Is the VA funded for 2021?

Contents

In addition, there are $ 152.7 billion (an additional $ 14.9 billion or 10.2%) in mandatory funding for 2021 for benefit plans that include Compensation and Pensions, Repair Benefits, Housing and Insurance. This budget provides ample funding for major priorities of the Secretariat.

How much VA benefits will increase in 2022? In 2022, VA payments will increase by 5.9%, the largest increase in over 40 years.

Is the VA government funded?

VA funding is provided through the budget of the Military Building, Veterans Affairs, and related agencies (MILCON-VA). … The FY2018 budget requirement of the VA President is $ 182.66 billion. Compared to the established FY2017 figure of $ 176.94 billion, this would be an increase of 3.23% (or $ 5.72 billion).

How are VA services paid for?

Veterans do not pay for VA care, but do pay for copying. Veterans do not need to pay, the monthly fee that most Americans pay for private health insurance, to get VA care. Veterans may, however, need to pay for a copy.

Is the VA a federally funded program?

The Department of Veterans Affairs (VA) is a federal government agency that provides benefits, health care and cemetery services to veterans. The President appoints the Secretary of State for Veterans Affairs, an official at the executive level, with the recommendation and approval of the Senate.

Will VA benefits increase in 2021?

| Nakasa VA% | 5.9% |

|---|---|

| Useful Date | December 1, 2021 |

| Nakasa VA% | 2.90% |

| Useful Date | December 1, 1996 |

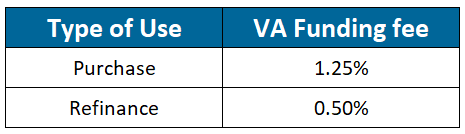

Can VA funding fee be paid by seller?

The seller may agree to pay your VA Support amount as a discount instead of adding it to your loan amount. They will also be able to pay pre-paid taxes and insurance; debt to be paid in cash; and a guarantee or judgment on the borrower.

Who pays the VA subsidy? Lenders must pay a one-time VA subsidy with VA home loan or repayment. Borrowers pay the money directly to the Veterans Affairs Department. The government is using the money raised to continue to provide housing purchases to active military members, veterans and surviving couples.

Who is exempt from paying the VA funding fee?

The VA grant is a one-time payment to the federal government to help develop the program for future generations. Veterans receiving disability benefits, military couples and Purple Heart recipients are exempt from VA subsidy payments.

Do disabled veterans pay funding fee?

