Which bank gives loan easily?

Contents

HDFC Bank customers can get Personal Loans with minimal or no documentation. In fact, if they are pre-approved for a Personal Loan, they can easily apply for it. Lower interest rates: Interest rates on Personal Loans are lower than other sources.

What is the easiest loan to get approved? Easiest loans and their risks

- Urgent loans. …

- Salary loans. …

- Loans with bad credit or no-credit check loans. …

- Local banks and credit unions. …

- Local charities and non-profit organizations. …

- Payment plans. …

- Salary promotions. …

- Distribution of a loan or hardship from your 401 (k) plan.

Which bank gives most loan?

| Lender | Initial Interest Rate | Maximum Loan Amount |

|---|---|---|

| Wells Fargo Best Great Bank | 5.74% | $ 100,000 |

| Lightstream Best for Home Improvement Loans | 2.49% | $ 100,000 |

| Marcus of Goldman Sachs Best for Debt Consolidation Loans | 6.99% | $ 40,000 |

| TD Fit Loan (TD Bank) Best for co-subscribers | 6.99% | $ 50,000 |

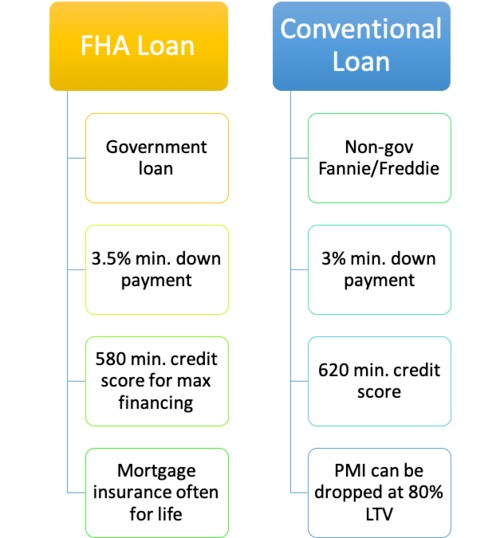

Can you put 3% down on a conventional loan?

Can I get a mortgage with 3% down? Yes! The conventional program 97 allows 3% down and is offered by many lenders. Fannie Mae’s HomeReady loan and Freddie Mac’s Home Possible loan also allow 3% down with extra flexibility for income and credit qualification.

Do conventional loans require 5% down? Conventional loans require buyers to make a minimum 5 percent down payment on a home. Because this is a conventional loan, and because the down payment is less than twenty percent, private mortgage insurance (PMI) will be required.

Can you do a conventional loan with 3% down?

The conventional 97 loan also allows you to decrease by only 3%, while FHA requires a minimum of 3.5%. And, conventional loans offer lower mortgages the higher your credit score. That’s good news if you have a good credit score of 720 or higher.

Is it smart to buy a house with only 3% down?

It’s between buying a house with a small down payment now and continuing to rent for years because you can’t afford a bigger one. And even if you decrease by only 3 to 5 percent, the former can have significant benefits. If you buy a house with a fixed mortgage, you are protected from rent losses in your neighborhood.

What is the lowest percent down for a conventional loan?

The minimum down payment required for a conventional mortgage is 3%, but borrowers with lower credit scores or higher debt-to-income ratios may be required to put down more. You will also probably need a larger down payment for a jumbo loan or a loan for a second home or investment property.

Can you put less than 20 down on a conventional loan?

Typically, conventional loans require a PMI when you take out less than 20 percent. … Most lenders offer conventional loans with PMI for down payments ranging from 5 percent to 15 percent. Some lenders may offer conventional loans with a 3 percent down payment. Federal Housing Administration (FHA) loan.

What is the lowest percent down for a conventional loan?

The minimum down payment required for a conventional mortgage is 3%, but borrowers with lower credit scores or higher debt-to-income ratios may be required to put down more. You will also probably need a larger down payment for a jumbo loan or a loan for a second home or investment property.

What kind of loan requires 20% down?

Conventional loans come with very low rates, plus no mortgage insurance is required when you lower 20%. Conventional loans are sponsored by Fannie Mae and Freddie Mac and available at your local lender. Conventional loans remain the mortgage chosen for buyers with good credit and a healthy down payment.

How much money do I need to buy a house with FHA loan?

An FHA loan requires a down payment of only 3.5% of the purchase price of the home if your FICO score is at least 580. Although some lenders may require a higher credit score from 620 to 640. Other types of loans eliminate the down payment requirement altogether.

What is the FHA minimum loan amount? The minimum loan balance of FHA 203 (k) is $ 5,000 – you can’t borrow less than this.

How much do I need for FHA closing costs?

The closing costs on your FHA loan will be similar to those of a conventional mortgage loan. These costs will usually be around 2% to 6% of the cost of your property. Your costs will be linked to things like your loan amount, where the property is located and lender costs.

How much money do I need at closing FHA?

FHA closing costs average anywhere from 2% to 4% of the loan amount. Your actual costs will be linked to various factors such as your loan amount, credit score and lender fees. Some of the costs are standard for all FHA loans, while others are costs based on a lender or third parties as your estimate.

Can I include closing costs in my FHA loan?

“FHA might be just what you need.” Your down payment can be as low as 3.5% of the purchase price, and most of your closing costs and fees can be included in the loan.

What must the buyer pay with an FHA mortgage?

FHA-insured mortgages come with higher closing costs than conventional loans, but this does not mean that the seller has to pay higher fees at closing. The homeowner pays mortgage insurance and establishes an escrow lien for the payment of property taxes and insurance.