How does a VA loan work for the seller?

Contents

What does this mean? Using a VA loan means you end up saving both money on the purchase and the life of the loan. However, it means that the seller of the house will spend money to sell the house to you. If you are worried that the seller has rejected your offer because you are using a VA loan, do not be.

Is the VA loan good for the seller? Are VA loans good for buyers? Not necessarily. Receiving an offer from a buyer using a VA loan when selling your home can be as difficult as a buyer using a traditional mortgage. There are many myths and misunderstandings about VA mortgages, but you as a seller should not worry.

Are VA loans hard for sellers?

The short answer is œ…. € € € € V V V V V V V V V V V V V V V V V V V V V V V V V V V V Today, you can have almost the same issues with a buyer who has the same mortgage as any other. And VA liberal guidelines may be the only reason your buyer can buy your home.

Why do sellers not want VA loans?

The VA mortgage also comes with a minimum of asset requirements that could end up forcing home sellers to make multiple adjustments. Because VA assessments can increase their repair costs, home sellers sometimes refuse to accept a mortgage-sponsored purchase offer.

What fees do sellers pay on a VA loan?

Note: We require the seller cannot pay more than 4% of the total home loan in the seller’s discount. But this rule only includes some closing costs, including VA subsidy fees. The law does not cover credit score points.

How much does a VA loan cost the seller?

When using a VA loan, the buyer, seller, and lender each pay different parts of the closing price. The seller cannot pay more than 4% of the total mortgage in the closing price. However, their share of closing prices includes buyers ‘and sellers’ s commissions.

Why VA loans are bad for sellers?

Why do sellers not like VA loans? Many sellers and their homeowners do not like VA mortgages because they believe these mortgages make it harder to close or more expensive for the seller.

Does the seller have to pay closing costs on a VA loan?

One of the major benefits of VA mortgages is that sellers can pay all of your closing costs. In addition, they do not have to pay for any of them, so this will always be a model of negotiation between the buyer and the seller.

Why do sellers hate VA loans?

Before issuing a mortgage guarantee, the VA wants to make sure the homes bought by veterans are safe and secure and worth their sale price. … Because VA assessments can increase the cost of their repairs, home sellers sometimes refuse to accept a purchase offer that is backed by a mortgage.

Why VA loans are bad for sellers?

VA loans come with red tape, slow assessments and fees paid by buyers instead of buyers – all the reasons given are rejected, the representatives said. In addition, real estate agents and veterans say some vendors have rejected the offer due to misunderstandings about the VA program.

Can sellers discriminate against a VA loan?

No VA-approved lender can discriminate against a buyer. … No seller can refuse to offer property on the basis of discriminationâ € the seller is required to comply with the Housing Rules.

What does the seller have to pay for a VA loan?

In California, as well as across the country, these â â masusellers of â â are usually limited to 4% of the loan amount. As he puts it on the VA website: â œ unaWe require the seller not to be able to pay more than 4% of the mortgage on the seller discount. … The law does not cover loans.â €

Do sellers have to pay a closing price on a VA loan? When using a VA loan, the buyer, seller, and lender each pay different parts of the closing price. The seller cannot pay more than 4% of the total mortgage in the closing price. However, their share of closing prices includes buyers ‘and sellers’ s commissions.

What is the seller required to pay on a VA loan?

The seller’s agreement is when the VA buyer asks the seller to pay the price associated with the VA Loan on behalf of the buyer. The VA gives permission to the seller, but requires the seller’s permission not to exceed 4% of the loan amount.

How much can seller pay for VA closing costs?

The seller can contribute up to 4% of the sale price, with a reasonable and standard interest rate on the VA home loan. The total contribution may exceed 4% because the standard closing price does not count towards the total.

Does the seller have to pay closing costs on a VA loan?

One of the major benefits of VA mortgages is that sellers can pay all of your closing costs. In addition, they do not have to pay for any of them, so this will always be a model of negotiation between the buyer and the seller.

How much can seller pay for VA closing costs?

The seller can contribute up to 4% of the sale price, with a reasonable and standard interest rate on the VA home loan. The total contribution may exceed 4% because the standard closing price does not count towards the total.

Who pays the VA closing fee?

One of the major benefits of VA mortgages is that sellers can pay all of your closing costs. In addition, they do not have to pay for any of them, so this will always be a model of negotiation between the buyer and the seller.

What is the average closing cost on a VA loan?

How much does it cost to close a VA mortgage? The cost of closing a VA loan is usually 1-5% of the loan amount. So for a $ 200,000 mortgage, the closing price could be anywhere from $ 2,000 to $ 10,000.

Why VA loans are bad for sellers?

VA loans come with red tape, slow assessments and fees paid by buyers instead of buyers – all the reasons given are rejected, the representatives said. In addition, real estate agents and veterans say some vendors have rejected the offer due to misunderstandings about the VA program.

What kind of loan should you avoid?

You will have the option of choosing from several types of loans to help you overcome your financial hardship; however, there are several types of loans that should be avoided at all costs. In this section, we have defined payday loans and future cash loans as two major loans that should be avoided.

Is a VA loan really worth it?

The VA mortgage offers better terms and interest rates than other home loans. 100% â € yawan Usually, no payment is required for a VA loan, as long as the sale price does not exceed the estimated value. … There is no penalty for early payment.

How does a VA loan work when selling a house?

Using a VA loan means you end up saving both money on the purchase and the life of the loan. However, it means that the seller of the house will spend money to sell the house to you. If you are worried that the seller has rejected your offer because you are using a VA loan, do not be.

Is there a Viager in the UK? The French viger system is similar to the release of a British private equity fund without a bank or insurance company paying the transaction fees. It is a limited liability contract which includes the seller (s) of the seller (s) sending the card to the buyer in exchange for a bouquet and monthly payment (rent) until death.

