Are all FHA loans 3.5% down?

Contents

The minimum down payment on an FHA loan is either 3.5 percent or 10 percent, depending on your credit score. For anyone with a credit score of 580 or higher, 3.5 percent is the minimum required for a down payment. Everyone with a credit score of 500 to 579 will have to have 10 percent down payment.

Does FHA not offer an advance payment? Although FHA loans have a standard down payment requirement of 3.5%, you can get a zero FHA loan without using your own money for the down payment or closing costs.

Does FHA do 3% down?

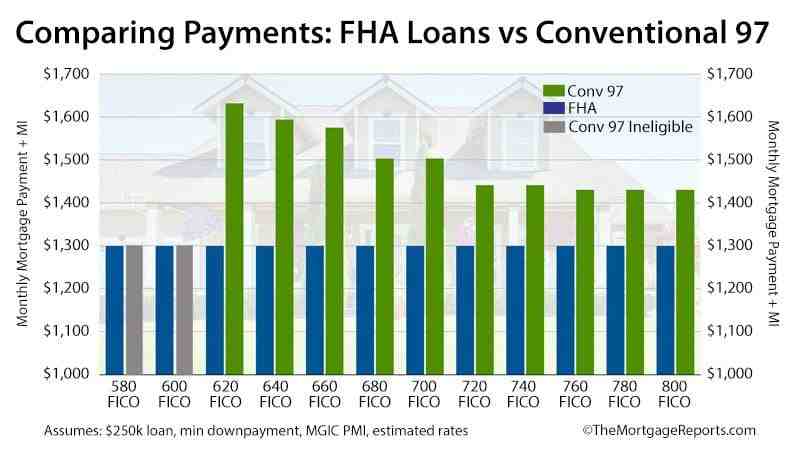

The conventional 97 loan also allows you to decrease by only 3%, while FHA requires a minimum of 3.5%. And, conventional loans offer lower mortgages the higher your credit score. That’s good news if you have a good credit score of 720 or higher.

Can I get a mortgage with only 3% down?

Who qualifies for a 3% down mortgage? To qualify for a 3% down conventional loan, you typically need a credit score of at least 620, a two-year employment history, a steady income, and a debt-to-income ratio (DTI) below 43%. If you apply for the HomeReady or Home Possible loan, there are also income limits.

What is the minimum down payment for FHA?

An FHA loan is a government-backed loan secured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For example, the minimum required down payment for an FHA loan is only 3.5% of the purchase price.

What credit score is required to get an FHA loan with only 3.5% down?

FHA Loan Advance FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the range of 500 – 579. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans.

What is the lowest credit score FHA will accept?

For those interested in applying for an FHA loan, applicants must now have a minimum FICO score of 580 to qualify for the low down payment benefit, which is currently around 3.5 percent. If your credit score is below 580, however, you are not necessarily excluded from FHA loan eligibility.

Can I get a mortgage with 3.5% down?

The minimum down payment varies depending on the mortgage program. VA and USDA loans allow zero down payment. Conventional loans start at 3 percent down. And FHA loans require at least 3.5 percent down.

What is the minimum amount to put down on an FHA loan?

An FHA loan is a government-backed loan secured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For example, the minimum required down payment for an FHA loan is only 3.5% of the purchase price.

What kind of loan requires a 20% down payment? Conventional loans come with very low rates, plus no mortgage insurance is required when you lower 20%. Conventional loans are sponsored by Fannie Mae and Freddie Mac and are available from your local lender.

What happens if I put 20% down on an FHA loan?

FHA loan minimum down payment programs are 3.5% for borrowers with FICO scores at 580 or better. FHA loan program rules for borrowers with a FICO score between 500 and 579 require a 10% down payment, but nothing as high as 20%. … But in general, borrowers are not required to pay 20% down on FHA loans.

What is the catch with an FHA loan?

Mortgage insurance protects the lender if you are unable to pay off your mortgage on the road. If your down payment is less than 20%, you generally have to pay for this insurance, no matter what loan you receive.

Can you put more money down on a FHA loan?

The reverse is also true – FHA mortgage lenders can put more money on their down payment to lower monthly mortgage bills – there is no requirement that the borrower has to pay only the 3.5% minimum. One important detail to be aware of – the FHA requires down payments made by the buyer.

Why are FHA loans bad?

