What would cause an underwriter to deny a VA loan?

Contents

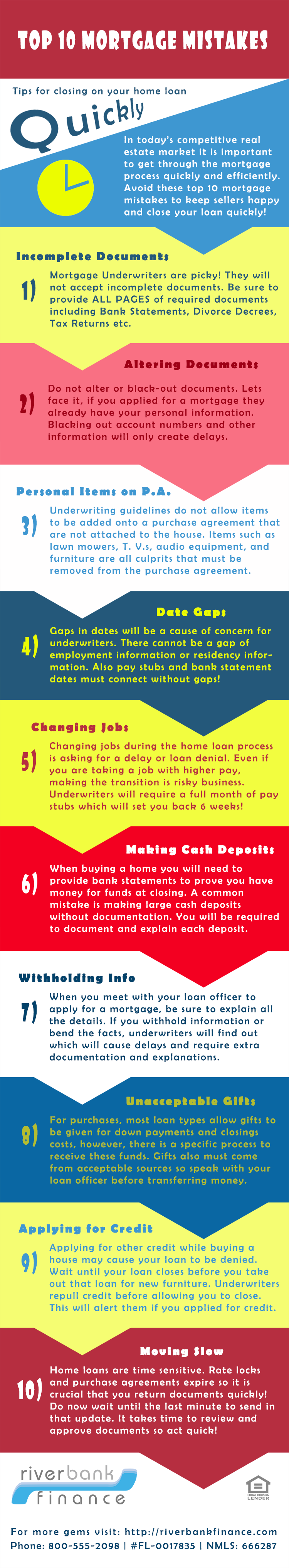

Application Errors Application errors are the main cause of VA loan rejection. That is why before sending the documents, you need to double check them to ensure their accuracy. Underwriters are perfectionists when it comes to accuracy and it is wise to eliminate all mistakes.

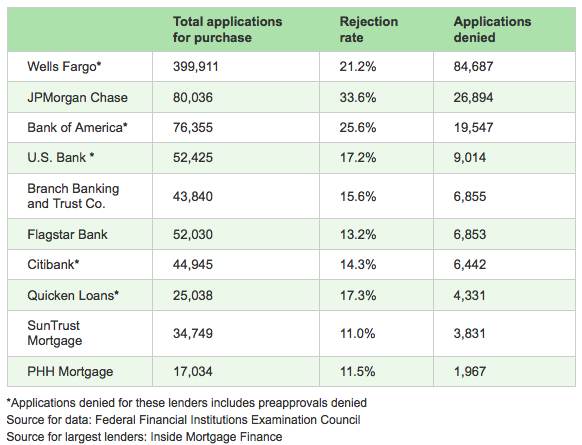

Can a VA loan be denied underwriting? How often do underwriters deny VA loans? About 15% of VA loan applications are rejected, so if yours doesn’t get approved, you’re not alone. If you are denied during the automated subscription phase, you may be able to request approval through manual subscription.

What will cause VA loan to get disapproved?

If your VA loan application was rejected, it could be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income was too low. If so, look for ways to increase your income if possible.

What disqualifies you from a VA loan?

Dishonorable Discharge Veteran status requires service members to be discharged or released from the military under conditions other than dishonorable ones. A veteran on dishonorable leave will not be able to participate in the VA Loan Guaranty program.

Why would a VA home loan be denied?

The most common reason VA home loan applications are rejected is due to errors on the application itself. Lenders cannot issue loans unless they are sure that your personal and financial details are correct. Before submitting your application, take the time to review each statement you make and the numbers you enter.

Why would an underwriter not approve a loan?

Your loan is never fully approved until the underwriter confirms that you are able to repay the loan. … Some of these problems that may arise and your subscription is denied are insufficient cash reserves, a low credit score, or high debt ratios.

Why would an underwriter deny a loan?

Both early and late reasons for denying a mortgage loan can include declining credit scores, property problems, fraud, job loss or change, undeclared debt, and more.

