How much is a payment on a $200 000 house?

Contents

On a $ 200,000, 30-year mortgage with a fixed interest rate of 4%, your monthly payment will be $ 954.83 – not including taxes or insurance. But these can vary greatly depending on your insurance policy, the type of loan, the size of the down payment, and more.

How much do you need to make to buy a 200k home? How much income is needed for a 200k mortgage? A $ 200k mortgage with a 30% interest rate over 30 years and a $ 10k down payment requires an annual income of $ 54,729 to qualify for the loan. You can calculate for even more variations in these parameters with the Required Income Calculator from our Mortgages.

How much is a downpayment on a 200k house?

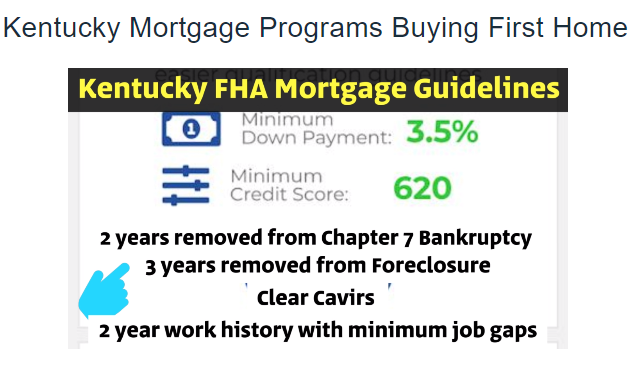

Conventional mortgages, like the traditional 30-year fixed-rate mortgage, usually require a down payment of at least 5%. If you are buying a home for $ 200,000, in this case, you need $ 10,000 to insure a home loan. Mortgage FHA. For a government-backed mortgage such as an FHA mortgage, the minimum down payment is 3.5%.

What is the typical down payment on a house in 2021?

Average down payment on Home 2021: $ 27,850.

Is 20k a good down payment on a house?

Typically, mortgage lenders want to reduce your home purchase by 20 percent because it reduces their loan risk. It is also a “rule” that most programs require mortgage insurance if you put less than 20 percent (although some loans avoid this). But NOT a rule you want to put 20 percent.

How much should a first time home buyer put down?

Realistically, most first-time home buyers want to reduce at least 3 percent of the home purchase price for a conventional loan, or 3.5 percent for a loan. FHA. To qualify for one of those zero-down loans for a first-time home buyer, you must meet special requirements.

What would the monthly payment be on a $250 000 house?

| Annual Percentage Rate (APR) | Monthly payment (15 years) | Monthly payment (30 years) |

|---|---|---|

| 3.50% | $ 1,787.21 | $ 1,122.61 |

How much is a downpayment on a $250 house?

The minimum down payment to buy a home with an FHA loan is only 3.5 percent of the home purchase price. This means that the down payment for, say, a $ 250,000 home would be $ 8,750 with this type of loan.

How much income do I need for a 250k mortgage?

How Much Income Do I Need for a 250k Mortgage? You have to make $ 76,906 a year to afford a 250k mortgage. We base the income you need on a 250k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $ 6,409.

What is the down payment on a 250000 dollar home?

For a $ 250,000 home price the minimum down payment would be $ 8,750.

How much is a downpayment on a $250 house?

The minimum down payment to buy a home with an FHA loan is only 3.5 percent of the home purchase price. This means that the down payment for, say, a $ 250,000 home would be $ 8,750 with this type of loan.

How much do I need to make to afford 250k house?

How much income is needed for a 250k mortgage? A $ 250k mortgage with an interest rate of 4.5% for 30 years and a down payment of $ 10k requires an annual income of $ 63,868 to qualify for the loan.

How much is 3.5 downpayment?

Often, a down payment for a home is expressed as a percentage of the purchase price. As an example, for a $ 250,000 home, a 3.5% down payment is $ 8,750, while 20% is $ 50,000.

What credit score is needed to buy a house?

| Type of loan | Minimum FICO® score |

|---|---|

| Conventional | 620 |

| FHA loans requiring a 3.5% down payment. | 580 |

| FHA loans requiring a 10% down payment. | 500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

| Self VA | 580 |

What credit score do I need to buy a home in 2021? What are the FHA Credit Score Requirements in 2021? The Federal Housing Administration, or FHA, requires a credit score of at least 500 to purchase a home with an FHA loan. A minimum of 580 is required to make the minimum down payment of 3.5%. However, many lenders need a score of 620 to 640 to qualify.

What is a good credit score to buy a house UK?

A credit score of 750 is a ‘Fair-Excellent’ score in all UK credit reference agencies. This is generally a good score and will mean that you will have options of mortgage lenders. The exact mortgage rate that is offered depends on your unique circumstances.

What is a good credit score if you want to buy a house?

It is recommended that you have a credit score of 620 or higher when applying for a conventional loan. If your score is less than 620, you may be offered a higher interest rate.

Do you need a good credit score to buy a house UK?

