What is the downside of a FHA loan?

Contents

A major drawback of FHA loans is the high cost of FHA mortgage insurance, which must be paid for the entire life of the loan if you pay a minimum of 3.5% deposit. FHA county loan limits also reduce your purchasing power, as they are set at 35% below compliant normal loan limits in most U.S. counties.

What is the mystery about the FHA loan? Mortgage insurance protects the lender if you cannot pay the mortgage on the way. If your down payment is less than 20%, you should generally pay this insurance, no matter what loan you get.

Why you should not get an FHA loan?

There are several reasons to avoid an FHA loan, including higher upfront costs and with every payment. He is not ready to take out a mortgage: a small deposit could be a red flag. … Pre-insurance: When you deposit less than 20%, you have to pay mortgage insurance. FHA loans have two types of collateral.

Why do sellers not want FHA loans?

When an FHA home loan is used, the appraiser must determine the market value of the home purchased. … This is another perceived shortcoming of FHA loans to vendors. Some sellers try to avoid borrowers using this mortgage program because they feel that their homes will not pass the appraisal process.

Why are FHA loans bad?

FHA loans often have higher interest rates than other loans, simply because they are more risky. Because their credit rating requirements are lower, there is a greater chance that the borrower will not repay the loan. To protect against this additional risk, lenders will charge a higher interest rate.

Why is it so hard to buy a house with an FHA loan?

You cannot buy any house with an FHA loan. Well, the FHA has a few more hoops to jump over than regular loans. To approve the loan, the house must undergo an inspection by the U.S. Department of Housing and Urban Development.

Why would FHA not approve a home?

Loan Limitations A house that is too expensive cannot be eligible for an FHA loan. The HUD sets loan limits on an annual basis, which vary according to the area and number of units. The FHA can only insure an amount up to this limit. A high-quality home with a standard FHA advance of 3.5 percent may have a loan amount that exceeds the limit.

Why are FHA loans less attractive to sellers?

Another possible hurdle for sellers is that FHA loans have stricter criteria than conventional mortgages. When valuing, the home needs to be examined in more detail, and sales can be prevented by things like broken paint, broken windows, or malfunctioning appliances.

What is one disadvantage of an FHA loan?

The main drawback of FHA loans is that mortgage insurance premiums have to be paid for the entire life of the loan for borrowers who repay 3.5 percent of the advance. FHA borrowers can only cancel their mortgage payment by refinancing into another type of loan.

Are FHA loans bad for people?

In summary, FHA loans are not just for low-income borrowers. Anyone who meets the basic conditions for this program can apply for a loan. Earning “too much” money won’t stop you from signing up.

Why is FHA bad for sellers?

Unfortunately, some home sellers see the FHA loan as a riskier loan than a regular loan because of its requirements. More favorable financial requirements of the loan can lead to a negative perception of the borrower. On the other hand, strict loan appraisal requirements can make a seller nervous.

What are the disadvantages of a FHA loan?

If you are considering using an FHA loan, here is a short list of disadvantages that these mortgages have:

- They require mortgage insurance premiums in advance and annually.

- They often come with higher interest rates.

- They are not for use on investment property.

- Houses must meet strict ownership requirements.

What is the minimum credit score for an FHA loan?

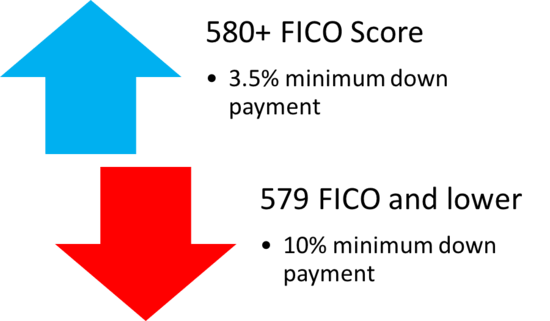

You will need a credit score of at least 580 to qualify. If your credit score drops between 500 and 579, you can still get an FHA loan if you can pay a 10% deposit. 1 For FHA loans, your down payment may come from savings, a family member’s financial gift, or a repayment assistance grant.

What credit rating do you need for a FHA 2021 loan? FHA credit requirements for FHA 2021 loan applicants must have a minimum FICO® 580 rating to qualify for the low down payment benefit, which is currently 3.5%. If your credit score is below 580, the prepayment requirement is 10%. You can see why it’s important to keep your credit history in good standing.

Can I get a FHA loan with a 620 credit score?

The Federal Housing Authority or the FHA requires a credit score of at least 500 to purchase a home with an FHA loan. A minimum advance payment of 3.5% requires a minimum of 580. However, many lenders require a score of 620 to 640 to qualify.

Is it hard to get approved for an FHA loan?

Read our editorial standards. To qualify for an FHA loan, you need a 3.5% down payment, a 580 credit score, and a 43% DTI ratio. An FHA loan is easier to get than a regular mortgage. The FHA offers several types of home loans, including home improvement loans.

Can you be denied a FHA loan?

Reasons to Reject an FHA There are three popular reasons you were turned down for an FHA loan – poor creditworthiness, a high debt-to-income ratio, and generally too little money to cover the down payment and closing costs.