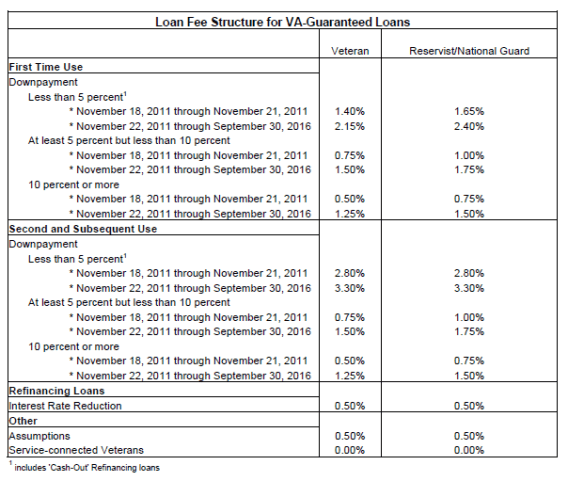

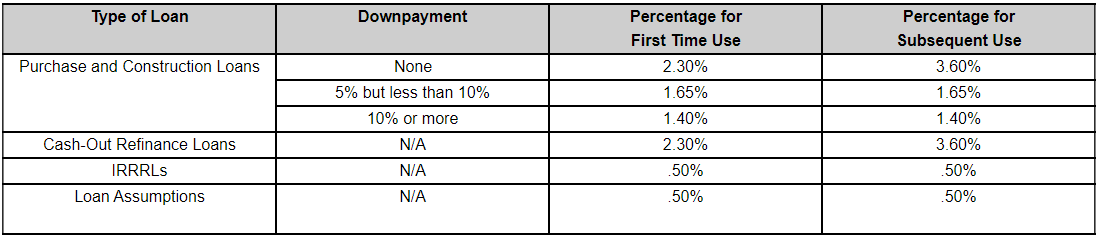

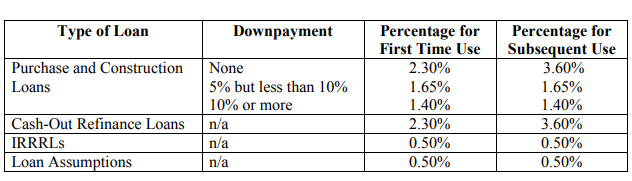

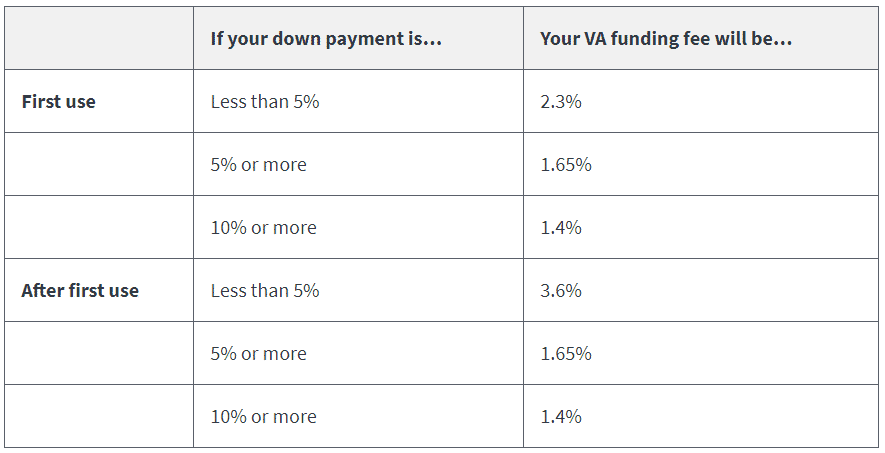

VA subsidies in 2021 Most veterans will pay a 2.3 percent subsidy when buying a home. … This one-time loan applies to the most popular type of VA mortgage: unpaid mortgage. The total amount of subsidy is as follows.

How much disability is exempt from VA funding fee?

The VA Support Fund helps cover those losses and preserves the program so future generations of military home buyers can take advantage of this amazing program. But borrowers and homeowners with disabilities at least 10 percent are exempt from paying VA subsidies.

Do sellers have to pay VA closing costs?

When using a VA loan, the buyer, seller, and lender each pay different parts of the closing price. The seller cannot pay more than 4% of the total mortgage in the closing price. … As a buyer, you must pay VA subsidy, original loan amount, discount rates, VA rate, insurance and more.

Who pays the VA closing fee?

When using a VA loan, the buyer, seller, and lender each pay different parts of the closing price. The seller cannot pay more than 4% of the total mortgage in the closing price. However, their share of closing prices includes buyers ‘and sellers’ s commissions.

Does seller pay closing costs in Virginia?

In Virginia, sellers usually pay closing fees, transfer taxes, and recording fees during closing.

What fees must the seller pay on a VA loan?

Note: We require the seller cannot pay more than 4% of the total home loan in the seller’s discount. But this rule only includes some closing costs, including VA subsidy fees. The law does not cover credit score points.

What fees are sellers required to pay on a VA loan?

In California, as well as across the country, these â â masusellers of â â are usually limited to 4% of the loan amount. As he puts it on the VA website: â œ unaWe require the seller not to be able to pay more than 4% of the mortgage on the seller discount.

Can you charge a processing fee on a VA loan?

The Department of Veterans Affairs (VA) allows lenders to charge borrowers’ original debt. It can be a lump sum or a total loan amount. Your lender can charge you only 1%, and 1% will cover the cost of processing, writing, and obtaining your loan.

Is VA funding fee the same as points?

No. VA Support Funds are entered as Debt Insurance.

What is the cost of VA 2020? As of January 1, 2020, the VA subsidy rate is 2.30% for first-time VA borrowers without interest. The interest rate increases to 3.60% for those receiving a second VA loan. The amount of interest is applied only to the amount spent on the VA loan, so the loan amount is not applied to the borrower.

How much are points on a VA loan?

The VA loan level usually pays 1% of your loan amount. As a result, the price of points varies with the size of the home loan. One point on a VA $ 200,000 loan is $ 2,000 and two points equals $ 4,000. On a $ 250,000 loan, one point will cost $ 2,500 while two points will cost $ 5,000.

How many points do you need for a VA loan?

The VA does not set minimum credit scores for VA loan eligibility, but lenders usually do. Because of this, VA mortgage interest rates vary by lender, with most lenders typically needing 620 mortgages to make a profit.

Who pays VA discount points?

