What happens to VA benefits if you go to jail?

Contents

If you go to jail, your veteran disability benefits will be reduced or discontinued. If you are incarcerated, the Department of Veterans Affairs (VA) will occasionally reduce or discontinue your disability benefits.

How often is a VA loan denied?

Some veterans are denied military status, credit history, lack of income, or the loan terms they are seeking. Overall, about 15 percent of applications are rejected, but some may be able to reapply.

What will cause a VA loan to be rejected? The most common reason why VA home loan applications are denied is due to errors on the application itself. Lenders cannot give loans unless they are sure that your personal and financial details are correct. Before you submit your application, take the time to review each statement you make and the numbers you enter.

What percentage of a VA loan is guaranteed?

How much is the warranty? VA will guarantee up to 50 percent of a home loan up to $ 45,000. For loans between $ 45,000 and $ 144,000, the minimum collateral amount is $ 22,500, with a maximum collateral, of up to 40 percent of the loan up to $ 36,000, depending on the amount of entitlement a veteran has available.

How often do VA home loans get denied?

Overall, about 15 percent of applications are rejected, but some may be able to reapply.

How much will VA loan approve for?

VA loan limits vary by district and currently range from $ 548,250 to $ 822,375. While qualified Veterans with their full entitlement may borrow as much as a lender wishes to extend, those with a reduced or diminished entitlement are bound by VA loan limits.

Can a VA loan be rejected?

When lenders refuse a loan, they do so reluctantly. VA lenders make money by approving loans, not denying them, so they will do everything they can to get your approval. When they can’t, they’ll send a so-called Adverse Action Notice. … You must first find out specifically why exactly your loan was denied.

Can a VA loan be denied in underwriting?

How Often Do Insurers Deny VA Loans? About 15% of VA loan applications are rejected, so if yours is not approved, you are not alone. If you are denied during the auto-signing stage, you may be able to seek approval with manual insurance.

What denies a VA loan?

In the overwhelming majority of cases, inexperienced loan officers or strict coverages are the reason for being denied for a VA loan. If your lender is not approved to do a manual on VA home loans, you may be told that you are not approved without further explanation or choice.

What denies a VA loan?

In the overwhelming majority of cases, inexperienced loan officers or strict coverages are the reason for being denied for a VA loan. If your lender is not approved to do a manual on VA home loans, you may be told that you are not approved without further explanation or choice.

Why is it so hard to get a VA loan?

Borrowers must show that they have the income to make the mortgage. They should not have a huge debt burden. Although there is no minimum credit score requirement, borrowers could find it difficult to get approval from a lender if they do not have at least a 620 FICO Score.

What will fail a VA loan inspection?

During the inspection, they will check for any wear or problems that could cause the system to fail shortly after the sale goes through. If they determine that the system is not capable of heating the house to at least 50 degrees Fahrenheit during the winter without a problem, the house will fail the inspection.

Why do sellers hate VA loans?

Many sellers – and their real estate – do not like VA loans because they believe that these mortgages are difficult to close or more expensive for the seller.

Can sellers discriminate against a VA loan? No VA-approved lender can discriminate against a buyer. … No seller can refuse to offer property on a discriminatory basis — the seller must comply with Fair Housing laws.

Why VA loans are bad for sellers?

VA loans come with dirty tape, appraisal delays and fees paid by sellers instead of buyers – all reasons why offers are rejected, agents say. In addition, real estate agents and veterans say some vendors are rejecting offers because of misunderstandings about the VA program.

