How can I afford a 300k house?

Contents

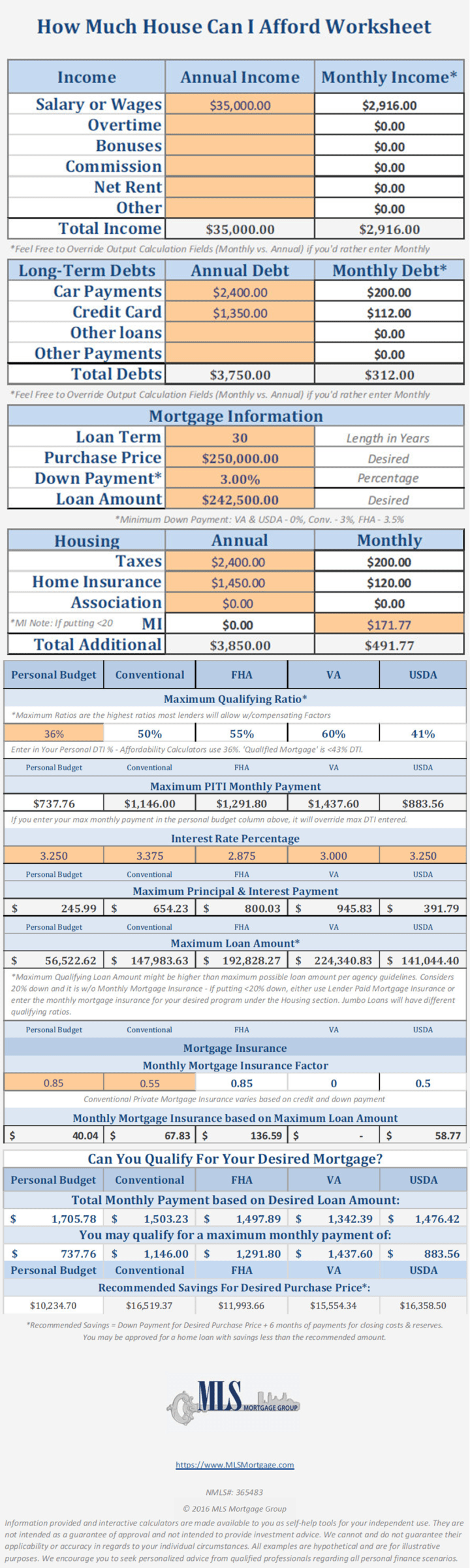

Down payment: You should have a down payment equal to 20% of the value of your home. This means that to afford a $ 300,000 home, you would need $ 60,000. Closing costs: Typically, you will pay between 3% and 5% of a home’s value in closing costs. On a $ 300,000 home, you’d need $ 9,000 to $ 15,000.

Can I afford a 300k house with a 60k salary? The usual rule of thumb is that you can afford a mortgage of two to 2.5 times your annual income. It’s a $ 120,000 to $ 150,000 to $ 60,000 mortgage. … Lenders want principal, interest, taxes and insurance – referred to as PITI – to be equal to or less than 28 percent of gross monthly income.

How much income do I need for a 350k mortgage?

How Much Income Do I Need For A 350k Mortgage? You have to earn $ 107,668 per year to afford a 350k mortgage. We base the income you need on a 350k mortgage on a payment equal to 24% of your monthly income. In your case, your monthly income should be around $ 8,972.

What is the monthly payment on a 350k mortgage?

With a $ 350,000 30-year mortgage with a 3% APR, you can expect a monthly payment of $ 1,264.81, excluding taxes and interest (these vary by location and property, so cannot be calculated without further details. ).

How much income do I need for a 400k mortgage?

What income is required for a 400k mortgage? To afford a $ 400,000 home, borrowers need $ 55,600 in cash to put down 10 percent. With a 30-year mortgage, your monthly income should be at least $ 8200, and your monthly payments on existing debt shouldn’t exceed $ 981.

How much income is needed to buy a $300 000 house?

This means that to afford a $ 300,000 home, you would need $ 60,000. Closing costs: Typically, you will pay between 3% and 5% of a home’s value in closing costs.

How much do you have to make to afford a $300000 house?

A person earning $ 50,000 a year might be able to afford a home worth between $ 180,000 and nearly $ 300,000. This is because the salary is not the only variable that determines the budget for the purchase of the house. You also need to consider your credit score, current debt, mortgage rates, and many other factors.

How much do I need to make to buy a 300k house?

A $ 300k mortgage with an interest rate of 4.5% over 30 years and a down payment of $ 10k will require an annual income of $ 74,581 to qualify for the loan. You can calculate even more variations in these parameters with our Mortgage Required Income Calculator.

How much is a downpayment on a 300k house?

If you are buying a $ 300,000 home, you would pay 3.5% of $ 300,000 or $ 10,500 as a down payment upon closing the loan. Your loan amount would then be for the remaining cost of the home, which is $ 289,500. Please note that this does not include closing costs and any additional fees included in the process.

How much income do you need to qualify for a $300 000 mortgage?

A $ 300k mortgage with an interest rate of 4.5% over 30 years and a down payment of $ 10k will require an annual income of $ 74,581 to qualify for the loan. You can calculate even more variations in these parameters with our Mortgage Required Income Calculator.

How much do I need to make to buy a 300k house?

This means that to afford a $ 300,000 home, you would need $ 60,000. Closing costs: Typically, you will pay between 3% and 5% of a home’s value in closing costs.

Can I afford a 300k house on a 60k salary?

