How do people afford more homes?

Contents

Here is what they said.

- Take a look at First-Time Home Buying Mortgage Options. …

- Reduce your debt. …

- Buy what you can …

- Use your pension as a discount. …

- Know when to leave. …

- Commission Reversal. …

- Consider Fixer-Upper. …

- Welcome to the venue you want.

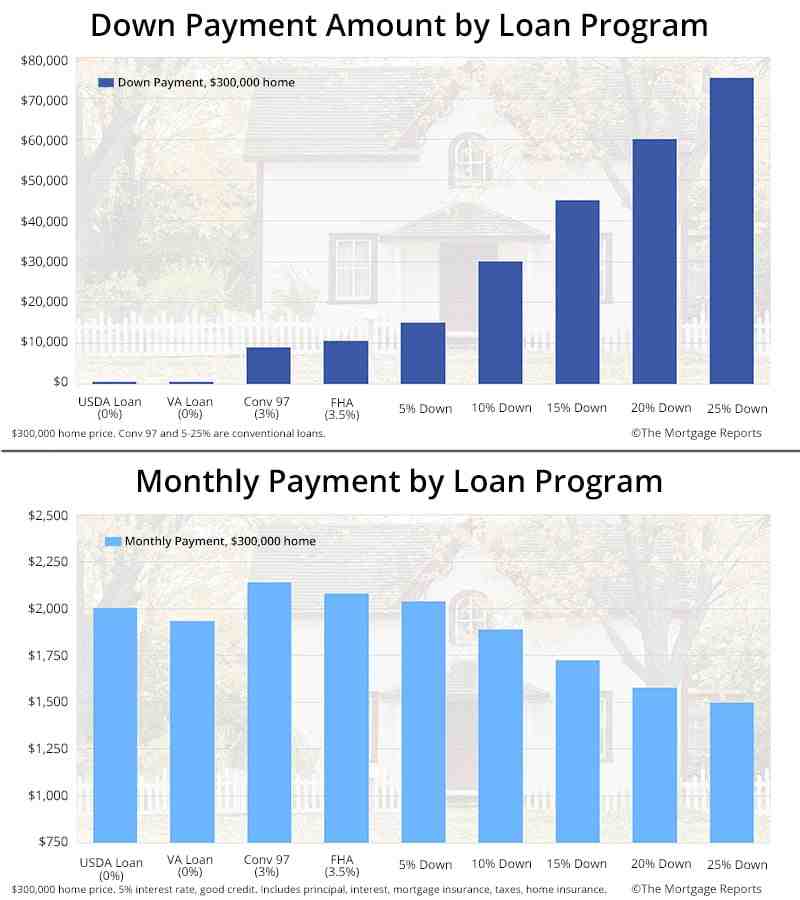

How can people afford 100k housing? When trying to determine how much mortgage you can afford, the general rule is to multiply your income by at least 2.5 or 3 to get an idea of the maximum value of the home you can afford. If you earn around $ 100,000, the maximum amount you can afford would be around $ 300,000.

How much do you have to make a year to afford a $300 000 house?

What is the required income for a 300k loan? + A $ 300k loan with 4.5% interest over 30 years and a $ 10k down payment will require an annual income of $ 74,581 to qualify for the loan.

How much money do you have to make in a year to buy a $ 400,000 home? To be able to afford a $ 400,000 home, lenders need $ 55,600 in cash to make a 10 percent reduction. When you have a 30-year loan, your monthly income must be at least $ 8200 and your monthly repayment of existing debt should not exceed $ 981. (This is an approximate example.)

How much do you need to make a year to afford a 550k house?

You need to make $ 169,193 a year to get a 550k mortgage loan. We base your income on a 550k mortgage by paying 24% of your monthly income. In your case, your monthly income must be about $ 14,099. The monthly repayment of the 550k loan is $ 3,384.

How much income do I need for a 200K mortgage?

A $ 200k loan with 4.5% interest rate over 30 years and a $ 10k down payment will require an annual income of $ 54,729 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

How much do I need to make to buy a 300k house?

This means that to buy a $ 300,000 home, you will need $ 60,000. Closing costs: Typically, you will pay about 3% to 5% of the value of the home for closing costs.

How much do I need to make a year to afford a 400k house?

What is the required income for a 400k loan? To be able to afford a $ 400,000 home, lenders need $ 55,600 in cash to make a 10 percent reduction. When you have a 30-year loan, your monthly income must be at least $ 8200 and your monthly repayment of existing debt should not exceed $ 981. (This is an approximate example.)

How much do you need to make to be able to afford a house that costs $300000?

This means that to buy a $ 300,000 home, you will need $ 60,000.