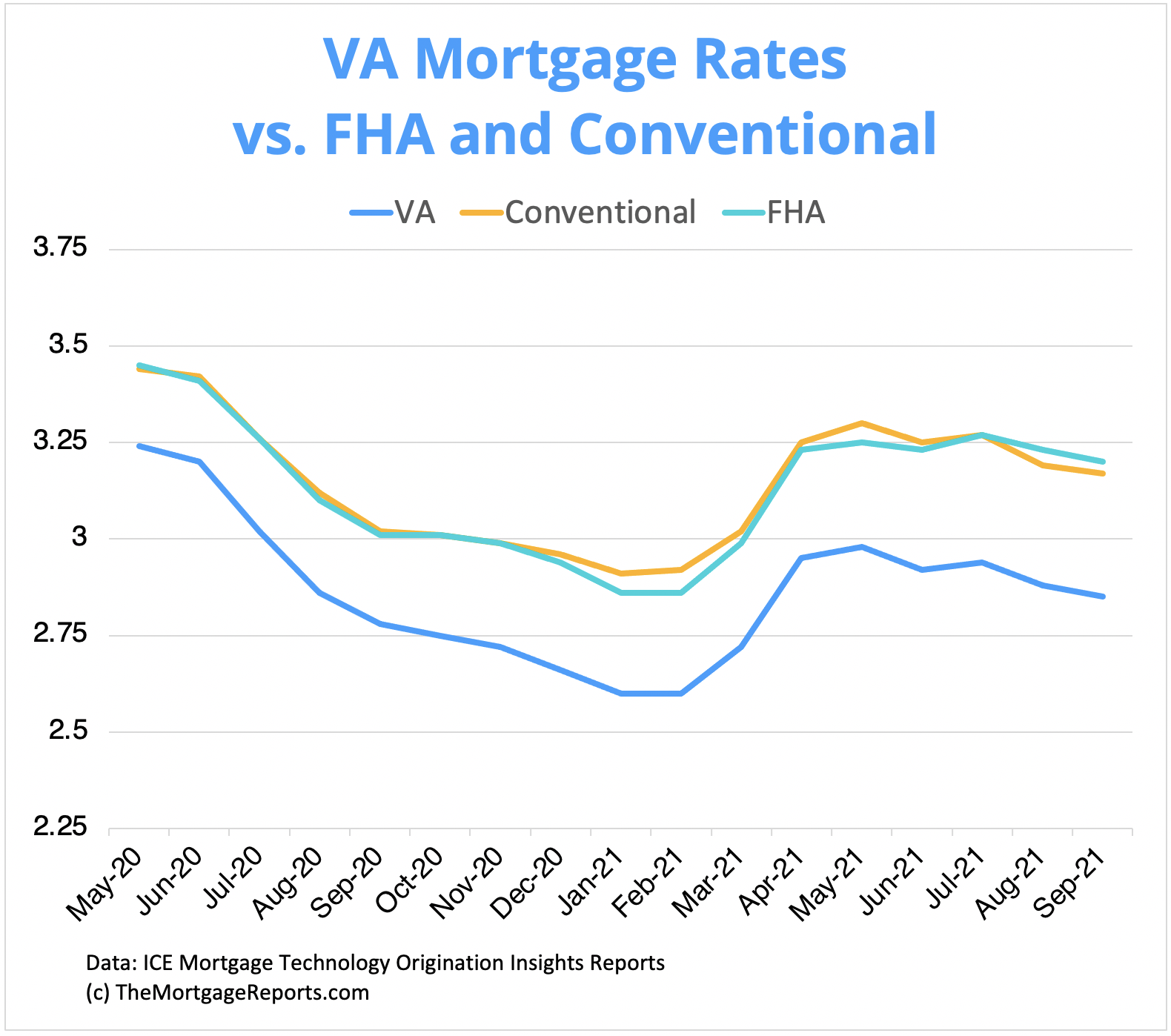

Is a VA loan really worth it?

VA loans offer better terms and interest rates than most other home loans. 100% financing – usually, no down payment is required for a VA loan, provided the purchase price of the home does not exceed the estimated value of the home. … There is no penalty for early repayment of the loan.

What does the seller have to pay for a VA loan?

In California, and nationwide, these “selling concessions” are usually limited to 4% of the loan amount. As stated on the VA’s website: â € œWe require that a seller cannot pay more than 4% of the total home loan in concessions from a seller. … The rule does not cover borrowing points

Are VA loans difficult for sellers?

The short answer is â € œNo. Today, you are likely to have roughly the same problems with a buyer who has such a mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

What should a seller know about VA loans?

And, for sellers, the most important thing to understand about VA loans is how good of a mortgage product they are for qualified borrowers. This high-quality nature means that if it deals with a veteran buyer, he or she is likely to use the VA loan.

