Can two married veterans combine their VA loans?

Contents

Eligible spouses may decide to use all of a spouse’s entitlement to a VA loan, divide their entitlement to a VA home loan evenly, or have one spouse use the remaining entitlement from a previous VA home loan, with the other spouse provides the remainder for the new mortgage. …

Can You Take a Joint VA Loan? A joint loan is a loan to the: Veteran and one or more Non-Veterans (no spouse), Veteran and one or more Veterans (no spouse) who do not use their entitlement, Veteran and the Veteran’s spouse who is also a Veteran, and both rights will be used; or.

How many VA loans can a Veteran get in a lifetime?

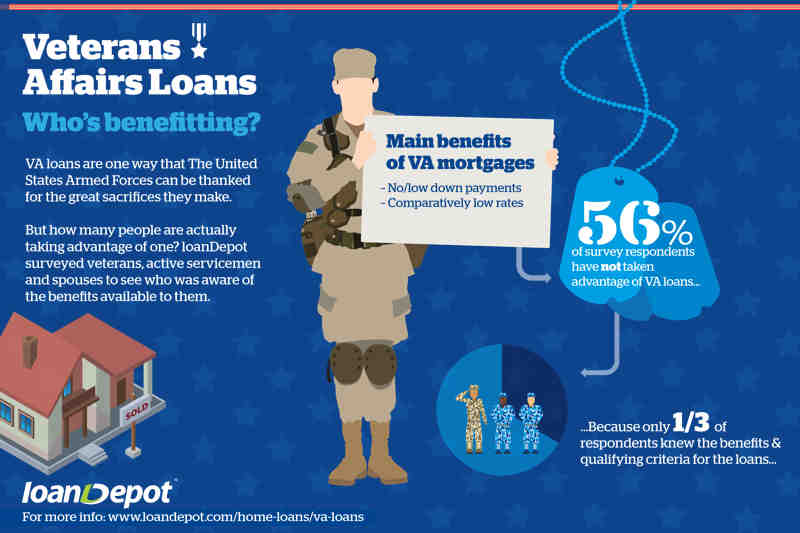

The VA home loan is a lifelong benefit for veterans, meaning there is no limit to how many times you can use a VA loan. One of the most common questions from borrowers who have purchased a home with a VA loan is whether they can use their benefits again.

Do you get VA loan for life?

The VA Loan Program provides veterans, active-duty personnel, and reservists with a benefit that can be used throughout a lifetime.

How many VA loans can a veteran have at one-time?

The VA allows veterans in some situations to have two VA loans at the same time, and eligible veterans can qualify for a VA loan even if they have defaulted in previous years.

Can 2 Veterans combine VA loans?

It is considered a joint loan if both the military borrower and the other borrower are responsible for the mortgage and jointly own the house. Active duty military, veterans, and eligible spouses can take advantage of the VA loan.

Can I put my girlfriend on my VA loan?

The VA does not expressly prohibit non-spouse co-workers. In those cases, the agency tells VA lenders that it guarantees only the eligible borrower portion of the home loan. … Does this mean you can’t get a VA loan from your fiancé or fiancé, your long-term partner, or your civilian neighbor? New.

Can there be a co borrower on a VA loan?

Applying for a VA loan with your spouse as a partner, regardless of their veteran status, is no different than with other loans. veterans. Other than a spouse, no citizens are allowed to borrow for a VA loan. In addition, the veteran you choose to be your partner must plan to live on the property with you.

Can two Veterans buy a house together?

Two VA borrowers can also buy a home together. In this scenario, the borrowers could use one entitlement, both (so-called dual entitlements), or split the entitlements as they see fit. In all three situations, no deposit is required.

Does VA allow co signer?

Yes. You may have a co-signer on a VA home loan. But this person must live in the house with you and either: (a) your spouse; or (b) a former or current member of the military.

Can a VA loan close in 30 days?

You can close in 30 days It is possible to close a VA loan in just 30 days. This makes buying a home with a VA loan just as fast as a traditional mortgage. The key to a quick close lies in making sure you have everything you need to speed things up.

Can you take out a VA loan in 2 weeks? You are at that point where you want to get approval for a VA loan or maybe you are in the process and wondering, “How quickly can a VA loan close?” The simple answer is: you can take out a VA loan in less than 2 weeks.

Do VA home loans take longer to close?

Taking out a VA loan does not take much longer on average than a conventional mortgage. However, eligibility status and VA assessment issues can significantly delay the closing of a VA loan.

