Dear Sirs: I am writing to request the cancellation of the Private Mortgage Insurance (PMI) policy that accompanies my mortgage. As you know, Federal law allows PMI to be canceled when certain LTV ratios are met by normal mortgage amortization, or amortization combined with market appreciation.

How long do I have to pay mortgage insurance on an FHA loan?

Contents

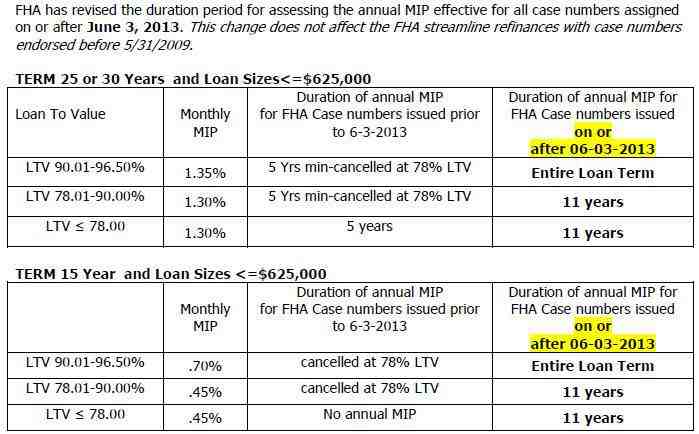

Although the law has changed this issue more than once, the current directive states that borrowers who lend less than 10 percent between FHAs must pay for FHA mortgage insurance until the full term of the loan is over. However, if you put down at least 10 percent, you can get FHA MIP after 11 years of your payments.

Can PMI be borrowed between FHAs? FHA MIP. Mortgage insurers are not the only borrowers who have to pay mortgage insurance. … Getting rid of PMI is relatively simple: Once you accrue 20 per cent equity in your home, by making payments to reach that level or by increasing the value of your home, you can request that PMI as.

How do I avoid FHA MIP?

FHA mortgage insurance cannot be canceled if you make an advance payment of less than 10%; you get rid of FHA mortgage insurance payments by refinancing the mortgage into a non-FHA loan. When you borrow 10% or more between FHAs, you pay mortgage insurance premiums for 11 years instead of the life of the loan.

What is the FHA MIP rate for 2021?

| Base Loan Amount | LTV | Annual MIP |

|---|---|---|

| â ‰ ¤ $ 625,500 | â ‰ ¤ 90% | 45 bps (0.45%) |

| â ‰ $ 625,500 | > 90% | 70 bps (0.70%) |

| > $ 625,500 | â ‰ ¤ 78% | 45 bps (0.45%) |

| > $ 625,500 | 78.01% to 90% | 70 bps (0.70%) |

When can FHA MIP be removed?

June 3, 2013-Present: Your MIP will only be canceled when your mortgage is fully paid off, unless you have made an advance payment of at least 10 percent. If so, your MIP will be canceled after 11 years.

Can I cancel PMI on a FHA loan?

If you bought a home with an FHA loan several years ago, you may be eligible to cancel your FHA PMI today. … If the balance of the loan is 78% of your original purchase price, and you have been paying FHA PMI for 5 years, your lender or mortgage insurance service must cancel today – by law.

How long do you have to pay property mortgage insurance?

Borrowers must pay their PMI until they have accumulated sufficient equity at home that the lender no longer considers to be high risk. PMI costs can range from 0.25% to 2% of the loan balance per year, depending on the size of the minimum payment and mortgage, the term of the loan, and the credit score of the borrower.

Can I cancel PMI after 1 year?

This federal law, also known as the PMI Cancellation Act, protects you from excessive PMI charges. You have the right to get rid of PMI once you have accumulated the required amount of equity in your home.

Is there a time limit on mortgage insurance?

There is one other way you can stop paying for PMI. If you have current payments, your lender or server must end the PMI the month after you reach the midpoint of your loan amortization schedule. … For 30-year loans, the midpoint would be after 15 years.

Do I have to pay mortgage insurance forever?

Fortunately, you do not have to pay private mortgage insurance, or PMI, forever. … And your lender must automatically cancel PMI charges as soon as your regular payments reduce the balance on your loan to 78 percent of the assessed value of your home.

Is FHA PMI permanent?

The good change is that FHA lowered its mortgage insurance premiums in January 2015. On the negative side, PMI is essentially permanent over the lifetime of most mortgages they insure.

Is PMI permanent now?