Are VA loans bad for sellers?

Using a VA loan means that you will end up saving money both on the purchase and over the life of the loan. However, it does mean that the person selling the house to you will have to spend more to sell the house to you. If you are concerned that the seller is rejecting your offer because you are using a VA loan, do not be.

Why do Realtors hate VA loans?

Before it guarantees mortgages, the VA wants to make sure homes that eligible veterans buy are safe and secure and worth their sale price. … Because VA estimates can increase their repair costs, homeowners sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Should a seller accept a VA loan?

Are VA loans bad for sellers? We need it. Accepting an offer from a buyer using a VA loan while selling your home can be just as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but you as a salesperson should have nothing to worry about.

Are VA loans attractive to sellers? VA mortgages are attractive to mortgage lenders because the loans are backed by the federal government. The lender will not lose money if the buyer defaults. These are probably the best mortgages out there for borrowers.

Are VA loans bad for sellers?

Using a VA loan means that you will end up saving money both on the purchase and over the life of the loan. However, it does mean that the person selling the house to you will have to spend more to sell the house to you. If you are concerned that the seller is rejecting your offer because you are using a VA loan, do not be.

Is a VA loan 100%?

VA Home Loans With Low Mortgage Quality VA loans allow 100% financing, never require mortgage insurance and carry flexible underwriting guidelines that make it easy for you to get your closing on time.

What will fail a VA inspection?

During the inspection, they will check for any wear or problems that could cause the system to fail shortly after the sale goes through. If they determine that the system is not capable of heating the house to at least 50 degrees Fahrenheit during the winter without a problem, the house will fail the inspection.

Why would a home seller not accept a VA loan?

Before it guarantees mortgages, the VA wants to make sure homes that eligible veterans buy are safe and secure and worth their sale price. … Because VA estimates can increase their repair costs, homeowners sometimes refuse to accept purchase offers backed by the agency’s mortgages.

Are VA loans difficult for sellers?

The short answer is â € œNo. Today, you are likely to have roughly the same problems with a buyer who has such a mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

Why VA loans are bad for sellers?

VA loans come with dirty tape, appraisal delays and fees paid by sellers instead of buyers – all reasons why offers are rejected, agents say. In addition, real estate agents and veterans say some vendors are rejecting offers because of misunderstandings about the VA program.

Do sellers prefer VA or conventional loan?

Some agents advise home sellers to take conventional loans or cash offers, even if they are lower than VA offers, as these options are perceived as less of a hassle than VA loans. “Choosing a conventional bid over a VA bid is not considered discrimination.”

Do VA loans cost the seller more?

VA loans have changed a lot in recent years and now they are generally not more difficult or expensive for sellers than any other loan. The most common myths are that VA loans: are less likely to close than other types of mortgages.

Is it harder to buy a house with a VA loan?

Should you be worried? The short answer is â € œNo. Today, you are likely to have roughly the same problems with a buyer who has such a mortgage as any other. And VA’s flexible guidelines may be the only reason your buyer can buy your home.

What disqualifies you from getting a VA loan?

Disgraceful Discharge Veteran status requires that service members be fired or released from the military under conditions other than disgraceful. A veteran with a dishonorable discharge will not be eligible to participate in the VA Loan Guarantee program.

Can you be denied a VA loan? How Often Do Insurers Deny VA Loans? About 15% of VA loan applications are rejected, so if yours is not approved, you are not alone. If you are denied during the auto-signing stage, you may be able to seek approval with manual insurance.

Why is it so hard to get a VA loan?

VA loans have different down payment requirements. Furthermore, lenders may require a down payment in certain situations. Most conventional loans require at least a small down payment.

Can you be denied for a VA loan?

If your VA loan application was denied, it could be because your income levels are too low. The best thing you can do is ask your lender for an explanation. They will be able to tell you if your income was too low. If so, look for ways to increase your income if possible.

Is it hard to get approved for a VA home loan?

If you are eligible, VA loans are fairly easy to qualify because there is no down payment required, no minimum credit score and no maximum limit on how much you can borrow in relation to income.