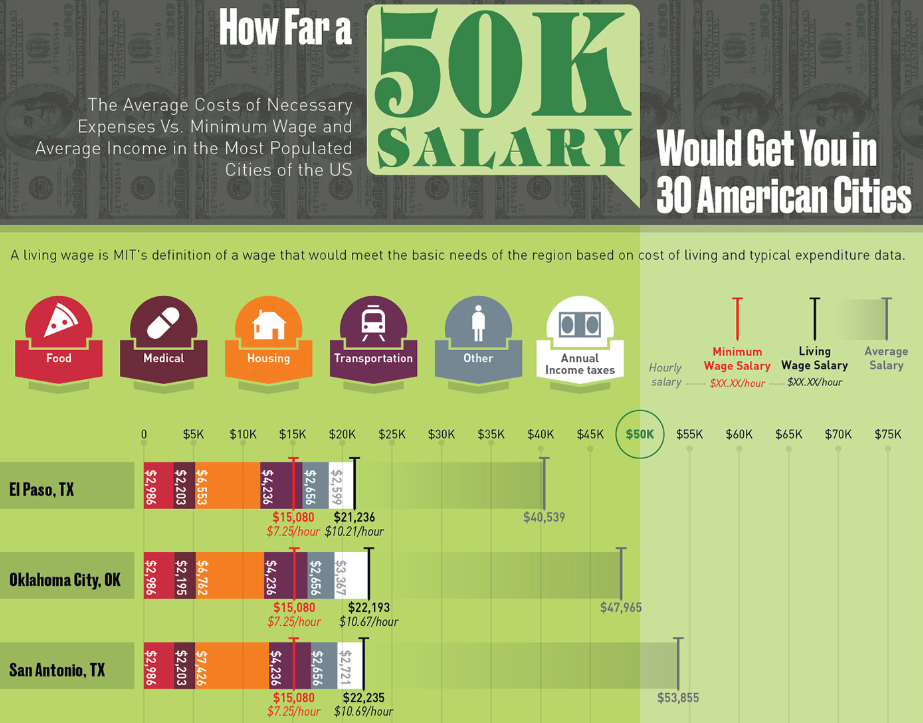

What house can I afford on 40k a year?

| Gross Revenue | 28% of gross monthly income | 36% of gross monthly income |

|---|---|---|

| $ 40,000 | $ 933 | $ 1,200 |

| $ 50,000 | $ 1,167 | $ 1,500 |

| $ 60,000 | $ 1,400 | $ 1,800 |

| $ 80,000 | $ 1,867 | $ 2,400 |

How much money do I have to make to afford a $400 000 house?

What is the required income for a 400k loan? To be able to afford a $ 400,000 home, lenders need $ 55,600 in cash to make a 10 percent reduction. When you have a 30-year loan, your monthly income must be at least $ 8200 and your monthly repayment of existing debt should not exceed $ 981.

How much income do you need for a $350 000 mortgage?

$ 350k loans with a 4.5% interest rate over 30 years and a $ 10k down payment will require an annual income of $ 86,331 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

How much mortgage can I get if I earn 30000 a year?

If you were to use the 28% rule, you would be able to repay a mortgage of $ 700 per month with an annual income of $ 30,000. Another guideline to follow is that your home should not pay more than 2.5 to 3 times your annual salary, which means that if you make $ 30,000 a year, your maximum budget is $ 90,000.

How much credit do I need for a 200k loan? A $ 200k loan with 4.5% interest rate over 30 years and a $ 10k down payment will require an annual income of $ 54,729 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

How much mortgage can I get if I make 35000 a year?

If you are single and make $ 35,000 a year, then you are probably only able to afford $ 105,000 a home.

What mortgage can I afford on 40k salary?

| Gross Revenue | 28% of gross monthly income | 36% of gross monthly income |

|---|---|---|

| $ 40,000 | $ 933 | $ 1,200 |

| $ 50,000 | $ 1,167 | $ 1,500 |

| $ 60,000 | $ 1,400 | $ 1,800 |

| $ 80,000 | $ 1,867 | $ 2,400 |

What kind of mortgage can I afford on 35k?

If you are single and make $ 35,000 a year, then you are probably only able to afford $ 105,000 a home. But you can certainly not buy a cheap house. Single people have a hard time buying homes until they earn above average.

How much mortgage can I get if I make 36000 a year?

For example, if you make $ 3,000 a month ($ 36,000 a year), you can afford to pay no more than $ 1,080 a month ($ 3,000 x 0.36).

How much do I need to earn to get a 70000 mortgage?

| 2% | 15 years old | 25 years old |

|---|---|---|

| 71000 | £ 456.89 | £ 300.94 |

| 72000 | £ 463.33 | £ 305.18 |

| 73000 | £ 469.76 | £ 309.41 |

| 74000 | £ 476.20 | £ 313.65 |

How much income do I need for a 70000 mortgage?

So if you get $ 70,000 a year, you have to spend at least $ 1,692 a month and up to $ 2,391 a month on rent.

How much income do I need for a 60k mortgage?

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. That is $ 120,000 to $ 150,000 debt $ 60,000.