What will disqualify you from a FHA loan?

Credit Problems with FHA Loans If you do not have an established credit history or do not use traditional credit, your lender must obtain a non-traditional consolidated credit report or develop a credit history in other ways. Bankruptcy does not disqualify the borrower from obtaining a mortgage secured by the FHA.

What are my chances of getting approved for a FHA loan?

Borrowers with a credit rating of up to 580 have the option of obtaining FHA loan approval with an advance payment of only 3.5%. That’s only $ 7,000 for a $ 200,000 home. Unlike other loans, FHA loans do not necessarily require two years of employment to qualify.

What is the current FHA minimum credit score requirement?

The minimum credit rating for eligibility for an FHA loan is 580 with an advance payment of 3.5 percent. If you can increase your down payment to at least 10 percent, you can have a credit score of up to 500 and still qualify.

What credit score is required to get an FHA loan with only 3.5% down?

A minimum advance payment of 3.5% requires a minimum of 580. However, many lenders require a score of 620 to 640 to qualify. Lenders appear to have begun to reduce their FHA minimum credit rating requirements since 2017, thanks to a new FHA policy, opening up home ownership to thousands more home buyers.

Does FHA require 5% down?

The minimum payment of an FHA loan is 3.5 percent or 10 percent, depending on your credit score. For anyone with a credit score of 580 or higher, 3.5 percent is the minimum required for prepayment. Anyone with a credit rating of 500 to 579 will need to have 10 percent to prepay.

Can I get an FHA loan with a 550 credit score?

People can get FHA loans with 550 credit ratings. Whether you can VI depends on the reason for your score of 550. Note that you will need to lower at least ten percent for a score below 580.

Is FHA only for first time buyers?

The FHA will insure mortgages for any primary residence. There is no requirement that you must be the first customer to use the FHA loan program.

Is anyone qualified for FHA? To be eligible for an FHA loan, borrowers must meet the following loan guidelines: Have a FICO rating of 500 to 579 with 10 percent lower or a FICO rating of 580 or higher with 3.5 percent lower. Have a verifiable work history of the last two years. … Use a loan to finance your primary residence.

Does FHA mean first-time home buyer?

The advantage of qualifying as a first-time home buyer is access to programs offered by the Federal Housing Authority (FHA). Programs may include low mortgage rates, low down payments, low closing costs, and loans for lower credit scores than required for conventional (non-FHA) loans.

What does FHA consider a first-time home buyer?

Individuals who did not own the main residence during the 3-year period ending on the date of purchase of the property. This may also include the spouse, so if one of them meets the above test, he is considered the first buyer of the apartment.

Is FHA the same as first-time home buyers?

FHA loans are not just for first time buyers. First and repeat buyers can finance houses with FHA mortgages. The FHA loan is often marketed as a product for “first customers” due to low prepayment requirements.

Who qualifies as a first-time home buyer?

According to the agency, the first buyer of the apartment: Someone who did not own the main residence for a period of three years, ending on the day of purchase of a new home. An individual who never had a principal residence, even if their spouse owned the apartment.

Can you only get an FHA loan once?

Can you get an FHA loan more than once? You can get more FHA loans in your life. But even though you don’t have to be the first buyer of an apartment to qualify, you can generally only have one FHA loan at a time. This prevents potential borrowers from using the loan program to purchase investment property.

Can you get an FHA loan if you already own a house?

Government-supported FHA loans are available exclusively for the buyer’s primary residence. You cannot use the loan to buy a recreational or investment home. However, in some circumstances, you may be eligible for an FHA loan for another property, even if you already have a home. The FHA makes exceptions for some hardships.

Is FHA only for first-time buyers?

FHA loans are not just for first time buyers. First and repeat buyers can finance houses with FHA mortgages. … The FHA will insure mortgages for each primary residence. There is no requirement that you must be the first customer to use the FHA loan program.

How long do you have to wait between FHA loans?

After the exclusion, you must wait three years before you can qualify for another FHA loan. If you have been in bankruptcy, you must wait two years before you can apply for another FHA loan.

Who qualifies for an FHA loan?

FHA loan requirements

- FICO® rating at least 580 = 3.5% advance payment.

- FICO® rating between 500 and 579 = 10% advance payment.

- MIP (mortgage insurance premium) is required.

- Debt to income ratio

- The house must be the main residence of the borrower.

- The borrower must have a steady income and proof of employment.

Who is not eligible for an FHA loan?

Borrowers with FICO scores between 500 and 579 should defer 10% for an FHA mortgage. Those with FICO scores below 500 are not eligible for FHA funding. In addition, borrowers will need a 12-month record of timely payments for all financial obligations.

Do FHA loans have income limits?

FHA Loan Income Requirements There is no minimum or maximum salary that would qualify you or prevent you from obtaining an FHA-secured mortgage. However, you must: Have at least two open credit accounts. For example, a credit card and a car loan.

What will disqualify you from an FHA loan?

Reasons to Reject an FHA There are three popular reasons you were turned down for an FHA loan – poor creditworthiness, a high debt-to-income ratio, and generally too little money to cover the down payment and closing costs.