Is VA loan worse than conventional?

Contents

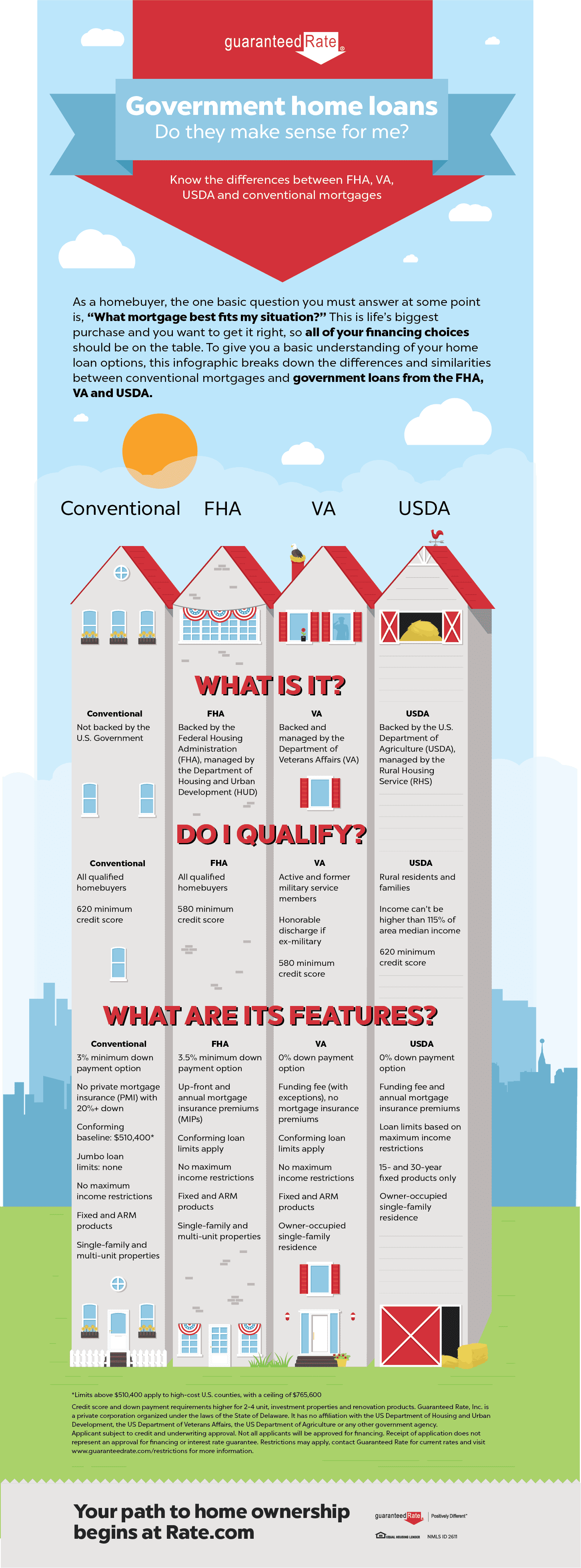

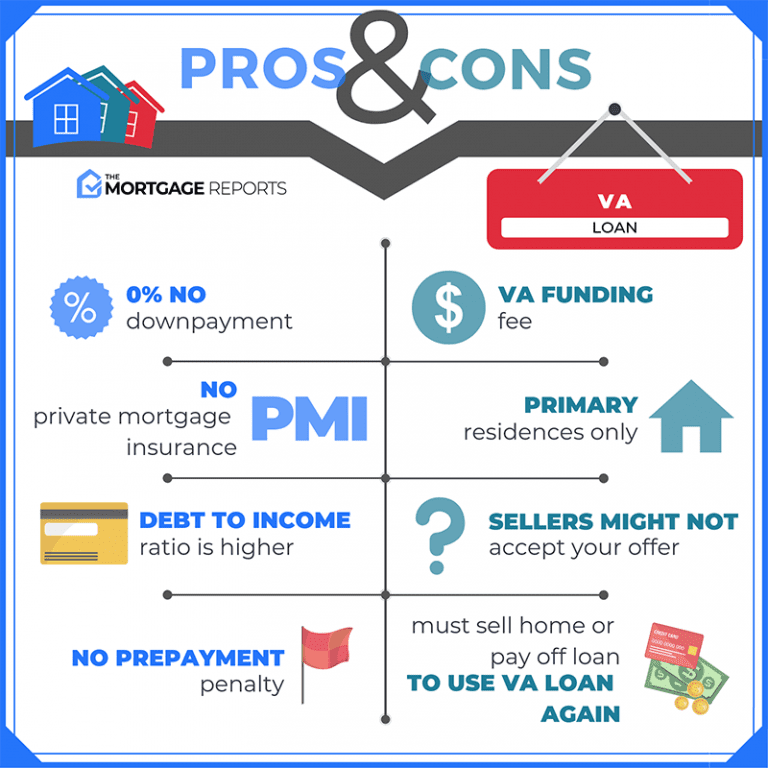

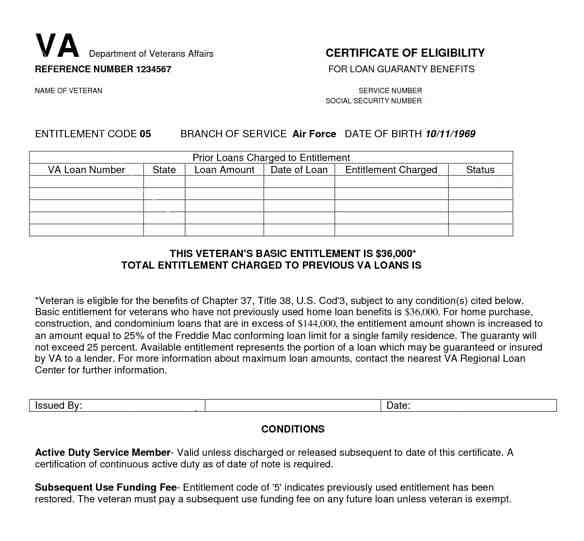

VA loans typically have lower interest rates than conventional mortgages, allow for a higher debt-to-income ratio and lower credit scores, and do not require private mortgage insurance. … He says lenders are often offering veterans products other than VA loans that are better for the bank, not for the loan.

What are the disadvantages of a VA loan? 5 Potential Disadvantages of a VA Loan

- You can have less equity in your home. …

- VA loans cannot be used to buy holiday homes or investment properties. …

- Resistance of the seller to VA financing. …

- The Financing Fee is higher for subsequent use. …

- Not all lenders offer – or understand – VA loans.

Is it better to go VA or Conventional?

VA loans are typically easier to qualify for credit than conventional loans. … In general, VA loans tend to have lower interest rates – and if rates fall, refinancing with a VA Interest Rate Reduction Loan (IRRRL) may be easier than having a lower interest rate. conventional loan.

Why do sellers prefer conventional over VA?

Some agents advise home sellers to take out conventional loans or cash offers, even if they are lower than VA offers, because these options are perceived as less annoying than VA loans. … “Choosing a conventional bid over a VA bid is not considered discrimination.”

Why do sellers not like VA loans?

Why do sellers dislike VA loans? Many sellers – and their real estate agents – don’t like VA loans because they believe that these mortgages make it harder to close or more expensive for the seller.

Why you shouldn’t get a VA loan?

Since you need to factor in the cost of the VA financing rate, you may end up with a problem that exceeds the market value of your home. Manufactured homes may require a minimum payment and may not be eligible for a 30-year term. You cannot use a VA loan for rental property.

