How much is the VA funding fee for first time use?

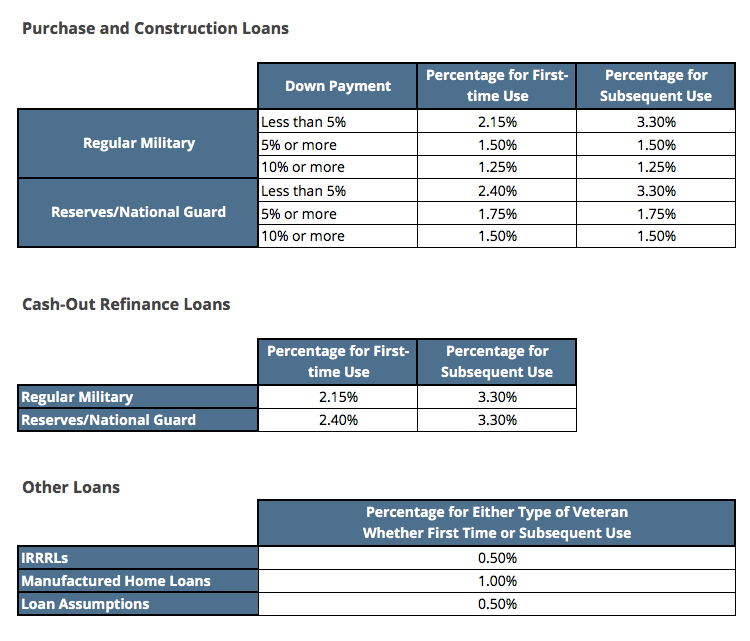

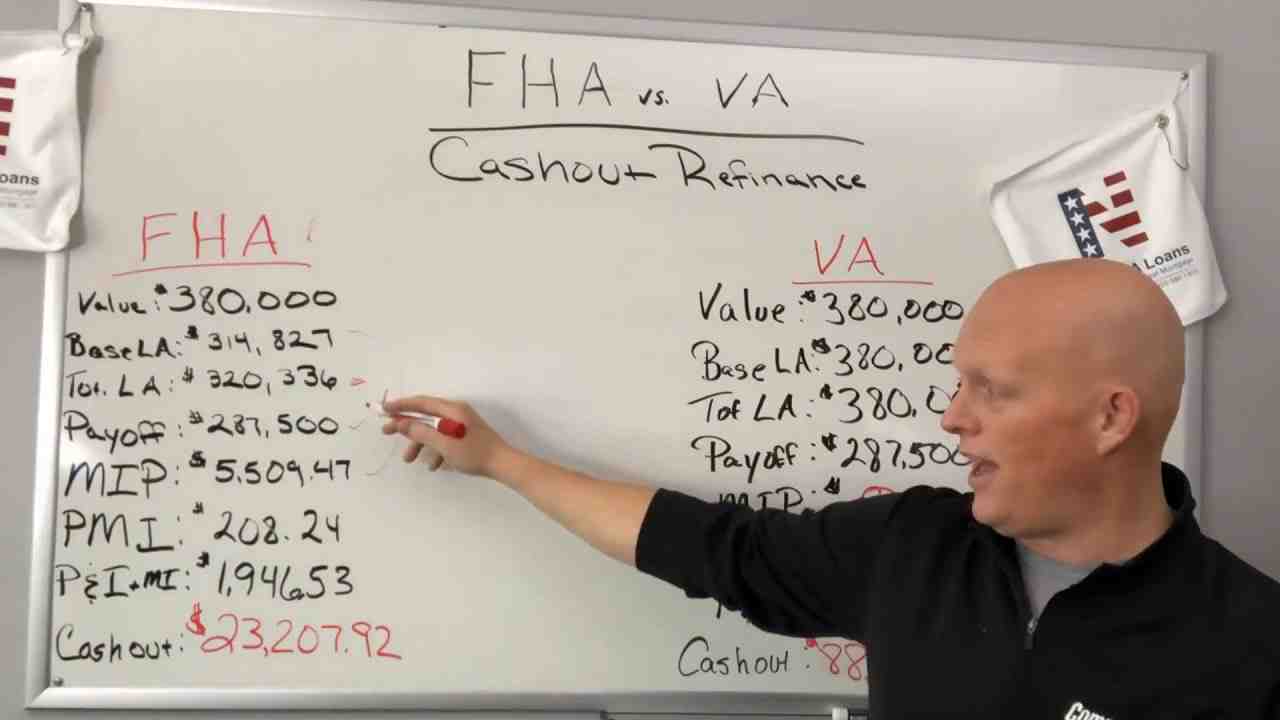

Prepaid mortgage payments for VA are 2.3% with a down payment of zero, 1.65% with a down payment of 5% to 9.9%, and 1.4% with a down payment of 10% or more. Cash payments for a VA cash-out refinance loan are the same as for a purchase loan.

