How many years is a typical land loan?

Mortgage loans are often short term loans, two to five years followed by a lump sum payment, compared to the typical 15 and 30 year terms offered on a mortgage loan.

How much can you borrow on earth? You may be able to borrow up to $ 864,000.

What is the maximum tenure for a land loan?

The maximum loan term available for land loans is 15 years while for a home loan, it can be up to 30 years.

What is the tenure for land loan?

“Land loans are available for a shorter tenure compared to home loans. The maximum possible duration of land loans is 15 years. Lenders like SBI offer ten years of tenure in the event of a land loan, ”explains Mehra.

Can you fully finance land?

Land loans are a financing option used to purchase land and, like a mortgage, can be obtained from a bank or lender, who will assess your credit history and the value of the land to determine if you are a eligible buyer. However, land loans are risky for lenders because there is no house to serve as collateral.

How long do you have to live in a VA loan home before selling?

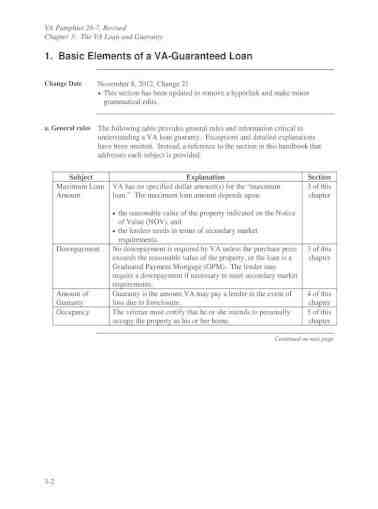

Veterans and active duty personnel who obtain a VA loan must certify that they intend to personally occupy the property as their primary residence. Essentially, homebuyers have 60 days, which the VA considers a “reasonable period of time,” to occupy the home after the loan closes.

Can I sell my house and get another VA loan? The good news is, yes, you can get another VA home loan if you are an eligible military, veteran, or other qualified borrower. … Buy a house with a VA loan, sell it, then buy another house with a new VA loan. Refinance from one VA loan to another.

How long after VA loan can you sell?

VA loans require that you occupy the property within 60 days of closing. Anything above that is considered rental property and the new VA loan could be called and foreclosed. VA lenders understand that sometimes active duty personnel do not stay on site very long.

Can I sell my VA loan?

Mortgage lenders approve loan applications using these universal guidelines and once a loan is approved the loan can be sold in what is called the “secondary” market and VA loans are no different. … Once a loan is sold, the original VA lender is paid by the buying company and has the money to issue more VA loans.

How long do you have to occupy a VA loan home before renting?

Most VA home loan agreements state that you occupy the house for at least 12 months. At the end of those 12 months, you will likely be able to rent the house to a tenant, even if they are not affiliated with the military.

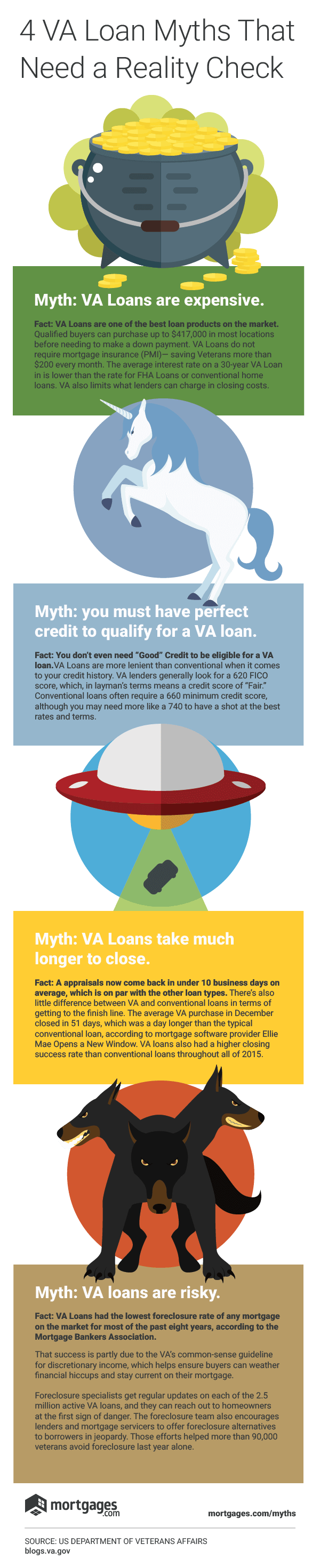

Why do sellers avoid VA loans?

