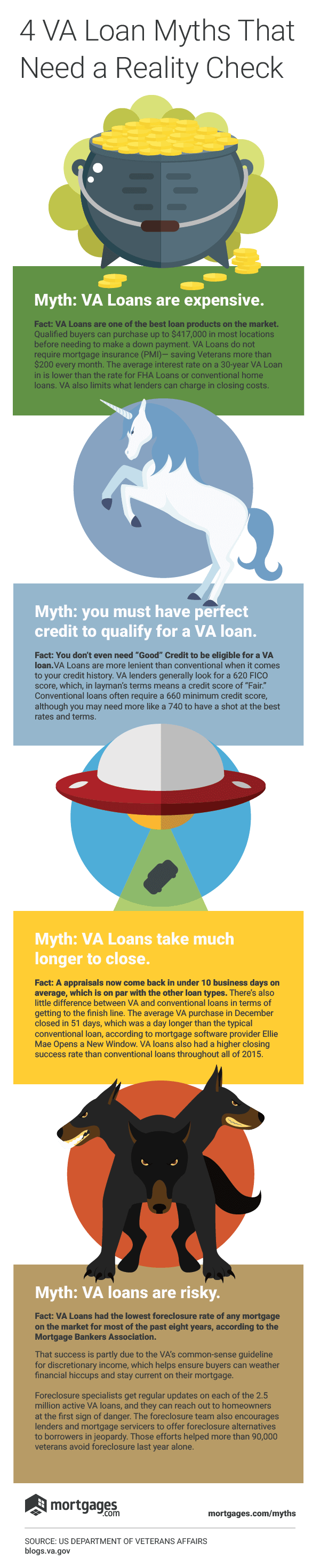

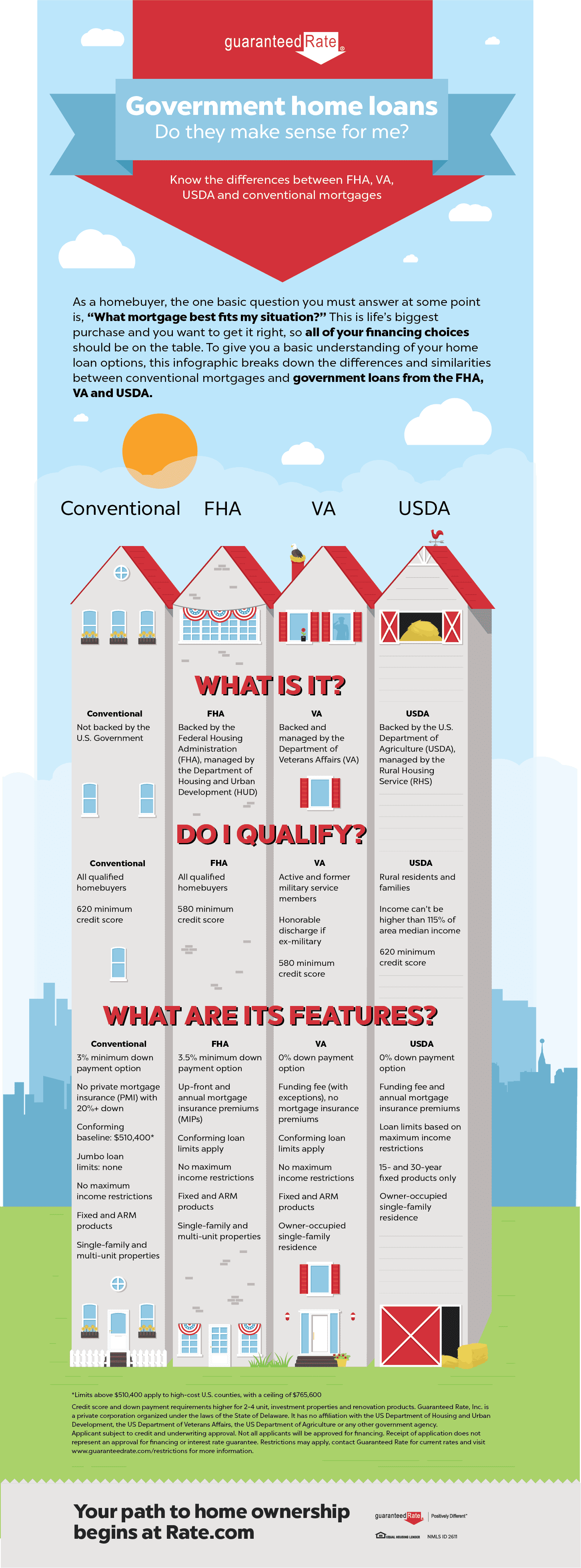

Currently, the minimum credit score for a VA loan is 660; the minimum for a USDA loan or FHA loan is 620.

Is AmeriSave legit?

Yes, AmeriSave is a legitimate mortgage and refinancing company. It offers a range of programs that are good loan options for some people. However, not all applicants are eligible to take out a home loan.

What can the VA require a veteran do when obtaining a loan?

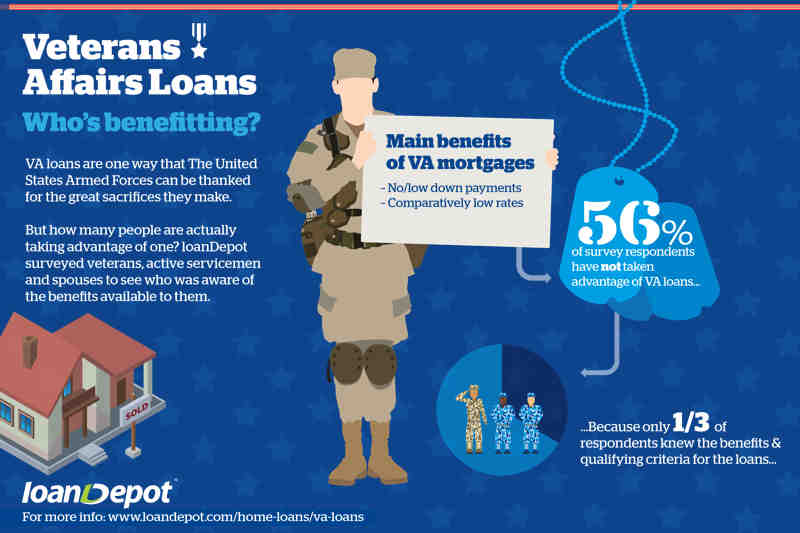

What are VA loan eligibility requirements?

- You are currently on active military service, or you are a veteran who has been honestly discharged and has met the minimum service requirements.

