Is the VA collecting debts?

Contents

All debt collection by the VA has been suspended since April 6, 2020, as a result of an executive order from that then President Donald Trump. President Joe Biden extended that suspension until September 30, 2021. … However, the moratorium on debt collection and exemption of medical care copayments has expired.

How long do you have to pay back VA debts? To request a plan, you will need to submit the following 2 items: Financial Status Report (Form VA 5655). If you request a plan that will repay your entire debt balance within 5 years, you do not need to submit this form at this time.

How do I fight the VA debt?

You can request a waiver if you cannot repay your entire debt balance even with smaller monthly payments over time. We may waive some or all of your VA debt. If we grant your waiver request, you will not have to repay what we agree to waive.

How can I get rid of my VA debt?

Contact VA Debt Management Center To Resolve Your Debt You can reach VA Debt Management Center during normal business hours by calling 1-800-827-0648. International callers should call the VA Debt Management Center at 1-612-713-6415.

Does the VA offer debt relief?

COVID-19 debt relief options for VA benefit debt include: Repayment plan. You may request a repayment plan. This will allow you to repay the debt in smaller monthly amounts over time.

Is VA disability protected from garnishment?

In general, VA disability benefits can only be enhanced if the person in receipt of those benefits waives military retirement pay to receive the VA compensation. In this case, only the amount of disability compensation paid in lieu of military retirement pay can be decorated.

Are VA disability benefits protected?

No, not all 100 percent VA disability ratings are automatically protected. While some ratings are 100 percent protected in some cases, not all ratings are 100 percent protected.

Is VA disability considered income?

Disability benefits you receive from the Department of Veterans Affairs (VA) are not taxable. You do not have to include them as income on your tax return. … disability compensation and disability pension payments paid to veterans or their families. grants for homes designed for wheelchair living.

What happens if you owe the VA money?

The official VA website states, “When you choose to receive benefits under another program, the debt will be repaid from your last payment under your current benefits program, up to the full amount of your last payment.”

How do I repay my VA overpayment?

Go to Pay.va.gov to pay by credit or debit card ONLY from your bank account (also known as direct payment). Please pay each debt separately. Are you paying off the full balance of the debt or do you receive monthly VA benefit payments? Call us at 800-827-0648 (or 1-612-713-6415 from overseas) before making a payment.

Does VA forgive debt?

A waiver means that we agree to forgive a VA (or â € œwaiveâ €) debt. You can request a waiver if you cannot repay your entire debt balance even with smaller monthly payments over time. … If we grant your waiver request, you will not have to repay what we agree to waive.

Can the VA take money from my bank account?

Debt collectors generally cannot take your Social Security or VA benefits directly from your bank account or prepaid card. After your debt collector has legalized you for the debt and obtained a judgment, it may obtain a court order for your bank or credit union to transfer money from your prepaid account or card.

What if I owe the VA money? The VA may withhold future benefits or send it to a collection agency. The VA can garnish wages or file a suit in federal court. They are able to withhold approval for a VA home loan. If you receive Social Security benefits, the VA may also withhold these.

What is a VA overpayment?

A VA overpayment is when a Veteran receives more VA benefits than he or she is entitled to and therefore has to repay that extra money to the Department of Veteran Affairs. This can often happen if a Veteran is delayed in submitting paperwork or forgets to update records.

Will the VA forgive debt?

A waiver means that we agree to forgive a VA (or â € œwaiveâ €) debt. You can request a waiver if you cannot repay your entire debt balance even with smaller monthly payments over time. … If we grant your waiver request, you will not have to repay what we agree to waive.

What happens if the VA overpaid you?

If you have been overpaid or thought you were overpaid by the VA, you have sixty days to respond to the Debt Management Letter. After 60 days, the debt is sent to the VA’s Debt Management Center and the veteran is notified of how the VA intends to collect the debt.

How do I fight the VA debt?

You can request a waiver if you cannot repay your entire debt balance even with smaller monthly payments over time. We may waive some or all of your VA debt. If we grant your waiver request, you will not have to repay what we agree to waive.

What is a VA hardship?

What is VA financial hardship? “Financial hardship” means speeding up your VA disability claim which means that you, the veteran, cannot earn enough income to cover essential expenses such as housing payments or medical expenses related to your disability.

Does the VA offer debt relief?

COVID-19 debt relief options for VA benefit debt include: Repayment plan. You may request a repayment plan. This will allow you to repay the debt in smaller monthly amounts over time.

Can your VA benefits be garnished?

In general, VA disability benefits can only be enhanced if the person in receipt of those benefits waives military retirement pay to receive the VA compensation. In this case, only the amount of disability compensation paid in lieu of military retirement pay can be decorated.

