What repairs does VA loan require?

Contents

If the total cost of repairs is $ 500 or less, the work should not be completed until an insurer has conditionally approved the loan. If the total cost of repairs is greater than $ 500, the work should not be completed until the lender issues a ready to close loan.

What are the inspection requirements for a VA loan? Requirements for VA loans for housing include:

- Functional electrical, heating and cooling systems.

- Adequate roofing that lasts for the foreseeable future.

- Sufficient in size for basic necessities of life.

- Clean, continuous water supply with sanitary facilities.

- Free of lead-based paint.

- Free of wood that destroys insects, fungus and dry rot.

What are typical lender required repairs?

Typical conditions that are likely to trigger the lender’s necessary repairs include missing or non-functioning carbon monoxide monitors and fire alarms, missing water heater straps, floor problems such as missing tiles or uneven floors, deteriorated roof problems, missing stair rails or broken stairs and peeling paint or water stains …

Do appraisers consider repairs?

Appraisers are trained to note all easily observable faults and repairs to be performed. For example, if your home’s roofing is worn or your kitchen needs an update, such conditions will be noted in the appraiser’s report. The condition of a property is very important in assessments.

Do conventional loans require repairs?

Yes, a conventional loan may require repairs based on the outcome of an assessment, and like the other assessments, health and safety factors are prioritized. However, a conventional loan does not have such strict approval guidelines compared to other types of loans (e.g. FHA and VA).

What will fail a VA loan inspection?

What will fail a VA assessment? In general, any visible health or safety issues will pose a problem on a VA assessment report. You will not be able to close a home until these issues are resolved. In some cases, sellers are willing to cover the cost of major repairs instead of losing sales.

What does the VA inspector look at?

VA appraisers will look at the interior and exterior of the property and assess the overall condition. They will also recommend any obvious repairs needed to get the home to meet the MPRs. Keep in mind that this is not a home inspection and VA does not guarantee that the home is free of defects.

What disqualifies for VA loan?

The full period (at least 90 days) for which you were called or ordered for active service, or. At least 90 days if you were discharged for an emergency, a reduction in force or for the sake of the government, or. Less than 90 days if you were discharged due to a service-related disability.

What are the service requirements for a VA loan?

You may be eligible for a VA loan by meeting one or more of the following requirements: You have completed 90 consecutive days of active duty in wartime, OR. You have served 181 days of active duty in peacetime, OR. You have 6 years of service in the National Guard or reserves, OR.

Do VA loans require repairs?

Can a buyer pay for VA necessary repairs? The reality is that VA buyers can pay for repairs in the home that are necessary to close a loan, even if they are issues related to VA’s minimum property requirements.

Can you get a VA loan without serving?

For active service members, you are eligible to apply for VA mortgage benefits as long as your discharge was NOT categorized as dishonorable if you meet the basic requirements of the VA loan program. These basic requirements are not to have an honorable discharge and to earn a minimum time in uniform.

Who pays for VA loan closing costs?

Who pays the final costs of a VA loan? When you use a VA loan, the buyer, seller and lender each pay different parts of the closing costs. Seller can not pay more than 4% of the total home loan in closing costs. But their share of the closing costs includes commissions to buyer and seller realtors.

How do I avoid closing costs with a VA loan? Now you know that there are closing costs on VA loans, but what if you do not want or can bring these costs to closing? The most common way to overcome bringing these funds to closure is by selling paid closing costs and VA sales concessions. Remember that the seller is NOT obligated to pay the buyer’s closing costs.

What closing costs are VA Buyers not allowed to pay?

Here is a list of the VA fees that a borrower cannot pay outside of the 1% set-up fee: Application fees. Home assessments ordered by the lender. Home inspection ordered by lender.

Can a VA buyer pay their own closing costs?

When you go to buy a home with a VA guaranteed mortgage, you will typically encounter fees like closing costs and other expenses. How they are paid is often a matter of negotiation between you and the seller. But there are also fees that VA does not allow the buyer to pay.

What fees are required to be paid by the seller on a VA loan?

Note: We require that a seller can not pay more than 4% of the total home loan in the seller’s concessions. However, this rule only covers some closing costs, including the VA financing fee. The rule does not cover borrower discount points.

