What is bad about a VA loan?

Contents

Lower Closing Costs Lenders typically charge underwriting, processing, and documentation fees on all of their loans, but those fees may not be paid for by VA lenders and may be forced on their behalf by the lender or seller. the veterans.

What are the disadvantages of a VA loan? 5 Possible Disadvantages of a VA Loan

- You may have less equity in your home. …

- VA Loans cannot be used to Buy Holiday Homes or Investment Properties. …

- Vendor Objection to Financing VA. …

- The Financing Fee is Higher for Subsequent Use. …

- Not All Lenders Offer – or Understand VA Loans.

Why do sellers hate VA loans?

Before it guarantees mortgages, the VA wants to make sure that homes that eligible veterans buy are safe as well as worth their selling price. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers with the agency’s mortgage backing.

Are VA loans difficult for sellers?

The short answer is â € œno.â € It’s true that VA loans were once more difficult to close â € ”but that’s ancient history. Today, you are likely to have virtually the same problems with a buyer with this type of mortgage as anyone else. And VA flexible guidance may be the only reason your buyer can buy your home.

Why VA loans are bad for sellers?

VA loans come with bureaucracy, appraisal delays and fees paid by sellers instead of buyers – all reasons why offers are rejected, agents say. Additionally, say estate agents and veterans, some sellers turn down offers because of misconceptions about the VA program.

Is a VA loan bad for the seller?

Using a VA loan means you’ll save money on the purchase and over the life of the loan. However, it does mean that the person selling you will have to spend more to sell you the house. If you’re worried about the seller denying your offer because you’re using a VA loan, don’t be.

Should a seller accept a VA loan?

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer using a VA loan when selling your home can be just as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but you as a seller should have nothing to worry about.

Are VA loans difficult for sellers?

The short answer is â € œno.â € It’s true that VA loans were once more difficult to close â € ”but that’s ancient history. Today, you are likely to have virtually the same problems with a buyer with this type of mortgage as anyone else. And VA flexible guidance may be the only reason your buyer can buy your home.

How often do VA loans get denied?

Overall, about 15 percent of applications are rejected, but some may be able to reapply.

Can VA home loans be refused? You need to be able to prove to the lender that you can afford the monthly loan payments. If your VA loan application was turned down, this may be because your income levels are too low. … They’ll be able to tell you if your income was too low. If so, look for ways to increase your income if possible.

Why would an underwriter deny a VA loan?

In the vast majority of cases, inexperienced loan officers or strict overlays are the reason for being turned down for a VA loan. If your lender is not approved to underwrite manually on VA home loans, you may be advised that you have not been approved without further explanation or options.

Can an underwriter deny a VA loan?

How often do underwriters deny VA loans? About 15% of VA loan applications are rejected, so if your applications are not approved, you are not alone. If you are turned down at the automated underwriting stage, you may be able to request approval by handwriting.

What does it mean when a VA loan is in underwriting?

Underwriting serves as the final review of a borrower’s loan file. … VA lenders generally rely on a Nominated Underwriting System, â € or AUS, to determine a buyerâ € ™ s pre-purchase status. AUS is a computer program that immediately evaluates a buyer’s eligibility, based on a variety of factors.

Is it hard to get approved for a VA loan?

If you are eligible, VA loans are relatively easy to qualify for, as there is no lower payment required, no minimum credit scores, and no upper limit on how much you can borrow compared to income .

Can you be denied a VA home loan?

How often do underwriters deny VA loans? About 15% of VA loan applications are rejected, so if your applications are not approved, you are not alone. If you are turned down at the automated underwriting stage, you may be able to request approval by handwriting.

What will cause VA loan to get disapproved?

The most common reason why VA home loan applications are turned down is because of errors on the application itself. Lenders can only give loans if they are sure that your personal and financial details are correct. Before you submit your application, please take time to review each statement you make and numbers you quote.

What will cause VA loan to get disapproved?

The most common reason why VA home loan applications are turned down is because of errors on the application itself. Lenders can only give loans if they are sure that your personal and financial details are correct. Before you submit your application, please take time to review each statement you make and numbers you quote.

Can a VA loan be rejected?

When lenders refuse a loan, they do so reluctantly. VA lenders make money by approving loans, not denying them so they will do what they can to get your approval. When they cannot, they will send what is called an Adverse Action notice. … First you need to find out specifically, exactly why your loan was turned down.

Can a VA loan be denied in underwriting?

How often do underwriters deny VA loans? About 15% of VA loan applications are rejected, so if your applications are not approved, you are not alone. If you are turned down at the automated underwriting stage, you may be able to request approval by handwriting.

Is it harder to buy a home with a VA loan?

Should you worry? The short answer is “no.” It’s true that it was harder to close VA loans at one time – but that’s ancient history. Today, you are likely to have virtually the same problems with a buyer with this type of mortgage as anyone else. And VA flexible guidance may be the only reason your buyer can buy your home.

Why do sellers not want VA loans? Many sellers – and their real estate agents – don’t like VA loans because they think these mortgages make it harder to close or more expensive for the seller. … Less likely to close than other types of mortgages. Take ages to reach closure. Have appraisers who slow down and routinely underestimate homes.

Why do Realtors hate VA loans?

In some cases, home sellers will not accept purchase offers backed by VA-guaranteed mortgages in case of low appraisal value. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers with the agency’s mortgage backing.

Do sellers prefer VA loans?

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer using a VA loan when selling your home can be just as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but you as a seller should have nothing to worry about.

Why dont sellers want VA loans?