Before securing mortgages, the VA wants to make sure that homes purchased by eligible veterans are safe and secure and are worth their sale price. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept offers to purchase guaranteed by the agency’s mortgages.

Are VA loans a hassle for the seller?

The short answer is ‘no’. It’s true that VA loans were once more difficult to close – but that’s old history. Today, you are likely to have much the same problems with a buyer who has this type of mortgage loan as another. And flexible VA guidelines may be the only reason your buyer can buy your home.

What are the pros and cons of a VA loan for a seller?

| Pro | Con |

|---|---|

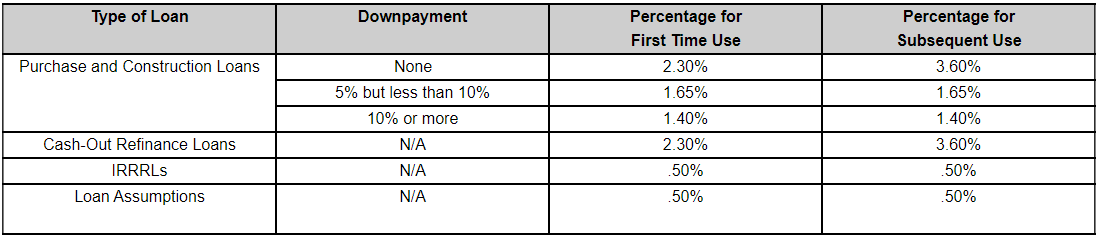

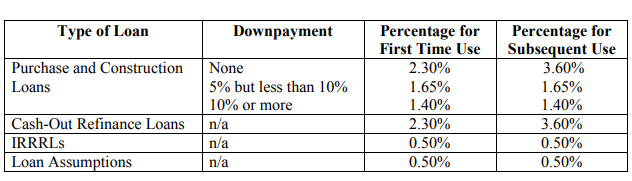

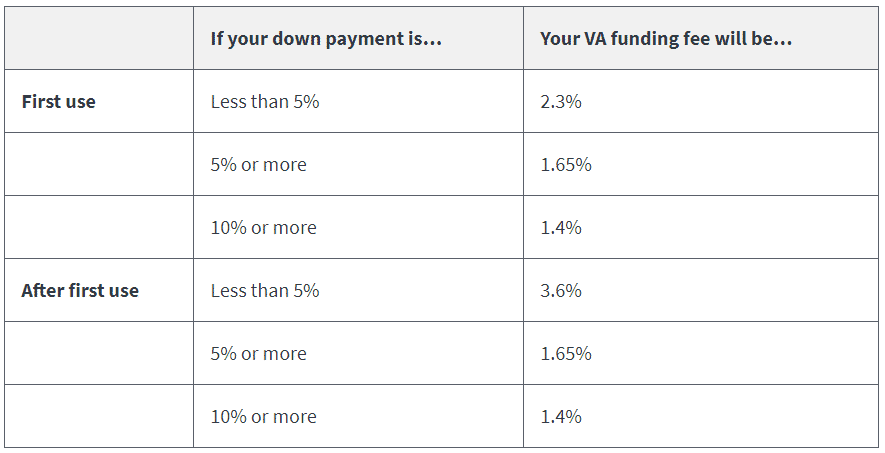

| No PMI | VA finance charges increase after first use |

| Higher authorized DTI | Loan could exceed market value |

| Credit flexibility | Only for main residences |

| Higher than average interest rates | Salespeople and agents may not be familiar |

Why do sellers prefer conventional over VA?

