How much will a VA loan finance?

Contents

VA will guarantee up to 50 percent of a mortgage loan of up to $45,000. For loans between $45,000 and $144,000, the minimum guarantee amount is $22,500, with a maximum guarantee of up to 40 percent of the loan up to $36,000, subject to the amount of entitlement a veteran has available.

Is a VA loan based on income? The debt to income ratio determines whether you can qualify for VA loans. The acceptable debt ratio for a VA loan is 41%. Generally, the debt to income ratio refers to the percentage of your gross monthly income that goes into debt. In fact, it’s the ratio of your monthly debt obligations to your gross monthly income.

How much will a VA loan give me?

The VA guarantees up to 25% of loans over $144,000. The percentage depends on whether the borrower makes an advance. Most VA loans are obtained without an upfront payment; therefore, most VA loans are backed by 25% from the federal government. The compliance loan limit for most US counties is $417,000.

What is the maximum amount you can borrow for a VA loan?

VA loans are available up to $548,250 in most areas, but can exceed $800,000 for single-family homes in high-cost counties. Loan limits do not apply to all borrowers. The limit on your VA loan – or how much you can borrow without giving a down payment – is directly based on your entitlement.

Is a VA loan 100%?

VA Home Loans with Low Mortgage Rates VA loans allow 100% financing, never require mortgage insurance, and have flexible underwriting guidelines that make it easy for you to reach your closing on time.

Is a VA loan 100%?

VA Home Loans with Low Mortgage Rates VA loans allow 100% financing, never require mortgage insurance, and have flexible underwriting guidelines that make it easy for you to reach your closing on time.

Does a VA loan have a LTVR of 100%?

The VA cashout loan allows for a loan-to-value ratio (LTV) of up to 100 percent. This means VA homeowners can potentially enjoy the full value of their home, no matter how big it is. The cash back can be used to pay off other debts, pay for home improvements, invest in real estate, or any other purpose.

How much will VA loan approve for?

VA Loan Limits for 2021. VA loans are available up to $548,250 in most areas, but can exceed $800,000 for single-family homes in high-cost counties. … Your VA loan limit – or how much you can borrow without making a down payment – is based directly on your entitlement.

How much can you borrow with a VA loan 2021?

About VA Loan Limits The default VA loan limit is $548,250 for most US counties in 2021, an increase of $510,400 in 2020. For more expensive housing markets in the continental United States, VA loan limits reach up to $822,375 for 2021, from $765,600 in 2020.

What is the maximum loan available on a VA loan?

VA loans are available up to $548,250 in most areas, but can exceed $800,000 for single-family homes in high-cost counties. Loan limits do not apply to all borrowers. The limit on your VA loan – or how much you can borrow without giving a down payment – is directly based on your entitlement.