What does the seller pay for on a VA loan?

With VA loans, sellers are allowed to pay for some or all of the buyer’s costs. VA loans allow sellers to contribute up to 4.0 percent of the home’s selling price. In this example, it would be $ 8,000, but the closing cost of a $ 200,000 would generally not be quite high.

Is a VA loan good for the seller?

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer who uses a VA loan when selling your home can be just as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but you as a seller should have nothing to worry about.

What does seller pay at closing for VA loan?

Seller can not pay more than 4% of the total home loan in closing costs. … As a buyer, you must pay the VA financing fee, loan creation fee, borrower discount points, VA appraisal fee, title insurance and more.

How much income do I need for a VA loan?

Are there income restrictions for VA loans? No, VA does not limit the income of qualified VA borrowers. Other government-guaranteed mortgage programs may set a maximum income amount to qualify for specific loan programs, but VA does not have such a requirement.

How much do you need to earn to qualify for a VA loan? If the monthly gross income is $ 7,000, the debt ratio is 2,639 divided by 7,000 for a ratio of. 38 or 38. Since the ratio is below the maximum ratio of 41, the borrower qualifies for the loan based on the debt ratio.

Do you need income for VA loan?

VA prefers a debt to income, or DTI, of no more than 41%. However, borrowers with higher DTI ratios may be approved if they have enough “residual income,” another factor that lenders consider when reviewing mortgage applications.

What disqualifies for VA loan?

The full period (at least 90 days) for which you were called or ordered for active service, or. At least 90 days if you were discharged for an emergency, a reduction in force or for the sake of the government, or. Less than 90 days if you were discharged due to a service-related disability.

Is a VA loan based on income?

The debt-to-income ratio determines whether you can qualify for a VA loan. The acceptable debt in relation to income for a VA loan is 41%. Generally, debt-to-income ratio refers to the percentage of your monthly gross income that goes to debt. In fact, it is the ratio of your monthly debt obligations to your monthly gross income.

Can I get a VA loan with no income?

So no, it is not impossible to get a VA loan if you are unemployed, you just need to be able to prove that you have a source of income other than a paycheck.

Can I qualify for a VA loan without a job?

You do not have to have a job at all to qualify for a VA loan. … When applying for a VA loan, you can ask your lender to consider social security income, disability income, alimony, child support, annuities and retirement income.