- You have served at least 90 consecutive active days during wartime or at least 181 consecutive days of active duty during peacetime.

Can a veteran be denied a VA home loan? Applying for a home loan with a VA loan increases your chances of getting a great home. While most qualified veterans are eligible to qualify for funding, some will reject their loan application.

Can you lose VA loan eligibility?

Lenders who have lost a VA loan to default have reduced VA lending rights, which limits how much they can borrow without making a down payment. … Some lenders may retain some basic VA lending rights, while others may repurchase with their second-tier rights.

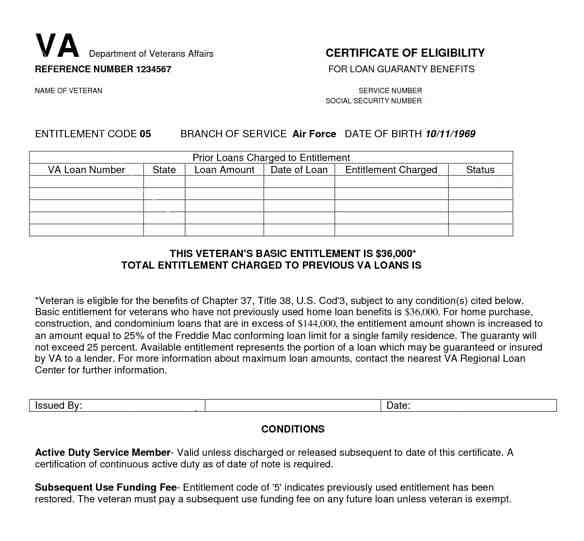

What is required of a veteran to obtain a VA loan quizlet?