What do loan underwriters look at to approve?

Let’s discuss what underwriters look for in the loan approval process. When considering your application, they take into consideration a variety of factors, including your credit history, income, and any outstanding debts. This important step in the process focuses on the three Cs of underwriting: credit, capacity and collateral.

Why would a VA home loan be denied?

The most common reason VA home loan applications are rejected is due to errors on the application itself. Lenders cannot issue loans unless they are sure that your personal and financial details are correct. Before submitting your application, take the time to review each statement you make and the numbers you enter.

Why Was I Denied A VA Home Loan? If your VA loan application was rejected, it could be because your income levels are too low. The best thing you can do is ask your lender for clarification. They will be able to tell you if your income was too low. If so, look for ways to increase your income if possible.

What will cause VA loan to get disapproved?

5 Things That Can Hinder Your VA Loan

- Application errors. Double-check the loan documents. …

- Change of occupation. Keep your employment consistent throughout the loan process. …

- Change in credit. …

- Delays of the borrower. …

- Factors beyond your control.

Can a VA loan be rejected?

When lenders turn down a loan, they do so reluctantly. VA lenders make money by approving loans, not denying them, so they’ll do what they can to get your approval. When they can’t, they’ll send out what’s called an adverse action alert. … You must first find out exactly why your loan was denied.

What disqualifies you from a VA loan?

Dishonorable Discharge Veteran status requires service members to be discharged or released from the military under conditions other than dishonorable ones. A veteran on dishonorable leave will not be able to participate in the VA Loan Guaranty program.

Why would a house not be VA approved?

Insufficient Heating Homes that do not have adequate heating systems will never pass the VA rating. For a home to be approved, there must be an efficient and acceptable source of heat that can provide residents with a comfortable living condition.

Can I get a VA home loan with a 550 credit score?

The short answer is yes, it is possible to get a VA loan with bad credit. For VA loans, borrowers often need a FICO score of at least 620, but the VA does not impose a minimum credit score requirement, and some lenders may be willing to go below that limit.

Can you get a VA home loan with a credit score of 500? Most mortgage companies state that you must have at least a 620-660 credit score and high income to qualify for a VA loan. … You can get a VA loan with a credit score of 500.

What is the lowest credit score you can have for a VA loan?

Generally, lenders will require minimum credit scores of 580 to 620 to be eligible for a VA loan.

What is the lowest credit score for a VA loan?

Despite this VA flexibility, many individual lenders impose a minimum credit score requirement on VA loans. Generally, lenders will require minimum credit scores of 580 to 620 to be eligible for a VA loan.

What credit score is too low to get a mortgage?

You need a minimum credit score for Canadian mortgage approval from a large bank, and that number is 600. If you have a credit score below 600, most of Canada’s large banks will not approve you for a mortgage loan.

What is the minimum credit score for veterans first mortgage?

Currently, the minimum credit score for a VA loan is 660; the minimum for a USDA loan or an FHA loan is 620.

Can I get a VA home loan with a 590 credit score?

VA Mortgage: Minimum Credit Score 580-620 Technically, there is no minimum credit score requirement for a VA loan. However, most lenders impose a minimum score of at least 580. And many start at 620. Similar to FHA loans, VA loans don’t have risk-based pricing adjustments.

What will fail a VA appraisal?

If a home does not meet the VA’s Minimum Ownership Requirements (MPR), the home will fail to pass the VA rating. MPRs ensure that the home is ready for the move so that veterans don’t have to go through a long list of expensive repairs after closing the home.

Is it difficult to pass a VA assessment? VA assessment guidelines can be stringent and can take fixer-uppers out of contention. Many of the guidelines can be frustrating for military buyers who are considering older homes in need of renovation. If a home does not meet the MPRs, the buyer will have to decide how to proceed.

What will not pass a VA appraisal?

Insufficient Heating Homes that do not have adequate heating systems will never pass the VA rating. … For this reason, homes that use a wood stove as the main source of heat must have a secondary heating system capable of maintaining a minimum temperature of 50 degrees in the plumbing rooms of the house.