Can VA disability be garnished by the IRS?

By law, the IRS cannot levy VA disability benefits or any government checks you receive as public assistance (i.e. VA pension).

Can your VA benefits be taken away?

The United States Department of Veterans Affairs (VA) may deduct your disability rating if it determines that you have obtained your rating fraudulently, or if it determines that it has made a “clear and insurmountable error” in issuing your rating.

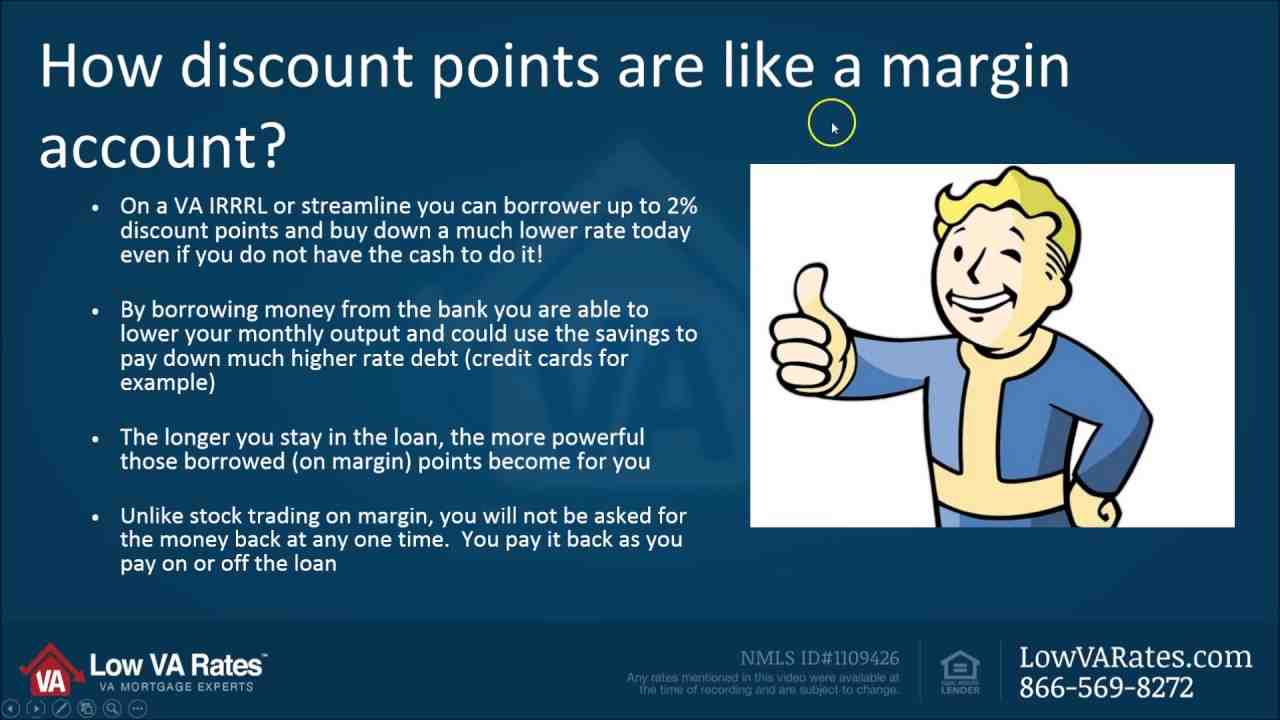

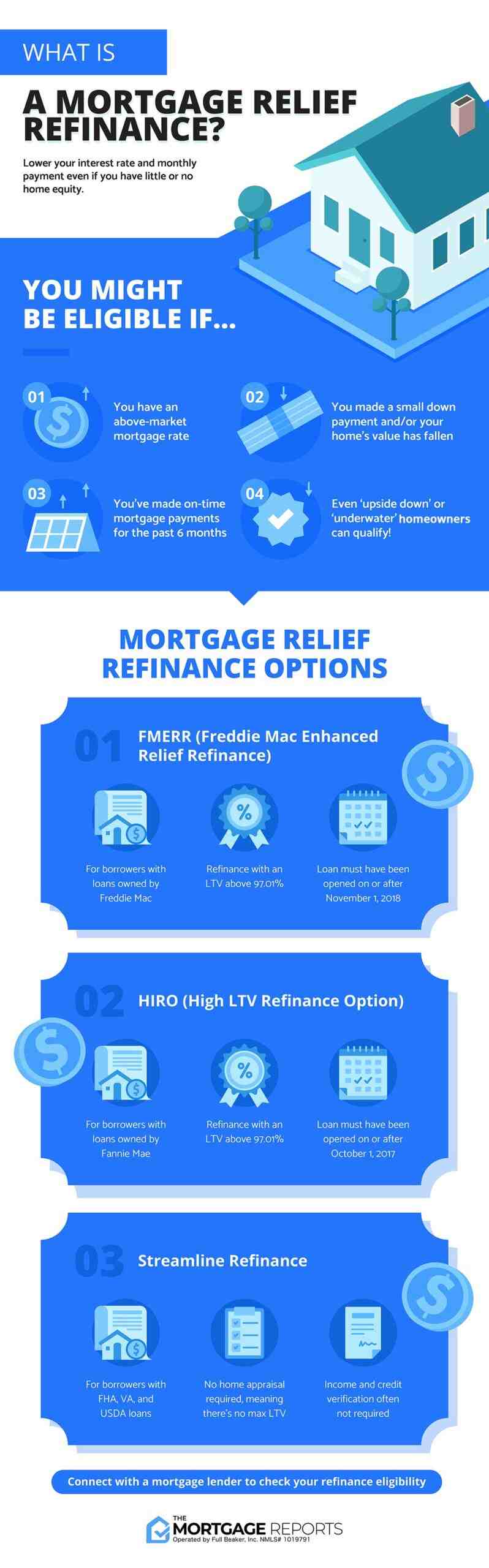

What is the VA cash out program?

What is VA Cash Refinancing? Simply put, VA cash refinancing allows veterans, active-duty servants, members of the Reserve and National Guard, and surviving spouses who qualify for a loan for up to 100% of their country’s assessed value.

How do you know if you owe the VA money?

Check the debt status of VA disability compensation, non-service pension, or educational benefits …. Ask for help

- Call us at 800-827-0648 (or 1-612-713-6415 from overseas). …

- Contact us online through Ask VA.

- Contact us by post at:

What do you mean? Be obliged to pay an amount (.). 2 intr to be in debt.

What does it mean you owe me?

1a (1): be obliged to pay or refund what has been received: be owed the sum of $ 5 due to me. (2): being obligated to render (something, as a duty or a service), I am in favor of you.

What does it mean if I say you owe me to someone?

You use this phrase to indicate that you are doing something nice for someone who needs to be “paid back” later. It’s only part of the sentence. …

What is the meaning of you owe me?

You owe it to me, it means that the listener is the one who owes or has to give something to the speaker.

What does it mean if I say you owe me to someone?

You use this phrase to indicate that you are doing something nice for someone who needs to be “paid back” later. It’s only part of the sentence. …

What is the meaning of you owe me?

You owe it to me, it means that the listener is the one who owes or has to give something to the speaker.

