government.

Are all mortgages federally backed?

Anyone who has a loan backed by Fannie Mae, Freddie Mac, VA, FHA or USDA are mortgages backed by the state.

What mortgage loans are federally backed?

Federal Housing Loans (FHAs) are state-backed mortgages for homeowners who may have lower than average credit ratings. FHA loans require a lower minimum deposit and a lower credit rating than many conventional loans.

What Mortgage companies are backed by the government?

Fannie Mae and Freddie Mac are mortgage companies founded by the United States Congress. No institution issues or services its own mortgages. Instead, they buy and guarantee mortgages issued through lenders in the secondary mortgage market.

Which mortgage loans are guaranteed by the federal government?

Federal Housing Authority (FHA) loans are guaranteed by the government and are intended for homeowners who may have lower than average credit ratings and do not have the funds for a large deposit. They require a lower minimum deposit and a lower credit rating than many conventional loans.