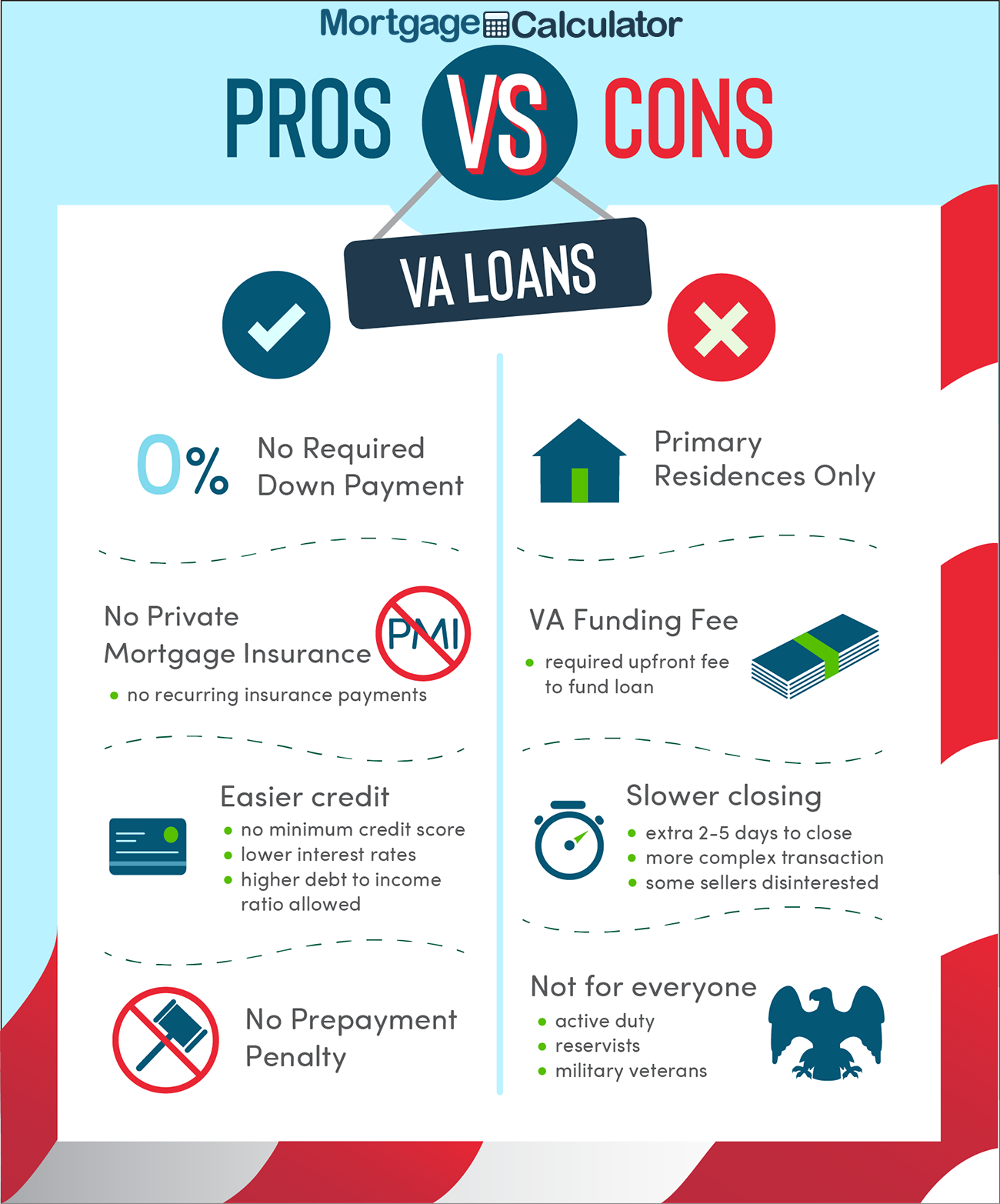

Is it hard to qualify for a VA loan?

If you are eligible, VA loans are pretty easy to qualify for as there is no down payment required, no minimum credit score and no maximum limit on how much you can borrow relative to income.

Can you be denied for a VA loan?

How often do insurers refuse VA loans? About 15% of VA loan applications are rejected, so if yours is not approved, you are not alone. If you are rejected during the automatic drawing phase, you may be able to apply for approval through manual drawing.

What disqualifies you from a VA loan?

Dishonest discharge Veteran status requires that conscripts be discharged or released from the military under conditions other than dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA loan guarantee program.

How long does it take to get approved for a VA loan?

On average, you can get approved and close on a VA loan of 30 to 45 days. Again, however, this will vary from lender to even borrower. Below are the factors that affect your approval time.

How fast can you get a VA loan? It is possible to close on a VA loan for as little as 30 days. It makes buying a home with a VA loan just as fast as a traditional mortgage. The key to a quick closure lies in making sure you have everything you need to speed things up.

How long is the VA home loan process?

On average, a VA loan takes from 50 to 55 days to close – from signed contract to closing.

Can a VA loan close in 30 days?

You can close in 30 days It is possible to close on a VA loan in as little as 30 days. It makes buying a home with a VA loan just as fast as a traditional mortgage. The key to a quick closure lies in making sure you have everything you need to speed things up.

How often do VA home loans get denied?

Overall, about 15 percent of applications are rejected, but some may re-apply.

Is it hard to get approved for a VA home loan?

If you are eligible, VA loans are pretty easy to qualify for as there is no down payment required, no minimum credit score and no maximum limit on how much you can borrow relative to income.

What disqualifies you for a VA loan?

You have served 181 days of active duty in peacetime, OR. You have 6 years of service in the National Guard or reserves, OR. You are the spouse of a service member who has died in connection with the service or as a result of a service-related disability.

Can you be denied a VA home loan?

How often do insurers refuse VA loans? About 15% of VA loan applications are rejected, so if yours is not approved, you are not alone. If you are rejected during the automatic drawing phase, you may be able to apply for approval through manual drawing.

Do VA loans take longer to process?