Why do sellers dislike VA loans?

Before securing a mortgage, the VA wants to make sure the homes that eligible veterans buy are safe and secure, and worth their sale. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

What is the downside of a VA loan?

Disadvantages of a VA loan As long as you do not pay for the mortgage insurance with a VA loan, you will pay a financing fee at the end (although this rate may be financed in your default). If you take out your first VA loan and don’t make a down payment, the financing rate is equivalent to 2.3 percent of what you borrowed.

Why do sellers not like VA loans?

Why do sellers dislike VA loans? Many sellers – and their real estate agents – don’t like VA loans because they believe that these mortgages make it harder to close or more expensive for the seller.

Why do some home sellers not accept VA loans?

Some home sellers do not accept VA offers because they (erroneously) believe that they will pay all of the buyer’s closing costs. The VA limits the closing costs that Veterans can pay, which is a huge benefit for those who have served our country.

Can a seller discriminate against a VA loan?

No VA-approved provider can discriminate against a buyer. … No seller can refuse to offer a property on a discriminatory basis – the seller is required to comply with the laws of the Fair Housing Act.

What is a safe harbor qualified mortgage?

Under the qualifying mortgage rules, “safe harbor” provisions protect lenders against distressed loan processes that claim to have extended a mortgage that the lender had no reason to believe they could repay. … The majority of new home mortgages are sold by lenders in the secondary mortgage market.

What Determines a Qualified Mortgage? A qualified mortgage also means that your lender has followed the rules of ability to repay. This means that a lender will ask for and document your income, assets, credit history, employment and monthly expenses to make a good faith effort to know if you will be able to repay the loan they offer you.