VA mortgage loans also come with minimal property requirements that can force home sellers to do many repairs. Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers supported by agency mortgages.

What does seller pay for VA loan?

Vendor Contributions are allowed But the Department of Veterans Affairs limits the amount of money a seller can contribute toward the buyer’s VA loan closing costs. In California, and throughout the country, these ‘seller concessions’ are usually limited to 4% of the loan amount.

Why is it so hard to buy a house with VA loan?

VA buyers do not have to put money down to buy a house. And because the VA guarantees the loan, the buyer does not pay for private mortgage insurance, a cost that can add up to another 1 percent on top of the purchase price.

Why is a VA loan so hard to get?

Lenders need to show they have the income to make the mortgage payments. They should not have a huge debt load. Although there is no minimum credit score requirement, lenders could have a hard time getting approved by a lender if they do not have a minimum FICO 620 Score.

Why do sellers hate VA loans?

Before it guarantees mortgages, the VA wants to make sure that homes that eligible veterans buy are safe as well as worth their selling price. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers with the agency’s mortgage backing.

Why do Realtors hate VA loans?

In some cases, home sellers will not accept purchase offers backed by VA-guaranteed mortgages in case of low appraisal value. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers with the agency’s mortgage backing.

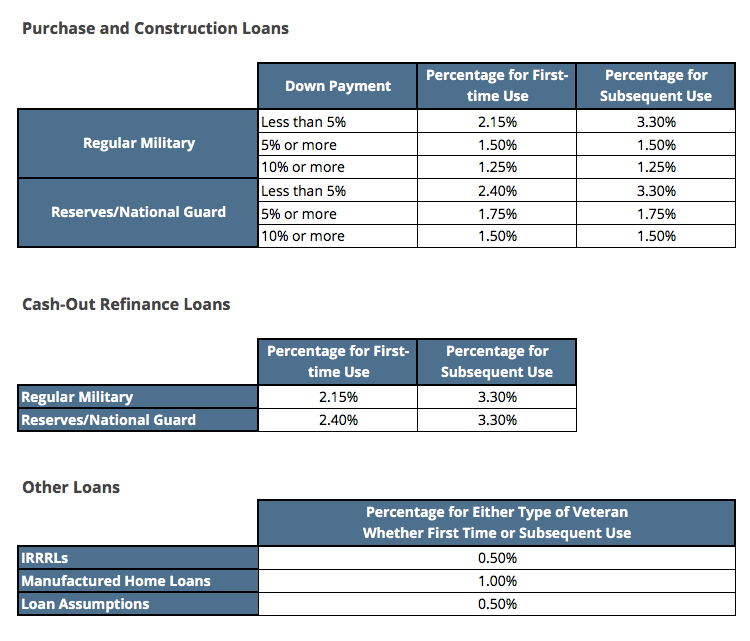

How much are VA funding fees?

How Much is the VA Financing Fee? The VA financing fee is a one-time fee of 2.3% of the total loaned with a VA home loan. The financing fee increases to 3.6% for lenders who have used the VA loan program before, but it can be reduced by putting down at least 5% at closing.

Can the VA funding fee be waived? Who can get a VA funding fee exemption? The VA funding fee exemption provides a special waiver for eligible military service members, veterans, or surviving spouses who deduct the financing fee from their closing costs.

How much is the VA funding fee 2020?

As of January 1, 2020, the VA financing fee rate is 2.30% for first-time VA loan borrowers with no lower payment. The financing fee increases to 3.60% for VA second loan borrowers. The financing fee rate is only applied to the amount financed in the VA loan, so no lender discount is charged.

What is the VA funding fee for a first time user?

Fees for a first VA purchase loan are 2.3% with a zero down payment, 1.65% with a lower payment of 5% to 9.9%, and 1.4% with a lower payment of 10% or more. The financing fees for a VA cash refinancing loan are the same as for a purchase loan.

Is paying the VA funding fee worth it?

But while the VA Financing Fee can make buying or refinancing a home a little more expensive, the benefits of VA loans can often outweigh the startup costs, making a VA home loan worth considering. … This COE will usually specify disability status and whether you should be exempt from paying a VA Financing Fee.

How much is the VA funding fee for first time use?

Fees for a first VA purchase loan are 2.3% with a zero down payment, 1.65% with a lower payment of 5% to 9.9%, and 1.4% with a lower payment of 10% or more. The financing fees for a VA cash refinancing loan are the same as for a purchase loan.

Is the VA funding fee a closing cost?

Buyers who receive VA disability compensation are exempt from paying this fee. The financing fee is the only closing cost that VA buyers can roll to their loan balance, which is how most lenders approach this fee.

What is a typical VA funding fee?

The VA financing fee is a one-time fee of 2.3% of the total loaned with a VA home loan. The financing fee increases to 3.6% for lenders who have used the VA loan program before, but it can be reduced by putting down at least 5% at closing.

How much is the VA funding fee 2021?

VA financing fees in 2021 Most veterans will pay a 2.3 percent financing fee when buying a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: a mortgage loan with no down payment.

Is the VA funding fee tax deductible 2021?

The good news is that the VA loan financing fee is completely tax deductible. Because it’s a form of mortgage insurance, you can take the entire amount you pay as a deduction on your annual income taxes.

What is the funding fee for a VA loan?

The VA financing fee is a one-time fee paid to the Department of Veterans Affairs that supports the VA home loan program. Veterans who put down less than 5% on their home purchase will pay 2.3% of the total loan on first home purchase and 3.6% on subsequent loans.