What are the normal VA fees? VA loan repayment is a one-time payment of 2.3% of the total amount borrowed by VA home loan. The interest rate rises to 3.6% for borrowers who have used the VA loan program, but can be reduced by placing at least 5% below closing.

How do I get my VA funding fee waived?

According to the VA, you may be free to pay VA fees if:

- You receive a VA disability grant for a disability related to your military service.

- You are entitled to disability benefits for service-related disabilities but instead receive retirement or occupational income.

Are VA funding fees negotiable?

You (the buyer) or seller can negotiate who will pay for other closing costs such as: VA fees.

What percentage of disability is required to waive VA funding fee?

But lenders and homeowners with disabilities at least 10 percent are exempt from paying VA Fees. Depending on the amount of the loan, the cancellation of this payment may result in a significant change.

How much is a VA funding fee 2021?

VA financing fees by 2021 Most veterans will pay a 2.3 percent fee when buying a home. This equates to $ 2,300 for every $ 100,000 borrowed. This one-time lender applies to the most popular type of VA loan: home loan free of charge.

Is the VA funding fee worth it?

“Any pre-mortgage loan is a real payment,” said Bowden. … But while a VA loan can make buying or renovating a home more expensive, the benefits of a VA loan can often outweigh the initial costs, which makes the VA home loan more affordable. worthy of consideration.

How is VA funding fee calculated?

VA loan fees are expressed as a percentage of the loan amount. For regular military lenders with no down payment, the interest rate is 2.15%. Rates go up 3.3% for borrowers with previous VA loans. For those with a minimum payment of 5% to 9%, the fee is 1.5%.

Is the VA funding fee a closing cost?

Customers who receive VA disability compensation do not pay this fee. Cash payments are the only closing costs that VA customers can incur to balance their loans, and that is how most lenders approach this payment.

What is VA funding fee?

VA payment is a one-time payment that the Soldier, service member, or survivor pays with a VA-backed or VA-backed home loan. This fee helps to lower the cost of borrowing for U.S. taxpayers. as the VA home loan program does not require low payments or monthly mortgage insurance.

How can I avoid closing costs with a VA loan?

Now, you know there is a cost to close VA loans, but what if you do not want or cannot afford to cover those costs? The most common form of failure to bring these funds to a close is through closing costs paid by the seller and VA sales agreements. Remember, the seller is NOT required to pay the buyer’s closing costs.

Is a VA loan 100 financing?

VA Home Loans With Low Mortgage Rates VA loans allow 100% financing, never require home insurance, and have simple writing guidelines that enable you to reach your closing on time.

Do I pay the closing costs with a VA loan? One of the great benefits of VA loans is that merchants can pay all the closing costs associated with your loan. Also, they do not have to pay for any of them, so this will always be a product of communication between buyer and seller.

What is the maximum VA for 100% financing?

About VA Loan Limits The average VA loan limit is $ 548,250 for most U.S. states by 2021, an increase from $ 510,400 by 2020. For the most expensive real estate markets in the United States, credit limit VA reaches $ 822,375 for 2021, up from $ 765,600 by 2020.