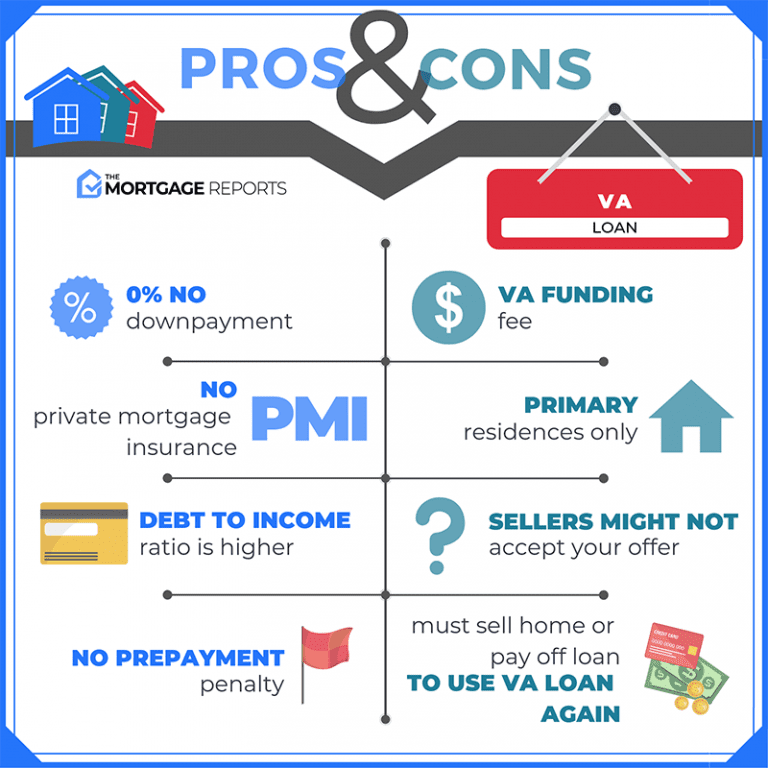

Why do Realtors hate VA loans?

In some cases, home sellers don’t accept purchase offers backed by VA-guaranteed mortgages for fear of a low appraisal value. … Because VA appraisals can increase their repair costs, sometimes home sellers refuse to accept sales offers backed by the agency’s mortgages.

How long does a VA home loan approval take?

On average, you can get a VA loan approved and closed in 30 to 45 days. Again, however, this will vary by lender and even borrower. Below are the factors that affect your approval time.

Are VA loans harder to close?

Should you be concerned? The short answer is “no†. It’s true that VA loans were once more difficult to close – but that’s ancient history. Today you probably have about the same problems with a buyer who has this type of mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

Why do Realtors hate VA loans?

Before guaranteeing mortgages, the VA wants to make sure homes that eligible veterans buy are safe and worth their sale price. … Because VA appraisals can increase their repair costs, sometimes home sellers refuse to accept sales offers backed by the agency’s mortgages.

Can a VA loan close in 20 days?

Most VA loans close in 40 to 50 days, which is standard for the mortgage industry regardless of the type of financing.

How long does it take a VA loan to close?

Most VA loans close in 40 to 50 days, which is standard for the mortgage industry regardless of the type of financing. In fact, dig a little into the numbers and you won’t find much of a difference between VA and conventional loans. Let’s look at five key factors that can affect the timeline of purchasing a VA loan.

How long does a VA loan take to approve?

On average, you can get a VA loan approved and closed in 30 to 45 days. Again, however, this will vary by lender and even borrower. Below are the factors that affect your approval time.

Can you have 2 VA loans at the same time?

Yes, you can have two VA loans at once, but VA loans must be used for main residences and have specific occupancy requirements. It is possible to have two VA loans at once for two separate main residences. … Typically you have used about $50,000 of your VA loan entitlement on that first property.

Can I have 2 VA mortgages at the same time? VA loans can only be used for principal residences and they have occupancy requirements to ensure the loan is used in this way. That said, it is possible to have two VA loans at once for two different main residences.

Can I get a VA loan if I already own a home?

If you own a home, you can still get a VA loan with your full legal guarantee if you paid off the loan for the home you own or refinanced the mortgage to a non-VA loan. … But there’s one big caveat: The house you buy with your new VA mortgage must become your primary residence.

Can I get another VA loan if I already have one?

Yes: VA benefits can be used again and again, provided you meet the conditions for reuse.

Can you get more than one VA loan in your lifetime?

Your VA mortgage benefits are a lifetime benefit. … It is certainly possible to have more than one VA loan at a time, but veterans will still have to meet the VA’s occupancy requirements.

Can you have 2 VA loans in the same city?

Essentially, the rights can be used for any amount borrowed without a limit. However, there is a limit to the amount the VA will guarantee. … The only problem is that the VA loan is for owner-occupied homes only, which means you can’t have more than one VA loan in the same city.

How long do you have to wait between VA loans?

It really only refers to how old your current loan is. Under the new law, if you want to refinance into a VA loan or move from one VA loan to another, there is now a minimum waiting period of 210 days, measured from the day you make your first payment on your existing loan until the closing date of your new one.

Can I get a VA loan if I already have one?

The good news is, yes, you can still get a VA home loan if you’re an eligible service member, veteran, or other qualified borrower. …Buy a home with a VA loan, sell it, then buy another home with a new VA loan. Refinance from one VA loan to another.

Does the 90 day flip rule apply to VA loans?

The VA allows a property to be turned over within 90 days of ownership by an investor/owner. But again, the VA allows the lender to add additional tiers to the requirements. … -If the seller has not put 20% on the title, some lenders will not make the loan.

Can I use my VA loan a second time?

One of the most common questions from borrowers who have purchased a home with a VA loan is whether they can use their benefits again. Fortunately, there is no limit to the number of times a Veteran can use the loaner program.