The usual rule of thumb is that you can afford a mortgage of two to 2.5 times your annual income. It’s a $ 120,000 to $ 150,000 to $ 60,000 mortgage. … Lenders want principal, interest, taxes, and insurance – referred to as PITI – to be equal to or less than 28 percent of gross monthly income.

How Much Home Can I Afford To Earn 65k Per Year? I earn $ 65,000 a year. How much house can I afford? You can afford a $ 221,000 house.

Can I afford a 300k house?

The oldest rule of thumb says that you can typically afford a home that is two to three times the price of your gross income. So, if you make $ 100,000, you can typically afford a home between $ 200,000 and $ 300,000. … You don’t have as much money to pay off your mortgage as someone earning the same debt-free income.

How much do I need to make to buy a 300k house?

A $ 300k mortgage with an interest rate of 4.5% over 30 years and a down payment of $ 10k will require an annual income of $ 74,581 to qualify for the loan. You can calculate even more variations in these parameters with our Mortgage Required Income Calculator.

How much income do I need for a 350k mortgage?

How Much Income Do I Need For A 350k Mortgage? You have to earn $ 107,668 per year to afford a 350k mortgage. We base the income you need on a 350k mortgage on a payment equal to 24% of your monthly income. In your case, your monthly income should be around $ 8,972.

How much income do I need for a 400k mortgage?

What income is required for a 400k mortgage? To afford a $ 400,000 home, borrowers need $ 55,600 in cash to put down 10 percent. With a 30-year mortgage, your monthly income should be at least $ 8200, and your monthly payments on existing debt shouldn’t exceed $ 981.

How much income is needed to buy a $300 000 house?

This means that to afford a $ 300,000 home, you would need $ 60,000. Closing costs: Typically, you will pay between 3% and 5% of a home’s value in closing costs.

What is the monthly payment on a 350k mortgage?

With a $ 350,000 30-year mortgage with a 3% APR, you can expect a monthly payment of $ 1,264.81, excluding taxes and interest (these vary by location and property, so cannot be calculated without further details. ).

Which banks will lend 5 times salary?

Nationwide, it will allow people looking to enter the real estate ladder to borrow 5.5 times their annual income, more than the 4.5 loan-to-income ratio offered by most lenders. However, borrowers will have to take out one of the construction company’s standard fixed-rate five- or ten-year mortgages to benefit from it.

Do banks lend 4 times your salary? Most mortgage lenders use a multiple income of 4 to 4.5 times your salary, some offer a 5 times salary mortgage, and some will use 6 times your salary, in the right circumstances to calculate the amount of the mortgage you can afford.

Do lenders lend 5 times salary?

If you have a very good income with no loans or credit cards and no large monthly outgoings you could get 5x your income. When we say possible, we know that the government has instructed mortgage lenders to lend only 5 times the income to 15% of their borrowers!

Can I borrow more than 4.5 times my salary?

Even though income has not been the key lending criterion for banks and real estate companies for more than five years. Mortgage lenders used to calculate how much they would lend with a simple multiplication of an applicant’s income: 4 or 4.5 times the salary was the limit.

Can you borrow 6 times your salary for a mortgage?

You may even be able to get a 6x income remortgage. Typically, most mortgage lenders will offer you a mortgage for around 3 to 4 times your salary. To increase the amount you may be able to borrow you may need to make a larger mortgage deposit and likely have a very good credit score.

Which banks will lend 5 times salary?

Which banks lend your salary five times? Barclays, Sainsbury’s Bank, Santander, Scottish Widows Bank and Virgin Money allow customers to borrow five times their earnings.

Can I borrow more than 4.5 times my salary?

Even though income has not been the key lending criterion for banks and real estate companies for more than five years. Mortgage lenders used to calculate how much they would lend with a simple multiplication of an applicant’s income: 4 or 4.5 times the salary was the limit.

Is it possible to borrow more than 5 times my salary?

Possibly. Most mortgage providers will limit their loan to 4.5 times your income, although some may be lending less than that, and as we’ve discussed in this article, others extend to more. … x5 wage mortgages. x4-4.5 wage mortgages.

Can you borrow more than 4.5 times my salary UK?

Mortgage lenders have had an absolute limit set by the UK’s Financial Conduct Authority (FCA) on the number of mortgages they can issue at more than 4.5 times an individual’s income. (Or 4.5 times the joint income on a combined application.)

Can you borrow 6 times your salary for a mortgage?

You may even be able to get a 6x income remortgage. Typically, most mortgage lenders will offer you a mortgage for around 3 to 4 times your salary. To increase the amount you may be able to borrow you may need to make a larger mortgage deposit and likely have a very good credit score.

Can I get a mortgage 5 times my salary?

Yes. While it is true that most mortgage lenders limit the amount you can borrow based on 4.5 times your income, there are fewer mortgage providers out there who are willing to stretch. up to five times your salary. These lenders are not always easy to find, so using a mortgage broker is recommended.

Which bank gives 5 times salary mortgage?

Barclays offers five times the income mortgages: which one? News.

Do mortgage lenders lend 5 times salary?

Mortgage lenders used to calculate how much they would lend with a simple multiplication of an applicant’s income: 4 or 4.5 times the salary was the limit.

How many times your salary can you borrow for a mortgage 2020?

Borrow up to 6x your salary with a low mortgage rate By taking on relatively low debt – $ 300 per month – and a 3.0% mortgage rate, this person may be able to borrow up to $ 564,000 per month. a mortgage. ($ 614K minus the $ 50,000 down payment). That’s almost six times their salary.