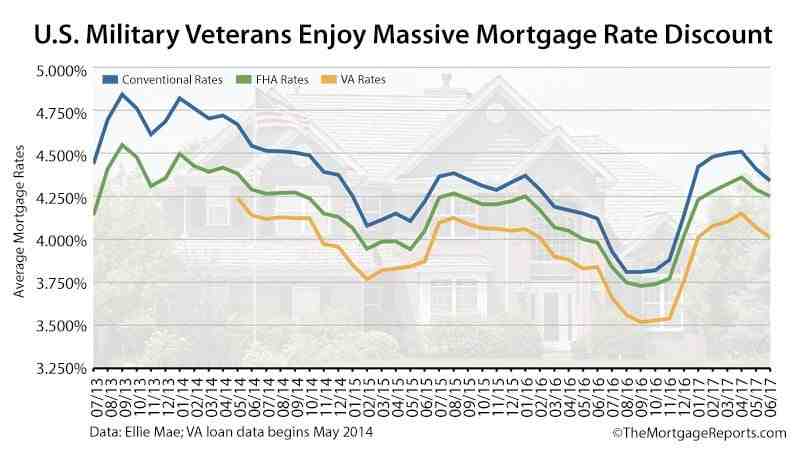

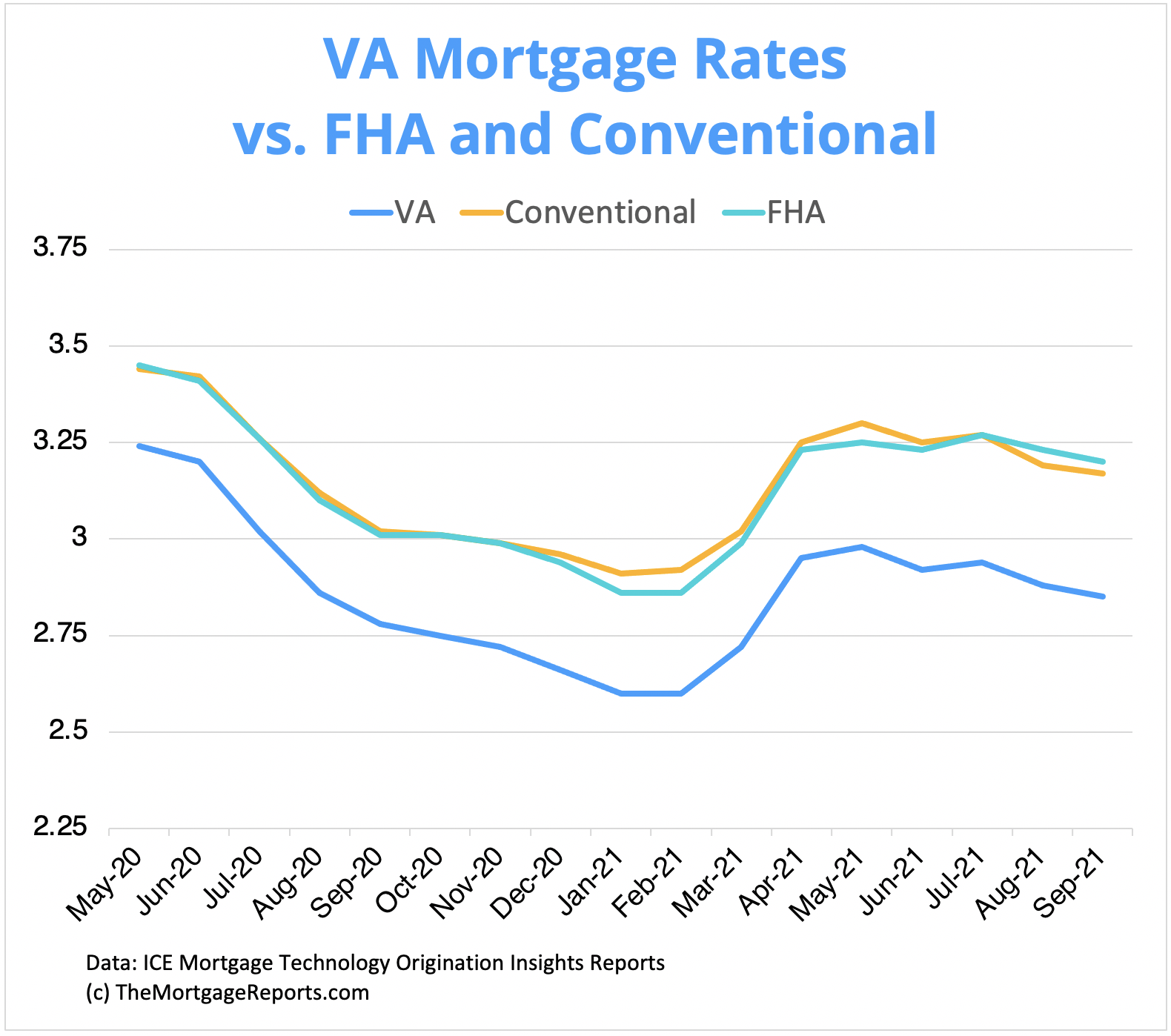

What is the highest VA Interest Rate?

| Product | Interest rate | APR |

|---|---|---|

| A steady 30-year jumbo | 3,200% | 3,270% |

What is the maximum amount VA will guarantee?

1. How much is a guarantee? The VA will guarantee up to 50 percent of home loans up to $ 45,000. For loans between $ 45,000 and $ 144,000, the minimum guarantee amount is $ 22,500, with a maximum guarantee, up to 40 percent of the loan up to $ 36,000, depending on the number of entitlements a veteran has it.

Can a veteran qualify for 125% financing on a VA loan?

VA loans are certified, in part, by the US Veterans Affairs Department (VA) and are available for active members of the military, military or family members of the military. Benefits include up to 100% cash, interest competition fees, and no home insurance for eligible borrowers.