Who pays the VA Loan discount? Usually the lender pays the discount, but the seller can also pay these as part of the transaction. The VA allows sellers to pay close to 4 percent of the loan amount to items such as discounts and closing prices.

What is a typical VA funding fee?

The VA subsidy is a one-time payment of 2.3% of the total amount borrowed with the VA home loan. The interest rate increases to 3.6% for borrowers who have previously used the VA loan program, but can be reduced by putting at least 5% less off.

How much is a VA funding fee 2021?

VA subsidies in 2021 Most veterans will pay a 2.3 percent subsidy when buying a home. That equates to $ 2,300 for every $ 100,000 borrowed. This one-time loan applies to the most popular type of VA mortgage: unpaid mortgage.

Is the VA funding fee worth it?

â € aneEvery first interest on a government mortgage is a real payment, â Bow Bowden said. But although VA mortgages can make buying or renovating a home a little more expensive, the benefits of a VA mortgage can often be higher than the initial price, making a VA mortgage worth considering.

Does a VA loan include points?

For each type of VA loan, the amount of the loan may include VA grant amount. There are no fees and charges or discounts that can be included in the loan amount for a regular purchase or building loan. Only the rebate can include some authorization fees and charges and discount points in the loan amount.

Is appraisal included in VA loan?

A VA rating is required for each VA purchase loan. But do not make the mistake of assessing the home, which provides a more in-depth study of the home’s physical condition. These two things are different and unlike price, you do not need to look at the house when you are buying a home.

Are there points on a VA loan?

Buying a VA â € wanda kuma kuma kuma kuma aka aka sani kuna kuna kuna kuna kuna kuna nufin kuna yana kuna kuna kuna kuna kuna kuna nufin nufin nufin kuna nufin kuna kuna kuna kuna yana yana yana yana kuna kuna kuna kuna kuna yana yana

Do veterans pay closing costs?

Do home buyers in California have to pay a closing price on a VA loan? The answer is yes. In most cases, borrowers who use the VA mortgage plan to buy a home in California must pay the closing price.

Do veterinarians pay closing fees? The VA loan repayment rate can average anywhere from 3 to 5 percent of the loan amount, but the price will vary depending on where you buy it, the lender you work with and more. But you can always ask sellers to pay a percentage, or both, of the closing price when you make a regular offer on the home.

What closing costs can a veteran not pay?

Payment Percentage 1 If your lender is charging the wrong amount, there are a number of things you can not pay, including: Borrowing or processing fees. Profits lock interest. Document preparation costs.

Can a VA buyer pay their own closing costs?

When you go to buy a home with a VA mortgage, you will usually come across costs like closing costs and other costs. How to pay for those is usually a matter of negotiation between you and the seller. But there are also fees VA does not allow the buyer to pay.

How can I avoid closing costs with a VA loan?

Now, you know there is a closing price on a VA loan, but what if you do not want to or can not bring these prices to close? The most effective way to overcome bringing these costs to a close is by paying the seller’s closing fee and VA sales. Remember, the seller is not required to pay a buyer’s closing price.

How can I avoid closing costs with a VA loan?

Now, you know there is a closing price on a VA loan, but what if you do not want to or can not bring these prices to close? The most effective way to overcome bringing these costs to a close is by paying the seller’s closing fee and VA sales. Remember, the seller is not required to pay a buyer’s closing price.

What is the average closing cost on a VA loan?

In California, VA mortgage rates are on average between 3% and 5% of the loan amount. For example, on a loan amount of $ 500,000, the total amount of debt the borrower can close could be between $ 15,000 (3%) and $ 25,000 (5%). But they can fall outside this range, at times.

Can a VA buyer pay their own closing costs?

Closing costs are always part of the mortgage calculation. But one of the major benefits of VA mortgages is that they limit what veterans and veterans can pay at the closing price. VA buyers are sometimes prevented from paying certain fees and charges. … 1 per cent fee charged by the lender.

Do spouses of 100 disabled veterans get benefits after death?

Is Veteran Disability Compensation Continued for Survivors After Death? No, veterans’ disability compensation is no longer being paid to surviving couples. However, survivors may have access to a different type of benefit called Retaliation.

How much do surviving couples get from VA disability? The average monthly DIC rate is $ 1,340 for eligible couples. Values are increased for each dependent, as well as if the surviving wife is not home or in need of assistance and attendance. The VA also adds an average benefit of $ 332 to the monthly living DIC if there are children under 18 years of age.

When my husband dies will I get his VA disability?