Some agents advise home sellers to take conventional or cash loan offers, even if they are inferior to VA offers, as these options are seen as less complicated than VA loans. … “Choosing a conventional offer rather than a VA offer is not considered to be discrimination. “

Do sellers prefer VA loans? Are VA Loans Bad for Sellers? Not necessarily. Accepting an offer from a buyer using a VA loan when selling your home can be just as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but as a seller you shouldn’t have to worry.

Is a VA loan bad for the seller?

Using a VA loan means that you will end up saving money both over the purchase and over the life of the loan. However, this does mean that the person selling you the house will have to spend more to sell you the house. If you are worried that the seller will decline your offer because you are using a VA loan, don’t be.

Are VA loans hard for sellers?

The short answer is ‘no’. It’s true that VA loans were once more difficult to close – but that’s old history. Today, you are likely to have much the same problems with a buyer who has this type of mortgage loan as another. And flexible VA guidelines may be the only reason your buyer can buy your home.

Why do sellers hate VA loans?

Unauthorized VA Fees The VA also limits loan origination fees to 1% of the loan amount. Lenders still charge mortgage fees that the VA itself doesn’t allow, but they charge sellers for them, which increases sellers’ closing costs.

Why do sellers hate VA loans?

Before securing mortgages, the VA wants to make sure that homes purchased by eligible veterans are safe and secure and are worth their sale price. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept offers to purchase guaranteed by the agency’s mortgages.

Are VA loans a hassle for the seller?

The short answer is ‘no’. It’s true that VA loans were once more difficult to close – but that’s old history. Today, you are likely to have much the same problems with a buyer who has this type of mortgage loan as another. And flexible VA guidelines may be the only reason your buyer can buy your home.

Why VA loans are bad for sellers?

VA loans come with red tape, appraisal delays, and fees borne by sellers rather than buyers – all reasons why bids are turned down, agents said. Additionally, according to realtors and veterans, some salespeople are rejecting offers because of misconceptions about the VA program.

Why would a seller prefer a conventional loan?

Duration of closure. Overall, conventional loans just tend to close faster. Less paperwork and fewer stipulations allow these mortgages to be processed faster, and many sellers find this to be a great bonus.

What are the advantages of conventional loans?

Conventional loans can require less paperwork and can be obtained faster than government insured loans. Mortgage lenders can approve conventional loans without the typical delays incurred with FHA or government guaranteed loans.

Why do many borrowers prefer conventional mortgages?

Borrowers generally prefer conventional mortgages to avoid the additional costs associated with most unconventional mortgages. … You are generally required to pay Private Mortgage Insurance (PMI), which is an ongoing monthly fee in addition to your mortgage payment, on a conventional loan with an LTV ratio greater than 80%.

Is a VA loan always better than conventional?