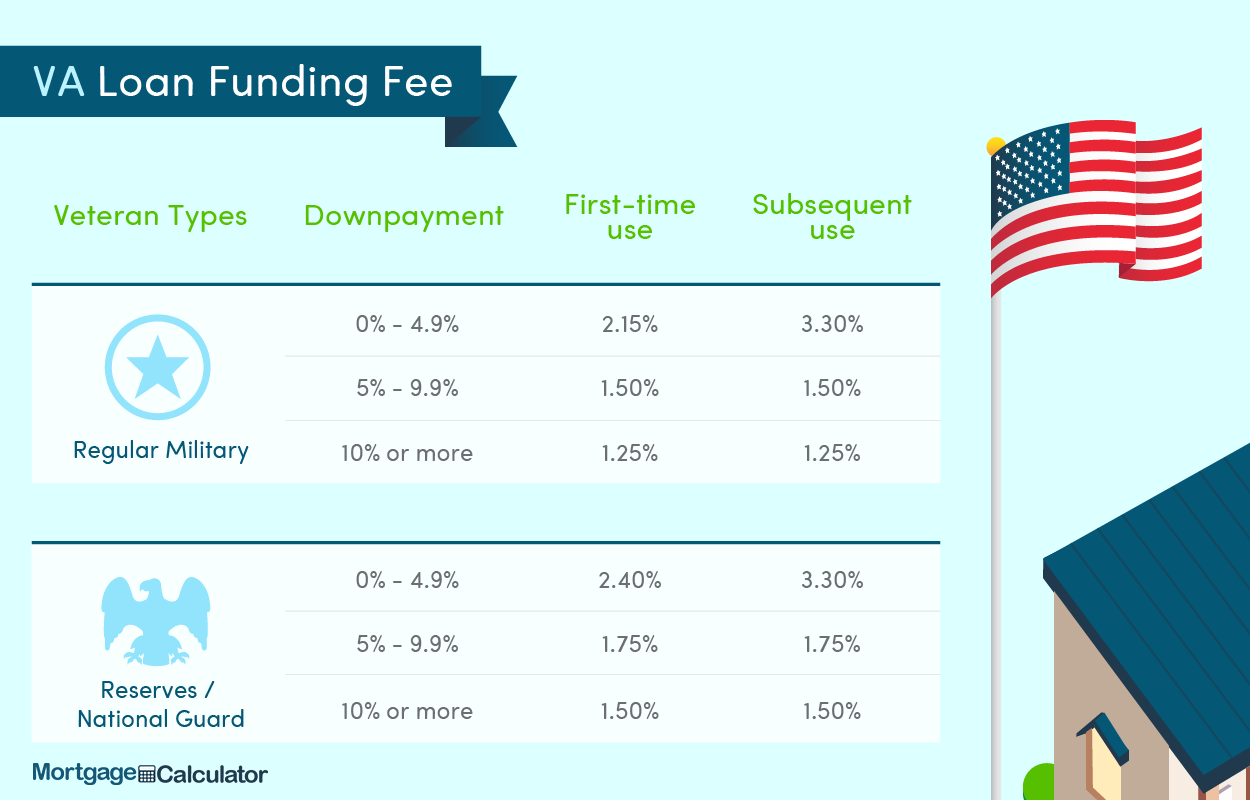

What is the VA funding fee for 2021?

VA Finance Fees in 2021 Most veterans will pay a 2.3% finance fee when purchasing a home. This is equal to $2,300 for every $100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: a no down payment mortgage loan.

Who pays closing costs on a VA loan?

When using a VA loan, the buyer, seller and lender pay different parts of the closing costs. The seller cannot pay more than 4% of the total home loan in closing expenses. However, their share of closing costs includes commissions for buyers and sellers.

What fees do sellers pay on a VA loan? In California, and across the country, these “seller leases” are generally limited to 4% of the loan amount. As it states on the VA website: “We require that a seller cannot pay more than 4% of the total home loan on the seller’s concessions.

Who pays the VA closing fee?

One of the great benefits of VA loans is that sellers can pay all of the closing costs related to the loan. Again, they are not obligated to pay any of them, so this will always be a product of negotiation between buyer and seller.

How much are VA closing costs?

How Much Are Seller’s Closing Costs in Virginia? In Virginia, closing costs typically amount to about 0.9% of the selling price of a home, not including realtor fees. With an average home value of $332,063, sellers can expect to pay around $3,083 at closing.

What does the seller pay for on a VA loan?

With VA loans, sellers can pay for some or all of the buyer’s costs. VA loans allow sellers to contribute up to 4.0% of the home’s sale price. In this example, that would be $8,000, but closing costs of $200,000 will generally not be that high.

Why do sellers not like VA loans?

Why Sellers Dislike VA Loans? Many sellers – and their real estate agents – dislike VA loans because they believe these mortgages make closing more difficult or more expensive for the seller.

Why do sellers dislike VA loans?

Before securing mortgages, the VA wants to ensure that the homes that qualified veterans buy are safe and worth the sale price. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Do sellers dislike VA loans?

VA loans come with bureaucracy, appraisal delays and fees charged by sellers rather than buyers — all reasons why offers are being rejected, agents say. Also, say real estate agents and veterans, some sellers reject offers because of misconceptions about the VA program.

How can I avoid closing costs with a VA loan?

Now, you know there are closing costs on VA loans, but what if you don’t want to or can’t bring those costs into closing? The most common way to beat closing these funds is through closing costs paid by the seller and VA sales grants. Remember that the seller is NOT obligated to pay the buyer’s closing costs.

Why do sellers hate VA loans?

VA mortgage loans also come with minimal property requirements that can end up forcing homeowners to make a lot of repairs. Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Does VA loan waive closing costs?

The VA loan allows you to include some of the closing costs in the total loan amount. … The other fees that create your closing costs cannot be incorporated into the loan. But you can receive concessions from the seller or lender to reduce the initial cash cost.

Is FHA or VA loan better?

If you are eligible, a VA loan can often be the better choice between an FHA loan and a VA loan. This is because VA loans allow borrowers to move into a home with zero down payment and no mortgage insurance. However, FHA loans can also be a great option, especially for borrowers with poor credit or low income.

What does a VA loan have that an FHA loan doesn’t have? FHA Loan vs. GO. … With an FHA loan, you cannot remove the MIP unless you refinance or pay off the mortgage. With a VA loan, there is no mortgage insurance requirement, but you will have to pay a financing fee based on the loan amount.

Why do sellers not like VA loans?

Why Sellers Dislike VA Loans? Many sellers – and their real estate agents – dislike VA loans because they believe these mortgages make closing more difficult or more expensive for the seller.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory way – seller is obligated to comply with Fair Housing Act laws.

Are VA loans a hassle for the seller?

Using a VA loan means that you will end up saving money on the purchase and over the life of the loan. However, this means that the person who sells you the house will have to spend more to sell it. If you’re worried about the seller denying your offer because you’re using a VA loan, don’t worry.