Having a Certificate of Qualification (COE) is a requirement to obtain a VA loan. You must file a DD Form 214, submit your annual retirement statement, NGB Form 22 or 23, or obtain a COE from a commanding unit or higher as proof of your COE.

How long has New Day USA been in business?

Founded in 2002, New Day employs more than 530 people in its Maple Lawn development office in Fulton.

How many employees does NewDay USA have?

Is NewDay USA legitimate?

NewDay USA is a trusted mortgage lender for veterans and their families. The company offers FHA loans and VA loans in 43 states. It also offers refinancing options.

What credit score does NewDay USA require?

NewDay lowers FICO Minimums to 680.

What does NewDay USA do?

NewDay USA is a direct-to-consumer mortgage lender. This means you work directly with a lending officer at their company to get your mortgage. To get started, fill out a lead form, and then a lender will contact you to discuss your options and requirements.

Is NewDay USA same as USAA?

The US also says that New Day Financial, which does business as NewDay USA, violated the USAA’s slogan “We know what it means to serve” with “We understand what it means to serve.” € USAA marked the slogan in 1999 and received a copyright registration for it in 2011.

What is NewDay USA interest rates?

Example: $ 251,250 Loan on a single family primary residence for 30 years at a fixed interest rate of 2.25% (2.48% APR): 360 monthly payments of $ 960 (monthly payments do not include amount for taxes and insurance premiums; total payments more are high).

What does NewDay USA do?

NewDay USA is a direct-to-consumer mortgage lender. This means you work directly with a lending officer at their company to get your mortgage. To get started, fill out a lead form, and then a lender will contact you to discuss your options and requirements.

Who owns NewDay USA?

Robert Posner is the Founder and Chief Executive Officer of NewDay USA and CEO of Chrysalis Holdings, LLC. He founded NewDay USA in 1998 based on his passion for helping veterans own their own homes.

What is NewDay USA worth?

NewDay USA predicts more than double revenue by 2020 at over $ 300 million, serving more than 20,000 veteran families.