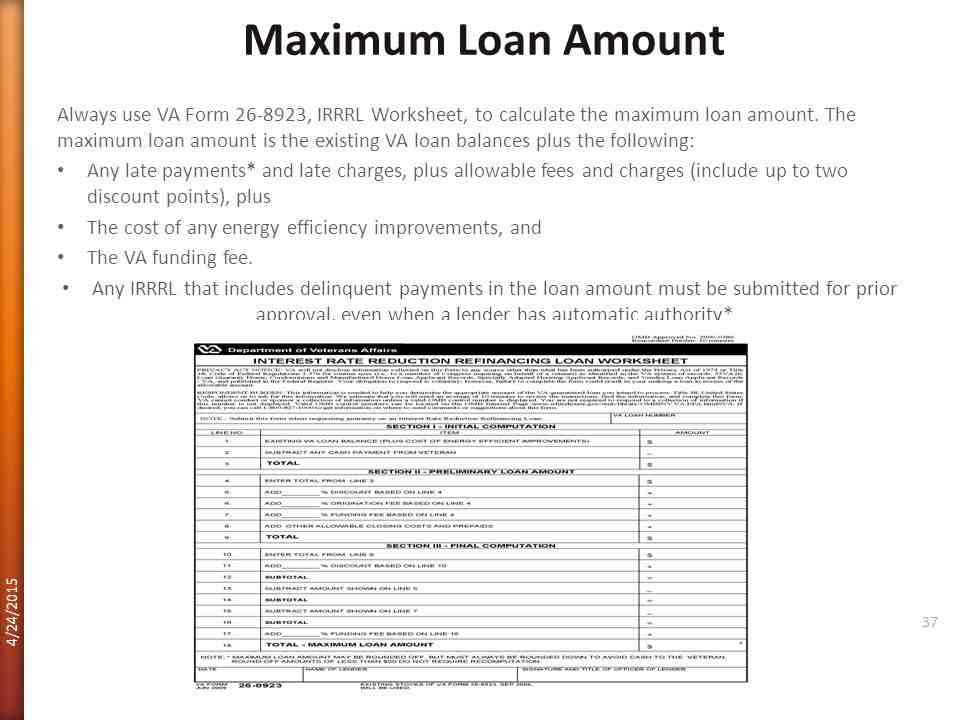

VA loans generally have easier credit qualifications compared to conventional loans. … Typically, VA loans tend to have lower interest rates – and if the rates go down, refinancing with a VA Interest Rate Reduction Loan (IRRRL) may be easier than with a conventional loan.