What does it mean to owe it to someone?

It is defined as: being obligated (someone to do something) We are obliged to build the memorial veterans.

Can I still use my GI Bill if I owe the VA money?

Assistance can be given back to veterans who owe money to the department – including advances under the Post-9/11 GI Bill claiming repayment, as well as debt incurred from other Veterans Business benefits programs for housing and medical expenses – to repay the money owed to them.

Do you have to pay back a GI Bill? Normally if you drop a class you will have to pay back any GI money you received for that class to the VA. This includes your payment and fee payment (although it was paid to the school – not you), your Monthly Housing Allowance, your book stipend, and any start – up or college money you received.

Can you get a VA loan if you owe the VA money?

The VA allows those who owe money to the agency to make a compromise offer. Like the payment waiver option, you need to contact the VA Debt Management Center to apply with the following required documents: … In the letter, explain how much you want to pay and how. Financial Status Report.

What happens if you owe the VA money?

The official VA website states, “When you choose to receive benefits under another program, the debt will be repaid from your last payment under your current benefits program, up to the full amount of your last payment.”

Will the VA forgive debt?

A waiver means that we agree to forgive a VA (or â € œwaiveâ €) debt. You can request a waiver if you cannot repay your entire debt balance even with smaller monthly payments over time. … If we grant your waiver request, you will not have to repay what we agree to waive.

Will the VA forgive debt?

A waiver means that we agree to forgive a VA (or â € œwaiveâ €) debt. You can request a waiver if you cannot repay your entire debt balance even with smaller monthly payments over time. … If we grant your waiver request, you will not have to repay what we agree to waive.