What makes a loan eligible for safe harbor?

To qualify for the secure port, which is a conclusive presumption of compliance with the repayment capacity rule, the APR could not exceed the APOR for a comparable transaction by (1) 1.5 percentage points or more for a first transaction lien or (2) 3.5 percentage points or more for a junior lien transaction.

What are the 8 key factors that must be taken into account when determining ability to repay?

At a minimum, creditors should generally consider eight underwriting factors: (1) current or reasonably expected income or assets; (2) current employment status; (3) the monthly payment on the covered transaction; (4) the monthly payment on any simultaneous loan; (5) the monthly payment for mortgage bonds; …

What disqualifies a loan from being a qualified mortgage?

Qualified mortgages may not have the following features: Risky loan features, or those that offer artificially low monthly loan repayments in the early years of the loan term, including interest-only loans, lenders, or negative repayment loans , sometimes called subprime.

What are the 4 types of qualified mortgages?

There are four types of QMs – General, Temporary, Small Creditor, and Balloon-Payment.

Which would be considered to be a qualified mortgage QM?

General definition of QM. A loan qualifies as a general QM as defined in the ATR / QM Rule if: it has no negative amortization, interest only or global payment characteristics, a term exceeding 30 years, or total points and fees which generally exceed 3 percent of the loan amount (General QM Product Requirements)

Is FHA a qualified mortgage?

Any loan that meets the requirements of the product features and is eligible for purchase, guarantee, or insurance by a GSE, FHA, VA, or USDA is QM regardless of the income to income ratio (this category QM applies to GSE loans as long as GSEs are in FHFA custody and to federal agency loans until an agency issues …

What does safe harbor mean in mortgage?

Under qualified mortgage rules, “safe harbor” provisions protect lenders against distressed loan processes that claim to have extended a mortgage that the lender had no reason to believe they could repay.

What is the difference between safe harbor and rebuttable presumption?

The distinction is key, since the qualification for the safe harbor would be based on a limited number of loan features, while the qualification for a rebuttable presumption could be based on a broader set of more vaguely defined criteria.

What is the general QM final rule?

QM’s general final rule is part of the CFPB’s work to protect homeowners from the pitfalls of irresponsible and inaccessible debt and mortgage lending. Under the statute, QM loans are presumed to be made on the basis of the lender’s reasonable determination of the owner’s ability to repay the loan.

What are the 4 types of qualified mortgages?

There are four types of QMs – General, Temporary, Small Creditor, and Balloon-Payment.

Is FHA a qualified mortgage? Any loan that meets the requirements of the product features and is eligible for purchase, guarantee, or insurance by a GSE, FHA, VA, or USDA is QM regardless of the income to income ratio (this category QM applies to GSE loans as long as GSEs are in FHFA custody and to federal agency loans until an agency issues …

Which would be considered to be a qualified mortgage QM?

General definition of QM. A loan qualifies as a general QM as defined in the ATR / QM Rule if: it has no negative amortization, interest only or global payment characteristics, a term exceeding 30 years, or total points and fees which generally exceed 3 percent of the loan amount (General QM Product Requirements)

What is an acceptable feature of a qualified mortgage?

All qualified mortgages must generally meet the following mandatory requirements: 1. The loan may not have negative repayment, interest-only payments, or balloon payments. 2. Total points and fees may not exceed 3 percent of the loan amount.

Which of the following is not a required characteristic of a qualified mortgage QM?

Terms in this area (18) Which of the following is not a required feature of a qualified mortgage (QM)? The answer is that the borrower has to make a down payment.

What disqualifies a loan from being a qualified mortgage?

Qualified mortgages may not have the following features: Risky loan features, or those that offer artificially low monthly loan repayments in the early years of the loan term, including interest-only loans, lenders, or negative repayment loans , sometimes called subprime.

What are the requirements for a qualified mortgage? These parameters require that the lender has not taken monthly payments of the debt in excess of 43% of the pre-tax income; that the provider has not paid more than 3% in original points and expenses; and that the loan was not issued as a risky or too expensive loan with terms such as negative repayment, balloon payment …

What feature must not present for a loan to fall under the definition of a qualified mortgage?

Certain risky loan features are not allowed, such as: An “interest only” period, when you pay only the interest without paying the principal, which is the amount of money you have borrowed. “Negative repayment,” which can allow your loan principal to increase over time, even if you make payments.

Which of the following is not a feature of a qualified mortgage quizlet?

A seller repossessed a $ 150,000 mortgage at 6% interest. Payments are interest only for 10 years. How much balloon payment will be due?