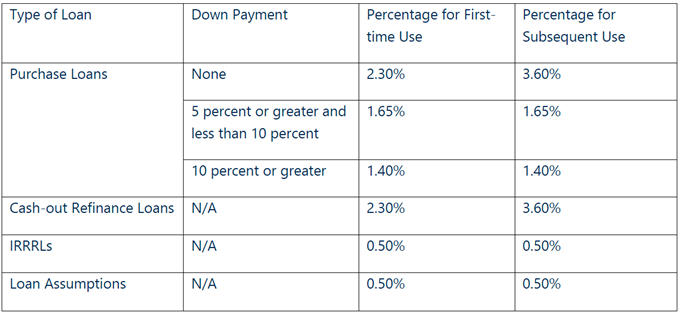

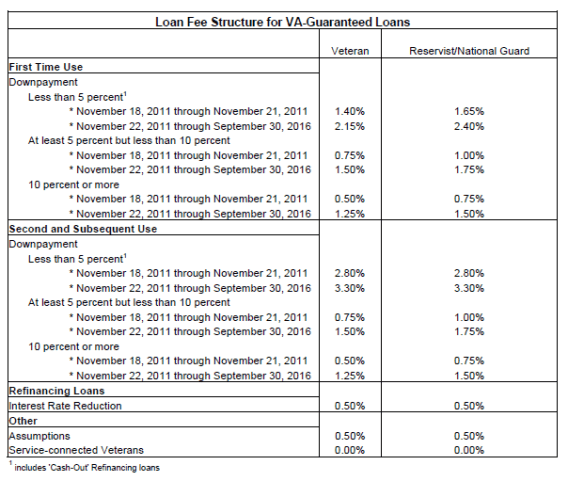

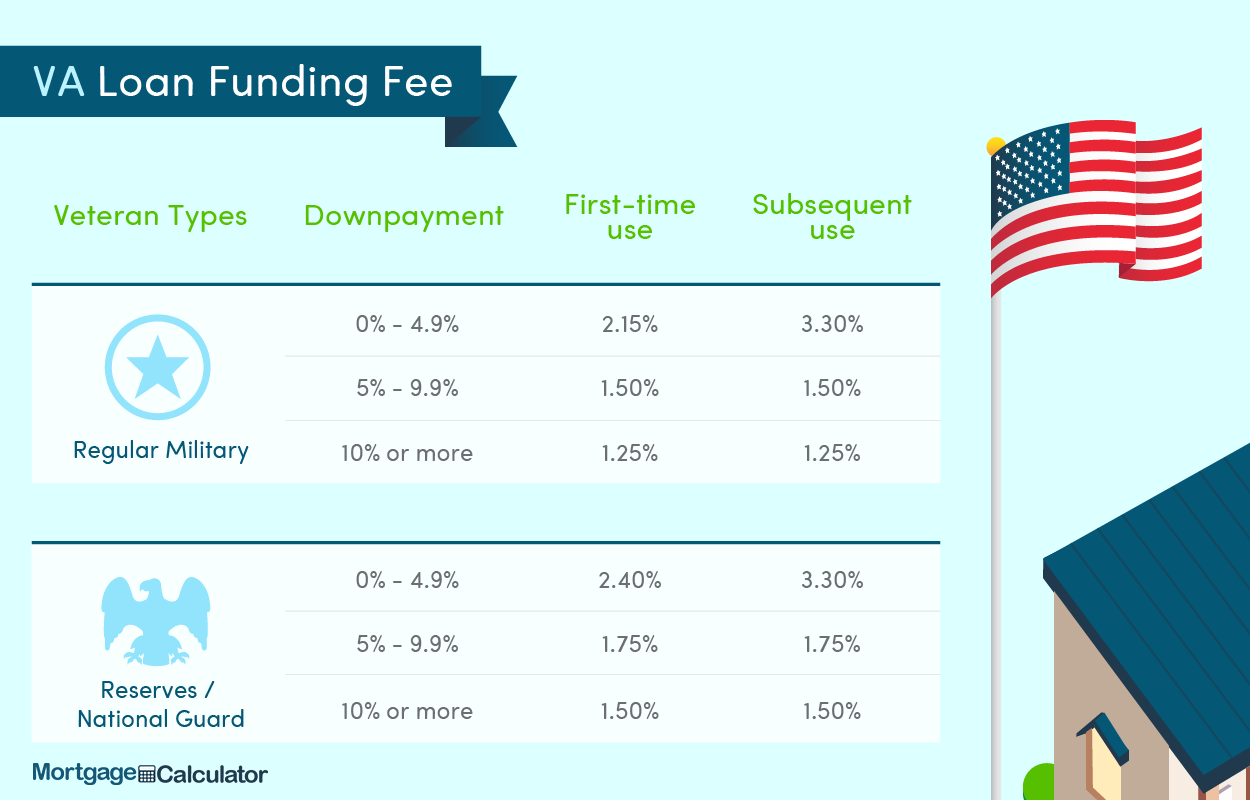

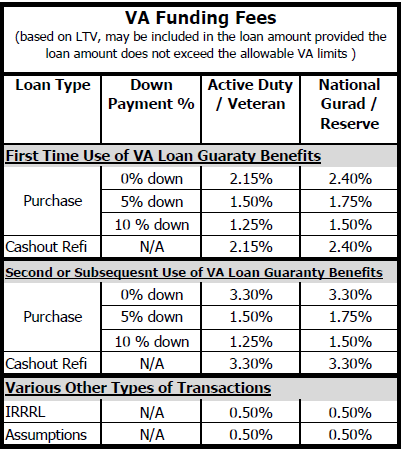

What are the disadvantages of a VA loan? 5 potential disadvantages of a VA loan

- You might have less equity in your home. …

- VA loans cannot be used to purchase vacation homes or investment property. …

- Vendor resistance to VA financing. …

- Funding costs are higher for later use. …

- Not all lenders offer – or understand – VA loans.

Why do sellers hate VA loans?

Unauthorized VA Fees The VA also limits loan origination fees to 1% of the loan amount. Lenders still charge mortgage fees that the VA itself doesn’t allow, but they charge sellers for them, which increases sellers’ closing costs.

Can sellers discriminate against a VA loan?

No VA approved lender can discriminate against a buyer. … No seller can refuse to offer a property on a discriminatory basis – the seller is required to comply with the laws of the Fair Housing Act.

Are VA loans a hassle for the seller?

The short answer is ‘no’. It’s true that VA loans were once more difficult to close – but that’s old history. Today, you are likely to have much the same problems with a buyer who has this type of mortgage loan as another. And flexible VA guidelines may be the only reason your buyer can buy your home.

Is a VA loan always the best option?