What is the major difference between a VA loan and a FHA loan?

In short, FHA mortgages are federally insured mortgages designed to help qualified borrowers buy a home with less money and credit. VA mortgages are government-insured mortgages for active or veteran military service members and their spouses.

What is a main similarity between an FHA and VA mortgage?

Loan Duration One thing the VA and FHA loans have in common is that they are both available in a variety of terms. Depending on your budget and needs, you can apply for a 30-year FHA loan or a 30-year VA loan. Mortgages are also available in terms of 15 or 10 years.

What is the difference between FHA and VA loan programs quizlet?

Do FHA and VA loans differ from conventional loans in what important respects? FHA and VA do not lend funds directly. The FHA guarantees loans and the VA guarantees loans, but the loans themselves are made by qualified and approved lenders.

Do you have to put down earnest money with a VA loan?

Technically speaking, if you are using a VA loan to buy a house, you don’t need to make a serious cash deposit. That is, the VA does not require buyers to include serious cash in an offer.

Why Sellers Dislike VA Loans? Why Sellers Dislike VA Loans? Many sellers – and their real estate agents – dislike VA loans because they believe these mortgages make closing more difficult or more expensive for the seller.

What do I do if I don’t have earnest money?

If you ask yourself, “What if I don’t have serious money?”, you have options. For example, in your offer, you can request a serious money waiver. … Although the seller is less likely to agree, they may opt to waive the serious money offer when market conditions are not in their favor.

Is earnest money required by law?

Making money isn’t always a requirement, but it can be a necessity if you’re shopping in a competitive real estate market. Sellers tend to favor these bona fide deposits because they want to ensure that the sale doesn’t fail. The money earned can act as additional insurance for both parties to the transaction.

Is earnest money required for a cash sale?

There is no law that mandates the minimum serious cash deposit in California. It is more a matter of custom and common practice. Therefore, the “standard” value may vary from one real estate market to another. … In California, a typical or average serious cash deposit can range from 1% to 3% of the purchase price.

Can you waive contingencies with a VA loan?

Only a conventional buyer (getting a conventional loan) really has the legal right to waive this contingency. That’s right…if the buyer is receiving an FHA or VA loan product, he is prohibited by the federal government from losing his serious money if he cancels due to this low valuation!

Can VA loans waive escrow?

If you’re tired of including collateral dollars in every monthly payment you make on your mortgage loan insured by the US Department of Veterans Affairs – better known as a VA loan – there’s good news: depending on the agreement you signed with your mortgage lender, you can cancel this escrow agreement.

Why do Realtors hate VA loans?

In some cases, home sellers do not accept VA mortgage-backed purchase offers for fear of the low appraised value. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Why are VA loans bad for sellers?

Sellers Must Pay Certain Fees The loan program prohibits buyers from paying certain fees at closing. Typically, this will include the loan underwriting fee and the closing fee. These fees do not go away. Instead, they become the seller’s responsibility.

What are the pros and cons of a VA loan for a seller?

Why do sellers hate VA loans?

Before securing mortgages, the VA wants to ensure that the homes that qualified veterans buy are safe and worth the sale price. … Because VA appraisals can increase your repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property in a discriminatory way – seller is obligated to comply with Fair Housing Act laws.

Why VA loans are bad for sellers?

VA loans come with bureaucracy, appraisal delays and fees charged by sellers rather than buyers — all reasons why offers are being rejected, agents say. Also, say real estate agents and veterans, some sellers reject offers because of misconceptions about the VA program.

What are the disadvantages of a VA loan?

5 Potential Disadvantages of a VA Loan

- You may have less equity in your home. …

- VA loans cannot be used to buy vacation homes or investment properties. …

- Seller resistance to VA financing. …

- Financing Fee Is Higher for Subsequent Use. …

- Not all lenders offer – or understand – VA loans.

Why you shouldn’t use a VA loan?

Since you need to factor in the cost of the VA’s financing fee, you may end up with a loan that exceeds the market value of your home. Prefab homes may require a minimum payment and may not be eligible for a 30-year term. You cannot use a VA loan for rent.

Is a VA loan bad for a seller?

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer who uses a VA loan when selling their home can be as difficult as a buyer who uses a conventional mortgage. There are many myths and misconceptions about the VA loan, but you, as the seller, should have nothing to worry about.

How does VA loan affect seller?

Using a VA loan means that you will end up saving money on the purchase and over the life of the loan. However, this means that the person who sells you the house will have to spend more to sell it. If you’re worried about the seller denying your offer because you’re using a VA loan, don’t worry.

Should a seller accept a VA loan offer?

And the idea that sellers have to pay VA buyers’ closing costs is simply false. In short, there is no reason for a seller to reject your offer to buy simply because you are using a VA loan.