Will VA approve a home with foundation issues?

Structurally sound. To help service members avoid costly surprises, VA appraisers will cautiously evaluate a home for structural weaknesses such as: Cracked / cracked foundation. Large holes in floors, walls or ceilings.

What repairs does VA loan require?

If the total cost of repairs is $ 500 or less, the job shouldn’t be completed until an underwriter has conditionally approved the loan. If the total cost of the repairs is more than $ 500, the job shouldn’t be completed until the lender issues a clear to close the loan.

What are VA appraisal repairs?

The VA appraisal process includes a high-level look at the health, safety, and marketability of the property. It is not uncommon for the VA appraiser to discover problems that need repair before the loan can move forward. Many times these are small problems that require minimal time and money.

Who pays for VA appraisal repairs?

The lender hires the appraiser, but the buyer generally pays for the appraisal. VA assessment costs vary by region. In the Northwest, taxes could be $ 800 or more, while in the Midwest and South, the cost could be closer to $ 450.

What are typical lender required repairs?

Typical conditions that could trigger repairs requested by the lender include missing or non-functioning carbon monoxide monitors and fire alarms, missing water heater belts, flooring issues such as missing tiles or uneven floors, roof deterioration issues, missing stair railings or broken stairs and peeling paint or water stains …

What does the VA look for in appraisals?

Appraisers will review recent comparable home sales, or “comps,” to help determine the property’s value. VA appraisers look for at least three homes that are similar in size, age, and location to the one you are hoping to purchase. … Lenders usually need at least one good recent sale of a comparable home to get on with a loan.

How much income do you need to qualify for a VA loan?

Are There Income Restrictions for VA Loans? No, the VA does not limit income for qualified VA loan borrowers. Other government-guaranteed mortgage programs may set a maximum amount of income to qualify for specific loan programs, but the VA has no such requirement.

How much do you have to earn to qualify for a VA loan? If the gross monthly income is $ 7,000, the debt ratio is 2,639 divided by 7,000 for a ratio of. 38 or 38. Since the ratio is less than the maximum ratio of 41, the borrower qualifies for the loan based on the leverage ratios.

Can I get a VA loan with no income?

So, no, it’s not impossible to get a VA loan if you’re unemployed, you’ll just need to be able to prove that you have another source of income other than your salary.

Can I qualify for a VA loan without a job?

You don’t have to have a job to qualify for a VA mortgage. … When you apply for a VA loan, you can ask your lender to consider Social Security income, disability income, alimony, child support, annuities, and retirement income.

Do you need proof of income for a VA home loan?

Employment and income are two important factors. The VA needs a record of both in the form of pay slips, tax returns, and employment verification documents. … The alternative documentation consists of one month of the most recent paychecks, plus the two most recent W-2 tax forms of the VA loan applicant.

Do I have to show proof of income for VA loan?

Income Documentation / Employment Verification You must verify all of your sources of income when applying for a VA home loan, and you may need to provide written or verbal verification of your employment. Here is a list of the most common income documents you will need (depending on your financial situation).

Is a VA loan based on income?

The debt-to-income ratio determines whether you can qualify for VA loans. The acceptable debt-to-income ratio for a VA loan is 41%. Generally, the debt-to-income ratio refers to the percentage of your gross monthly income that goes into debt. In effect, it is the ratio of your monthly debt obligations to your gross monthly income.

What is a VA loan based on?

With residual entitlement, the VA home loan limit is based on the loan limit of the county where you live. This means that if you default on your loan, we will pay your lender up to 25% of the county loan limit minus the amount of your entitlement that you have already used.

Does income affect VA loan?

What Factors Affect VA Loan Accessibility? To calculate how much home you can afford with a VA loan, VA lenders will evaluate your debt-to-income ratio (DTI). The DTI ratio reflects the relationship between your gross monthly income and the main monthly debts. … There is no hard cap on the DTI report for VA loans.