Surviving military couples may receive compensation for veterans’ disabilities. This benefit is called Dependency and Indemnity Compensation (DIC), and is paid monthly. DIC is available to surviving military couples (widow or widower) and dependent children.

Does my family get my VA disability if I die?

If you are a surviving wife, child, or parent of a service member who died on the job, or a survivor of a veteran who died of an injury or illness related to the service, you may be eligible for tax – VA Dependency and Indemnity Compensation (VA DIC).

Is my wife entitled to my VA disability?

Federal law makes it clear that VA disability benefits are not a marital property. This legal guide is found in the USFSPA, which excludes VA disability benefits from marital status.

Does the spouse of a deceased veterans get benefits?

Survivors and children of deceased military personnel and the elderly may receive DIC or pension benefits. … These cash benefits for survivors include self-sufficiency compensation (DIC), accumulated compensation benefits, and death pensions.

Who is entitled to VA death benefits?

You may be eligible for death benefits from the Department of Veterans Affairs (VA) if you are a survivor of: Service Member or veteran whose death is related to service. Veterans whose entire disability is related to service but whose deaths have not been reported.

How much does the widow of a 100% disabled veteran receive?

The program offers living benefits from about $ 1,280 a month to $ 2,940 a month for eligible couples, depending on the value of the veteran’s salary. There are additional fees for dependent children. Some parents of veterans who have died may also benefit if their income is low.

How much is the VA widows pension?

| Survival Pensions – Average Retirement Average (MAPR) 2019-20 | ||

|---|---|---|

| For Living Couples | every year | every month |

| Home Without Dependence | $ 11,273 | $ 939 |

| Home With One Trust | $ 14,116 | $ 1,176 |

| Help and Attendance Without Dependents | $ 14,742 | $ 1,228 |

How Much Does VA disability pay for spouse?

If you are a veteran with a disability rate of 30%, and you have a dependent spouse (no dependent parents or children), your monthly stipend will be $ 493.35 per month.

Can you use VA disability for mortgage income?

In essence, VA lenders can count disability income as effective access to mortgages, and related disabled lenders are exempt from VA subsidy payments, VA mandatory rate applies to any acquisition and repurchase loan to help cover losses and ensure the continued success of the program.

Can you raise VA disability income on a regular loan? Increase & Increase Income VA lenders can not collect taxable income while calculating the amount of your balance. The VA and lenders want to clarify looking at the rest of the mental income each month, in large part because this surplus helps ensure that veterans are fit for the financial crisis.

Can VA disability be counted as income?

Disability benefits received from the VA should not be included in your gross income. Some of the costs considered for disability benefits include: Compensation for the disabled and payment of disability pensions paid either to veterans or their relatives, … Benefits under the Disability Assistance Program you.

Is VA disability considered disposable income?

The courts therefore ruled that the benefits of the elderly were eligible as “disposable funds” which all creditors needed to repay to creditors before they could get relief from Chapter 13.

Do I have to disclose my VA disability?

9. Do I have to report an unexplained injury or illness during an interview or indicate on a job application that I have a disability? No. The ADA does not require you to state that you have any medical conditions on the job application or during an interview.

What counts as income for VA loan?

Income is the amount of money left over from all post-mortgage payments, mortgage and insurance taxes, federal and state taxes and the amount of interest and mortgages are deducted from the main monthly check.

Do VA loans require proof of income?

Application Form / Job Proof You must verify all income sources when applying for a VA mortgage, and you may need to provide proof of employment in writing or orally. Here is a list of most of the income receipts you need (depending on your financial situation).

Can income be grossed up for a VA loan?

Increased Increase & Reduction Income Reduction income is another major factor for providing VA loans. VA lenders must have a minimum amount of gross income remaining each month after paying high interest rates. … VA lenders can not collect taxable income while calculating the amount of your remaining income.

Do I have to disclose my VA disability?

9. Do I have to report an unexplained injury or illness during an interview or indicate on a job application that I have a disability? No. The ADA does not require you to state that you have any medical conditions on the job application or during an interview.

Do you have to disclose veteran status?

Exercise Ahead Explaining your military affiliation and military expertise is highly required if you plan to use the skills for career advancement. Whether you have four or 20 years of service, your support for the country is a work in progress, and you should be proud of it.

Can I be sued for my VA disability?

Generally speaking, VA disability benefits can only be redeemed if the person receiving these benefits leaves the military pension to receive VA compensation. In this case, only the amount of disability compensation paid in lieu of the salary of a retired soldier can be accumulated.