What does Viager mean in English?

“viager” is a real estate transaction, which is popular in France, where the buyer pays a rent and then a series of payments for the duration of the seller’s lifetime.

What is a life annuity sale?

The sale of the year of life consists of the sale of the land by the landlord (payer) to the buyer (known as the lender) who will pay the price by year. … The buyer pays compensation to the seller until he dies.

What does Viager Libre mean?

The main type of viager agreement is œ œ viager libreâ €. In this case the seller agrees to leave the house immediately after the sale is completed but he still has the right to pay, called rent, from the buyer. Property prices are usually higher for a viager freedom contract.

What is a life annuity sale?

The sale of the year of life consists of the sale of the land by the landlord (payer) to the buyer (known as the lender) who will pay the price by year. … The buyer pays compensation to the seller until he dies.

How does a viager work?

The viger system is the purchase of a land asset paid to the seller, called an annuitant, bouquet and annuities. correspond to a fraction of the total price paid in cash. is the amount of money that the buyer will pay regularly in addition to the bouquet over the life of the seller.

What is a Viager contract?

Viger is a foreclosure contractor (â € ré ré ré ré di di di di € € alamun alamun alamun alamun nu nu bi bi bi bi bi tare tare tare tare tare tare tare tare tare don bi bi bi bi bi bi bi bi bi bi bi bi bi bi bi bi bi bi bi don don don don don don don don don to remain in the property until they are gone.

What is a life annuity property in France?

What is the cost of living? The sale of the year of life consists of the sale of the land by the landlord (payer) to the buyer (known as the lender) who will pay the price by year. This amount is known as the “living cost” because it will end overnight on the payer’s death.

What does viager Libre mean?

The main type of viager agreement is œ œ viager libreâ €. In this case the seller agrees to leave the house immediately after the sale is completed but he still has the right to pay, called rent, from the buyer. Property prices are usually higher for a viager freedom contract.

Can a seller refuse a VA loan?

And the idea that buyers have to pay closing prices for VA buyers is not true. In short, there is no reason why a seller should refuse to buy you just because you are using a VA loan.

Do sellers prefer VA or conventional mortgages? Some agents advise home sellers to take a regular loan or cash offer, even if they are less than a VA offer, because these options are seen as less difficult than a VA loan. … â € naOptional offer on the VA offer is not considered discriminatory.â €

Can a seller turn down a VA loan?

Before issuing a mortgage guarantee, the VA wants to make sure the homes bought by veterans are safe and secure and worth their sale price. … Because VA assessments can increase the cost of their repairs, home sellers sometimes refuse to accept a purchase offer that is backed by a mortgage.

Why do Realtors hate VA loans?

Before issuing a mortgage guarantee, the VA wants to make sure the homes bought by veterans are safe and secure and worth their sale price. … Because VA assessments can increase the cost of their repairs, home sellers sometimes refuse to accept a purchase offer that is backed by a mortgage.

What are the disadvantages of a VA loan?

5 Possible VA Loan Problems

- You Can Have A Lack Of Equality In Your Home. …

- VA loans cannot be used to buy Holidays or Investment Assets. …

- Resistance Dealer for VA Financing. …

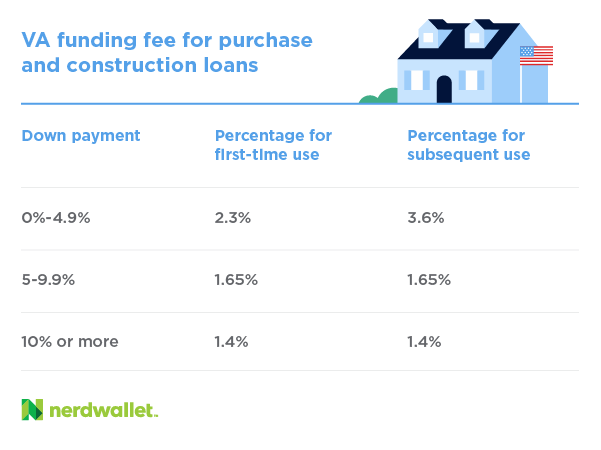

- The subsidy is larger for future use. …

- Not All Lenders Offer – or Understand – VA Loans.

Why don’t people want to get a VA loan? VA loans come with red tape, slow assessments and fees paid by buyers instead of buyers – all the reasons given are rejected, the representatives said. In addition, real estate agents and veterans say some vendors have rejected the offer due to misunderstandings about the VA program.

What is a drawback of a VA loan?

VA bankruptcy While you will not have to pay mortgage insurance with the VA mortgage, you will have to pay a down payment (although the loan amount may be included in your mortgage). If you receive your first VA loan and do not pay it back, the subsidy equals 2.3 percent of what you borrowed.

What fees does the seller pay on a VA loan?

Note: We require the seller cannot pay more than 4% of the total home loan in the seller’s discount. But this rule only includes some closing costs, including VA subsidy fees. The law does not cover credit score points.

Why you shouldn’t use a VA loan?

Since you need to calculate the VA grant amount, you may eventually end up with a loan that exceeds your home market value. Manufactured homes may require a minimum payment and may not qualify for a 30-year warranty. You cannot use a VA loan for rental properties.

Do sellers dislike VA loans?

The VA mortgage also comes with a minimum of asset requirements that could end up forcing home sellers to make multiple adjustments. Because VA assessments can increase their repair costs, home sellers sometimes refuse to accept a mortgage-sponsored purchase offer.

Why do sellers dislike VA loans?

Many sellers and their homeowners do not like VA mortgages because they believe these mortgages make it harder to close or more expensive for the seller.