VA loans are quick and easy to process. They should not take a longer process than a conventional loan. Since the length of time can vary depending on your lender’s loan volume, you should ask your lender how long it will take to close your loan.

How long does underwriting take on a VA loan?

Once a lender has a completed loan file, income documents and a credit report, the application will be submitted to a VA insurer for processing. Underwriters can take as long as 14 days to make a decision to take out a loan for individuals with a solid credit background.

Why is my VA loan taking so long?

Extensive repairs can push the closing date back by weeks or months. The valuation value can also affect the final timeline. VA loans can not be issued for more than the valuation value of the home. If the appraisal value falls below the purchase price, buyers have some considerations (and some delays) ahead.

How much are VA loan closing costs?

Like any mortgage loan, the VA loan comes with closing costs and related expenses. The closing costs of the VA loan can on average be anywhere from 3 to 5 percent of the loan amount, but the costs can vary significantly depending on where you buy, the lender you work with and more.

Why do sellers hate VA loans? VA mortgages also come with minimum property requirements that can end up forcing home sellers to make many repairs. Because VA assessments can increase their repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgage.

How much are closing costs on a $300 000 home?

Total closing costs for buying a house of $ 300,000 can cost anywhere from around $ 6,000 to $ 12,000 – or even more. The funds typically cannot be borrowed because it would raise the buyer’s loan to a point where they may no longer qualify.

What is 3% of closing costs?

Closing costs are handling fees you pay to your lender when you close your loan. Closing costs on a mortgage usually amount to 3% – 6% of your total loan balance. Valuation fees, attorneys’ fees and inspection fees are examples of common closing costs.

How do you calculate closing costs for buyer?

D I = J. This is the sum of all your final costs. It represents the sum of all your borrowing costs and all your non-borrowing costs. This is roughly the amount you should budget for, as it represents the lender’s estimate of what you will owe at closing time.

Can closing costs be included in VA loan?

With the exception of the VA Funding Fee, all closing costs must be paid upon closing and cannot be financed on your loan. Interest rate reduction refinancing loans (IRRRLs) are another exception. All closing fees on an IRRRL can be rolled into your new loan.

How much are closing costs in VA for buyer?

In California, the closing costs of a VA loan tend to average between 3% and 5% of the amount borrowed. For example, on a loan amount of $ 500,000, the borrower’s total closing costs may fall somewhere between $ 15,000 (3%) and $ 25,000 (5%). But they can in some cases fall outside this range.

Can the closing cost be included in the loan?

Can closing costs be included in the loan? If you do not have the money to pay closing costs in advance, you may be able to include them in your loan balance. This is often allowed on refinancing loans, although unfortunately it is not an option for home buyers.

Why is a VA loan so hard to get?

Borrowers must show that they have the income to pay the mortgage. They should not have a large debt burden. Although there is no minimum credit score requirement, borrowers may have difficulty getting approved by a lender if they do not have at least a 620 FICO score.

Is it difficult to get a VA loan approved? If you are eligible, VA loans are pretty easy to qualify for as there is no down payment required, no minimum credit score and no maximum limit on how much you can borrow relative to income.

What would disqualify you from getting a VA loan?

Veteran status requires that service members be discharged or released from the military under conditions other than dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA loan guarantee program.

Can you be denied for a VA loan?

How often do insurers refuse VA loans? About 15% of VA loan applications are rejected, so if yours is not approved, you are not alone. If you are rejected during the automatic drawing phase, you may be able to apply for approval through manual drawing.

Why would a VA home loan be denied?

The most common reason for VA home loan applications being rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial information is correct. Before submitting your application, take the time to review each statement you make and the numbers you enter.

How often do VA loans get denied?

Overall, about 15 percent of applications are rejected, but some may re-apply.

How often do VA loans fall through?

For all purchases, according to Ellie Mae, 74.3 percent of VA loans closed, compared to 74.1 percent of all mortgages. Conventional (non-governmental) performed slightly better than VA with a closing rate of 75.2 percent. In short, VA loans close at a high rate and are less likely than the average loan to not close.

Why would a VA home loan be denied?

The most common reason for VA home loan applications being rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial information is correct. Before submitting your application, take the time to review each statement you make and the numbers you enter.