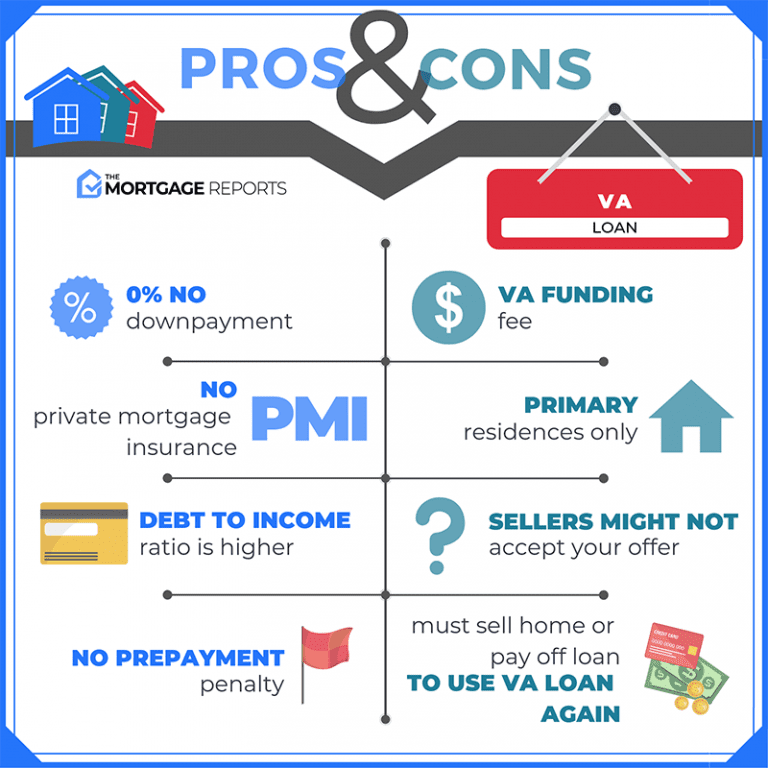

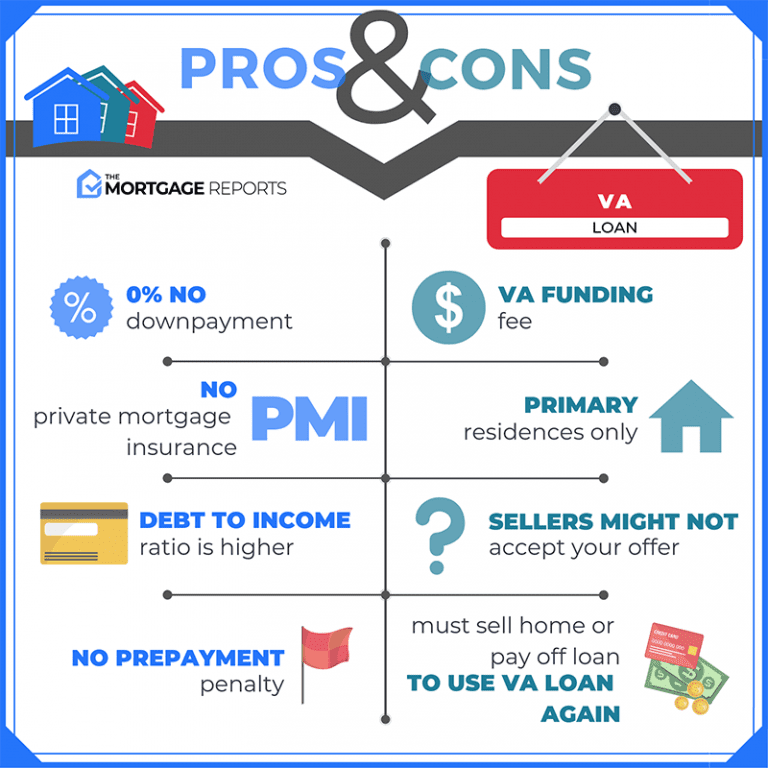

Do you have to pay mortgage insurance with a VA loan?

1. No down payment, no mortgage insurance. … With a VA loan you can also avoid rising mortgage insurance costs. At 5 percent down, private mortgage insurance (PMI) costs $ 150 a month on a $ 250,000 home, according to PMI provider MGIC.

Why are VA loans bad? The lower interest rates on VA loans are misleading. Both will end up costing you much more in interest over the life of the loan than their 15-year counterparts. Plus, you’re more likely to get a lower interest rate on a 15 year fixed rate conventional loan than on a 15 year VA loan.

How can I avoid closing costs with a VA loan?

Now you know that there are closing costs for VA loans, but what if you do not want these costs or do not bring them for closure? The most common way to raise these funds to complete the deal is through seller-paid closing fees and VA sales concessions. Remember, the seller is NOT required to pay the closing costs of the buyer.

What is the average closing cost on a VA loan?

How much are VA loan closing costs? VA loan closing costs are typically 1-5% of the loan amount. So for a $ 200,000 mortgage loan, the closing costs can be anywhere from $ 2,000 to $ 10,000.

What closing costs can a VA buyer not pay?

Here is a list of VA fees that a loan cannot pay outside of the 1% origination fee: Application fee. Home ratings ordered by the lender. Home inspections ordered by the lender.

When can mortgage insurance be removed on a VA loan?

“If the loan has a sufficient equity cushion, the PMI will be removed.” PMI does not apply to all mortgages with deposits below 20 percent. For example, government-backed FHA loans and VA loans with low or zero down payment requirements have different rules.

