Can I buy a house with $20000 deposit?

Contents

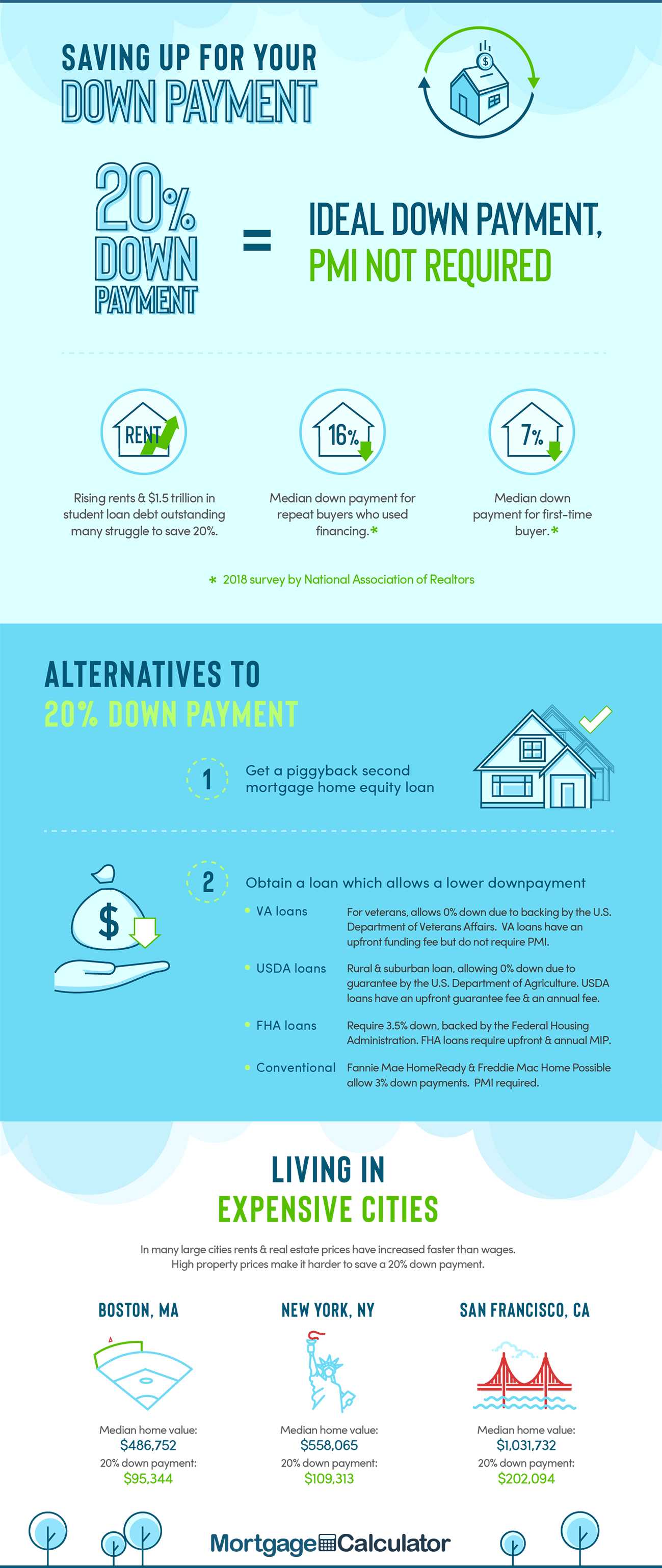

One of the most common questions we are asked is if you can buy a house with less than a 20% down payment. The answer is yes, but you will have to pay the lender for mortgage insurance and you may have to meet some additional credit requirements, such as genuine. savings.

Is $ 10,000 enough to pay for a house? Ordinary mortgages, like a traditional 30-year fixed-rate mortgage, usually require a down payment of at least 5%. If you buy a home for $ 200,000, you’ll need $ 10,000 to secure a home loan. FHA mortgage. For a government-guaranteed mortgage (such as an FHA mortgage), the minimum down payment is 3.5%.