Not necessarily. The VA loan is a solid product, but it is not perfect, thanks in large part to the financing fees that lenders charge when making these loans. These financing fees, which vary depending on the borrower and the number of times a borrower has taken out a VA loan, could make these loans too expensive.

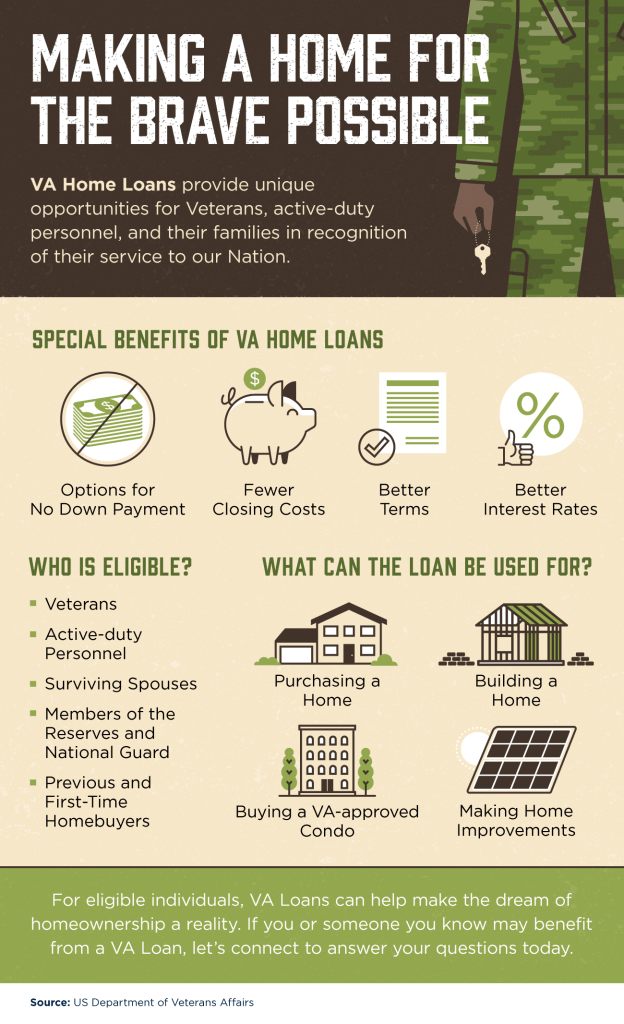

Is a VA loan really worth it?

VA loans offer better terms and interest rates than most other home loans. 100% Financing – Typically, no down payment is required for a VA loan, as long as the purchase selling price of the home does not exceed the appraised value of the home. … There is no penalty for early repayment of the loan.

Why do sellers not like VA loans?

Why don’t sellers like VA loans? Many sellers – and their real estate agents – don’t like VA loans because they think these mortgages make closing more difficult or costly for the seller.

Do sellers prefer VA or conventional loan?

Many sellers and real estate agents are turning their backs on the most qualified buyers in the market. Over the past six years, VA loans have had a higher average closing success rate than conventional mortgages, according to data from Ellie Mae.

Why do sellers hate VA loans?

Before securing mortgages, the VA wants to make sure that homes purchased by eligible veterans are safe and secure and are worth their sale price. … Because VA appraisals can increase their repair costs, home sellers sometimes refuse to accept offers to purchase guaranteed by the agency’s mortgages.

Why are conventional loans more attractive to sellers?

Term of Closing As a general rule, conventional loans simply tend to close faster. Less paperwork and fewer stipulations allow these mortgages to be processed faster, and many sellers find this to be a great bonus.

Can you get a home loan for land only?

A land mortgage is exactly what it appears to be: a loan that helps you buy vacant land. … Since there is no house or structure involved, most banks and lenders will take a cautious approach to a land mortgage, even if you intend to build on it in the future.

Can I get a loan just to buy land? So, if you are looking to buy land, you may not be eligible for a mortgage, but a mortgage. Home loans are only available for property already built, under construction or likely to be built soon. To finance the purchase of vacant land, you will have to opt for a land loan instead.