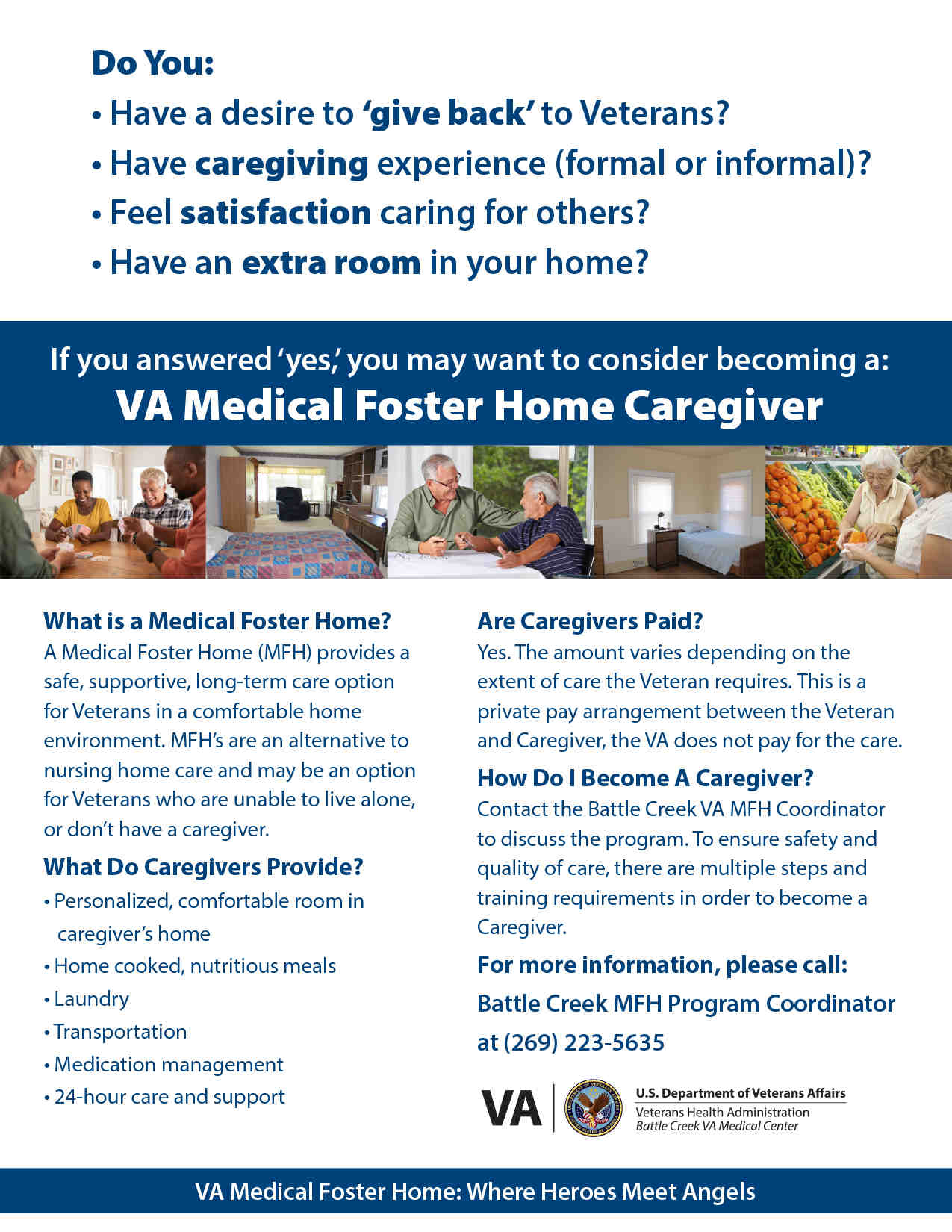

Can the VA help veterans with debt?

VA Personal Loan Options for Veterans Unsecured loans of up to $ 40,000 are available with interest rates ranging from as low as 4.99% to 36%, depending on your credit history. Military spouses and military dependents are also eligible for financial assistance.

What happens if you owe the VA money?

The official VA website states, “When you choose to receive benefits under another program, the debt will be repaid from your last payment under your current benefits program, up to the full amount of your last payment.”

Are VA benefits paid for life?

VA disability is not usually lifelong. … With this designation, you will receive lifetime VA disability benefits (absent if fraud is detected). VA reserves permanent and complete disability for the most severe cases. Most recipients of VA disabilities can expect periodic revisions.

How long are VA benefits paid? If your decision notice shows a disability rating of at least 10%, you will receive your first payment within 15 days. We will pay you by direct deposit or by check. If you do not receive payment after 15 days, call the Veterans helpline at 800-827-1000, Monday to Friday, 8:00 to 9:00. ET.

Do veterans get paid for life?

The VA Pension program is a benefit for Veterans paid to wartime Veterans with limited or no income, aged 65 or over, or, under 65, with a permanent and total disability, or, a patient in a nursing home, or, in receipt of Social Security disability payments.