In the UK, there is no set minimum credit score that you need to buy a home. However, if you are buying a home mortgage, your credit score should be high enough for lenders to be willing to offer you a mortgage.

What is a decent credit score UK?

A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent (reference: https://www.experian.co.uk/consumer/guides/good-credit-score.html). TransUnion (formerly known as Callcredit) is the UK’s second largest CRA, and has scores ranging from 0-710.

What is the normal credit score to buy a house?

For most types of loans, the credit score required to buy a home is at least 620. But higher is better, and borrowers with scores of 740 or more will get the lower interest rates.

What is the ideal credit score for a first time home buyer?

FICO® Scores☠‰ of at least 640 or more are typically all that are needed to qualify for first-time homebuyer assistance. The FICO® Scores range from 300 to 850. But chances are that you may need higher credit scores of about 680 or so to qualify for a conventional mortgage. For more, see “What is a Good Credit Score?”

Can a seller refuse an FHA loan?

So yes, the seller can refuse an FHA loan offer from a home buyer. Sellers may also reject purchase offers from buyers using a conventional or VA mortgage loan, if they feel it is in their best interest. It is your prerogative to choose what you feel is the best offer for your particular situation.

Can you discriminate against FHA loans? The FHA also prohibits discrimination based on race, color, religion, sex, national origin, disadvantage, or family status. This is defined as children under the age of 18 living with a parent or legal guardian, pregnant women, and people who ensure custody of a child under the age of 18.

Can sellers refuse FHA?

Yes, a seller may refuse an FHA loan offer from a home buyer. You may reject any offer that does not meet your needs or expectations. Discrimination in housing, on the other hand, is prohibited by law. FHA loans have a closing success rate similar to conventional mortgages.

Why do some sellers refuse FHA?

Why Do Some Sellers Not Accept FHA Loans? Sellers want to be able to sell their home with the least frustration and cost to them possible. Anything they believe can pose a risk to the perfect sale can send them running in the other direction.

Can an FHA loan be denied?

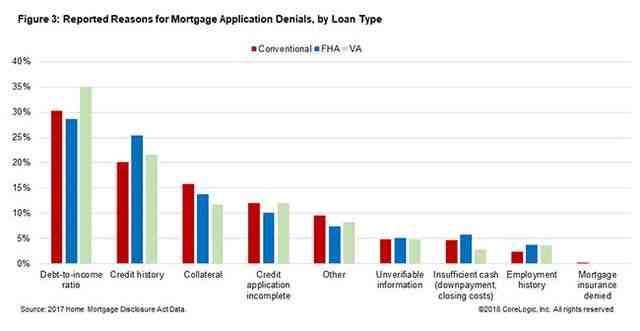

Reasons for FHA Rejection There are three popular reasons why you have been turned down for an FHA loan: bad credit, a high debt-to-income ratio, and insufficient overall cash to cover down payment and closing costs.

Why would a seller not accept FHA?

There are two main reasons why sellers may not want to accept offers from buyers with an FHA loan. … The other main reason sellers don’t like FHA loans is that the guidelines require appraisers to look for certain flaws that may raise concerns about habitability or health risks, security or safety.

How does a FHA loan affect the seller?

FHA loans attract buyers who may not have the money savings for out-of-pocket closing costs. The FHA loan allows the seller to collect up to 6 percent of the value of the home to pay the buyer’s closing costs, making it easier for the buyer to afford the home.

What will cause an FHA loan to be denied?

Reasons for FHA Rejection There are three popular reasons why you have been turned down for an FHA loan: bad credit, a high debt-to-income ratio, and insufficient overall cash to cover down payment and closing costs.

Why are FHA loans bad for sellers?

Unfortunately, some homeowners see the FHA loan as a riskier loan than a conventional loan because of its requirements. The more lenient financial requirements of the loan can create a negative perception of the borrower. And, on the other hand, strict loan appraisal requirements can make the seller nervous.

Does FHA loan affect seller?

1. How does an FHA loan affect the seller? Property being purchased on FHA loan must meet the minimum property requirements set by HUD (the federal department that oversees this program). But other than that, FHA loans don’t affect sellers much.

Is it hard to sell a house with FHA loan?

You can certainly sell a home even if you still have an FHA loan. There are some potential hurdles when selling a home. For example, some people do not have enough equity in their homes to make traditional sales, so they may have to make short sales.

Do sellers discriminate against FHA loans?

There is no law that can force a seller to accept FHA financing, although sellers artificially limit their group of buyers by doing so. Buyers, however, can help their cause by agreeing to a “as is” assessment, for one. They may also consider asking for less vendor contributions to help with closing costs.

Is an FHA loan bad for the seller?

Unfortunately, some homeowners see the FHA loan as a riskier loan than a conventional loan because of its requirements. The more lenient financial requirements of the loan can create a negative perception of the borrower. And, on the other hand, strict loan appraisal requirements can make the seller nervous.