What qualifies as a qualified mortgage?

A qualified mortgage is a mortgage that meets certain requirements for the protection of lenders and the secondary market trade under the Dodd-Frank Wall Street Reform and Consumer Protection Act, a significant piece of financial reform legislation passed in 2010. .

Why are VA loans bad?

The lower interest rates on VA loans are misleading. They both ended up spending a lot more interest on the life of the loan than their 15-year-old counterparts. In addition, you are more likely to get a lower interest rate on a conventional 15-year fixed rate loan than on a 15-year VA loan.

Why do sellers dislike VA loans? Before securing a mortgage, the VA wants to make sure the homes that eligible veterans buy are safe and secure, and worth their sale. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Why you shouldn’t use a VA loan?

Since you need to factor in the cost of the VA financing rate, you may end up with a problem that exceeds the market value of your home. Manufactured homes may require a minimum payment and may not be eligible for a 30-year term. You cannot use a VA loan for rental property.

What is the downside of a VA loan?

Disadvantages of a VA loan As long as you do not pay for the mortgage insurance with a VA loan, you will pay a financing fee at the end (although this rate may be financed in your default). If you take out your first VA loan and don’t make a down payment, the financing rate is equivalent to 2.3 percent of what you borrowed.

Do sellers dislike VA loans?

And the idea that sellers have to pay closing costs for VA buyers is simply false. In short, there is no reason why a seller should reject your purchase offer just because you are using a VA loan.

Is a reverse mortgage a qualified mortgage?

Advice requesting that you expressly recognize some reverse mortgages as qualified mortgages. We believe that the Agency should also create a limited class of non-FHA unsecured reverse mortgages capable of meeting the definition of “qualified residential mortgage”; under the Risk Retention Rule.

Why do you never have a reverse mortgage? The reverse mortgage procedure may not be enough to cover the property tax, home insurance premiums and home maintenance costs. Failure to keep the current one in any of these areas can cause the lenders to call the reverse mortgage due, which could result in the loss of the home.

What type of mortgage is reverse mortgage?

A reverse mortgage is a type of loan that allows homeowners 62 years of age and older, typically who have paid off their mortgage, to borrow a portion of their home equity as tax-free income. Unlike a regular mortgage in which the landlord makes payments to the lender, with a reverse mortgage, the lender pays the landlord.

Are all reverse mortgages FHA?

Yes. Most reverse mortgage loans today are Home Equity Conversion Mortgages (HECM), secured by the Federal Housing Administration (FHA), which is part of the U.S. Department of Housing and Urban Development. (HUD). …

What is a reverse mortgage also called?

In the United States, the HECM secured by FHA (home equity conversion mortgage) aka reverse mortgage, is an unsecured loan. In simple terms, lenders are not liable to repay any loan balance that exceeds the net proceeds of the sale of their home.

Is a reverse mortgage considered income?

Reverse mortgage payments are considered loan procedures and not income. The lender pays you, the loan, the loan proceeding (in a lump sum, a monthly down payment, a line of credit, or a combination of all three) while you continue to live in your home.

What is the downside to a reverse mortgage?

The disadvantage of a reverse mortgage is that you use the equity of your home while you are alive. Once passed, your heirs will receive fewer heirs. Another possible downside would be regretting taking out a reverse mortgage too early in your retirement years.

Who pays the taxes on a reverse mortgage?

No, reverse mortgage payments are not taxable. Reverse mortgage payments are considered loan procedures and not income. The lender pays you, the loan, the loan proceeding (in a lump sum, a monthly down payment, a line of credit, or a combination of all three) while you continue to live in your home.

Are reverse mortgages exempt from mortgage servicing rules?

The Office of Consumer Financial Protection (CFPB) today finalized a new rule requiring mortgage lenders to provide homeowners with some foreclosure protection. … Reverse mortgages, however, are excluded from the new rule, due to the urgency of an unnamed business group in the agency’s final rule.

What are exemptions of being a small servicer?

Small Servicers, reverse mortgage lenders, and mortgage lending servers where the lender is a qualified lender under the Farm Credit Loans Act of 1971 (“Farm Credit Loans”) are exempt from regulations for service policies and procedures; early intervention; and continuity of contact.

Does respa apply to reverse mortgages?

In particular, the TILA-RESPA rule does not apply to the HELOC, to the reverse mortgage or to the mortgage secured by a mobile home or a home that is not attached to a real estate property (i.e., a terrain). … The TILA-RESPA rule includes some new restrictions on a certain activity before receiving a Consumer Loan Estimate.