However, PMI is not necessarily a permanent requirement. Lenders are required to leave PMI when the mortgage LTV ratio reaches 78% through a combination of prime mortgage reduction and house price appreciation. … A mortgage calculator can show you the impact of different rates on your monthly payment.

Is PMI forever on FHA?

Traditional private mortgage insurance, or PMI, has to be paid for two years but then it is cancellable. … In as little as two years, you could get rid of mortgage insurance forever. Compare that to a minimum of five years for FHA, and a maximum of 30 years if your FHA loan was opened after June 3, 2013.

How do I get my FHA PMI back?

Requesting a Repayment A refund of an initial mortgage insurance premium (MIP) can be requested through the Single Family Insurance Operations Division (SIP) HUD. On the FHA Link, go to the Upfront Premium Collection menu and select Request a Refund in the Pay Up Premium section.

Can I cancel PMI on a FHA loan?

If you bought a home with an FHA loan several years ago, you may be eligible to cancel your FHA PMI today. … If the balance of the loan is 78% of your original purchase price, and you have been paying FHA PMI for 5 years, your lender or mortgage insurance service must cancel today – by law.

Do you have to keep PMI on loan between FHAs? FHA mortgage loans do not require a PMI, but require an Initial Mortgage Insurance Premium and a mortgage insurance premium (MIP) instead. Depending on the terms and conditions of your home loan, most FHA loans today will require an MIP for 11 years or the lifetime of the mortgage.

Can you cancel PMI before 2 years?

Many loans have a ‘seasonal requirement’ that requires you to wait at least two years before you can refinance to get rid of PMI. So if your loan is less than two years old, you can request a refi that cancels PMI, but you are not guaranteed to get approval.

How can I get rid of PMI without 20% down?

In summary, for PMI, if you have less than 20% of sales price or house value to use as an advance payment, you have two basic options: Use a & quot; independent & quot; first mortgage and PMI payment until LTV reaches the mortgage 78%, at which point the PMI can be eliminated. 1 Use a second mortgage.

What are some ways you can pay PMI Even if you can’t put down 20% on your mortgage? There are several ways to avoid PMI:

- Put down 20% on your home purchase.

- Lender-paid mortgage insurance (LPMI)

- VA loan (for eligible military veterans)

- Some credit unions may waive PMI for qualified applicants.

- Pork mortgages.

- Physician loans.

Can a bank refuse to remove PMI?

PMI paid to a lender cannot be deducted unless you refinance your mortgage. In this case, PMI should not be referenced in your mortgage note. FHA Mortgage. … If your LTV ratio is 90% or less, you are only required to pay the monthly mortgage insurance for the first eleven years of your loan.

How do I remove a lender from my PMI?

That mortgage rate will not change forever, so you will have to repay the loan in full to get rid of the LPMI â € œpremium.â € You can do this by paying off the loan out of your savings (easier to say not done), refinance the loan, or sell the house and pay the debt.

Is a lender required to remove PMI?

The lender or server must automatically terminate your PMI when your mortgage balance reaches 78 percent of the original purchase price – in other words, when your loan-to-value ratio (LTV) drops to 78 percent. This is provided you are in good condition and have not missed any mortgage payments.

Can lender paid PMI be Cancelled?

There is no simple way to get rid of LPMI. You basically have two options: sell the house or refinance the mortgage. With refinancing in general, you need to ensure that you get a lower rate and that you can afford the final costs to make it financially worthwhile.

Can you get rid of PMI Before 20%?

You have to pay PMI if you pay less than 20% closing. There are two types of PMI for traditional loans: loan-paid mortgage insurance and lender-paid mortgage insurance. … The only way to achieve LPMI is to achieve 20% equity and refinance your loan.

Can PMI be removed early?

You can ask for a PMI to cancel earlier if you have made extra payments that reduce the principal balance of your mortgage to 80 per cent of the original value of your home. … You must have a good payment history and be up to date with your payments.

Do you only pay PMI until you reach 20%?

Homebuyers who put less than 20% of the sale price down will have to pay PMI until the total equity of the house reaches 20%. This can take years, and it’s literally a lot of money.

How can I get rid of PMI without 20% down?

In summary, for PMI, if you have less than 20% of sales price or house value to use as an advance, you have two basic options: Use the first “stand-alone” mortgage and pay PMI until the LTV reaches the mortgage 78 %, at which point the PMI can be eliminated. 1ï »¿Use a second mortgage.