Does mortgage insurance reduce over time?

Does PMI decrease over time? No, PMI does not decline over time. However, if you have a conventional mortgage, you can cancel PMI if your mortgage balance is equal to 80% of the value of your home at the time of purchase.

When can a borrower discontinue paying private mortgage insurance?

Final PMI Cancellation If you are currently on payment, your lender or service provider will need to stop the PMI the month after you reach the midpoint of your loan repayment schedule. (This final cancellation applies even if you have not reached 78% of the original value of your home.)

Does VA require homeowners insurance?

VA lenders require that you have enough homeowners insurance in place before you can take out a loan. VA lenders require that you have enough homeowners insurance in place before you can take out a loan.

What are the insurance requirements for a VA loan?

Title insurance. VA does not require a lender to take out a VA loan or to get the veteran loan for title insurance. The lender can apply its own title insurance claims for VA lending transactions. VA only requires that the title to the property conform to the standards described above “Estate of the Veteran in the Property.”

Is home insurance legally required?

New South Wales and Victoria Even though it is not legally required, your mortgage lender can expect you to take out insurance before settling. Of course, the property must be handed over in the same condition as when it was sold (except normal wear and tear).

What will cause VA loan to get disapproved?

The most common reason why VA home loan applications are rejected is due to errors on the application itself. Lenders can not take out loans unless they are sure that your personal and financial details are correct. Before submitting your application, take the time to review each statement you make and the numbers you enter.

Can a VA loan be denied in underwriting? How often do underwriters refuse VA loans? About 15% of VA loan applications are rejected, so if your not approved, you are not alone. If you are denied during the automated underwriting stage, you may be able to seek approval through manual underwriting.

Can a VA loan be rejected?

If lenders refuse a loan, they will repay it. VA lenders make money by approving loans, not refusing them, so they do what they can to get your approval. If they can not, they send what is called an adverse action note. … You must first find out specifically why your loan was refused exactly.

What disqualifies for VA loan?

You have served 181 days of active service during peacetime, OR. You have 6 years of service in the National Guard or reserves, OR. You are the spouse of a service member who has died in the line of duty or as a result of a service-related disability.

What denies a VA loan?

In the overwhelming majority of cases, inexperienced loan officers or strict overdrafts are the reason for refusing a VA loan. If your lender is not approved for manual underwriting on VA home loans, you may be told that you are not approved without further explanation or options.

Why would an underwriter deny a VA loan?

In the overwhelming majority of cases, inexperienced loan officers or strict overdrafts are the reason for refusing a VA loan. If your lender is not approved for manual underwriting on VA home loans, you may be told that you are not approved without further explanation or options.

What does it mean when a VA loan is in underwriting?

Underwriting serves as the final review of a lender’s file. … VA lenders generally rely on an â € œAutomated Underwriting Systemâ € or OFF to determine a buyer’s prepayment status. An AUS is a computer program that directly evaluates a buyer’s qualification based on several factors.

Why did my VA Home Loan get denied?

If your VA loan application was rejected, it may be because your income level is too low. The best thing you can do is ask your lender for clarification. They can tell you if your income was too low. If so, look for ways to increase your income if at all possible.

What disqualifies you from a VA loan?

Dishonorable Discharge Veteran status requires that service members be discharged or discharged from the military under conditions such as dishonesty. A veteran with a dishonest discharge will not be eligible to participate in the VA loan guarantee program.

Can you be denied for a VA loan?

If your VA loan application was rejected, it may be because your income level is too low. The best thing you can do is ask your lender for clarification. They can tell you if your income was too low. If so, look for ways to increase your income if at all possible.

Why is it so hard to get a VA loan?

Lenders must show that they have the income to make the mortgage payments. They should not have a large debt burden. Even if there is no minimum credit score requirement, lenders can have a hard time getting approved by a lender if they do not have at least a 620 FICO score.