Can I buy a house with $10000 deposit?

With a $ 10,000 deposit, most lenders will only approve you for a $ 100,000 home loan. If you pay more mortgage insurance to lenders, you may be allowed to take out a larger loan. If this is the largest down payment you can afford, you may be able to apply for a low-deposit, no-deposit home loan.

Can I buy a house for 10,000? First Homeowner Grant (New Homes) The First Homeowner Scholarship (New Homes) is eligible for a $ 10,000 scholarship. The scheme is administered by Revenue NSW. You can apply for the scheme if you are arranging funds to buy your home.

How much money should you have saved before buying a house?

When collecting a home, it is important to have a cash savings or emergency fund that is not used for down payment or closing costs. It is good to collect at least 3-6 months of living expenses in this cash reserve.

How much money should I save before buying my first house?

All of this means that if the policy, interest, taxes, and insurance (collectively known as PITI) reach $ 2,000 a month, the borrower would have to save at least another $ 4,000 to cover the first two months of payments when saving to buy their home. .

How much should you put away to save for a house?

If you save 20% of your income, you can buy a home in the next one to three years, depending on your market. For example, if you earn $ 96,000 a year, you’ll save $ 19,200 in one year. It’s $ 38,400 in two years and $ 57,600 in three years.

Is 5 down on a house enough?

For borrowers with high creditworthiness and a steady income, a 3-5% discount can be a financially good option to allow you to start investing and raising equity earlier.

How big is the house down payment in 2021?

Is 5% down payment enough for a house?

It is better to put 20 percent down if you want the lowest possible interest and monthly payment. However, if you want to get into the house right away and start building equity, it may be better to buy with a smaller down payment – say 5-10 percent down.

What kind of mortgage can you get with 5% down?

5% down payment Borrowers with a lower credit score may be required to pay a down payment of at least 5% to get a regular loan, which means they have to finance 95% of the value of the home. This is sometimes referred to as a “regular 5 down loan” or a “normal 95 mortgage loan”.

Is a 5 percent down payment enough?

There are standard loan options that require a down payment of only 3 percent, but many lenders set a minimum of 5 percent. If the loan is for a vacation home or multi-family home, you may be charged more, usually 10 percent and 15 percent, respectively.

What is the average down payment on a house?

The average down payment in America is about 6% of the borrower’s loan value. However, depending on your loan type and credit score, you can also buy a home with a discount of only 3%. If you qualify for a USDA loan or a VA loan, you can even buy a home without money.

What is a good amount to put down on a house?

Typically, mortgage lenders want you to reduce your home purchase by 20 percent, as this reduces their credit risk. It’s also a rule that most programs require mortgage insurance if you bet less than 20 percent (although some loans avoid this).

What is the typical down payment on a house in 2021?

Average down payment: 12% In its 2021 report, the National Association of Real Estate Agents (NAR) examined U.S. home buying trends. NAR states that “based on the value of the home” is the median of all contributions. buyers accounted for 12%.

How much do you need for a down payment on a $300 000 house?

If you buy a $ 300,000 home, you would pay 3.5% of $ 300,000 or $ 10,500 as a down payment upon termination of the loan. Your loan will then cover the remaining home, which is $ 289,500. Please note that this does not include closing costs or any additional charges associated with the process.

How much is a downpayment on a 300k house?

If you buy a $ 300,000 home, you would pay 3.5% of $ 300,000 or $ 10,500 as a down payment upon termination of the loan. Your loan will then cover the remaining home, which is $ 289,500. Please note that this does not include closing costs or any additional charges associated with the process.

How much should a first time home buyer put down?

To buy a house, you usually have to pay a deposit equal to at least 5% of the sale price. For banks, this is usually the smallest deposit they entertain, although many demand significantly more.

What is the typical down payment on a house in 2021?

According to OptimalBlue, the median down payment for a single-family home was $ 28,300 in June 2021, but that number may vary from state to state. In addition, according to a survey conducted by the National Association of Real Estate Agents in 2020, the average percentage of the contribution was 12% of the value of the home.