Can I get a FHA loan if I don’t have 2 years of income?

Contents

There is no requirement for a minimum or maximum income for an FHA loan.

When can you qualify for the FHA again? After release, you must wait three years before you can qualify for another FHA loan. If you have gone bankrupt, you must wait two years before applying for a second FHA loan.

Does FHA look at income?

The FHA does not set minimum income to qualify for the loan, but it does have guidelines for debt-to-income ratios. In other words, you will need to make enough money to cover the costs of your existing loans as well as new loans.

What will fail an FHA inspection?

Structure: In general the structure of the house should be adequate in good condition to protect the occupants. This means severe structural damage, leaks, moisture, rot or fur damage can cause the house to fail inspection. In this case, repairs must be made to keep the FHA debt moving forward.

What will disqualify you from a FHA loan?

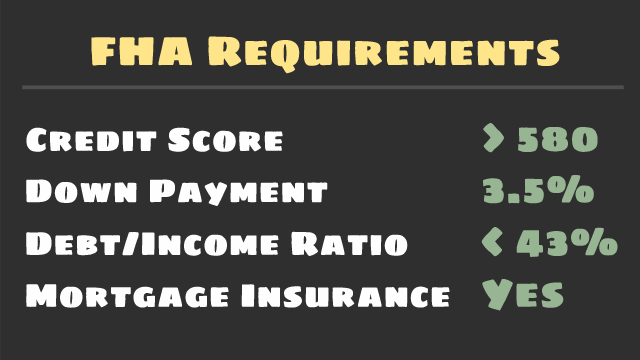

According to the Department of Housing and Urban Development (HUD), you need at least 500 credit points to qualify for an FHA loan. If you do well below this limit, you may be denied an FHA loan. In fact, bad credit is one of the most common causes of denial â € kasta any type of debt.

Does FHA look at gross or net income?

The lender will consider your gross income â € “the amount you make before tax or deductionâ €” when calculating your DTI share. … The Department of Housing and Urban Development, which sets the FHA guidelines, defines gross income as the annual amount earned by creditors who will be responsible for the debt.

What proof of income do I need for a FHA loan?

The FHA wants to see proof of consistent income. If you are an employee, you will need to submit a file that includes the most recent pay slips (at least two, preferably income so far), and a letter or form from your employer confirming that you has worked for the company for the past two years.

What credit score is needed for a first-time home buyer?

FICO® ☉ scores of at least 640 or more are typically all that is needed to qualify for a first-time home purchase assistance. FICO® scores range from 300 to 850. But chances are you may need high credit scores of around 680 or to qualify for a regular loan.

How long after buying a home has your credit score increased? The decline may not appear immediately, but you will see it reported within 1 or 2 months of closing, when the lender reports your first payment. On average it takes about 5 months for your score to rise when you pay off on time, but only if the rest of your loan habits become stronger.

How much should a first time home buyer put down?

In fact, most first-time homebuyers should set at least 3 percent of their home sales value on a standard loan, or 3.5 percent on an FHA loan. To qualify for one of the zero home buyer loans for the first time, you must meet certain requirements.

What mistakes do first-time home buyers make?

Mistakes for the first time buyer

- Looking for a home before applying for a mortgage.

- Talk to only one lender.

- Buying more home than you can afford.

- Going fast

- Shedding your savings.

- Recklessly with credit.

- Improving a neighborhood home.

- Emotions are based on emotions.

What are the two largest obstacles for first-time home buyers?

Poor credit history, rising home prices, and limited savings are also challenges that can make it difficult to buy a home for the first time.

What disqualifies you as a first-time home buyer?

To be considered a first-time buyer, you may not own or own a home for the past three years. You will also need to qualify for a mortgage like other lenders. The lender will have the minimum credit requirements and the largest share of debt and income.

Who qualifies for 1st time home buyer?

An individual who has not had an administrative residence for three years. If you own a home but your spouse does not, then you can buy a home together for the first time. A single parent who was married to an ex-wife when he married. Displaced homeowner with only one wife.

What is the maximum income to qualify for first-time home buyers? There is a paid hat. In this program, first-time Home Buyers with an income of up to $ 125,000 or partners with a shared income of up to $ 200,000 are eligible.

What are the qualifications for first-time home buyers?

Generally, first-time buyers need to secure at least two years of income and a permanent job to qualify for a mortgage. Although there may be ways to qualify for less than two years of work. Homebuyers should also keep an eye on their credit. The bridge requirements start at a minimum of 580 FHA loans.

What qualifies you as a first-time buyer?

To qualify as a first home buyer, you must buy the first home you or your spouse own or own in Australia, although there are exceptions. You must also move into the home within 12 months, and live for at least six consecutive months.

What disqualifies you as a first-time home buyer?

To be considered a first-time buyer, you may not own or own a home for the past three years. You will also need to qualify for a mortgage like other lenders. The lender will have the minimum credit requirements and the largest share of debt and income.