Can You Use Your VA Loan Twice? VA loans are not a one-time payment; you can use them multiple times as long as you meet the eligibility requirements. You can even have multiple VA loans at once.

How many times can you reuse VA loan?

The bottom line: No restrictions on using VA loans, but understand your right. The main takeaway is that as long as you qualify and can qualify with a lender, there is no limit to how many times you can take out a VA loan in your lifetime.

Can you use a VA mortgage loan more than once?

Reusing your VA loan benefits is certainly possible. … There is also no cap on how many times you can use a VA loan, so many veterans have the option of getting a second VA loan.

Can you buy two houses with a VA loan?

The bottom line: Yes, you can buy two houses with a VA loan. As such, buying a home with a VA loan to turn it into a second home or investment property is allowed, but you can remodel the property after living there. You can also earn rental income by living in one unit and renting out the other.

Does the VA check occupancy?

The short answer is yes. The VA’s official site reminds borrowers: “The lender may accept the occupancy certification at face value unless there is specific information indicating that the veteran will not occupy the property as a home or does not intend to within a reasonable time after to inhabit the closing of the loan.”

How Long Should You Occupy a VA Loan Home Before Renting? Most VA home loan agreements require you to occupy the home for a minimum of 12 months. At the end of those 12 months, you can probably rent out the house to a tenant, even if they aren’t in the military.

What is the VA occupancy requirement?

Veterans and active-duty personnel taking out a VA loan must certify that they intend to personally occupy the property as their primary residence. Essentially, home buyers have 60 days, which the VA considers a “reasonable time” to move into the home after the loan is closed.

Who can live in a VA loan home?

The VA’s Occupancy Rules Basically, anyone receiving the loan must live in the house, excluding renting out the property, using the building solely for work purposes, or allowing friends or ineligible relatives to live there. Occupancy must also be met within a ‘reasonable time’, meaning 60 days in most cases.

Does the VA check occupancy?

The short answer is yes. The VA’s official site reminds borrowers: “The lender may accept the occupancy certification for face value unless there is specific information indicating that the veteran will not occupy the property as a home or does not intend to use it within a reasonable period of time.” time after the closing of the loan. â€

What does a VA inspector look for?

VA appraisers look at the interior and exterior of the property and assess its overall condition. They will also recommend any obvious repairs needed to keep the home compliant with MPRs. Please note that this is not a home inspection and the VA does not guarantee that the home is free from defects.

Are VA home Inspectors picky?

Agents say the appraisers sometimes fail to meet VA guidelines that say appraisals must be completed within 14 days in Washington state. VA home inspectors can also be overly picky, they say.

Is it hard to pass a VA home inspection?

VA assessment guidelines can be strict and can put fixers out of the fray. Many of the guidelines can be frustrating for military buyers considering renovating older homes. If a property does not meet the MPRs, the buyer must decide how to proceed.

Do you have to occupy a VA loan home?

VA loans require you to occupy the property within 60 days of closing. Anything beyond being considered a rental property and the new VA loan can be invoked and foreclosed. VA lenders understand that sometimes active duty employees don’t sit for long.

How hard is it to get approved for a second mortgage?

To be approved for a second mortgage, you will likely need a credit score of at least 620, although the requirements for individual lenders may be higher. In addition, keep in mind that higher scores correlate with better rates. You will also likely need to have a debt-to-income ratio (DTI) below 43%.

How long does it take to get a second mortgage? In short, expect the mortgage process to take an average of 30-45 days, depending on the lender, borrower and loan. Some disruptors are trying to shorten that timeline, but expect 4-6 weeks or more for now. And remember, the more on the ball you are, the faster the process can go.

Is it hard to get approved for a second house?

To qualify for a conventional second home loan, you typically need to meet higher credit score standards of 725 or even 750, depending on the lender. Your monthly debt-to-income ratio should be strong, especially if you’re trying to limit your down payment to 20%.

How much deposit do I need to buy a second home?

When you apply for one, potential lenders weigh how much you’re already paying for your existing mortgage to make sure you can afford another mortgage. Mortgage rates for a second home can sometimes be higher, and most lenders require a down payment of at least 15% of the property’s value.

Is it easier to qualify for a second home?

Since second home mortgages are typically easier to qualify than investment property mortgages and have a lower interest rate, it is important that you carefully evaluate all the criteria needed to meet them.

What credit score do you need to buy a second home?

Lenders will examine your credit score to make sure it meets their standards, which vary. Fannie Mae has set the minimum credit score of 640 for a second home as long as there is a down payment of 25% or more, which is higher than the minimum of 620 for a primary home. Debt-to-income ratio.

Is it harder to buy a second home?

The good news is that the mortgage interest on purchase loans is lower than on refinancing loans. … Some banks require larger down payments and higher minimum credit scores for second home mortgages, meaning they are slightly more difficult to obtain than a primary home mortgage.

How much deposit do I need to buy a second home?

When you apply for one, potential lenders weigh how much you’re already paying for your existing mortgage to make sure you can afford another mortgage. Mortgage rates for a second home can sometimes be higher, and most lenders require a down payment of at least 15% of the property’s value.