What is the minimum you can borrow on a VA loan?

VA loan limits vary by district and currently range from $ 548,250 to $ 822,375. While eligible Veterans with full right may borrow more than the farmer intends to extend, those with limited or limited rights are bound to VA loan limits.

Can VA loan for refinance be 100 percent?

VA loan lending allows for up to 100 percent credit-quality (LTV). That means VA homeowners can afford to use all of their homes, no matter how big they are.

How much will a VA loan finance?

The VA will guarantee up to 50 percent of home loans up to $ 45,000. For loans between $ 45,000 and $ 144,000, the minimum guarantee amount is $ 22,500, with a maximum guarantee, up to 40 percent of the loan up to $ 36,000, depending on the number of entitlements a veteran has it.

Can I buy a million dollar home with a VA loan?

For example, VA lenders in San Francisco, California, and Washington, D.C., will find that VA loans of a million dollars or more are possible.

How much money do I need in the bank for a VA loan?

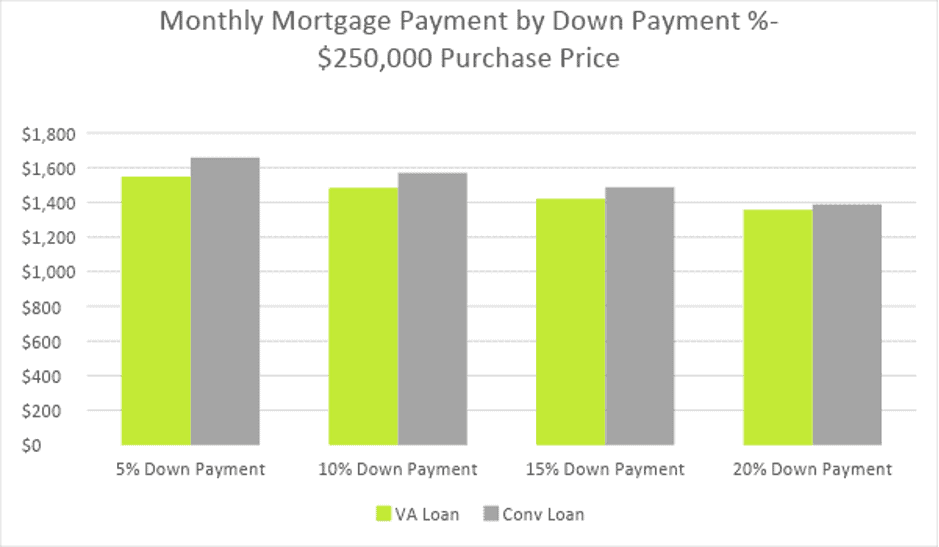

VA and USDA loans do not require a down payment, which is a huge benefit. Ordinary loans usually require a minimum payment of at least 5 percent, although some lenders may drop below 3 percent. For FHA loans, at least 3.5 percent.

Do you have to have money in the bank for a VA loan? With all these options available, it is possible to get a VA loan at no cost. VA loans also do not require private mortgage insurance (PMI), but you will pay the VA loan when you close, which will be a percentage of the total loan value. That fee helps keep the program running for future lenders.

How many months of bank statements do I need for a VA loan?

Lenders usually review 2 months of the latest bank statements along with your mortgage application. You will need to provide bank statements for any accounts that hold the amount that you will use to qualify for the loan.

Does a VA loan require bank statements?

Lenders need to verify your work, income and assets before they can get their first VA loan approval. The other document you will provide is a complete bank statement for each of your accounts. … Your bank statement is sent to the person who wrote the letter to check as soon as you are under contract.

How many bank statements are needed for a VA loan?

Summary of VA Loan List Over the past two years W-2 statements. The last two years of taxation. Recent bank reports from checks, savings and retirement accounts. Recent charges.

What are the disadvantages of a VA loan?

5 Potential Risks of VA Loans

- You Can Have Less Equality in Your Home. …

- VA Loans cannot be used to Buy Vacation Housing or Investment Equipment. …

- Seller Resistance to VA Financing. …

- Higher Fees for Subsequent Use. …

- Not All Borrowers Provide â € “or Understand â €“ VA Loans.

Why do sellers hate VA loans? Before verifying mortgages, the VA seeks to ensure that the homes that qualified fighters buy are safe and secure and equal to their retail price. … Because VA rates can increase their repair costs, homeowners sometimes refuse to accept pricing backed by corporate home loans.

Why do people not want to accept VA loans?

VA loans come with a “red tape”, a delay in rates and fees paid by sellers as opposed to consumers – all reasons given are denied, agents say. In addition, real estate agents and veterans say some salespeople are refusing to pay due to misconceptions about the VA program.