FHA loans often come with higher interest rates than other loans, simply because they are riskier. As their credit score requirements are lower, there is a greater chance that the borrower will default on the loan. To protect themselves from this additional risk, lenders will pay a higher interest rate.

What is the minimum amount for FHA loan?

The minimum loan balance of FHA 203 (k) is $ 5,000 – you cannot borrow less than this.

What are the FHA loan limits for 2020?

According to an FHA announcement, the 2020 FHA loan limit for most of the country will be $ 331,760, an increase of nearly $ 17,000 over the 2019 loan limit of $ 314,827.

How much money do you need for FHA?

An FHA loan requires a down payment of only 3.5% of the purchase price of the home if your FICO score is at least 580. Although some lenders may require a higher credit score from 620 to 640. Other types of loans eliminate the down payment requirement altogether.

What is 3 percent down on a house?

An advance is a down payment on the purchase of a home. Down payment requirements are typically expressed as a percentage of the home’s sale price. For example, if a mortgage lender requires a 3 percent down payment on a $ 250,000 home, the homeowner must pay at least $ 7,500 at closing.

Is it better to put 3% or 5% down on a house? It is better to lower it by 20 percent if you want the lowest possible interest rate and a monthly payment. But if you want to get into a house now and start building a tie, it might be better to buy with a smaller down payment – say 5 to 10 percent down.

How much is 3% down on a $300000 house?

Fannie Mae and Freddie Mac (the agencies that set rules for compliant mortgages) require a down payment of only 3% of the purchase price. That’s $ 9,000 on a $ 300,000 home – the lowest possible unless you’re eligible for a zero-down VA or USDA loan.

How much is a downpayment on a 300k house?

Calculate how much deposit the banks want. Your loan amount will be $ 380,000, which is 95% loan-to-value ratio (LVR). If you choose to purchase property for $ 300,000, you will need to save at least $ 15,000 to cover the minimum 5% deposit required.

What is the payment on a 300000 mortgage at 3%?

| Annual Percentage Rate (APR) | Monthly payment (15 years) | Monthly payment (30 years) |

|---|---|---|

| 3.00% | $ 2,071.74 | $ 1,264.81 |

How much is 3% of a down payment for a house?

For example, if a mortgage lender requires a 3 percent down payment on a $ 250,000 home, the homeowner must pay at least $ 7,500 at closing. A down payment reduces the amount the buyer needs to borrow to buy the home. It also represents the immediate equality of the buyer in the home.

Is 3% down payment enough?

Conventional Loan: Conventional loan requirements for primary residences depend entirely on the individual lender. Some lenders may require you to have 5% down, while other lenders may require only 3%. … FHA loan: With an FHA loan, you will need a down payment of at least 3.5%.

Can I buy a home with only 3% down?

FHA and conventional loans are available with only 3 or 3.5 percent down, and that total amount could come from down payment assistance or a cash gift. What credit score do I need to buy a home without money? The USDA non-cash loan program usually requires a credit score of at least 640.

How much downpayment is enough?

Putting at least 20% down on a home will increase your chances of getting approved for a decent rate mortgage, and will allow you to avoid mortgage insurance. But you can take less than 20% off.

What credit score do you need for 3% down?

Fannie Mae’s minimum qualifications require a FICO credit score of at least 620 for a 3% low mortgage. However, be aware that most people who are approved for conventional mortgages have credit scores in the 700s or better, and that it may be difficult to get approval with a score in the lower end.

Can I buy a home with only 3% down?

FHA and conventional loans are available with only 3 or 3.5 percent down, and that total amount could come from down payment assistance or a cash gift. What credit score do I need to buy a house without money? The USDA non-cash loan program usually requires a credit score of at least 640.

Can I get a mortgage with only 3% down?

Who qualifies for a 3% down mortgage? To qualify for a 3% down conventional loan, you typically need a credit score of at least 620, a two-year employment history, a steady income, and a debt-to-income ratio (DTI) below 43%. If you apply for the HomeReady or Home Possible loan, there are also income limits.

What credit score do you need for 3% down?

Fannie Mae’s minimum qualifications require a FICO credit score of at least 620 for a 3% low mortgage. However, be aware that most people who are approved for conventional mortgages have credit scores in the 700s or better, and that it may be difficult to get approval with a score in the lower end.