Why would a seller not want a VA loan?

Many real estate agents – and their real estate agents – do not like VA loans because they believe that these mortgages make it difficult to close or charge a lot of money to the seller. … They have less chance of closing than other types of home loans. Take years to the end. Have slow and regular inspectors who do not take the value of housing.

Why you shouldn’t get a VA loan?

Since you need to estimate the cost of a VA mortgage, you may end up with a loan that exceeds the market value of your home. Built houses may require a small fee and may not be eligible for a period of 30 years. You may not use a VA loan for rental property.

What is a drawback of a VA loan?

VA Loan Limitations Although you do not pay for home insurance with a VA loan, you will have to pay a down payment when you close (although this fee can be repaid on your loan). If you take out your first VA loan and do not make a down payment, the loan amount is about 2.3 percent of what you borrow.

What fees does the seller pay on a VA loan?

Note: We require the seller to be able to repay more than 4% of the total home loan in the seller’s concessions. But this rule only covers some closing costs, including VA fees. The law does not cover debt rebates.

Are VA loans a hassle for the seller?

Using a VA loan means you will end up saving money when you buy and for the rest of the loan life. However, it does mean that the person selling you the house will have to spend a lot of money to sell you the house. If you are worried about the seller rejecting your offer because you are using a VA loan, do not do so.

Why you shouldn’t use a VA loan?

Since you need to estimate the cost of a VA mortgage, you may end up with a loan that exceeds the market value of your home. Built houses may require a small fee and may not be eligible for a period of 30 years. You may not use a VA loan for rental property.

Why do sellers dislike VA loans?

Many real estate agents – and their real estate agents – do not like VA loans because they believe that these mortgages make it difficult to close or charge a lot of money to the seller.

Do sellers dislike VA loans?

VA mortgage loans also come with limited property requirements that could eventually force real estate agents to make more repairs. Because VA inspections can increase their repair costs, real estate sellers sometimes refuse to accept refunds backed by corporate home loans.

Why do sellers dislike VA loans?

Many real estate agents – and their real estate agents – do not like VA loans because they believe that these mortgages make it difficult to close or charge a lot of money to the seller.

Can retailers identify VA debt? No VA-approved credit can identify a customer. … No seller can refuse to rent a property because of discrimination – the seller is required to comply with the requirements of the Fair Housing Act.

Are VA loans difficult for sellers?

The short answer is “no.” It is true that VA loans have been difficult to close â € ”but that is an old story. Today, you may have the same problems with a buyer who has this type of home loan like any other. And flexible VA guidelines may be the only reason your buyer buys your home.

What should a seller know about VA loans?

And, for retailers, the most important thing you need to understand about VA loans is how good a credit product is to qualified lenders. This high quality feature means that, if you are dealing with an older customer, he or she can use a VA loan.

Are VA loans bad for sellers?

Using a VA loan means you will end up saving money when you buy and for the rest of the loan life. However, it does mean that the person selling you the house will have to spend a lot of money to sell you the house. If you are worried about the seller rejecting your offer because you are using a VA loan, do not do so.

What sellers need to know about VA loans?

And, for retailers, the most important thing you need to understand about VA loans is how good a credit product is to qualified lenders. This high quality feature means that, if you are dealing with an older customer, he or she can use a VA loan.

Do sellers have to pay closing costs on VA loans?

When using a VA loan, the buyer, seller, and other borrower pay different parts of the closing costs. The seller will not pay back the 4% of the total home loan in closing costs. However, their share of closing costs includes commissions for buyers and sellers of real estate.

What does a VA loan require the seller to pay?

Note: We require the seller to be able to repay more than 4% of the total home loan in the seller’s concessions. But this rule only covers some closing costs, including VA fees. The law does not cover debt rebates.

Why VA loans are bad for sellers?

VA loans come with a “red tape”, a delay in rates and fees paid by sellers as opposed to consumers – all reasons given are denied, agents say. In addition, real estate agents and veterans say some salespeople are refusing to pay due to misconceptions about the VA program.

Is a VA loan really worth it?

VA loans offer better interest rates and interest rates than most other home loans. 100% financing â € ”normally, no down payment is required for a VA loan, as long as the real estate price does not exceed the estimated value of the house. … There is no penalty for paying off debt prematurely.

What does the seller have to pay for a VA loan?

In California, and across the country, these “seller agreements” are usually limited to 4% of the loan amount. As stated on the VA website: â € œWe require the seller to be able to repay more than 4% of the total mortgage loan agreement. … The law does not cover the details of a loan repayment.â €